PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836671

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836671

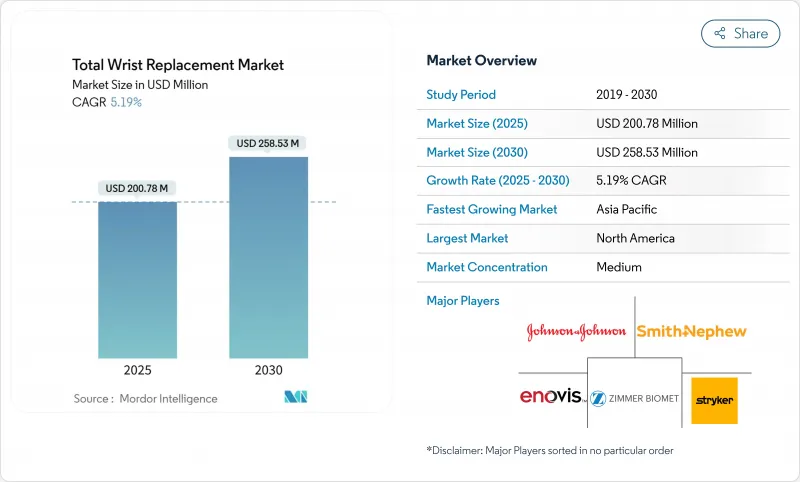

Total Wrist Replacement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Total Wrist Replacement Market size is estimated at USD 200.78 million in 2025, and is expected to reach USD 258.53 million by 2030, at a CAGR of 5.19% during the forecast period (2025-2030).

The transition from experimental procedures to routine motion-preserving solutions reflects fourth-generation implants that achieve more than 90% five-year survivorship, a performance level that encourages wider surgeon adoption while supporting patient demand for functional recovery over fusion solutions. Bundled payment models across major payers have already trimmed Medicare joint-replacement episode costs by 20.8%, creating cost visibility that favors outpatient pathways and drives procedure migration to ambulatory surgical centers. Material science also propels differentiation: cobalt-chromium alloys keep the lead through proven strength, yet ceramic components gain pace as surgeons look to minimize metal-ion release risks. Geographically, North America remains the revenue anchor, but rapid procedure uptake in China, Japan, and India positions Asia for the fastest expansion through 2030.

Global Total Wrist Replacement Market Trends and Insights

Rising Prevalence of Rheumatoid & Osteoarthritis

Rheumatoid arthritis affects 2.5 million individuals in the United States, and wrist arthritis is present in 13.6% of the general population, expanding the clinical pool eligible for arthroplasty. Shifting demographics and sedentary work habits bring the earlier onset of pathology that pushes treatment demand among younger, economically active patients. Comparative studies confirm that arthroplasty delivers better functional results than arthrodesis in rheumatoid cohorts despite slightly different complication profiles, strengthening the procedure's value proposition. Disease-modifying antirheumatic therapies now prolong joint integrity, yet prolonged survival raises the lifetime need for motion-preserving interventions. In practice, the Universal Total Wrist prosthesis improved Disabilities of the Arm, Shoulder and Hand (DASH) scores by 29% while cutting pain scores from 66.3 to 6.7, an outcome that resonates with patient-reported priorities.

Advancements in 4th-Generation Modular Implants

Fourth-generation systems provide four-year survival rates above 90%, dwarfing the 42% mid-term results seen in first-generation devices. Modular trays let surgeons tailor component sizes intraoperatively, minimizing malalignment risk and enabling easier staged revisions. The Freedom prosthesis, for instance, receives patient satisfaction scores of 8.7/10, but radiographic lucency in one-third of implants underlines the need for annual surveillance. Enhanced kinematics via semi-constrained ellipsoidal joints distribute load more evenly across the radiocarpal interface. Titanium-nitride coatings on CoCrMo and Ti6Al4V alloys virtually eliminate detectable ion release, responding to long-term biocompatibility concerns

High Procedure & Device Cost / Limited Reimbursement

U.S. payers have yet to publish national coverage determinations for total wrist arthroplasty, obliging surgeons to secure prior authorization case by case. Several private insurers label the operation experimental outside rheumatoid indications, enforcing restrictive criteria that limit patient throughput. Device prices remain elevated relative to hip and knee counterparts because smaller volumes offer fewer economies of scale, while regulatory hurdles raise commercialization costs. Bundled payment contracts push providers toward lower implant expenditures unless superior outcomes justify premium components. In many emerging markets, state payers favor high-volume orthopedic interventions over niche wrist procedures, delaying reimbursement inclusion.

Other drivers and restraints analyzed in the detailed report include:

- Preference for Motion-Preserving Procedures

- Expansion of Outpatient/ASC Arthroplasty

- High Revision & Complication Rates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Total Wrist Fusion represented 65.17% revenue in 2024, illustrating surgeon trust in reliable pain control and predictable union. In contrast, arthroplasty rises at a 7.32% CAGR as fourth-generation devices prove durable beyond the rheumatoid cohort and into osteoarthritis as well as post-traumatic indications, enlarging the candidate base. The 3D-printed microporous titanium prosthesis (3DMT-Wrist) lowered pain from 66.3 to 6.7 while tripling grip strength, reinforcing momentum behind motion-preserving platforms.

Clinical meta-analyses place arthroplasty complications at 19%, nearly matching the 17% rate seen in fusion among rheumatoid cases, eroding historical perceptions of high failure risk. Seven-year survival of 97% achieved by the Re-motion system underscores progress, though one-third of recipients still face secondary interventions. Artificial-intelligence guidance now offers millimeter-level accuracy on screw trajectory and component alignment, enhancing reproducibility. As evidence solidifies, the total wrist replacement market size for arthroplasty is set to expand faster than any other technology segment through 2030.

The Total Wrist Replacement Market is Segmented by Technology (Total Wrist Replacement, Total Wrist Fusion), Material (Cobalt-Chromium Alloys, Titanium Alloys, Stainless Steel, and More), End User (Hospitals, Ambulatory Surgical Centers, Specialty Orthopedic Clinics), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains leadership with 39.81% revenue in 2024, supported by Medicare initiatives such as CJR that reduce average episode costs and create stable reimbursement for complex wrist implants. Consolidated centers of excellence draw volume nationally, while FDA 510(k) clarity lowers the hurdle for incremental implant upgrades. ASC expansion, driven by payer pressure, accelerates site-of-service conversions without diminishing patient safety metrics.

Asia-Pacific records the fastest 9.39% CAGR through 2030. China's high procedure volume, together with local manufacturing capability, now positions domestic implants ahead of imported counterparts, dramatically tightening price-performance ratios. Knowledge-sharing through the Asia Pacific Wrist Association plus multinational fellowship exchanges quickly diffuse surgical best practices. Japan and India further elevate regional numbers thanks to national insurance expansion and private-sector hospital networks.

Europe posts moderate, steady growth. The market benefits from methodical adoption following rigorous registry feedback loops that benchmark survivorship and complication metrics. The completion of Enovis's EUR 800 million purchase of LimaCorporate in 2024 brought additional 3D-printed expertise into continental portfolios, supporting take-up of trabecular titanium designs. Cross-border research consortia, combined with pan-EU medical-device directives, provide an integrated pathway for advanced implants while preserving patient safety obligations.

- Acumed

- Small Bone Innovations Inc.

- Zimmer Biomet

- Integra LifeSciences Holdings Corp.

- Johnson & Johnson

- Stryker

- Enovis

- Medartis

- Skeletal Dynamics LLC

- Anika Therapeutics

- Conmed

- Extremity Medical LLC

- Wright Medical Group

- Smiths Group

- Orthofix

- KeriMedical SA

- Avanta Orthopaedics

- MatOrtho Limited

- Signature Orthopaedics

- Stanmore Implants

- Biotechni SAS

- LimaCorporate S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Rheumatoid & Osteoarthritis

- 4.2.2 Advancements in 4th-Generation Modular Implants

- 4.2.3 Preference for Motion-Preserving Procedures

- 4.2.4 Expansion of Outpatient/ASC Arthroplasty

- 4.2.5 Emergence of 3-D-Printed Patient-Specific Devices

- 4.2.6 Bundled-Payment Models Rewarding Outcomes

- 4.3 Market Restraints

- 4.3.1 High Procedure & Device Cost / Limited Reimbursement

- 4.3.2 High Revision & Complication Rates

- 4.3.3 Regulatory Caution After Device Withdrawals

- 4.3.4 Sparse Long-Term Evidence for Novel Biomaterials

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Technology

- 5.1.1 Total Wrist Replacement (TWR)

- 5.1.2 Total Wrist Fusion (TWF)

- 5.2 By Material

- 5.2.1 Cobalt-Chromium Alloys

- 5.2.2 Titanium Alloys

- 5.2.3 Stainless Steel

- 5.2.4 Ceramic-based Components

- 5.2.5 Polymer Components

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Orthopedic Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Acumed LLC

- 6.3.2 Small Bone Innovations Inc.

- 6.3.3 Zimmer Biomet Holdings Inc.

- 6.3.4 Integra LifeSciences Holdings Corp.

- 6.3.5 DePuy Synthes (Johnson & Johnson)

- 6.3.6 Stryker Corporation

- 6.3.7 Enovis (DJO Global)

- 6.3.8 Medartis AG

- 6.3.9 Skeletal Dynamics LLC

- 6.3.10 Anika Therapeutics Inc.

- 6.3.11 CONMED Corporation

- 6.3.12 Extremity Medical LLC

- 6.3.13 Wright Medical Group NV

- 6.3.14 Smith & Nephew plc

- 6.3.15 Orthofix Medical Inc.

- 6.3.16 KeriMedical SA

- 6.3.17 Avanta Orthopaedics

- 6.3.18 MatOrtho Limited

- 6.3.19 Signature Orthopaedics

- 6.3.20 Stanmore Implants

- 6.3.21 Biotechni SAS

- 6.3.22 LimaCorporate S.p.A.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment