PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1436055

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1436055

Vietnam Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

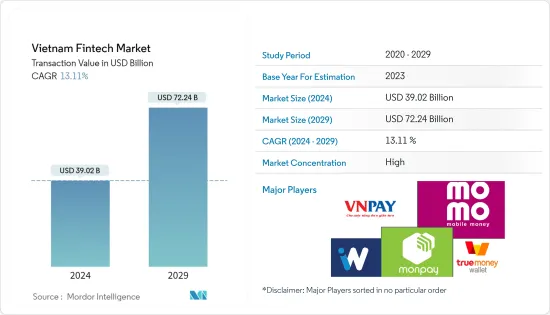

The Vietnam Fintech Market size in terms of transaction value is expected to grow from USD 39.02 billion in 2024 to USD 72.24 billion by 2029, at a CAGR of 13.11% during the forecast period (2024-2029).

Despite the negative socio-economic consequences of Covid-19, Vietnam is one of the few countries that recorded positive economic growth in 2020. As per the General Statistics Office (GSO) Vietnam's GDP increased by 2.91% in 2020. This reflects two key factors: the relative success in containing the health and business risks of the pandemic, and the ability of the country to keep investor confidence high. Apart from asymmetric gains, another key component of Vietnam's 2020 economic growth has been the role of foreign capital in the country.

The fast-growing FinTech market in Vietnam holds great market potential for technology companies that support digital banking, digital payments, block chain, and cryptography. Vietnam is currently home to more than 130 FinTech startups that cater to numerous clients and cover a broad range of services such as digital payments, alternative finance, wealth management and blockchain, among others.

The Vietnamese fintech space is in a growth trajectory, with supportive regulations, government policies, and investment attractiveness in the Asian region. In recent years, financial technology, or fintech, has been transforming a wide range of financial services, being adopted rapidly and attracting hundreds of billions of dollars in global investment value.

Vietnam is nascent fintech industrys but are demonstrating strong growth. There has been growth in various fintech sectors, like P2P lending, equity crowdfunding, digital payments, cryptoassets, and insurtech. With a significantly high proportion of the unbanked and underbanked, together with increasing mobile phone connection (150%), internet penetration (70%), and 3G&4G registration (45%), Vietnam remains largely an untapped market and a promised land for fintech investors.

Vietnam Fintech Market Trends

Increasing Per Capita Income Witnessing Growth in Vietnam FinTech Industry

Increasing per capita incomes and the rising population make Vietnam a perfect environment for investment in FinTech. Vietnam Gross Domestic Product (GDP) per Capita reached all time high recorded in Dec'2020 with 0.9% Y-o-Y growth. 0.8% growth in Internet connections yielding 70.3% Internet users in Jan'2021 from Vietnam made mobile connections equivalent to 158% of population. This made very easy for the corporates and organizations to drive their businesses through FinTech yielding increase in adapting FinTech to their daily life there in vietnam proving the further growth in forecast period.

Banks Accelerating Digital Push

Vietnamese banks are well aware of the importance of digital banking transformation; therefore, over the half decade i.e., since 2017 , they have proactively studied and tried new technologies for applying to their business operations through FinTech to better serve their customers and improve overall banking experiences.

Specifically, Vietnamese commercial banks have quickly adapted to and applied financial technologies (Fintech) to banking operations, such as mobile and QR code payments, electronic wallets, tokenization, payments via chip cards for domestic cards, etc. Those strong transformations have helped Vietnam's banking sector improve its competitiveness and expand the access to banking services of all people, especially those in the rural and remote areas. Almost all of the banks in Vietnam are investing in digitization,hence promoting adapting the FinTech and approximately half of them consider digital baking a top priority.

Vietnam Fintech Industry Overview

The Vietnam Fintech Market is highly competitive and fragmanted as Vietnam's fast-growing, yet fragmented, digital payment landscape has started witnessing the first signs of market consolidation. Vietnam is currently home to more than 130 FinTech startups that cater to numerous clients and cover a broad range of services such as digital payments, alternative finance, wealth management and blockchain, among others. There are currently over 5 million authenticated e-wallet users leaving plenty of opportunities for players.

In Vietnam, digital and mobile payment is undeniably the most developed and crowded fintech segment. The common services offered by such e-wallet or payment platforms include transfer money, pay for online transactions, like bill paying and utility bills, and point-of-sale transactions through wireless transactions from mobile, food delivery, ride hailing, etc. Vietnam groups such as VinID, MonPay, MoMo, iWealth, TrueMoney have been focusing on innovating FinTech industry and leading the Vietnam Fintech Market to the new heights.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXCEUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Insights into Technological Innovations in the Vietanamese BFSI Industry

- 4.2.1 Blockchain-related Innovations in Fintech Space in Vietnam

- 4.2.2 Insights into Open API and cloud computing ecosystem in Vietnam Fintech Space

- 4.2.3 Insights into Fintech Start-ups and Recent PE/VC/Seed Funding Deals in the Fintech Industry in Vietnam

- 4.2.4 Spotlight on Latest Innovations in the Global and Vietnamese Fintech Industry

- 4.3 Insights From Chinese and Other fintech industrys for Business Planning in Vietnam Fintech Landscape

- 4.4 Regulatory Landscape Ana Industry Policies Governing the Fintech Ecosystem in Vietnam

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.2 Market Restraints

- 4.5.3 Opportunities

- 4.6 Porters Five Forces Analysis

- 4.7 Insight on IT Spending by Financial Services Sector (Global and Vietnam)**

- 4.8 Insights into Opportunities and Competition in the Inwards and Outwards Foreign Remittance Services Segment**

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Digital Payments

- 5.1.1 Online Purchases

- 5.1.2 POS(Point of Sales) Purchases

- 5.2 Personal Finance

- 5.2.1 Digital Asset Management Services

- 5.2.2 Remittance/ International Monet Transfers

- 5.3 Alternative Financing

- 5.3.1 P2P Lending

- 5.3.2 SME Lending

- 5.3.3 Crowdfunding(gains based, product based, and reward based)

- 5.4 Insurtech

- 5.4.1 Online Life insurance

- 5.4.2 Online Health Insurance

- 5.4.3 Online Motor Insurance

- 5.4.4 Online Other General Insurance

- 5.5 B2C Financial Services Market Places

- 5.5.1 Banking and Credit

- 5.5.2 Insurance

- 5.6 E-Commerce Purchase Financing

- 5.7 Other front-end Fintech Solutions

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overvier and Integration/ Competition with Tradional Financial Services Companies

- 6.2 Company Profiles

- 6.2.1 MoMo

- 6.2.2 Zalo Pay

- 6.2.3 AirPay

- 6.2.4 Moca

- 6.2.5 TIMA

- 6.2.6 VayMuon

- 6.2.7 TrustCircle

- 6.2.8 Hudong

- 6.2.9 TheBank

- 6.2.10 iWealth

- 6.2.11 WiCare

- 6.2.12 Dwealth*

7 FUTURE OF THE MARKET

8 DISCLAIMER & ABOUT US