PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445775

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445775

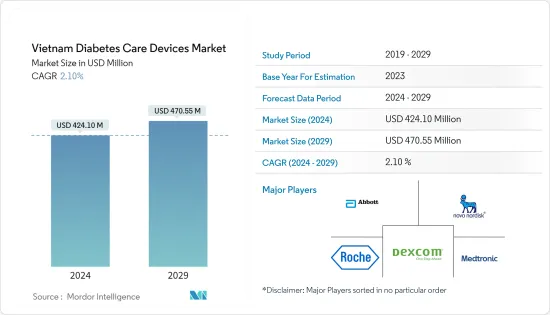

Vietnam Diabetes Care Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Vietnam Diabetes Care Devices Market size is estimated at USD 424.10 million in 2024, and is expected to reach USD 470.55 million by 2029, growing at a CAGR of 2.10% during the forecast period (2024-2029).

Among the nations affected by the COVID-19 epidemic, Vietnam has effectively stopped transmission since the beginning, with no deaths for months. However, the fourth wave of the COVID-19 epidemic has been wreaking havoc on Vietnam since then. Vietnam has seen four waves of the COVID-19 pandemic, according to the Ministry of Health (MOH).

The coronavirus disease-2019 (COVID-19) has been identified as a highly contagious viral illness caused by the coronavirus-2 that causes severe acute respiratory syndrome (SARS-CoV-2). Diabetes is one of the biggest risk factors for deadly COVID-19 outcomes. Diabetes patients are at risk of infection due to hyperglycemia, decreased immune function, vascular problems, and comorbidities such as hypertension, dyslipidemia, and cardiovascular disease. Furthermore, in the human body, angiotensin-converting enzyme 2 (ACE2) is a receptor for SARS-CoV-2. As a result, the use of angiotensin-converting enzyme (ACE) inhibitors in diabetic patients requires special consideration. COVID-19 severity and mortality were considerably greater in diabetic individuals than in those without. As a result, diabetic individuals should take care during the COVID-19 pandemic.

In Vietnam, according to the Ministry of Health, 29,000 patients die due to diabetes, annually. In order to prevent this situation, the ministry initiated a training program to improve the diagnosis of diabetes and the treatment capacity of medical professional's in taking care of diabetic patients in Vietnam during 2019-2020.

Vietnam Diabetes Care Devices Market Trends

Management Devices Hold Highest Market Share in Vietnam Diabetes Care Devices Market

Health insurance was introduced in Vietnam over 10 years ago, but the coverage is still relatively low. Vietnam is a low- to middle-income country with a per-capita GDP of around USD 4310. As a result, the expense of diabetes treatment significantly strains a patient's family budget. Diabetes medicine is inexpensive in HCMC as compared to the expense of treating other chronic disorders, including infectious, cardiovascular, and renal problems. The lack of government policies and healthcare schemes impacts Vietnam's market growth for management devices. The country's population of those over 60 years has created pressures on the healthcare system, as well as social security services and policies. Thus, the government needs to establish new policy programs that can reduce the burden of healthcare costs for diabetes treatment.

Digital companies are trying to improve the conditions of diabetic patients by reminding them when to test their glucose levels and passing the information to doctors and family members. According to a study conducted by GlucoMe (digital diabetes platform), along with Merck, at several endocrinology clinics and hospitals in Vietnam, using GlucoMe applications reduced the risks of the major issues related to diabetes for Type 2 diabetic patients. The awareness among diabetic patients in Vietnam is expected to increase the growth of the market for management devices in the country during the forecast period.

Increasing Diabetes Population in Vietnam

Diabetes is one of the four major noncommunicable diseases (NCDs), and its global prevalence has steadily increased in recent years. In Vietnam, Diabetes is rising at a rate of about 6.23% every year, and it has become a serious health and economic burden for Vietnamese society. Economic growth and changes in the social environment impact disease patterns ranging from infectious illnesses to noncommunicable diseases, with diabetes being one of the seven top causes of death and disability in Vietnam. The prevalence of obesity in Vietnam is still relatively low, although it has increased substantially during the past decade, particularly over the past 5 years. A major shift in dietary habits parallels the changes in obesity prevalence rates. Cigarette smoking is a major risk factor for diabetes in Vietnam. A recent meta-analysis suggests that cigarette smokers are 44%more likely to have diabetes than non-smokers. Although there is a high prevalence of cigarette smoking in Vietnamese men, this trend is decreasing.

Diabetes is recognized as a public health burden in Vietnam, and public health authorities have taken measures to reduce the burden-the diabetes burden in Vietnam results from several epidemiologic changes and drivers. Diabetes has the potential to reach epidemic proportions and, as a result, confer tremendous public health and economic burden in Vietnam. Although the prevalence of diabetes in rural areas is still relatively low, it is rising. In major cities, diabetes is as high as in other Western populations. The increase in the diabetes prevalence rates correlates with changes in risk factors, such as adiposity and a Westernized dietary pattern. It is generally believed that diabetes is preventable through lifestyle changes that include healthy eating and consistent physical activity. Still, more research is needed to validate this premise for the Vietnamese community.

Vietnam Diabetes Care Devices Industry Overview

The new technologies in diabetes devices, like continuous glucose monitoring, increased the market for monitoring devices. The mergers and acquisitions between the players, like the acquisition of TypeZero Technologies by Dexcom, are paving the way for automated insulin delivery. The acquisition has sent Dexcom ahead on its way in the race to create an artificial pancreas system rather than merely offering a boost to the continuous glucose monitoring devices market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Monitoring Devices

- 5.1.1 Self-monitoring Blood Glucose Devices

- 5.1.1.1 Glucometer Devices

- 5.1.1.2 Test Strips

- 5.1.1.3 Lancets

- 5.1.2 Continuous Blood Glucose Monitoring

- 5.1.2.1 Sensors

- 5.1.2.2 Durables

- 5.1.1 Self-monitoring Blood Glucose Devices

- 5.2 Management Devices

- 5.2.1 Insulin Pump

- 5.2.1.1 Insulin Pump Device

- 5.2.1.2 Insulin Pump Reservoir

- 5.2.1.3 Infusion Set

- 5.2.2 Insulin Syringes

- 5.2.3 Insulin Cartridges

- 5.2.4 Disposable Pens

- 5.2.1 Insulin Pump

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes population

- 6.2 Type-2 Diabetes population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Becton and Dickenson

- 7.1.2 Medtronic

- 7.1.3 Insulet

- 7.1.4 Tandem

- 7.1.5 Ypsomed

- 7.1.6 Novo Nordisk

- 7.1.7 Sanofi

- 7.1.8 Eli Lilly

- 7.1.9 Abbottt

- 7.1.10 Roche

- 7.1.11 Lifescan (Johnson &Johnson)

- 7.1.12 Dexcom

- 7.2 Company Share Analysis

8 MARKET OPPORTUNITIES AND FUTURE TRENDS