PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836578

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836578

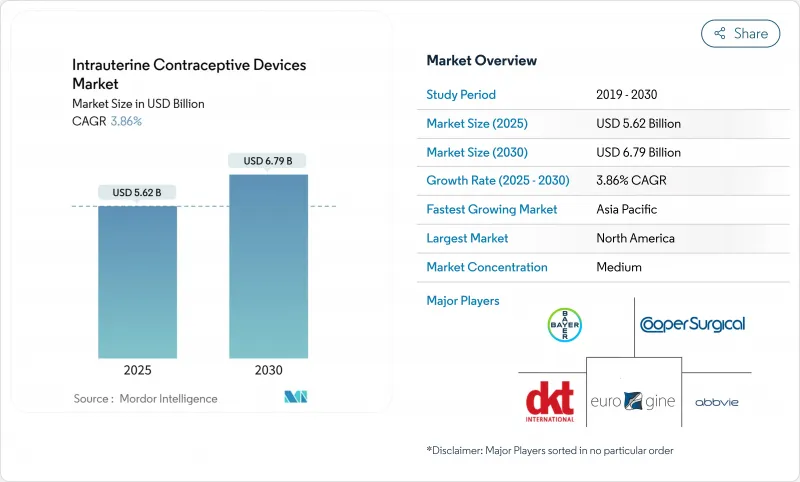

Intrauterine Contraceptive Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The intrauterine contraceptive devices market is valued at USD 5.62 billion in 2025 and is forecast to reach USD 6.79 billion by 2030, expanding at a 3.86% CAGR.

Growth is supported by rapid product innovation, rising demand from younger cohorts delaying childbirth, and expanding NGO procurement that eases affordability constraints. Copper IUDs still command most revenue because of long product life and low unit cost, yet hormonal devices are closing the gap as clinical data confirm their additional therapeutic benefits. Manufacturers are accelerating R&D on flexible frames and lower-copper or alternative-metal systems to reduce side effects-an essential differentiator in markets where discomfort and bleeding remain leading causes of discontinuation. Political headwinds in several U.S. states and cultural resistance in parts of Africa and the Middle East threaten adoption, but coordinated public-sector and NGO distribution programs continue to widen access, particularly in underserved rural areas.

Global Intrauterine Contraceptive Devices Market Trends and Insights

Technological Innovation Leading to Effective Contraceptives and Fewer Side Effects

New materials and engineering approaches are redefining copper devices. The FDA-cleared MIUDELLA uses a nitinol frame and 50% less copper yet keeps 99% efficacy, easing pain and heavy bleeding previously linked to conventional designs. Research teams are testing flexible iron-based frames that could cut inflammatory responses while safeguarding contraceptive strength. These improvements matter most in markets where fear of adverse events still deters uptake, and they give suppliers an edge with premium pricing tied to better user comfort.

Rising Demand for Long-Acting Reversible Contraceptives (LARCs)

Healthcare providers are steering patients toward devices that need no daily action and have <1% first-year failure rates. Women aged 25-34 already represent nearly two-thirds of IUD use, mirroring their desire for long protection while postponing pregnancies. Updated U.S. practice guidelines in 2024 place LARCs first in counseling scripts, a move likely to ripple into other national protocols.

Risk of Side Effects and Complications

Heavy bleeding, cramping and misplaced insertions remain top deterrents. A 2024 International Journal of Pharmaceutics study links polymer formulation and curing conditions to variable LNG release, influencing adverse events. Provider skill also matters; malposition rates are nearly double when generalists insert devices versus obstetric-gynecology specialists.

Other drivers and restraints analyzed in the detailed report include:

- Government Initiatives and Support Policies

- Favorable Recommendations from Global Health Organizations

- Cultural and Religious Opposition Coupled with Lack of Awareness

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Copper devices generated 65.1% of the intrauterine contraceptive devices market revenue in 2024, reflecting their long clinical track record and lower per-unit price. Hormonal systems, however, will record a 6.25% CAGR to 2030, narrowing the gap as research underscores benefits in menstrual regulation and dysmenorrhea management. The February 2025 approval of MIUDELLA featuring a flexible nitinol frame and reduced copper illustrates how engineering refinements address historic pain and bleeding complaints, boosting acceptance in regions where side effects once limited uptake. Academic teams pursuing iron-based frames highlight a potential next class of non-hormonal products with softer inflammatory profiles that could lure users who previously avoided copper models.

Manufacturers are also enhancing supply-chain efficiency to lower production costs, a change that supports public-sector tenders seeking bulk volumes at modest price points. Given these trends, copper units will remain volume leaders, but hormonal devices are set to capture incremental value share as higher reimbursement ceilings in Europe and North America favor premium pricing.

Women aged 25-34 contribute 62.6% of the intrauterine contraceptive devices market size, aligning long-acting protection with peak career building years. Survey data indicate that immediate reversibility appeals strongly to this cohort once family-building decisions shift. In contrast, adolescents under 20 log the highest forecast CAGR at 7.18% through 2030 after medical bodies clarified eligibility and safety parameters. Policy moves that permit confidential youth access and school-based counseling also influence uptake. Meanwhile, uptake among women above 35 remains steady as many seek reliable spacing after completing families but avoid permanent sterilization.

The Intrauterine Contraceptive Devices Market Report is Segmented by Type (Hormonal Intrauterine Device and Copper Intrauterine Device), Age Group (20-24 Years, 25-34 Years and More), End User (Hospitals, Community Health Centers and More), Distribution Channel (Public Sector Procurement, Private Sector and More) and Geography (North America, Europe and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific owns 34.9% of intrauterine contraceptive devices market revenue because of large user bases and active family-planning programs. China's relaxation of birth limits fuels demand for reversible methods, while India's domestic suppliers scale up to meet rising urban uptake. A Delhi study found 73% of couples using modern contraception, with IUDs gaining traction among educated women eyeing career continuity. Japan and South Korea show slower uptake but higher unit values per device, reflecting a preference for newer hormonal systems.

Middle East and Africa is the fastest-growing region at 5.75% CAGR as multilateral initiatives expand product availability and provider capacity, though cultural resistance still dampens absolute penetration. UNFPA's Supplies Partnership now covers 54 countries, with IUD availability at secondary care sites rising to 65% in 2024. Sub-Saharan Africa's average modern-method prevalence sits at 28.4%, and only 9.6% of women use long-acting methods, highlighting vast untapped potential as training and outreach progress.

North America and Europe maintain high value shares, driven by premium products and reimbursement frameworks that absorb higher device costs. In the U.S., regulatory volatility has emerged as a wildcard, with several states debating coverage restrictions that could blunt future growth. Latin America's moderate expansion is led by Brazil and Mexico, where blended public-private programs ease budget pressures and raise awareness through mobile clinics and televised campaigns.

- Bayer

- The Cooper Companies

- DKT International

- Abbvie

- Pregna International

- Mona Lisa

- Gedeon Richter Polska Sp. z o.o.

- Prosan International

- SMB

- Melbea

- OCON Medical Ltd

- Viatris

- Contrel Europe nv

- HLL Lifecare

- Gynocare

- Aetos Pharma Pvt Limited

- Sebela Pharmaceuticals,

- Eurim Group

- EUROGINE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Innovation Leading to Effective Contraceptives and Less Side Effects

- 4.2.2 Rising Demand for Long-Acting Reversible Contraceptives (LARCs)

- 4.2.3 Government Inititives and Support Policies

- 4.2.4 Favorable recommendations from Global Health Organziations

- 4.2.5 Increasing Trend of Delayed Childbirth

- 4.2.6 Expansion of NGO-led social-marketing campaigns and public-private partnership distribution programs

- 4.3 Market Restraints

- 4.3.1 Risk of Side Effects and Complications

- 4.3.2 Cultural & Religious Opposition to IUDs Coupled with Lack of Awareness

- 4.3.3 Skilled Provider Shortage for Insertions

- 4.3.4 High up-front device and insertion cost

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 Regulatory Landscape

- 4.5.2 Technological Innovations Pipeline

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Hormonal Intrauterine System (LNG-IUS)

- 5.1.2 Copper Intrauterine Device

- 5.2 By Age Group

- 5.2.1 <20 Years

- 5.2.2 20-24 Years

- 5.2.3 25-34 Years

- 5.2.4 35-44 Years

- 5.2.5 >44 Years

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Gynecology and Obstetrics Clinics

- 5.3.3 Community Health Centers

- 5.3.4 Family Planning & Sexual Health Centers

- 5.3.5 Other Ambulatory Settings

- 5.4 By Distribution Channel

- 5.4.1 Public Sector Procurement

- 5.4.2 Private Sector (Retail & Clinics)

- 5.4.3 NGO and Donor-Funded Programs

- 5.4.4 Online/Pharmacy Retail

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 CooperSurgical Inc.

- 6.4.3 DKT International

- 6.4.4 AbbVie Inc (Allergan)

- 6.4.5 Pregna International Limited

- 6.4.6 Mona Lisa NV

- 6.4.7 Gedeon Richter Polska Sp. z o.o.

- 6.4.8 Prosan International BV

- 6.4.9 SMB Corporation of India

- 6.4.10 Melbea AG

- 6.4.11 OCON Medical Ltd

- 6.4.12 Viatris

- 6.4.13 Contrel Europe nv

- 6.4.14 HLL Lifecare Limited

- 6.4.15 Gynocare

- 6.4.16 Aetos Pharma Pvt Limited

- 6.4.17 Sebela Pharmaceuticals,

- 6.4.18 Eurim Group

- 6.4.19 EUROGINE, S.L

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment