PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850994

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850994

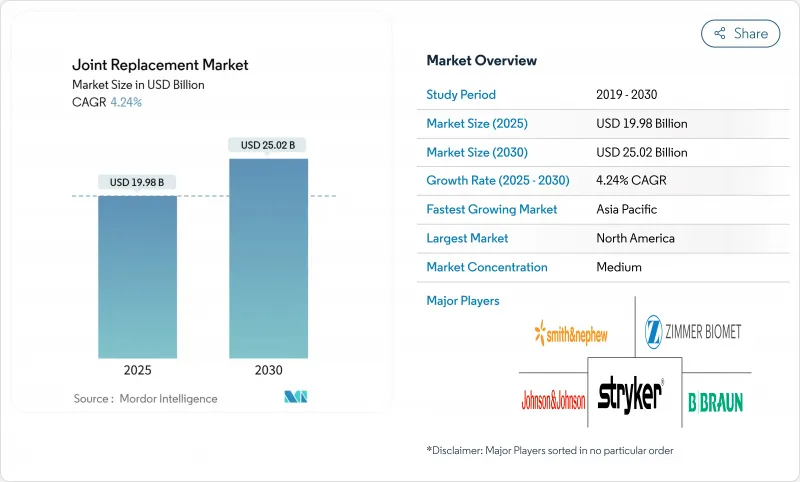

Joint Replacement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Joint Replacement Market size is estimated at USD 19.98 billion in 2025, and is expected to reach USD 25.02 billion by 2030, at a CAGR of 4.24% during the forecast period (2025-2030).

A mix of demographic ageing, lifestyle-related osteoarthritis, and continuous implant innovation is sustaining this moderate growth while forcing rapid shifts in surgical protocols. Robotic-assisted systems have captured a double-digit share of total knee cases in the United States and have catalysed the transition to same-day discharge pathways. Metallic devices still dominate, yet ceramics are gaining traction among younger, active recipients who want low wear and no metal ion exposure. Regionally, North America leads on utilisation, whereas Asia-Pacific is the fastest expanding zone as governments invest in orthopaedic capacity and broaden reimbursement.

Global Joint Replacement Market Trends and Insights

High Osteoarthritis Prevalence

Osteoarthritis affects 32.5 million adults in the United States and 606.5 million people worldwide. Knee disease alone accounts for more than half of all cases, creating a vast pool of potential surgical candidates. In the United States the economic burden is USD 136.8 billion a year, driven by nearly 1 million knee and hip replacements linked directly to osteoarthritis. More than half of those diagnosed with knee osteoarthritis ultimately undergo total knee arthroplasty, anchoring a structural demand curve for implants.

Rising Geriatric Population

Primary hip arthroplasties are forecast to hit 572,000 cases by 2030 and primary knee arthroplasties 3.48 million, marking 174% and 673% jumps from 2005 volumes. Revision hip and knee surgeries will rise in parallel as ageing implants reach the end of their life, intensifying the load on health systems. Emerging nations mirror this pattern; Colombia expects 39,270 lower-limb arthroplasties by 2050, with women representing 52.7% of procedures. Older patients often present multiple comorbidities, so providers prioritise less invasive techniques that shorten recovery time. Payers also encourage ambulatory settings: 72% of Medicare joint replacements already occur in outpatient facilities, up sharply from virtually none five years earlier.

High Procedure & Implant Cost

Average hip or knee implants cost USD 5,139 in 2023, while Medicare reimbursement for total hip arthroplasty kept falling, squeezing hospital margins. France exemplifies reimbursement pressure after mandating a 25% price cut on orthopaedic devices from 2025, risking product shortages as margins tighten. Bundled payment pilots in the United States favour large, not-for-profit hospitals that can spread risk, leaving smaller providers vulnerable. Orthopaedic trauma reimbursement eroded by one-third over two decades, well below inflation, reinforcing price sensitivity in device selection. Ambulatory centres deliver meaningful cost savings yet cascade margin pressure onto manufacturers, fomenting greater competition.

Other drivers and restraints analyzed in the detailed report include:

- Growing Preference for Minimally Invasive & Robotic-Assisted TJA

- Accelerated Post-Op Rehab Protocols Boosting Outpatient TJA Volumes

- Revision-Surgery Burden from Metal Hypersensitivity Claims

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Knee surgeries accounted for 39.54% of revenue in 2024, anchored by the high prevalence of knee osteoarthritis and well-established clinical pathways. Shoulder arthroplasty is the fastest-growing category at a 5.50% CAGR, stimulated by rising sports injuries among patients under 60 and the arrival of robotic guidance that reduces glenoid placement error. Hip replacement volumes increased 3.8% to 793,082 in 2023, while ankle and elbow procedures stay niche yet benefit from 3-D printed, patient-specific devices that extend implant indications. The partial-knee option is regaining relevance thanks to Zimmer Biomet's cementless Oxford implant that delivers a 94.1% 10-year survival rate. This array of procedure types outlines a maturing yet innovation-driven landscape that keeps the joint replacement market evolving.

Rapid adoption of unicompartmental knee arthroplasty also reflects surgeon willingness to preserve bone and hasten rehabilitation. Robotic alignment tools such as VELYS aim to overcome the steep technical learning curve that traditionally constrained utilisation. Meanwhile, rising revision demand amplifies training needs for complex reconstructions, reinforcing hospital reliance on high-volume arthroplasty specialists. These dynamics underpin a durable procedure mix that will continue to influence hospital resource planning and payer negotiations through 2030.

Metallic implants retained 47.87% revenue in 2024 due to proven fatigue strength and ease of machining. However, ceramics are expanding at a 10.93% CAGR as patients seek lower wear and no ion release. Titanium alloys preserve periprosthetic bone mineral density more effectively than cobalt-chromium, supporting the joint replacement market size for titanium-based systems at both primary and revision level. BIOLOX delta hip bearings show excellent survivorship and negligible allergic response, giving ceramics a persuasive value proposition. Polymer-metal hybrids and bioresorbable scaffolds are also gaining attention for complex revisions and young-adult trauma, signalling a diversified product pipeline.

Metal hypersensitivity has pushed R&D towards nickel-free or cobalt-free alternatives and advanced coatings that cut ion release. Smith + Nephew's OXINIUM resurfacing solution demonstrated a 94.1% 20-year survivorship and 35% fewer revisions than conventional alloys. Suppliers are adding antimicrobial silver coatings to fracture plates and instrument trays to fight surgical-site infection. Together these innovations will redefine material preference hierarchies and influence future joint replacement market share trajectories.

The Joint Replacement Market Report is Segmented by Procedure (Hip Replacement, Knee Replacement, and More), Product (Implants [Metallic, and More], Bone Grafts and Substitutes [Allograft, and More], and More), Technology (Conventional, and More), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 41.11% of revenue in 2024, supported by more than 2.15 million hip and knee replacements annually. Yet downward reimbursement revision exceeding 44% obliges hospitals to double down on operating-room efficiency and implant price negotiation.

Europe presents a seasoned regulatory environment and broad coverage, but reimbursement cuts, notably France's 25% device-price reduction from 2025, pressure profitability. Germany, the United Kingdom, and Italy post high procedural volumes, while broader EU discussions on raw-material sovereignty have spurred titanium and cobalt reshoring initiatives. Higher surgeon comfort with ceramic bearings and partial hip surface replacements differentiates European clinical practice.

Asia-Pacific is the fastest expanding zone at a 9.92% CAGR. China's titanium-industry hub in Baoji contributes 33% of global output, underpinning domestic implant growth. Japanese centres lead robot uptake, while India accelerates manufacturing and procedure counts via the Production Linked Incentive scheme. Robotic total knee arthroplasty trials in public hospitals reduced patient stay without compromising safety, evidencing technology adoption across resource tiers. Australia and South Korea add mature reimbursement frameworks and fast innovation diffusion, rounding out a heterogeneous but buoyant regional picture.

- Zimmer Biomet

- Stryker

- DePuy Synthes (J&J)

- Smiths Group

- B. Braun

- Enovis

- Exactech

- Corin Group

- MicroPort

- Conformis Inc.

- Medacta Group

- Globus Medical

- Waldemar Link GmbH

- Aesculap Implant Systems

- LimaCorporate

- Arthrex

- United Orthopedic Corp.

- Bioimpianti Srl

- Uteshiya Medicare

- Kyocera Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Osteoarthritis Prevalence

- 4.2.2 Rising Geriatric Population

- 4.2.3 Growing Preference for Minimally-Invasive & Robotic-Assisted TJA

- 4.2.4 Accelerated Post-Op Rehab Protocols Boosting Outpatient TJA Volumes

- 4.2.5 3-D-Printed, Patient-Specific Implants Cutting Revision Risk

- 4.2.6 Strategic Reshoring of Titanium & Cobalt Alloy Supply Chains

- 4.3 Market Restraints

- 4.3.1 High Procedure & Implant Cost

- 4.3.2 Availability of Pharmacological & Arthroscopic Alternatives

- 4.3.3 Revision-Surgery Burden from Metal Hypersensitivity Claims

- 4.3.4 Capacity Bottlenecks in Sterilisation & Clean-Room Machining

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Procedure

- 5.1.1 Hip Replacement

- 5.1.2 Knee Replacement

- 5.1.3 Shoulder Replacement

- 5.1.4 Ankle Replacement

- 5.1.5 Elbow Replacement

- 5.1.6 Others

- 5.2 By Product

- 5.2.1 Implants

- 5.2.1.1 Metallic

- 5.2.1.2 Ceramic

- 5.2.1.3 Polymeric & Hybrid Biomaterials

- 5.2.2 Bone Grafts & Substitutes

- 5.2.2.1 Autograft

- 5.2.2.2 Allograft

- 5.2.2.3 Synthetic

- 5.2.3 Fixation & Instrumentation

- 5.2.4 Others

- 5.2.1 Implants

- 5.3 By Technology

- 5.3.1 Conventional

- 5.3.2 Robotic-Assisted

- 5.3.3 Navigation/AR-Guided

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Specialty Orthopedic Centers

- 5.4.3 Ambulatory Surgery Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Zimmer Biomet Holdings Inc.

- 6.3.2 Stryker Corporation

- 6.3.3 DePuy Synthes (J&J)

- 6.3.4 Smith & Nephew plc

- 6.3.5 B. Braun Melsungen AG

- 6.3.6 Enovis (DJO Global)

- 6.3.7 Exactech Inc.

- 6.3.8 Corin Group

- 6.3.9 MicroPort Scientific

- 6.3.10 Conformis Inc.

- 6.3.11 Medacta Group

- 6.3.12 Globus Medical

- 6.3.13 Waldemar Link GmbH

- 6.3.14 Aesculap Implant Systems

- 6.3.15 LimaCorporate

- 6.3.16 Arthrex Inc.

- 6.3.17 United Orthopedic Corp.

- 6.3.18 Bioimpianti Srl

- 6.3.19 Uteshiya Medicare

- 6.3.20 Kyocera Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment