PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836476

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836476

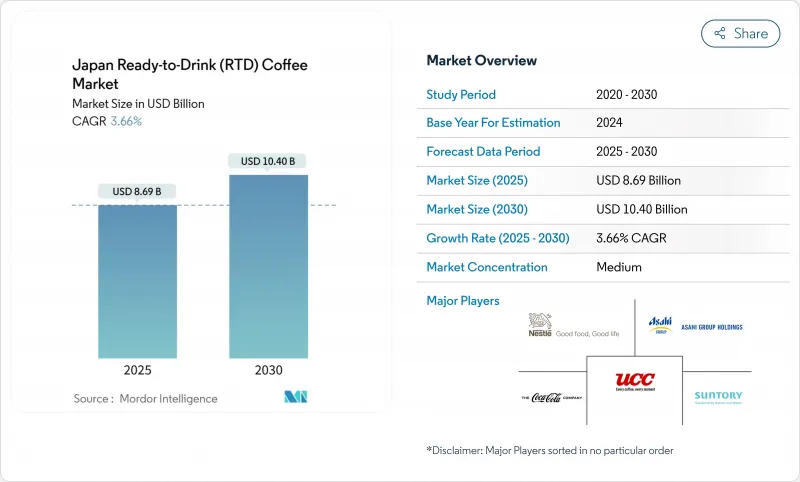

Japan Ready-to-Drink (RTD) Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Japanese Ready-to-Drink (RTD) Coffee market, valued at USD 8.69 billion in 2025, is projected to reach USD 10.40 billion by 2030, advancing at a CAGR of 3.66%.

The moderate growth trajectory reflects market maturity in a country where canned coffee has been deeply embedded in daily consumer routines for over five decades. However, the market's sustained performance is underpinned by rapid urbanization, Japan's unparalleled vending machine infrastructure, and persistent product innovation. Additionally, consumer preferences are transforming due to heightened health awareness and increasing demand for premium offerings. Significant market developments include the transition to convenient resealable PET bottles, the proliferation of cold-brew varieties, and diversification into plant-based alternatives. Despite intense market competition, established manufacturers maintain their market positions through innovative flavor combinations, enhanced functional benefits, and optimized distribution strategies.

Japan Ready-to-Drink (RTD) Coffee Market Trends and Insights

Convenience and On-the-Go Consumption on the Rise

Japan's RTD coffee market thrives due to a large and active workforce, approximately 69.6 million people in 2024, as reported by the Ministry of Internal Affairs and Communication (Japan) , many of whom operate in fast-paced urban environments like Tokyo. In Tokyo's prominent business districts, notably Shinjuku and Marunouchi, office workers depend on canned or bottled coffee during work breaks, capitalizing on immediate availability and streamlined service. This labor force fuels demand for quick caffeine fixes, especially through the country's dense vending machine network, which offers 24/7 access to hot and cold coffee. With one vending machine for every 23 people, Japan ensures unparalleled RTD availability, perfectly suited to its long-working-hour culture. The consistent year-round consumption of RTD coffee further highlights the entrenched role RTD beverages play in Japan's daily lifestyle.

Health Trends Spotting in RTD Coffee Beverages

Japanese consumers are demonstrating a significant shift toward RTD coffee products with health benefits, compelling manufacturers to develop innovative formulations with reduced sugar content and enhanced functional ingredients. This trend aligns with Japan's comprehensive focus on wellness and preventive health, particularly resonating among busy office workers and health-conscious older consumers. The substantial increase in demand for unsweetened black coffee, prominently featured by major brands like Suntory's BOSS and Asahi's Wonda, reflects a decisive movement toward healthier, low-calorie alternatives. The market is experiencing robust growth in functional RTD coffees enriched with essential nutrients, including protein, vitamins, collagen, and probiotics. Meiji's strategic April 2025 launch of a whole oats RTD coffee beverage, featuring 12 grams of whole grain oats per bottle and delivering beneficial dietary fiber with heart-healthy beta-glucan, exemplifies this innovative approach. These enhanced beverages effectively bridge the gap between nutritional requirements and convenience, catering to consumers seeking wholesome options in their daily routines.

High Amout of HFSS Sugar Limiting Iced Coffee Growth

The elevated sugar content in ready-to-drink (RTD) coffee beverages continues to deter health-conscious Japanese consumers, particularly amid growing awareness of high fat, salt, and sugar (HFSS) content. This concern is especially prominent among urban professionals and younger consumers who demand nutritional transparency in their beverage choices. The intensifying focus on health has accelerated the shift toward reduced-sugar options across the market. Manufacturers face the critical challenge of maintaining appealing flavor profiles while reducing sugar content, as traditional RTD coffee products typically contain significant levels of added sugars. This limitation particularly impacts the iced latte/cappuccino segment, where sweetened formulations have traditionally dominated consumer preferences. In response to this market evolution, major companies like Suntory and Asahi are actively developing and introducing innovative lower-sugar alternatives to address this growth constraint.

Other drivers and restraints analyzed in the detailed report include:

- Augmented Expenditure on Advertising and Promotional Activities

- Product Innovation Experiences Notable Surge

- Arabica Cost Volatility Post-Brexit Tariffs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cans dominate Japan's RTD coffee market with a commanding 51.31% share in 2024, continuing their legacy since UCC's groundbreaking introduction of canned coffee in 1969. Japan's network of approximately 3.93 million vending machines, as reported by the Japan Vending Machine Manufacturers Association in 2023, enables consumers to purchase hot and cold coffee throughout the year . Japanese consumers demonstrate strong loyalty to canned coffee, purchasing an average of 100 units annually through vending machines and convenience stores, underscoring the format's deep-rooted position in daily consumption patterns.

The bottle segment (PET and glass) demonstrates robust growth potential with a projected 5.12% CAGR from 2025 to 2030, driven by increasing consumer demand for resealable packaging that ensures product freshness and flexibility in consumption. Besides, glass bottles have established a strong presence in the premium segment, particularly for cold brew and specialty coffee offerings, capturing the attention of discerning consumers who value superior quality and sophisticated packaging presentation.

Iced latte and cappuccino products dominate 54.84% of the RTD coffee market share in 2024. These beverages capture mainstream consumer interest through their well-established taste profiles and premium milk-based formulations. The segment's market leadership reflects Japanese consumers' strong preference for creamy, balanced coffee beverages that minimize bitterness while delivering optimal caffeine benefits. Industry leaders BOSS Coffee (Suntory) and Georgia (Coca-Cola Japan) maintain substantial market presence through continuous product innovation and strategic marketing investments.

Cold brew RTD coffee exhibits exceptional growth at 5.87% CAGR (2025-2030). This expansion is primarily driven by younger consumers who value its distinctive, smooth, less acidic profile and enhanced caffeine content. The segment's market success is amplified by its established health advantages, including significantly reduced acidity and clean ingredient composition.

The Japan RTD Coffee Market is Segmented by Packaging Type (Bottles, Cans, and More), Product Type (Cold Brew RTD Coffee and More), Flavor (Plain/Classic and Flavored), Ingredient Base (Dairy-Based and Plant-Based Milk), Price Positioning (Mass and Premium), Distribution Channel (Supermarkets/Hypermarkets and More), and Prefecture (Tokyo, Kanagawa, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Starbucks Corporation

- Asahi Group Holdings, Ltd.

- The Coca-Cola Company (Japan)

- Suntory Holdings Limited

- UCC Ueshima Coffee Co., Ltd.

- Nestle S.A.

- Kirin Holdings Company, Limited

- DyDo Group Holdings, Inc.

- Ezaki Glico Co., Ltd.

- Key Coffee Inc.

- Sapporo Holdings Limited (Pokka Sapporo F&B)

- Ajinomoto Co., Inc.

- Lotte Corporation

- Morinaga Milk Industry Co., Ltd.

- PepsiCo, Inc

- Sangaria Co., Ltd.

- Illycaffe S.p.A.

- Heartland Food Products Group (Java House)

- Kitu Life, Inc.

- Ito En, Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience and On-the-Go Consumption on the Rise

- 4.2.2 Health Trends Spotting in RTD Coffee Beverages

- 4.2.3 Augmented Expenditure on Advertising and Promotional Activities

- 4.2.4 Product Innovation Experiences Notable Surge

- 4.2.5 Established Coffee Culture Supports Market Expansion

- 4.2.6 Workplace Consumption Boosts Market Demand

- 4.3 Market Restraints

- 4.3.1 High Amout of HFSS Sugar Limiting Iced Coffee Growth

- 4.3.2 Arabica Cost Volatility Post-Brexit Tariffs

- 4.3.3 RTD Coffee Faces Stiff Competition for Shelf Space from Emerging Alternatives

- 4.3.4 Caffeine Concerns Curbing RTD Coffee

- 4.4 Consumer Behaviour Analysis

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD MILLION)

- 5.1 By Packaging Type

- 5.1.1 Bottles

- 5.1.1.1 Glass Bottles

- 5.1.1.2 PET Bottles

- 5.1.2 Cans

- 5.1.3 Cartons

- 5.1.4 Others

- 5.1.1 Bottles

- 5.2 By Product Type

- 5.2.1 Cold Brew RTD Coffee

- 5.2.2 Iced Latte/Cappuccino

- 5.2.3 Nitro RTD Coffee

- 5.2.4 Functional / Protein-Enhanced RTD Coffee

- 5.3 By Flavor Profile

- 5.3.1 Plain/Classic

- 5.3.2 Flavored

- 5.4 By Ingredient Base

- 5.4.1 Dairy-Based

- 5.4.2 Plant-Based Milk

- 5.5 By Price Positioning

- 5.5.1 Mass

- 5.5.2 Premium

- 5.6 By Distribution Channel

- 5.6.1 Supermarkets/Hypermarkets

- 5.6.2 Convenienc/Grocery Stores

- 5.6.3 Online Retail Stores

- 5.6.4 Others (Vending Machine, Forecourt Stores, etc)

- 5.7 By Prefecture

- 5.7.1 Tokyo

- 5.7.2 Kanagawa

- 5.7.3 Osaka

- 5.7.4 Aichi

- 5.7.5 Saitama

- 5.7.6 Other Prefectures

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Starbucks Corporation

- 6.4.2 Asahi Group Holdings, Ltd.

- 6.4.3 The Coca-Cola Company (Japan)

- 6.4.4 Suntory Holdings Limited

- 6.4.5 UCC Ueshima Coffee Co., Ltd.

- 6.4.6 Nestle S.A.

- 6.4.7 Kirin Holdings Company, Limited

- 6.4.8 DyDo Group Holdings, Inc.

- 6.4.9 Ezaki Glico Co., Ltd.

- 6.4.10 Key Coffee Inc.

- 6.4.11 Sapporo Holdings Limited (Pokka Sapporo F&B)

- 6.4.12 Ajinomoto Co., Inc.

- 6.4.13 Lotte Corporation

- 6.4.14 Morinaga Milk Industry Co., Ltd.

- 6.4.15 PepsiCo, Inc

- 6.4.16 Sangaria Co., Ltd.

- 6.4.17 Illycaffe S.p.A.

- 6.4.18 Heartland Food Products Group (Java House)

- 6.4.19 Kitu Life, Inc.

- 6.4.20 Ito En, Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK