PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836453

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836453

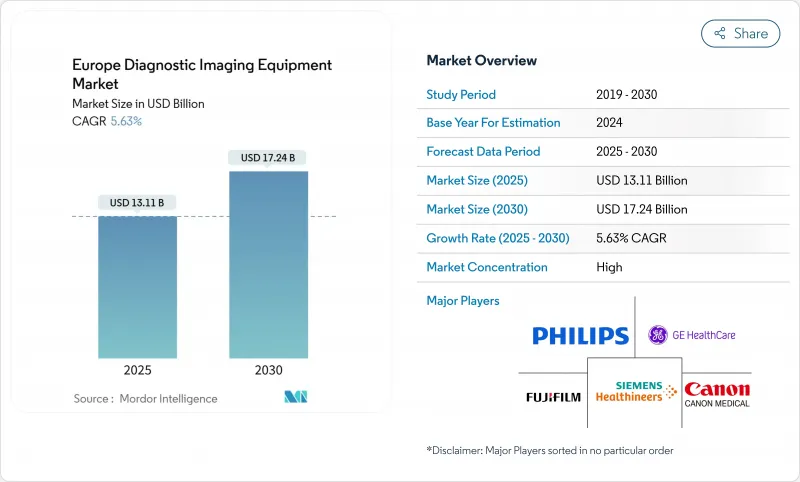

Europe Diagnostic Imaging Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe diagnostic imaging equipment Market size is estimated at USD 13.11 billion in 2025, and is expected to reach USD 17.24 billion by 2030, at a CAGR of 5.63% during the forecast period (2025-2030).

Accelerated equipment renewal cycles, a rapidly greying population, and hospital digitization mandates underpin the growth curve. Photon-counting CT, helium-free MRI, and AI-enabled workflow software improve image quality, slash scan times, and offset workforce shortages, creating strong replacement demand. Governments funnel fresh capital into modern imaging suites through schemes such as Germany's Hospital Future Act and France's Health Innovation Plan, widening the revenue base for vendors. Meanwhile, private equity groups consolidate outpatient radiology chains, boosting purchasing power for large fleet upgrades. Intensifying competition among Siemens Healthineers, Philips, and GE HealthCare drives aggressive product launches that emphasize sustainability, automation, and total-cost-of-ownership reduction

Europe Diagnostic Imaging Equipment Market Trends and Insights

Prevalence of chronic diseases and an aging European population

Europe's over-65 cohort is on track to jump from 21% in 2023 to 29% by 2050, translating into millions more oncology, cardiology, and musculoskeletal scans each year. Cancer incidence already exceeds 4.47 million new cases annually, with Northern and Western countries detecting disease earlier thanks to organized screening. Hospitals respond by prioritizing multipurpose scanners that handle high daily volumes yet deliver sub-millimetric resolution. Vendors cater to this surge with wider bore MRI and low-dose CT lines that preserve image quality for frail patients. Chronic disease management programs also drive sustained outpatient imaging referrals, re-orienting procurement toward scalable, cloud-connected systems that streamline image sharing among referring physicians.

Continuous technology innovation in imaging

Photon-counting CT provides up to four-fold higher spatial resolution and significantly lower radiation dose than conventional detectors, winning early adopters at sites such as San Raffaele Hospital in Italy. AI-aided reconstruction on Siemens Healthineers' Helium-free MRI platform cuts exam times by 30%, enabling more scans per day and easing scheduling backlogs. France earmarked EUR 1.5 billion for healthcare AI, and early pilots show a 28% improvement in tumor detection with AI-assisted mammography. These breakthroughs spark modality replacement even in budget-tight environments because operational savings offset frontline price premiums. Vendors complement hardware with subscription-based AI suites that automate repetitive tasks and support remote reading.

High capital and total-cost-of-ownership for advanced imaging equipment

Photon-counting CT and 3 T MRI units can top USD 1 million apiece, while annual service contracts often equal 10% of purchase price. EU MDR compliance adds incremental pre-market expenditure exceeding USD 50,000 for Class III devices and can lengthen time-to-market, delaying revenue realization for manufacturers and limiting early access for providers. Smaller clinics struggle to justify such outlays under fixed reimbursement, potentially widening geographic gaps in care.

Other drivers and restraints analyzed in the detailed report include:

- Rising healthcare infrastructure investment and hospital modernization programs

- Growing adoption of minimally invasive, image-guided procedures across specialties

- Persistent shortage of radiologists and imaging technologists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

X-ray retained the largest slice of the Europe diagnostic imaging equipment market at 35.41% in 2024, anchored by ubiquitous use in trauma and primary care. That dominance is stable through mid-term forecasts, but MRI's 7.46% CAGR represents the fastest lane, supported by helium-free magnet technology that removes bulk cryogen logistics and trims lifecycle emissions. Photon-counting CT shipments also accelerate thanks to oncology staging protocols demanding finer lesion characterization. Ultrasound remains indispensable in cardiac, obstetric, and point-of-care settings; 80% of Belgian emergency departments already use portable scanners for bedside triage. Nuclear imaging slots into theranostic regimens, while digital mammography enjoys AI decision support that lifts cancer detection sensitivity.

MRI's share growth reshapes vendor R&D budgets toward advanced coils, motion correction, and compressed sensing. X-ray manufacturers counter by integrating AI fracture detection and dual-energy functionality. CT suppliers bundle dose-tracking dashboards to satisfy tightening radiation governance. Segment players that deliver comprehensive modality ecosystems-hardware, software, and service-capture recurring revenue themes and deepen account stickiness within the Europe diagnostic imaging equipment market.

Fixed systems still represent 79.21% of installed base and remain indispensable for high-throughput oncology and trauma centers. These suites house ceiling-suspended detectors, 64-slice CT, and 3 T MRI that anchor multidisciplinary hubs. Yet shifting care models favor agile solutions, propelling mobile and handheld systems at 7.12% CAGR. The Europe diagnostic imaging equipment market size for portable ultrasound is projected to climb above USD 1.2 billion by 2030 as general practitioners and paramedics adopt pocket devices that expedite triage in ambulances and rural clinics. Chipiron's USD 17 million funding to engineer compact MRI underlines investor belief in mobility's disruptive potential.

Mobile CT and C-arms also align with surgical suite expansion and trauma resuscitation bays that demand rapid imaging without patient transfer. Vendors refine battery life, wireless data transfer, and antimicrobial casings to support infection-control protocols. Meanwhile, leasing firms offer pay-per-scan models that remove upfront capital hurdles, especially for small hospitals, and fuel broader diffusion across the Europe diagnostic imaging equipment market.

The Europe Diagnostic Imaging Equipment Market Report is Segmented by Modality (MRI, CT, Ultrasound, X-Ray, Nuclear Imaging, Fluoroscopy and C-Arms and Mammography), Portability (Fixed Systems and Mobile and Hand-Held Systems), Application (Cardiology, Oncology, Neurology, Orthopedics, and More), and End-User (Hospitals, Diagnostic Imaging Centres, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Siemens Healthineers

- Koninklijke Philips

- GE Healthcare

- Canon

- FUJIFILM

- Esaote

- Hologic

- Shimadzu

- Carestream Health

- Koning Health

- Agfa-Gevaert

- SAMSUNG (SamsungHealthcare.com)

- Mindray

- United Imaging Healthcare Co. Ltd.

- Ziehm Imaging

- Planmeca

- Guerbet SA

- BC Group DMS Imaging

- Bracco

- Neusoft

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Prevalence of chronic diseases and an aging European population

- 4.2.2 Continuous technology innovation in imaging

- 4.2.3 Rising healthcare infrastructure investment and hospital modernization programs

- 4.2.4 Growing adoption of minimally invasive, image-guided procedures across specialties

- 4.2.5 Expansion of outpatient and mobile imaging service models for greater access

- 4.2.6 Government initiatives promoting early diagnosis and digital health integration

- 4.3 Market Restraints

- 4.3.1 High capital and total-cost-of-ownership for advanced imaging equipment

- 4.3.2 Persistent shortage of radiologists and imaging technologists

- 4.3.3 Stringent EU regulatory landscape prolonging approvals

- 4.3.4 Uncertainity in Reimbursement policies within public healthcare systems

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Modality

- 5.1.1 MRI

- 5.1.1.1 < 1.5 T

- 5.1.1.2 1.5-3 T

- 5.1.1.3 > 3 T

- 5.1.2 CT

- 5.1.2.1 <= 16-slice

- 5.1.2.2 64-slice

- 5.1.2.3 >= 128-slice & photon-counting

- 5.1.3 Ultrasound

- 5.1.3.1 2-D

- 5.1.3.2 3-D/4-D

- 5.1.3.3 Hand-held & POCUS

- 5.1.4 X-ray

- 5.1.4.1 Analog

- 5.1.4.2 Digital (DDR/DR)

- 5.1.5 Nuclear Imaging

- 5.1.5.1 PET

- 5.1.5.2 SPECT

- 5.1.6 Fluoroscopy and C-arms

- 5.1.7 Mammography

- 5.1.1 MRI

- 5.2 By Portability

- 5.2.1 Fixed Systems

- 5.2.2 Mobile and Hand-held Systems

- 5.3 By Application

- 5.3.1 Cardiology

- 5.3.2 Oncology

- 5.3.3 Neurology

- 5.3.4 Orthopedics

- 5.3.5 Gastroenterology

- 5.3.6 Women's Health & OB-GYN

- 5.3.7 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Imaging Centers

- 5.4.3 Other End Users

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Siemens Healthineers AG

- 6.3.2 Koninklijke Philips N.V.

- 6.3.3 GE HealthCare

- 6.3.4 Canon Medical Systems Corporation

- 6.3.5 Fujifilm Holdings Corporation

- 6.3.6 Esaote SpA

- 6.3.7 Hologic Inc.

- 6.3.8 Shimadzu Corporation

- 6.3.9 Carestream Health

- 6.3.10 Koning Health

- 6.3.11 Agfa-Gevaert Group

- 6.3.12 SAMSUNG (SamsungHealthcare.com)

- 6.3.13 Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- 6.3.14 United Imaging Healthcare Co. Ltd.

- 6.3.15 Ziehm Imaging GmbH

- 6.3.16 Planmeca Oy

- 6.3.17 Guerbet SA

- 6.3.18 BC Group DMS Imaging

- 6.3.19 Bracco Imaging SpA

- 6.3.20 Neusoft Medical Systems Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment