Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432517

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432517

Thailand Feed Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 407 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

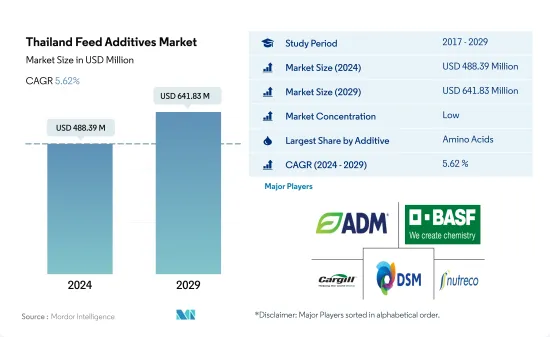

The Thailand Feed Additives Market size is estimated at USD 488.39 million in 2024, and is expected to reach USD 641.83 million by 2029, growing at a CAGR of 5.62% during the forecast period (2024-2029).

- The feed additives market in the country witnessed significant growth in 2022, with amino acids, binders, minerals, and probiotics being the major additives used in compound feed, accounting for 55.8% of the market share. Among these, methionine and lysine were the most significant feed amino acids, representing 30.8% and 21.8% of the market value, respectively, due to their efficiency characteristics, including improved gut health and easy digestion in animals, along with meat production.

- In addition to pelleting feed, synthetic feed binders were found to enhance animal digestion and nutrient intake, thereby preventing diseases. Synthetic binders held the largest share of the feed binders market in the country, accounting for 63.8% in 2022. Swine dominated the feed additives market, accounting for 57.2% of the market share by value, followed by poultry birds, which had a higher feed intake and production of approximately 12.2 million metric tons in 2022. The highest market share is mainly due to the increasing production of livestock in the country.

- Amino acids, prebiotics, and probiotics are expected to be the fastest-growing segments in the country's feed additives market, with amino acids registering a projected CAGR of 6.1%, followed by prebiotics and probiotics registering a projected CAGR of 6% each during the forecast period. Amino acids were crucial in protein synthesis and meat and milk production, which contributed to their high growth rate.

- Given the importance of feed additives in animal nutrition, the demand for feed additives in the country is anticipated to grow and register a CAGR of 5.6% during the forecast period.

Thailand Feed Additives Market Trends

Lower prices of poultry meat than pork increased the consumption of poultry meat and increasing farm sizes are encouraging the animal farmers to increase the poultry production

- In 2022, poultry birds accounted for 94% of the total animal headcount in the country, making them the largest animal type. This high share can be attributed to the increasing demand for poultry meat and eggs in the country, which led to a 7.4% increase in poultry birds' headcount from 2017 to 307.4 million heads in 2022. This growth is supported by the increasing farm sizes and a reduction in the number of producers.

- One of the main factors driving the demand for poultry meat is the lower cost of chicken meat compared to alternative protein options and the rising prices of pork meat in the country. The COVID-19 pandemic also contributed to the increasing demand for broiler meat production, which rose by 2%-3% in 2021 compared to 2020, according to the USDA. The outbreak of African swine fever resulted in a reduced supply of pork meat, leading to a significant increase in pork prices by 32% in the first eight months of 2022 compared to the same period the previous year. As a result, demand for poultry meat is expected to rise, driving broiler production during the forecast period.

- The cost of producing eggs increased to USD 1.76 per 20 eggs due to higher feed and raw material costs, which may lead to layer farms reducing the number of layers reared and lowering production capacity, potentially impacting layer production. However, the Thai government removed stringent COVID-19 restrictions nationwide on May 1, 2022. As a result, food service activities are slowly recovering, which is expected to boost demand for poultry products and, thus, poultry farming during the forecast period (2023-2029).

Fishes were the largest aquaculture species due to high demand for seafood and increase in freshwater cultivation is increasing the demand for aqua feed production

- Aquaculture species are one of the largest animal types cultivated and consumed in Thailand due to the availability of abundant resources. Aquaculture species accounted for 5% of the total feed produced in the country. The rapid development of aquaculture production in Thailand during the historical period increased the demand for aquaculture feed production, which increased by 50.2% from 2017 to reach 1.1 million metric tons in 2022. The quality of feed can reduce the risk of disease, improve productivity, and enhance the performance of animals, which has led to an increased demand for high-quality aquaculture feed in the country.

- Fish were the largest aquaculture species in Thailand, accounting for 67.3% of the total aquaculture feed production in 2022. This is due to their high demand for the Thai diet and the international market, where Thailand has a reputation for high-quality seafood products. Freshwater cultivation of aquaculture species accounted for 70% of the total aquaculture cultivation in the country, which increased the usage of compound feed in Thailand.

- The high growth in population, increasing demand for animal protein, and the popularity of seafood as a healthy source of protein are fueling the demand for compound feed in Thailand. Compound feed has several benefits, such as producing protein-rich meat and increasing yield, which has further driven the demand for compound feed production. These factors are expected to increase compound feed production by 12% from 1.1 million metric tons in 2023 to 1.2 million metric tons in 2029. Thus, the increasing demand for compound feed, coupled with the increasing usage of feed additives, is expected to drive feed production during the forecast period.

Thailand Feed Additives Industry Overview

The Thailand Feed Additives Market is fragmented, with the top five companies occupying 37.83%. The major players in this market are Archer Daniel Midland Co., BASF SE, Cargill Inc., DSM Nutritional Products AG and SHV (Nutreco NV) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49876

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Thailand

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Additive

- 5.1.1 Acidifiers

- 5.1.1.1 By Sub Additive

- 5.1.1.1.1 Fumaric Acid

- 5.1.1.1.2 Lactic Acid

- 5.1.1.1.3 Propionic Acid

- 5.1.1.1.4 Other Acidifiers

- 5.1.2 Amino Acids

- 5.1.2.1 By Sub Additive

- 5.1.2.1.1 Lysine

- 5.1.2.1.2 Methionine

- 5.1.2.1.3 Threonine

- 5.1.2.1.4 Tryptophan

- 5.1.2.1.5 Other Amino Acids

- 5.1.3 Antibiotics

- 5.1.3.1 By Sub Additive

- 5.1.3.1.1 Bacitracin

- 5.1.3.1.2 Penicillins

- 5.1.3.1.3 Tetracyclines

- 5.1.3.1.4 Tylosin

- 5.1.3.1.5 Other Antibiotics

- 5.1.4 Antioxidants

- 5.1.4.1 By Sub Additive

- 5.1.4.1.1 Butylated Hydroxyanisole (BHA)

- 5.1.4.1.2 Butylated Hydroxytoluene (BHT)

- 5.1.4.1.3 Citric Acid

- 5.1.4.1.4 Ethoxyquin

- 5.1.4.1.5 Propyl Gallate

- 5.1.4.1.6 Tocopherols

- 5.1.4.1.7 Other Antioxidants

- 5.1.5 Binders

- 5.1.5.1 By Sub Additive

- 5.1.5.1.1 Natural Binders

- 5.1.5.1.2 Synthetic Binders

- 5.1.6 Enzymes

- 5.1.6.1 By Sub Additive

- 5.1.6.1.1 Carbohydrases

- 5.1.6.1.2 Phytases

- 5.1.6.1.3 Other Enzymes

- 5.1.7 Flavors & Sweeteners

- 5.1.7.1 By Sub Additive

- 5.1.7.1.1 Flavors

- 5.1.7.1.2 Sweeteners

- 5.1.8 Minerals

- 5.1.8.1 By Sub Additive

- 5.1.8.1.1 Macrominerals

- 5.1.8.1.2 Microminerals

- 5.1.9 Mycotoxin Detoxifiers

- 5.1.9.1 By Sub Additive

- 5.1.9.1.1 Binders

- 5.1.9.1.2 Biotransformers

- 5.1.10 Phytogenics

- 5.1.10.1 By Sub Additive

- 5.1.10.1.1 Essential Oil

- 5.1.10.1.2 Herbs & Spices

- 5.1.10.1.3 Other Phytogenics

- 5.1.11 Pigments

- 5.1.11.1 By Sub Additive

- 5.1.11.1.1 Carotenoids

- 5.1.11.1.2 Curcumin & Spirulina

- 5.1.12 Prebiotics

- 5.1.12.1 By Sub Additive

- 5.1.12.1.1 Fructo Oligosaccharides

- 5.1.12.1.2 Galacto Oligosaccharides

- 5.1.12.1.3 Inulin

- 5.1.12.1.4 Lactulose

- 5.1.12.1.5 Mannan Oligosaccharides

- 5.1.12.1.6 Xylo Oligosaccharides

- 5.1.12.1.7 Other Prebiotics

- 5.1.13 Probiotics

- 5.1.13.1 By Sub Additive

- 5.1.13.1.1 Bifidobacteria

- 5.1.13.1.2 Enterococcus

- 5.1.13.1.3 Lactobacilli

- 5.1.13.1.4 Pediococcus

- 5.1.13.1.5 Streptococcus

- 5.1.13.1.6 Other Probiotics

- 5.1.14 Vitamins

- 5.1.14.1 By Sub Additive

- 5.1.14.1.1 Vitamin A

- 5.1.14.1.2 Vitamin B

- 5.1.14.1.3 Vitamin C

- 5.1.14.1.4 Vitamin E

- 5.1.14.1.5 Other Vitamins

- 5.1.15 Yeast

- 5.1.15.1 By Sub Additive

- 5.1.15.1.1 Live Yeast

- 5.1.15.1.2 Selenium Yeast

- 5.1.15.1.3 Spent Yeast

- 5.1.15.1.4 Torula Dried Yeast

- 5.1.15.1.5 Whey Yeast

- 5.1.15.1.6 Yeast Derivatives

- 5.1.1 Acidifiers

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Dairy Cattle

- 5.2.3.1.2 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Alltech, Inc.

- 6.4.2 Archer Daniel Midland Co.

- 6.4.3 BASF SE

- 6.4.4 Brenntag SE

- 6.4.5 Cargill Inc.

- 6.4.6 DSM Nutritional Products AG

- 6.4.7 Impextraco NV

- 6.4.8 Novus International, Inc.

- 6.4.9 SHV (Nutreco NV)

- 6.4.10 Solvay S.A.

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.