PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836539

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836539

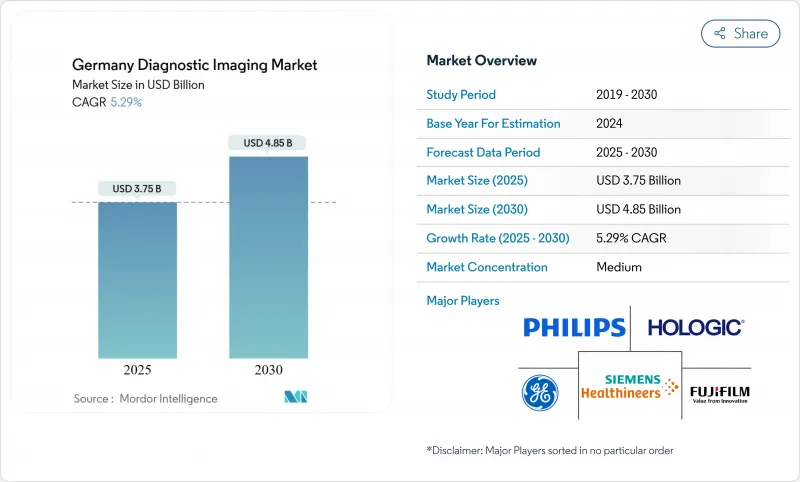

Germany Diagnostic Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Germany diagnostic imaging market size is estimated at USD 3.75 billion in 2025, and is expected to reach USD 4.85 billion by 2030, at a CAGR of 5.29% during the forecast period (2025-2030).

Growth builds on Germany's position as Europe's largest healthcare economy. Technology adoption accelerates because 1,874 hospitals now connect radiology equipment to new data backbones, while artificial-intelligence (AI) software offsets persistent radiologist shortages. Demographic pressure magnifies demand: Germany's population aged 65 and older continues to rise, pushing oncology and cardiology screening volumes higher and supporting steady equipment replacement cycles. Consolidation among private imaging chains and hospital capacity reductions intensify competition, yet regulatory barriers created by the Medical Device Regulation (MDR) reward vendors that maintain robust quality processes.

Germany Diagnostic Imaging Market Trends and Insights

Growing burden of chronic diseases

Rising prevalence of cancer, diabetes, and cardiovascular disease secures long-run imaging demand across the market. Cervical cancer illustrates the dynamic: 4,666 new diagnoses appear annually, and HPV-16/18 infections account for 76.5% of invasive tumors, making precise screening indispensable. National mammography sensitivity between 69.9% and 71.7% underscores the need for AI-enabled enhancement that improves lesion detection and reduces false-negatives. Chronic-disease care pathways now rely on longitudinal imaging, securing recurring equipment upgrades. Hospitals and outpatient centers therefore consider imaging hardware as revenue-protective infrastructure rather than discretionary capital, reinforcing steady orders even during broader economic volatility

Increased adoption of advanced technologies

The EUR 4 billion Hospital Future Fund accelerates digital infrastructure purchases that integrate AI, interoperability, and cloud architectures. DigitalRadar benchmarking of 1,624 hospitals revealed a mean digitization score of 33.3/100, exposing significant upgrade headroom. Philips' HealthSuite cloud imaging platform and NEXUS/CHILI's distribution pact with deepc confirm that scalable AI pipelines now influence procurement. Institutions adopt advanced modalities not merely for image quality but for seamless data exchange with electronic patient records mandated by the 2024 Digital-Gesetz.

Radiation-dose concerns & stricter regulation

Germany's Strahlenschutzverordnung enforces annual dose limits that require justification and optimization for every examination, pushing providers toward premium scanners with automated dose-tracking. Siemens Healthineers' photon-counting CT illustrates how vendors differentiate through low-dose performance while preserving diagnostic fidelity. Compliance adds cost and operational complexity, especially for facilities without integrated informatics, and may reduce examination frequency for low-value indications.

Other drivers and restraints analyzed in the detailed report include:

- Rapidly ageing population demanding early diagnosis

- Government grants for rural teleradiology roll-out

- High equipment cost & reimbursement gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

X-Ray retained 27.26% of Germany Diagnostic Imaging Equipment market share in 2024 because every hospital relies on radiography for trauma and routine chest studies. MRI, however, is boosting volumes in cardiac and neuro applications, and its 6.46% CAGR positions it as the primary growth engine through 2030. Siemens Healthineers expands its Magnetom Flow platform in the popular 1.5 Tesla segment, adding AI-enabled workflow automation that cuts exam times and broadens referral indications. PET/SPECT resurrection through theranostics further diversifies modality mix as GE Healthcare builds a dedicated center in Germany.

The Germany Diagnostic Imaging Equipment market now values modalities not only for image clarity but for how they integrate with electronic patient records and AI decision support. Ultrasound adoption benefits from hand-held devices that bring imaging to emergency rooms and rural clinics, while mammography modernizes through digital detectors and computer-aided detection that lift program sensitivity. Overall, modality portfolios continue to split between high-throughput X-Ray rooms that secure baseline service levels and premium MRI suites that capture incremental reimbursement, sustaining balanced capital investment profiles across provider types.

Fixed systems commanded 80.21% of the Germany Diagnostic Imaging Equipment market size in 2024 because large institutions still favor room-based CTs and MRIs for throughput efficiency. Nonetheless, mobile and hand-held systems post a 6.92% CAGR as workforce shortages make point-of-care diagnostics attractive. Siemens Healthineers' SOMATOM On.site CT allows intensive-care imaging without patient transport and provides remote control options that save technologist time.

Hand-held ultrasound units embedded with AI now generate automated measurements and share results directly to cloud archives, aligning with Germany's digital-health reimbursement framework for telematics infrastructure. Portable scanners complement rather than cannibalize fixed installations, revealing a dual-track procurement trend where hospitals purchase both categories to match case-mix variability.

The Germany Diagnostic Imaging Market Report is Segmented by Modality (MRI, Computed Tomography (CT), Ultrasound, X-Ray (Digital & Analog), Nuclear Imaging (PET / SPECT), and More), Portability (Fixed Systems and Mobile and Hand-Held Systems), Application (Cardiology, Oncology, Neurology, and More), and End-User (Hospitals, Diagnostic Imaging Centres, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Siemens Healthineers

- Koninklijke Philips

- GE Healthcare

- Canon

- FUJIFILM

- Agfa-Gevaert

- Esaote

- Hologic

- Shimadzu

- SAMSUNG (SamsungHealthcare.com)

- Carestream Health

- Mindray

- Ziehm Imaging

- United Imaging Healthcare Co. Ltd.

- Neusoft Medical Systems Co. Ltd.

- Planmeca

- Koning Health

- Guerbet SA

- Bracco

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing burden of chronic diseases

- 4.2.2 Increased adoption of advanced technologies

- 4.2.3 Rapidly ageing population demanding early diagnosis

- 4.2.4 Government grants for rural teleradiology roll-out

- 4.2.5 Private-equity consolidation of imaging centres

- 4.2.6 Expansion of national cancer-screening programs

- 4.3 Market Restraints

- 4.3.1 Radiation-dose concerns & stricter regulation

- 4.3.2 High equipment cost & reimbursement gaps

- 4.3.3 Radiologist shortage causing under-utilisation

- 4.3.4 Data-privacy hurdles hindering large-scale AI training & image sharing

- 4.4 Pricing Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Modality

- 5.1.1 MRI

- 5.1.2 Computed Tomography (CT)

- 5.1.3 Ultrasound

- 5.1.4 X-Ray (Digital & Analog)

- 5.1.5 Nuclear Imaging (PET / SPECT)

- 5.1.6 Mammography

- 5.1.7 Fluoroscopy & C-arms

- 5.2 By Portability

- 5.2.1 Fixed Systems

- 5.2.2 Mobile and Hand-held Systems

- 5.3 By Application

- 5.3.1 Cardiology

- 5.3.2 Oncology

- 5.3.3 Neurology

- 5.3.4 Orthopaedics

- 5.3.5 Obstetrics & Gynaecology

- 5.3.6 Gastro-Urology

- 5.3.7 Other Applications

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Imaging Centres

- 5.4.3 Ambulatory Surgery Centres

- 5.4.4 Speciality Clinics & Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Siemens Healthineers AG

- 6.3.2 Koninklijke Philips N.V.

- 6.3.3 GE HealthCare

- 6.3.4 Canon Medical Systems Corporation

- 6.3.5 Fujifilm Holdings Corporation

- 6.3.6 Agfa-Gevaert Group

- 6.3.7 Esaote SpA

- 6.3.8 Hologic Inc.

- 6.3.9 Shimadzu Corporation

- 6.3.10 SAMSUNG (SamsungHealthcare.com)

- 6.3.11 Carestream Health

- 6.3.12 Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- 6.3.13 Ziehm Imaging GmbH

- 6.3.14 United Imaging Healthcare Co. Ltd.

- 6.3.15 Neusoft Medical Systems Co. Ltd.

- 6.3.16 Planmeca Oy

- 6.3.17 Koning Health

- 6.3.18 Guerbet SA

- 6.3.19 Bracco Imaging SpA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment