PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836454

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836454

France Diagnostic Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

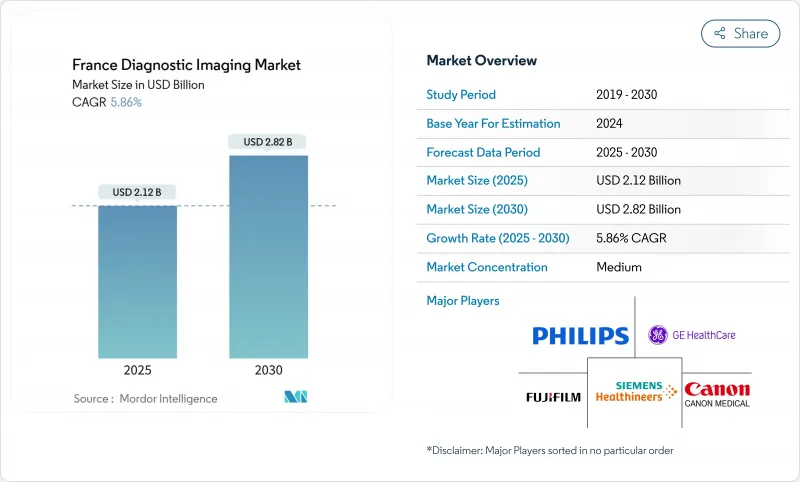

The France diagnostic imaging market size is estimated at USD 2.12 billion in 2025, and is expected to reach USD 2.82 billion by 2030, at a CAGR of 5.86% during the forecast period (2025-2030).

This growth is buoyed by government funding, steady healthcare spending growth, and rising demand from an aging population. Capital allocation under the national EUR 7 billion health-innovation plan, including EUR 1.5 billion earmarked for artificial-intelligence deployment, keeps equipment refresh cycles on track even as public hospitals face budget deficits. Structural shifts such as outpatient care growth, mobile imaging adoption, and AI-assisted workflows further strengthen demand signals across modalities, especially MRI and connected ultrasound. Competitive intensity remains moderate; major multinationals leverage bundled service contracts, while domestic innovators target portable and AI-enabled niches to unlock rural and suburban opportunities

France Diagnostic Imaging Market Trends and Insights

Rising Prevalence of Chronic Diseases & Aging Population

Chronic disease prevalence continues to rise, pushing imaging volumes across France. Healthcare reimbursements for diabetes, cardiovascular conditions, and cancer reached EUR 167 billion in 2024, making imaging a frontline diagnostic tool. An older demographic intensifies complexity, demanding AI-assisted protocols to detect multiple pathologies in a single scan. Survival gaps tied to travel distance-up to 10% lower five-year cancer survival for patients located farther from referral centers-spotlight the clinical value of locally available scanners. Limited radiologist supply heightens reliance on intelligent image triage, while mobile units help bridge urban-rural access disparities. Collectively, these factors anchor long-term growth in the France diagnostic imaging equipment market.

Government Investment to Modernize Hospital Imaging Capacity

France's EUR 7 billion health-innovation program identifies diagnostic imaging as a modernization priority. Funds channel toward large-scale equipment renewals, AI pilots, and specialized ventures such as Institut Curie's EUR 37 million FLASH-radiotherapy platform. The push responds to bottlenecks: annual mechanical-thrombectomy procedures plateaued at 7,500 amid staffing and scanner shortages. Vendor-provider "value partnerships," like Siemens Healthineers' EUR 60 million, 12-year contract with University Hospital Nantes, illustrate a new procurement logic that bundles hardware, service, and lifecycle upgrades. Such financing mechanisms accelerate deployments while containing upfront capital strain, underpinning the France diagnostic imaging equipment market expansion.

Ionizing-Radiation Safety Concerns

The January 2025 creation of the Autorite de surete nucleaire et de radioprotection consolidates nuclear-safety oversight and intensifies inspection frequency for 60,000 radiation-emitting devices nationwide. Stricter dose-reference levels prompt facilities to favor low-dose CT, iterative-reconstruction software, or MRI alternatives. Vendors develop visual and acoustic dose-alert systems showcased at AP-HP's APinnov 2025 event. While safety vigilance limits indiscriminate CT and X-ray growth, it also boosts demand for next-generation scanners with automated exposure control, mitigating, rather than halting, expansion of the France diagnostic imaging equipment market.

Other drivers and restraints analyzed in the detailed report include:

- Steady Growth in National Healthcare Spending and Equipment Replacement Programmes

- Shift Toward Outpatient and Ambulatory Imaging Centers Boosts System Installations Outside Hospitals

- Ongoing Shortage of Trained Radiologists and Technologists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

X-ray systems dominated 2024 with 31.41% France diagnostic imaging equipment market share, underscoring their ubiquity in emergency, chest, and musculoskeletal evaluations. The segment's growth moderates amid radiation-dose scrutiny, but upgrades to digital detectors sustain replacement demand. MRI, propelled by helium-free magnet technology that slashes annual operating costs, exhibits a robust 6.96% CAGR, the fastest in the landscape. The France diagnostic imaging equipment industry benefits from Philips BlueSeal and other zero-boil-off platforms that simplify siting and cut maintenance. CT maintains relevance for trauma and oncology staging, where AI-based image reconstruction reduces dose exposure. Ultrasound innovation-exemplified by Samsung's acquisition of Sonio-adds deep-learning capabilities for obstetric diagnostics.

In nuclear imaging, theranostic pathways drive SPECT/CT and PET/CT replacements as oncology centers pair diagnostics with targeted radionuclide therapy. Mammography remains vital to national screening programs, though novel magnetic-marker navigation shows promise in lowering re-excision rates for breast-cancer surgery. Overall, modality diversification ensures steady equipment cycles, reinforcing the France diagnostic imaging equipment market's value trajectory.

Fixed scanners retained 82.21% of the 2024 France diagnostic imaging equipment market size, reflecting hospital dependence on high-throughput, full-featured rooms. Widespread picture-archiving integration, power requirements, and advanced technologist workflows continue to favor stationary installations for complex imaging. However, portable systems record 7.23% CAGR, tapping unmet rural and elderly-care needs. Studies verify equal diagnostic accuracy when chest radiographs are performed at bedside, cutting transfer time and potential complications. DMS Group's Onyx mobile radiology platform exemplifies local manufacturer momentum, lifting company sales 9% to EUR 46.1 million in 2024.

COVID-19 reinforced clinical acceptance of point-of-care scanning, spurring permanent workflow changes. Battery life gains, AI on-device analytics, and 5G connectivity now allow real-time remote consultation, making mobility central to future procurement. These advances shape a two-tier market where fixed rooms handle high-complexity imaging and mobile units ensure proximity care, together enlarging the France diagnostic imaging equipment market.

The France Diagnostic Imaging Market Report is Segmented by Modality (MRI, Computed Tomography, Ultrasound, X-Ray, Nuclear Imaging, Fluoroscopy and Mammography), Portability (Fixed Systems and Mobile / Portable Systems), Application (Cardiology, Oncology, Neurology, Orthopedics, and More), and End-User (Hospitals, Diagnostic Centers, and Other End-Users). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Koninklijke Philips

- Siemens Healthineers

- GE Healthcare

- FUJIFILM

- Canon

- Hologic

- Shimadzu

- Carestream Health

- Esaote

- Mindray

- SAMSUNG (SamsungHealthcare.com)

- Agfa-Gevaert

- Ziehm Imaging

- United Imaging Healthcare Co. Ltd.

- Neusoft

- DMS Group

- Planmed

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of chronic diseases & ageing population

- 4.2.2 Government investment to modernise hospital imaging capacity

- 4.2.3 Steady growth in national healthcare spending and equipment replacement programmes

- 4.2.4 Shift toward outpatient and ambulatory imaging centres boosts system installations outside hospitals

- 4.2.5 Emphasis on early, value-based diagnosis increases utilisation rates

- 4.2.6 Integration of digital health and cloud-based image management drives demand for connected modalities

- 4.3 Market Restraints

- 4.3.1 Ionising-radiation safety concerns

- 4.3.2 High capital & maintenance cost of advanced systems

- 4.3.3 Lengthy CE-mark & reimbursement approval timelines

- 4.3.4 Ongoing shortage of trained radiologists and technologists

- 4.4 Pricing Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Modality

- 5.1.1 MRI

- 5.1.2 Computed Tomography

- 5.1.3 Ultrasound

- 5.1.4 X-Ray

- 5.1.5 Nuclear Imaging

- 5.1.6 Fluoroscopy

- 5.1.7 Mammography

- 5.2 By Portability

- 5.2.1 Fixed Systems

- 5.2.2 Mobile / Portable Systems

- 5.3 By Application

- 5.3.1 Cardiology

- 5.3.2 Oncology

- 5.3.3 Neurology

- 5.3.4 Orthopedics

- 5.3.5 Gastroenterology

- 5.3.6 Gynecology

- 5.3.7 Other Applications

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Centers

- 5.4.3 Other End-Users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Koninklijke Philips N.V.

- 6.3.2 Siemens Healthineers AG

- 6.3.3 GE HealthCare

- 6.3.4 FUJIFILM Holdings Corporation

- 6.3.5 Canon Medical Systems Corporation

- 6.3.6 Hologic Inc.

- 6.3.7 Shimadzu Corp.

- 6.3.8 Carestream Health Inc.

- 6.3.9 Esaote SpA

- 6.3.10 Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- 6.3.11 SAMSUNG (SamsungHealthcare.com)

- 6.3.12 Agfa-Gevaert NV

- 6.3.13 Ziehm Imaging GmbH

- 6.3.14 United Imaging Healthcare Co. Ltd.

- 6.3.15 Neusoft Medical Systems Co., Ltd.

- 6.3.16 DMS Group

- 6.3.17 Planmed Oy

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment