PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842500

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842500

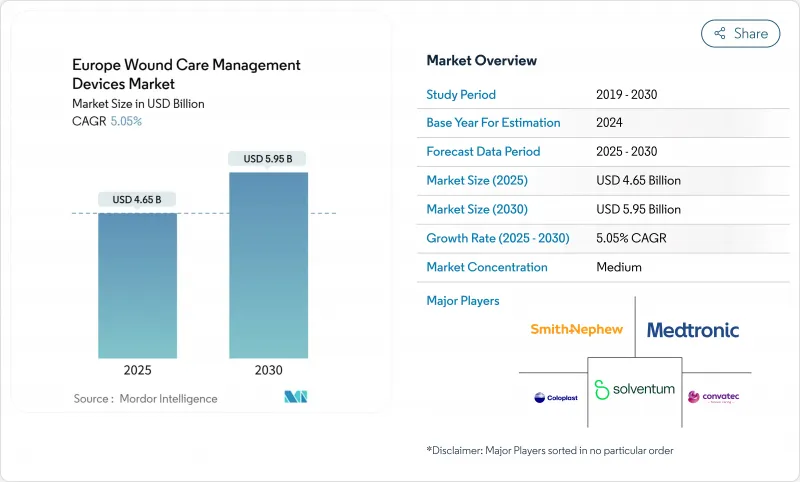

Europe Wound Care Management Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe wound care management devices market reached USD 4.65 billion in 2025 and is forecast to attain USD 5.95 billion by 2030, advancing at a 5.05% CAGR.

A confluence of rapid population ageing, the diabetes epidemic, and widespread adoption of AI-enabled imaging keeps the Europe wound care management devices market on a clear expansion path . Growing surgical procedure volumes, tighter regulatory standards under the EU-MDR, and the hospital-to-home shift are reshaping procurement criteria and product design priorities across the Europe wound care management devices market. Leading vendors now bundle data-rich dressings with telehealth platforms, helping providers shorten length of stay and lower rehospitalisation rates. While Germany remains the revenue anchor, France outpaces all other countries, propelled by favourable reimbursement pilots and strong digital-health uptake.

Europe Wound Care Management Devices Market Trends and Insights

Increasing incidences of chronic wounds & diabetic ulcers

Prevalence of diabetes mellitus in EU member states climbed from 7.01% in 2009 to 7.96% in 2019, translating into 61 million adults now living with the condition. Chronic wounds affect 2.21 per 1,000 citizens and carry an average treatment bill of EUR 15,000 per diabetic-foot-ulcer patient in Germany, encouraging hospitals to move rapidly toward bioactive dressings and portable NPWT platforms that help compress episode-of-care costs. Real-world data from the Barcelona metro area shows wound treatment outlays of EUR 34.99 million over three years, hinting at EUR 1.76 billion in national spending for Spain. Socioeconomic disparities worsen the load, as lower education levels and unemployment correlate with higher ulcer incidence, especially in Eastern and Southern Europe .

Escalating volume of elective & trauma-related surgeries

Deferred procedures from the pandemic era have pushed surgical caseloads above pre-2020 baselines across top European centres. Robotic, image-guided, and day-surgery pathways shorten hospital stay but demand sophisticated post-operative dressings that can transition safely to home care . Average reimbursements for complex tissue transfers range from EUR 5,933 for pedicled flaps to EUR 8,517 for free flaps across five major economies, underscoring high stakes for reliable closure technologies. Staple-compatible dressings and absorbable sealants are therefore gaining mindshare among theatre managers seeking to curtail operating-room turnover times.

Reimbursement hurdles for advanced wound care across major EU economies

German statutory insurance data shows 76% of leg-ulcer patients depend on older hydroactive or foam dressings, revealing clinician preference colliding with budget caps. French surveys echo the concern: 89% of caregivers would rather step-up to premium therapies, yet formularies limit freedom of choice. Although economic models prove that NPWT delivers superior long-run savings, high first-invoice prices and fragmented approval pathways slow penetration, effectively diluting growth prospects for the Europe wound care management devices market in price-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Rapidly ageing European population base

- Adoption of AI-enabled digital wound imaging for precision treatment

- EU-MDR compliance burden squeezing SME margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wound care products represented 66.49% of the Europe wound care management devices market share in 2024, powered by hydrofiber, alginate and antimicrobial dressings that cut change frequency and infection risk. Hospitals still buy gauze for basic cases, yet advanced dressings win formularies where staff shortages and infection-control metrics steer procurement. Leading portfolios now pair dressings with cloud-connected imaging dashboards, reinforcing loyalty contracts with group purchasing organisations.

Wound closure solutions, although smaller, are set to record a 5.89% CAGR through 2030. Sutures remain theatre stalwarts, but staplers and topical adhesives are quickly penetrating minimally-invasive segments. Smith+Nephew's RENASYS pipeline and Solventum's V.A.C. Peel & Place dressing that allows seven-day wear underscore the direction of innovation. Growth prospects hinge on the Europe wound care management devices market size for OR-compatible sealants, which could top USD 1.5 billion by 2030 under present adoption curves.

Chronic wounds drove 59.61% of applications inside the Europe wound care management devices market in 2024, reflecting high diabetes and vascular disease prevalence. Diabetic-foot and venous-leg ulcers attract intensive resource use, with German per-patient expenditures sitting at EUR 15,000. Molecular profiling now links down-regulated FGF7 and elevated MMP10 to stalled healing, paving the way for precision topical therapies.

Acute wounds display the faster 5.92% CAGR, aligned with surging surgical backlogs and trauma admissions. Burns, surgical incisions and lacerations favour rapid-closure kits and absorbable barrier films, creating scope for hybrid dressings integrating silver or iodine reservoirs. Future addressable Europe wound care management devices market size for acute indications may reach roughly USD 2 billion by decade-end if theatre volumes hold their 2025 trajectory.

The Europe Wound Care Management Devices Market is Segmented by Product (Wound Care [Dressings, Wound-Care Devices, and More] and Wound Closure), Wound Type (Chronic Wounds and Acute Wounds), End User (Hospitals & Specialty Wound Clinics and More), Mode of Purchase (Institutional Procurement and Retail / OTC Channel), and Geography (Germany, United Kingdom, and More). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Solventum

- Smiths Group

- Molnlycke Health Care

- Coloplast

- Hartmann Group

- B. Braun

- Cardinal Health

- ConvaTec Group plc

- Medtronic

- Johnson & Johnson

- Essity AB (BSN medical)

- Lohmann & Rauscher GmbH

- Baxter

- Acelity LP Inc. (KCI)

- Medela

- Integra LifeSciences Corp.

- Organogenesis Holdings

- Urgo Medical

- Derma Sciences (Integra)

- Advanced Medical Solutions Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing incidences of chronic wounds & diabetic ulcers

- 4.2.2 Escalating volume of elective & trauma?related surgeries

- 4.2.3 Rapidly ageing European population base

- 4.2.4 Rising prevalence of diabetes & obesity

- 4.2.5 Adoption of AI-enabled digital wound imaging for precision treatment

- 4.2.6 Hospital-to-home shift driving portable NPWT uptake

- 4.3 Market Restraints

- 4.3.1 Reimbursement hurdles for advanced wound care across major EU economies

- 4.3.2 High episode-of-care costs versus conventional dressings

- 4.3.3 EU-MDR compliance burden squeezing SME margins

- 4.3.4 Supply-chain volatility in collagen/alginate raw materials & growing AMR concerns

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Wound Care

- 5.1.1.1 Dressings

- 5.1.1.1.1 Traditional Gauze & Tape Dressings

- 5.1.1.1.2 Advanced Dressings

- 5.1.1.2 Wound-Care Devices

- 5.1.1.2.1 Negative Pressure Wound Therapy (NPWT)

- 5.1.1.2.2 Oxygen & Hyperbaric Systems

- 5.1.1.2.3 Electrical Stimulation Devices

- 5.1.1.2.4 Other Wound Care Devices

- 5.1.1.3 Topical Agents

- 5.1.1.4 Other Wound Care Products

- 5.1.2 Wound Closure

- 5.1.2.1 Sutures

- 5.1.2.2 Surgical Staplers

- 5.1.2.3 Tissue Adhesives, Strips, Sealants & Glues

- 5.1.1 Wound Care

- 5.2 By Wound Type

- 5.2.1 Chronic Wounds

- 5.2.1.1 Diabetic Foot Ulcer

- 5.2.1.2 Pressure Ulcer

- 5.2.1.3 Venous Leg Ulcer

- 5.2.1.4 Other Chronic Wounds

- 5.2.2 Acute Wounds

- 5.2.2.1 Surgical/Traumatic Wounds

- 5.2.2.2 Burns

- 5.2.2.3 Other Acute Wounds

- 5.2.1 Chronic Wounds

- 5.3 By End User

- 5.3.1 Hospitals & Specialty Wound Clinics

- 5.3.2 Long-term Care Facilities

- 5.3.3 Home-Healthcare Settings

- 5.4 By Mode of Purchase

- 5.4.1 Institutional Procurement

- 5.4.2 Retail / OTC Channel

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Solventum

- 6.3.2 Smith & Nephew plc

- 6.3.3 Molnlycke Health Care AB

- 6.3.4 Coloplast A/S

- 6.3.5 Paul Hartmann AG

- 6.3.6 B. Braun Melsungen AG

- 6.3.7 Cardinal Health Inc.

- 6.3.8 ConvaTec Group plc

- 6.3.9 Medtronic plc

- 6.3.10 Johnson & Johnson (Ethicon)

- 6.3.11 Essity AB (BSN medical)

- 6.3.12 Lohmann & Rauscher GmbH

- 6.3.13 Baxter International Inc.

- 6.3.14 Acelity LP Inc. (KCI)

- 6.3.15 Medela AG

- 6.3.16 Integra LifeSciences Corp.

- 6.3.17 Organogenesis Holdings

- 6.3.18 Urgo Medical

- 6.3.19 Derma Sciences (Integra)

- 6.3.20 Advanced Medical Solutions Group plc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment