PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440176

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440176

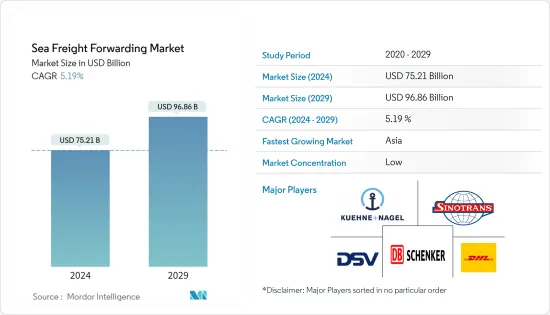

Sea Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Sea Freight Forwarding Market size is estimated at USD 75.21 billion in 2024, and is expected to reach USD 96.86 billion by 2029, growing at a CAGR of 5.19% during the forecast period (2024-2029).

Key Highlights

- The global sea freight forwarding market is booming, owing to the growing internet penetration, increasing Purchasing Power Parity, and developments in infrastructure and services designed particularly for the e-commerce industry. The epidemic negatively impacted the shipping industry as workforces in these sectors were shut down for safety and to prevent the spread of COVID-19.

- Sea freight forwarding has emerged as a preferred mode among several end-user industries and several strategic partnerships are also likely to promote the growth of sea freight forwarding during the forecast period. The growing global cross-border e-commerce market is driving the LCL volume and is positively impacting the sea freight forwarding market growth.

- Sea freight has been an important means of transporting goods, products, and people for thousands of years. Today, ships transport vital commodities such as coal, oil and gas, supporting the global economy. In 2021 alone, about 1.5 million tonnes of coal and about 1.10 million tonnes of oil were shipped.

- More importantly, about 85% of all goods are transported by sea, mainly by container ships. Compared to other means of transport, vessels have vast capacities suitable for transporting large, heavy, and bulky items that are more economical while producing relatively small amounts of emissions.

- Shipping rates are expected to drop further for the rest of the year and into 2023, according to shipowners and analysts. With a number of new vessels entering service over the next two years, net growth in the fleet size is expected to be over 9% through 2023 to 2024. By contrast, container volume growth in 2024 could be slightly negative according to Braemer.

Sea Freight Forwarding Market Trends

Rising Cross Broder E-Commerce is driving the Market

In 2021, retail e-commerce sales worldwide amounted to around USD 5,211 Billion and e-retail revenues are projected to grow even further at a quicker pace in the coming few years. Further, as online shopping is one of the most popular online activities worldwide is driving both the domestic and cross-border e-commerce in developing markets such as China, India, and Indonesia. This encompasses not just direct-to-consumer retail, but also shipments of electronics, pharmaceuticals, and consumer packaged goods.

Growth in e-commerce is tied very closely to the consumption growth in the region as developing economies make the gradual shift from growth by manufacturing for export to higher levels of consumption by expanding middle classes.

In China, cross-border e-commerce transactions already accounted for up to 25 percent of total import and export trading volumes. Compared to China, in other regions, the size of e-commerce related businessess is much smaller, but the growth is also rapid. One of the most preferred modese for e-commerce freight forwarding is through sea and many business are favoring that as evidenced by the growing of ocean freight volumes to 20 billion tons in 2021.

Rise In Seaborne Trade Transport Volume

The growth of seaborne trade benefits customers all around the world by lowering the cost of shipping. The prospects for the industry's continued growth remain favorable due to the increasing efficiency of shipping as a mode of transportation and further economic liberalization.

Despite the current circumstances, the industry's long-term prospects are still highly favorable. The world's population is still growing, and developing nations will keep needing more of the goods and raw materials that shipping transfers so securely and effectively. The volume of international trade conducted by sea has recently started to rise steadily once more. The fact that shipping is the most environmentally benign and cost-effective method of commercial transportation should eventually lead to an increase in the percentage of world trade that is transported by sea.

Over 50,000 merchant ships operate abroad and carry all different kinds of goods. More than a million seafarers of essentially every nationality make up the world fleet, which is registered in more than 150 countries.

According to the United Nations Conference on Trade and Development (UNCTAD), the operation of commercial ships generates freight rates worth roughly USD 380 billion for the global economy or about 5% of all trade.

The expansion of free trade and the demand for consumer goods has been fueled by rising industrialization and the liberalization of national economies. Technology advancements have also increased the effectiveness and speed of the shipping as a mode of transportation.

Between 1990 and 2020, seaborne trade volumes more than doubled to reach 10.65 billion tons. In 2020, 1.85 billion tons of international seaborne trade was carried by container ships. As of January 2021, Panama had the world's largest merchant fleet with 343.6 million DWT operator seats. The business volume of ocean freight forwarders has been steadily increasing because in the last three decades, the seaborne trade transport volume roughly tripled, reaching 150 billion metric tons in 2021.

Sea Freight Forwarding Industry Overview

The Sea Freight Forwarding Market is highly competitive and is highly fragmented with the presence of many players. A Sea Freight forwarder is an individual or company that acts as an intermediary and dispatches the shipments via common sea carriers and makes all arrangements for those shipments on behalf of its clients.

Sea Freight forwarders handle all the logistics needed and perform activities pertaining to shipments. With the Ocean freight volumes tripling from 2012 to 2022, the market has seen many new players entering in the last few years.

Some of the existing major players in the market include Kuehne + Nagel, DHL Supply Chain & Global Forwarding, DB Schenker, DSV Panalpina, Sinotrans, Expeditors, Nippon Express, CEVA Logistics, C.H. Robinson, and Kerry Logistics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Technological Trends

- 4.4 Investment Scenarios

- 4.5 Government Regulations and Initiatives

- 4.6 Spotlight - Sea Freight Transportation Costs/Freight Rates

- 4.7 Insights on the E-commerce Industry

- 4.8 Impact of COVID-19 on the Sea Freight Forwarding Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

- 5.3 Market Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Full Container Load (FCL)

- 6.1.2 Less-than Container Load (LCL)

- 6.1.3 Others

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 France

- 6.2.2.3 Netherlands

- 6.2.2.4 United Kingdom

- 6.2.2.5 Italy

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Australia

- 6.2.3.4 India

- 6.2.3.5 Singapore

- 6.2.3.6 Malaysia

- 6.2.3.7 Indonesia

- 6.2.3.8 South Korea

- 6.2.3.9 Rest of Asia-Pacific

- 6.2.4 Middle East & Africa

- 6.2.4.1 South Africa

- 6.2.4.2 Egypt

- 6.2.4.3 GCC Countries

- 6.2.4.4 Rest of Middle East & Africa

- 6.2.5 South America

- 6.2.5.1 Brazil

- 6.2.5.2 Chile

- 6.2.5.3 Rest of South America

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Kuehne + Nagel

- 7.2.2 Sinotrans

- 7.2.3 DHL

- 7.2.4 DB Schenker

- 7.2.5 DSV Panalpina

- 7.2.6 Expeditors

- 7.2.7 C.H Robinson

- 7.2.8 Ceva Logistics

- 7.2.9 Kerry Logistics

- 7.2.10 Nippon Express

- 7.2.11 Hellmann Worldwide Logistics

- 7.2.12 Geodis

- 7.2.13 Fr. Meyer's Sohn

- 7.2.14 Yusen Logistics

- 7.2.15 Bollore Logistics

8 FUTURE OF THE MARKET

9 DISCLAIMER