PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842539

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842539

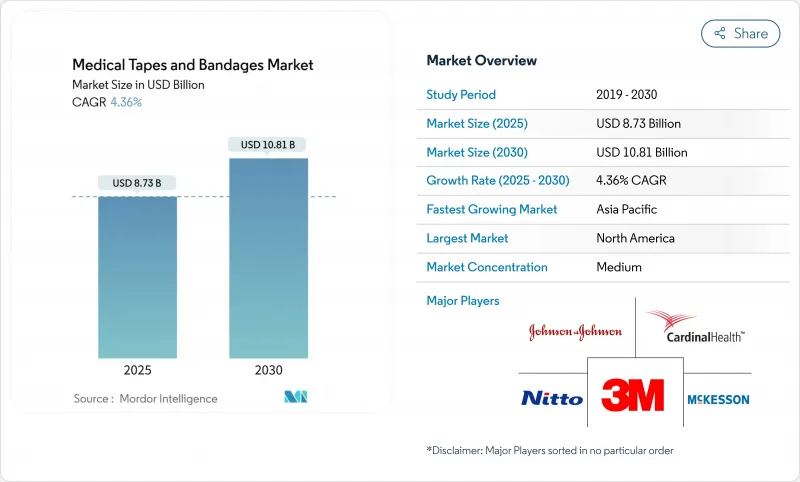

Medical Tapes And Bandages - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Medical Tapes And Bandages Market size is estimated at USD 8.73 billion in 2025, and is expected to reach USD 10.81 billion by 2030, at a CAGR of 4.36% during the forecast period (2025-2030).

Stable growth reflects aging populations, rising surgical volumes, and wider acceptance of advanced wound management technologies. Smart sensors, biodegradable films, and controlled-release antimicrobial layers are shifting demand from passive coverings to interactive dressings that shorten healing time and cut follow-up visits. Cost pressure on hospitals and payers is prompting interest in products that enable earlier discharge and home-based self-care without compromising clinical outcomes. Sustainability mandates are also influencing material choices, guiding manufacturers toward solvent-free adhesives, compostable backings, and reduced packaging waste. The medical tapes and bandages market is therefore evolving along two axes-digital connectivity and environmental stewardship-while maintaining focus on skin-sparing adhesion and broad infection control.

Global Medical Tapes And Bandages Market Trends and Insights

Rising Global Surgical Volumes Increasing Demand for Post-Operative Wound Dressings

Over 300 million procedures are performed worldwide each year, and aging patients increasingly undergo orthopedic, cardiovascular, and minimally invasive surgeries that require robust peri-operative dressings. Post-operative care can cost more than USD 6,000 per day for complex incisions, prompting hospitals to specify longer-wear tapes that maintain seal integrity for up to seven days to avoid excessive change frequency. Bandages with elastic compression and atraumatic removal are now preferred in ambulatory surgery centers, where same-day discharge hinges on patient comfort and the absence of skin stripping. Consequently, procurement teams place adhesion longevity and hypoallergenic performance at the top of evaluation criteria. These imperatives continue to enlarge the medical tapes and bandages market.

Growing Prevalence of Chronic Wounds, Including Diabetic Foot Ulcers and Pressure Ulcers

Roughly 6.7 million Americans live with non-healing ulcers; diabetic foot ulcers alone will affect up to 25% of diabetes patients during their lifetime. Chronic wounds generate USD 50 billion in annual treatment expenditures in the United States, driving demand for moisture-balancing bandages infused with silver or copper nanoparticles that curb biofilm formation. Clinical trials report 87.35% wound-area reduction from copper dressings versus 37.02% for conventional silver foams. Clinicians also favor layered composite tapes that modulate pH and temperature, enabling micro-environmental control and better granulation tissue development. These innovations bolster the medical tapes and bandages market by demonstrating measurable clinical payoff.

High Cost of Advanced Dressings and Silicone-Based Adhesive Tapes

Smart dressings can cost 5-10 times more per unit than plain gauze. Although clinical studies reveal 58.6% weekly material-cost savings when foam dressings shorten healing time lww.com, purchasing decisions often focus on sticker price. A Spanish regional audit recorded EUR 34.99 (USD 40.16) million in primary-care wound spending across three years, with EUR 8.46 (USD 9.74) million tied to tapes and bandages sciencedirect.com. Emerging markets with limited reimbursement struggle to absorb these premiums, delaying adoption and slowing the medical tapes and bandages market in low-resource settings. Wider transition to value-based procurement may temper this restraint over the next two years.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Home-Based Wound Care Supported by Telehealth and Self-Care Kits

- Integration of Antimicrobial Agents in Tapes and Bandages

- Clinical Concerns over Medical Adhesive-Related Skin Injury (MARSI)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bandages retained 59.14% of the 2024 medical tapes and bandages market share by revenue and continue to underpin routine wound protocols for surgical sites, lacerations, and chronic ulcers. Their configuration flexibility from conformable gauze rolls to high-compression elastic wraps allows clinicians to tailor pressure, absorbency, and breathability for each wound stage. Traditional cotton gauze remains ubiquitous due to procurement familiarity, but multi-layer cohesive dressings with viscose and elastic filaments are gaining traction for exudate control in limb ulcers. Hydrogel-impregnated pads embedded within elastic bandages reduce dressing change frequency by maintaining moist environments, vital for autolytic debridement. Consequently, the medical tapes and bandages market continues to leverage bandages as the baseline product family across emergency, inpatient, and home settings.

Paper tapes, though accounting for a smaller revenue base, register the strongest 6.28% CAGR thanks to their hypoallergenic cellulose fibers and gentle, repositionable adhesives that minimize epidermal stripping. Surgeons prefer them for delicate facial incisions, pediatric IV fixation, and ophthalmic dressings where skin trauma risk is elevated. Moreover, antimicrobial-coated paper substrates now incorporate silver salts without compromising tensile strength, positioning the sub-segment as a premium offering in infection-prone wards. Fabric tapes maintain relevance where tensile support and mechanical durability trump breathability, as in orthopedics. Plastic tapes fill waterproof niche demands for shower-safe ostomy and catheter sites. Across categories, solvent-free acrylic chemistries launched by 3M in 2025 illustrate how manufacturers are blending sustainability with high adhesion, reinforcing product-line differentiation inside the medical tapes and bandages market.

The Medical Tapes and Bandages Market Report Segments the Industry Into by Product Type (Bandages, Tapes), Application (Surgical Wound Treatment, Traumatic Wound Treatment, Ulcer Treatment, and More), End User (Hospitals, Clinics, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the medical tapes and bandages market with 33.41% revenue share in 2024, fueled by advanced reimbursement mechanisms, broad clinician acceptance of composite dressings, and robust clinical-trial infrastructure that validates new materials quickly. Hospitals routinely test digital dressings that send real-time data to electronic medical records, fostering early adoption of connected tapes. Material shortages and fluctuating resin prices, however, have prompted local production initiatives to de-risk supply chains.

Europe remained a dependable yet slower-growing region, with public health systems mandating tender processes emphasizing eco-labels and recyclability. Regulatory frameworks such as the European Medical Device Regulation impose extensive post-market surveillance, pushing companies toward thicker clinical evidence packages. Regardless, aging demographics and high prevalence of venous leg ulcers sustain steady consumption of compression bandage systems. Manufacturers must therefore align sustainability narratives with proven healing benefits to win pan-European tenders, maintaining their share of the medical tapes and bandages market.

Asia-Pacific, projected to advance at a 5.02% CAGR, witnesses rapid infrastructure modernization, rising chronic-disease burden, and government incentives for domestic med-tech manufacturing. China boosts local procurement quotas, prompting joint ventures between multinational brands and provincial device makers. India's national wound-care guidelines published in 2025 emphasize low-trauma adhesives and antimicrobial dressings for diabetic ulcers, opening volume contracts across public hospitals. Southeast Asian nations, meanwhile, adopt telehealth wound platforms to reach remote islands, expanding demand for sensor-enabled tapes capable of transmitting data over low-bandwidth networks. The convergence of policy support and manufacturing capacity places Asia-Pacific at the center of long-term expansion for the medical tapes and bandages market.

List of Companies Covered in this Report:

- 3M

- Johnson & Johnson

- Smiths Group

- Cardinal Health

- Coloplast

- B. Braun

- Nitto Denko

- Hartmann Group

- Henkel

- Mckesson

- BenQ Materials

- Triage Meditech Pvt. Ltd.

- Medline Industries

- Molnlycke Health Care

- Essity

- Derma Sciences

- Winner Medical Co. Ltd.

- Dynarex

- Lohmann & Rauscher

- Avery Dennison Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Surgical Volumes Increasing Demand for Post-Operative Wound Dressings

- 4.2.2 Growing Prevalence oof Chronic Wounds, Including Diabetic Foot Ulcers and Pressure Ulcers

- 4.2.3 Expansion of Home-Based Wound Care Supported by Telehealth and Self-Care Kits

- 4.2.4 Integration of Antimicrobial Agents in Tapes and Bandages

- 4.2.5 Expansion of Aging Population Worldwide

- 4.2.6 Emergence of Smart, Sensor-Embedded Tapes Enabling Remote Wound Monitoring

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Dressings and Silicone-Based Adhesive Tapes

- 4.3.2 Clinical Concerns over Medical Adhesive-Related Skin Injury (MARSI)

- 4.3.3 Increasing Competition from Advanced Wound-Care Products

- 4.3.4 Environmental Sustainability Pressures on Single-Use, and Non-Biodegradable Materials

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Bandages

- 5.1.1.1 Gauze Bandages

- 5.1.1.2 Elastic / Compression Bandages

- 5.1.1.3 Cohesive Bandages

- 5.1.1.4 Adhesive Bandages

- 5.1.1.5 Other Specialized Bandages

- 5.1.2 Tapes

- 5.1.2.1 Fabric Tapes

- 5.1.2.2 Paper Tapes

- 5.1.2.3 Plastic (PVC/PE) Tapes

- 5.1.2.4 Silicone & Low-Trauma Tapes

- 5.1.2.5 Hydrocolloid & Specialty Tapes

- 5.1.1 Bandages

- 5.2 By Application

- 5.2.1 Surgical Wound Treatment

- 5.2.2 Traumatic Wound Treatment

- 5.2.3 Ulcer Treatment

- 5.2.4 Burn Injury Treatment

- 5.2.5 Sports Injury Treatment

- 5.2.6 Others

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Clinics

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Home Care Settings

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 3M

- 6.3.2 Johnson & Johnson Services Inc.

- 6.3.3 Smith & Nephew plc

- 6.3.4 Cardinal Health Inc.

- 6.3.5 Coloplast A/S

- 6.3.6 B. Braun SE

- 6.3.7 Nitto Denko Corporation

- 6.3.8 Paul Hartmann AG

- 6.3.9 Henkel AG & Co. KGaA

- 6.3.10 McKesson Corporation

- 6.3.11 BenQ Materials Corporation

- 6.3.12 Triage Meditech Pvt. Ltd.

- 6.3.13 Medline Industries Inc.

- 6.3.14 Molnlycke Health Care AB

- 6.3.15 Essity AB

- 6.3.16 Derma Sciences

- 6.3.17 Winner Medical Co. Ltd.

- 6.3.18 Dynarex Corporation

- 6.3.19 Lohmann & Rauscher GmbH & Co. KG

- 6.3.20 Avery Dennison Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment