PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842532

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842532

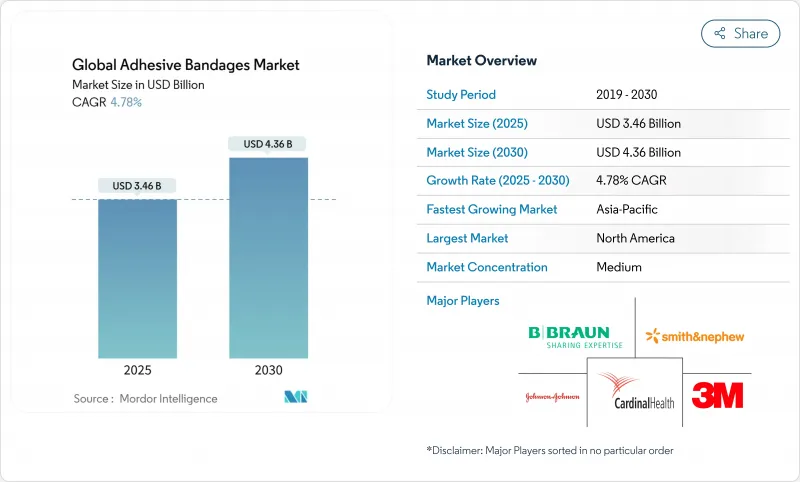

Global Adhesive Bandages - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The adhesive bandages market size reached USD 3.46 billion in 2025 and is forecast to attain USD 4.36 billion by 2030, advancing at a 4.78% CAGR.

Demand holds steady as healthcare systems confront the rising costs of chronic wound care, which drain Medicare of USD 28.1 billion-USD 31.7 billion each year. Medicated formats sustain current volume leadership, while digital health convergence spurs adoption of sensor-enabled dressings that record temperature, pH, and moisture. Parallel advances in breathable, waterproof, and biodegradable materials keep non-medicated lines competitively relevant, reflecting policy moves that mandate greener packaging and reduced volatile organic compounds. E-commerce platforms reshuffle go-to-market models, driving rapid uptake of home-care-oriented micro-packs, and North America preserves its lead because of robust reimbursement and regulatory clarity that accelerates smart-bandage approvals. Competitive pressure intensifies as smart-bandage innovators claim they can trim hospital therapy costs by 41% and reduce application time 61% relative to standard dressings.

Global Adhesive Bandages Market Trends and Insights

Growing Surgical Procedures & Trauma-Related Injuries

Expanding surgical volumes boost the adhesive bandages market as outpatient and ambulatory centers rely on extended-wear dressings that preserve sterile barriers and enable early discharge. National Collegiate Athletic Association surveillance shows lower-extremity trauma represents more than 50% of collegiate injuries, underscoring sustained demand for precision athletic strips . Minimally invasive techniques favor thin, highly conformable films that manage exudate without secondary fixation. Incorporating silver nanoparticles within substrate layers supports surgical-site infection prevention goals, an increasingly critical quality metric for payers.

Rising Incidence of Chronic Wounds & Diabetic Ulcers

In the United States, 6.7 million individuals face chronic wounds each year, with direct treatment costs topping USD 50 billion. Diabetic foot ulcers alone trigger USD 6.2 billion-USD 6.9 billion in annual Medicare spending. Smart dressings such as Caltech's iCares platform analyze nitric oxide and hydrogen peroxide biomarkers in real time and predict healing trajectories via machine-learning algorithms. Hydrocolloid matrices retain dominance in chronic settings despite raw-material supply squeezes, while hydrogel constructs with self-healing clay nanosheets promise up to 90% structural recovery within 4 hours.

Skin Irritation & Allergic Reactions to Latex/PU

Dermatitis concerns narrow product acceptance among increasingly informed consumers. A class-action suit filed in 2024 claims certain Band-Aid lines contain per- and polyfluoroalkyl substances, raising health-equity issues for products marketed to people of color. Latex allergies affect up to 6% of the general population, pushing producers toward hypoallergenic silicone and polyurethane blends, but trade-offs emerge around breathability and cost.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Sports Injuries & Active Lifestyle Demand

- Surge in Home First-Aid & E-Commerce Micro-Packs

- Emergence of Smart Sensor-Enabled Bandages

- Competition From Advanced Wound-Closure Solutions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medicated variants controlled 54.35% of adhesive bandages market size in 2024 courtesy of embedded antimicrobials that answer hospital-acquired infection mandates. Silver nanoparticle and PHMB matrices log 98.5% bacterial elimination against Staphylococcus aureus, reinforcing clinical trust. Low-trauma silicone coatings protect geriatric and pediatric skin, while cohesive fabrics suit high-motion athletic injuries. As reimbursement trends reward infection-prevention proof points, producers escalate evidence generation to defend pricing.

Non-medicated strips, although smaller in revenue today, expand at a 5.63% CAGR as sustainable PLA and solvent-free adhesives dovetail with regulatory carbon targets. Elastic cloth and waterproof PE films satisfy consumer preference for breathable and aquatic-safe dressings. Retailers promote value packs through online storefronts, widening access across emerging economies where discretionary healthcare buys gain traction. Such momentum keeps the adhesive bandages market firmly diversified across price tiers.

Adhesive Bandages Market is Segmented by Product Type (Medicated Bandages and Non-Medicated Bandages), Application (Wound Management, Orthopedic Support, and More), End User (Hospitals/Clinics, Ambulatory Centers, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 42.81% of global revenue in 2024, cementing leadership through high per-capita spend, rigorous reimbursement, and early adoption of smart sensor technologies. Chronic wounds cost the United States healthcare system more than USD 50 billion annually, driving continuous demand for premium dressings. Canada funds nationwide digital-health pilots that integrate wireless bandages into chronic-disease management, while Mexico expands manufacturing corridors that shorten regional supply chains.

Asia-Pacific produces the fastest 7.42% CAGR through 2030. China combines large-scale export capacity with rising domestic consumption as diabetes prevalence climbs. Japan's super-aged demographic spurs uptake of atraumatic hydrogels suited for fragile skin, and India's hospital build-out under Ayushman Bharat pushes rural penetration. Regional procurement increasingly favors CE-marked or US-FDA-cleared products, prompting multinationals to invest in localized assembly.

Europe shows stable expansion under Medical Device Regulation (EU 2017/745), which tightens clinical-evidence and traceability obligations . Sustainability incentives encourage biodegradable substrates; Beiersdorf registered 6.5% organic growth in 2024 by launching plastic-free patches under its Leukoplast line. Germany, the United Kingdom, and France anchor demand, while Eastern European markets improve access via EU structural funds.

- 3M

- Johnson & Johnson

- Beiersdorf

- Cardinal Health

- Smiths Group

- B. Braun

- Medline Industries

- ConvaTec Group plc

- Molnlycke Health Care

- Hartmann Group

- BSN medical (Essity)

- Nitto Denko Corp.

- Dynarex

- Detectaplast NV

- Avery Dennison Medical

- DermaRite Industries

- Lohmann & Rauscher

- Winner Medical Group

- Nichiban Co., Ltd.

- Henkel AG (Loctite Medical)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Surgical Procedures & Trauma-Related Injuries

- 4.2.2 Rising Incidence Of Chronic Wounds & Diabetic Ulcers

- 4.2.3 Increasing Sports Injuries & Active Lifestyle Demand

- 4.2.4 Technological Advances In Breathable & Waterproof Materials

- 4.2.5 Surge In Home First-Aid & E-Commerce Micro-Packs

- 4.2.6 Emergence Of Smart Sensor-Enabled Bandages

- 4.3 Market Restraints

- 4.3.1 Skin Irritation & Allergic Reactions To Latex/Pu

- 4.3.2 Competition From Advanced Wound-Closure Solutions

- 4.3.3 Sustainability Regulations Pushing Costlier Bio-Materials

- 4.3.4 Raw-Material Supply Volatility (Cotton, Hydrocolloid)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Medicated Bandages

- 5.1.1.1 Cohesive Fabric Bandages

- 5.1.1.2 Flexible Fixation Bandages

- 5.1.1.3 Hydrocolloid Adhesive Bandages

- 5.1.1.4 Antimicrobial (Silver/PHMB) Bandages

- 5.1.1.5 Silicone-based Low-Trauma Bandages

- 5.1.2 Non-Medicated Bandages

- 5.1.2.1 Cohesive Fabric Bandages

- 5.1.2.2 Flexible Fixation Bandages

- 5.1.2.3 Waterproof PE/PVC Strips

- 5.1.2.4 Elastic Cloth Strips

- 5.1.2.5 Biodegradable PLA Strips

- 5.1.1 Medicated Bandages

- 5.2 By Application

- 5.2.1 Wound Management

- 5.2.1.1 Acute (Surgical & Traumatic)

- 5.2.1.2 Chronic (Diabetic, Pressure, Venous Ulcers)

- 5.2.2 Orthopedic Support

- 5.2.3 Pain Management (Analgesic patches)

- 5.2.4 Sports & Athletic Wraps

- 5.2.5 First-Aid & Home Care

- 5.2.6 Veterinary Use

- 5.2.1 Wound Management

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Ambulatory Surgery Centers

- 5.3.3 Home Healthcare

- 5.3.4 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.3.1 3M

- 6.3.2 Johnson & Johnson

- 6.3.3 Beiersdorf AG

- 6.3.4 Cardinal Health

- 6.3.5 Smith & Nephew plc

- 6.3.6 B. Braun Melsungen AG

- 6.3.7 Medline Industries LP

- 6.3.8 ConvaTec Group plc

- 6.3.9 Molnlycke Health Care

- 6.3.10 Paul Hartmann AG

- 6.3.11 BSN medical (Essity)

- 6.3.12 Nitto Denko Corp.

- 6.3.13 Dynarex Corporation

- 6.3.14 Detectaplast NV

- 6.3.15 Avery Dennison Medical

- 6.3.16 DermaRite Industries

- 6.3.17 Lohmann & Rauscher

- 6.3.18 Winner Medical Group

- 6.3.19 Nichiban Co., Ltd.

- 6.3.20 Henkel AG (Loctite Medical)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment