PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842650

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842650

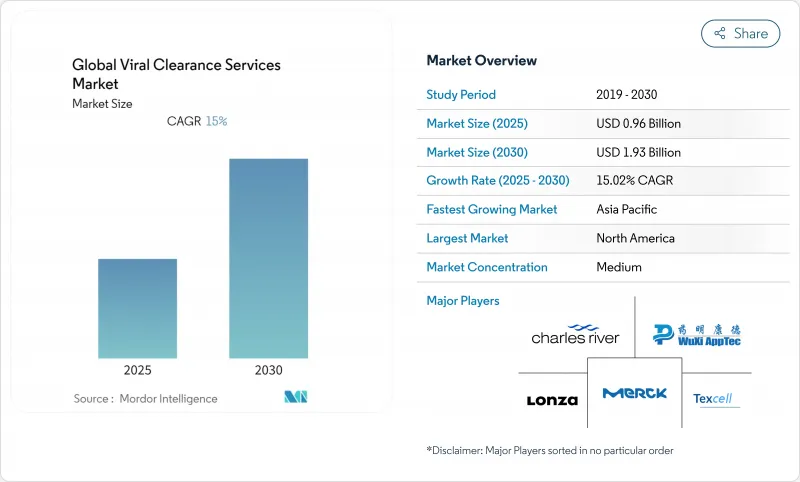

Global Viral Clearance Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The viral clearance services market size stood at USD 0.96 billion in 2025 and is expected to reach USD 1.93 billion by 2030, advancing at a 15.02% CAGR.

The doubling trajectory reflects surging demand for viral safety validation across biologics, vaccines, and advanced modalities such as cell and gene therapies. Platform-based validation encouraged by the United States Food and Drug Administration's (FDA) Q5A(R2) update has shortened study timelines, turning viral clearance from a compliance checkbox into a strategic enabler of faster product launches fda.gov. Rapid expansion of adeno-associated virus (AAV) and lentiviral vector pipelines has further magnified the need for bespoke protocols, while outsourcing to specialist contract development and manufacturing organizations (CDMOs) accelerates capacity growth.

Key growth catalysts include the global renaissance in large-molecule manufacturing, harmonized regulatory frameworks across major markets, and the steady industrialization of continuous bioprocessing. Competitive dynamics are reshaping as traditional equipment vendors extend into services and specialist contract research organizations (CROs) buy manufacturing assets to provide end-to-end offerings. Despite a robust outlook, cost-intensive multi-virus studies, shortages of skilled biosafety personnel, and fragmented guidance for novel modalities pose headwinds.

Global Viral Clearance Services Market Trends and Insights

Rising Demand for Viral Safety Validation in Large-Molecule Manufacturing

Large-molecule production has shifted viral clearance upstream into process design. FDA guidance now rewards platform approaches, letting manufacturers reuse clearance data across monoclonal antibody programs while preserving safety. Continuous bioprocessing lines incorporate in-line virus filters that provide real-time assurance, improving yields and lowering re-validation costs. Companies with such integrated capabilities launch products sooner and limit regulatory queries, turning viral clearance capacity into a clear competitive advantage. Equipment innovators have responded with high-flux filters that safeguard product quality without compromising throughput.

Expanding Biologics & Biosimilar Pipeline Worldwide

More than 700 gene therapies and hundreds of biosimilars are under development, and each new entrant needs rigorous clearance. International Council for Harmonisation (ICH) efforts have standardized requirements so that a single validation package can underpin submissions on multiple continents. Service providers therefore capture a larger slice of development budgets. Eurofins Scientific, for example, has reported a rebound in large contracted studies and allocated additional capacity to viral safety work.

High Cost & Complexity of Multi-Virus Validation Studies

Comprehensive studies often involve three to five model viruses, each tested across multiple process steps. The total research outlays range from USD 500,000 to USD 2 million, straining smaller biotech budgets and deterring innovators in resource-limited regions. Reagent supply chains are fragile, with long lead times for qualified seed stocks. Service providers are countering costs by adopting non-infectious surrogates and data-rich platform validations that regulators now accept.

Other drivers and restraints analyzed in the detailed report include:

- Cell & Gene Therapy Boom Requiring Bespoke Protocols

- Outsourcing Surge to Specialist CRO/CDMOs

- Shortage of Skilled Virology and Biosafety Workforce

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Viral removal methods captured 60.78% of the viral clearance services market size in 2024, reaffirming their status as the backbone of bioprocess safety. Chromatography, depth filtration, and virus-retentive membranes deliver predictable log-reduction values across monoclonal antibodies and recombinant proteins. Continuous downstream trains now weave these steps into single-use, closed systems that maintain sterility while minimizing hold times.

Hybrid strategies, though accounting for a smaller base, are growing at 17.04% CAGR through 2030 and are reshaping service portfolios. Providers integrate solvent/detergent inactivation, low-pH hold, and UV-C irradiation with physical removal in deliberate sequences that address both enveloped and non-enveloped threats. Asahi Kasei's Planova FG1 filter demonstrates how high-flux membranes accelerate throughput without sacrificing virus log-reduction factors. The viral clearance services market size for hybrid protocols is projected to expand from USD 140 million in 2025 to USD 350 million in 2030, underscoring industry appetite for multimodal resilience.

Second-generation hybrids layer high-pressure processing or nanofiltration onto legacy steps to combat robust parvoviruses. AI-guided design tools suggest optimal step combinations, reducing experimental runs by up to 30%. These innovations enhance predictability and support regulators' push toward risk-based, science-driven validation frameworks. As continuous manufacturing gains traction, providers able to integrate hybrid modules inline will gain share at the expense of batch-oriented competitors.

The Viral Clearance Services Market Report is Segmented by Method (Viral Removal [Chromatography and More], Viral Inactivation [Solvent/Detergent Treatment and More], and Hybrid Strategies), Application (Recombinant Proteins, Monoclonal Antibodies, and More), End-User (Large Pharma and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 39.32% of the viral clearance services market in 2024 and remains the global nexus for regulatory leadership, venture funding, and large-scale plant expansions. Fujifilm's USD 1.2 billion North Carolina project will triple bioreactor output by 2031, creating new demand for integrated clearance validation. Robust supply networks for qualified model viruses, plus proximity to FDA reviewers, enhance the region's strategic importance. The viral clearance services market size in North America is expected to climb from USD 380 million in 2025 to USD 740 million in 2030.

Europe maintains a substantial presence underpinned by the European Medicines Agency's comprehensive viral safety guidance and the European Commission's 2024 biotechnology strategy. Roche's €90 million gene therapy hub in Germany and Novartis's €40 million vector facility in Slovenia expand regional capacity. Yet Europe's multi-country regulatory landscape and rising labor costs temper growth to single-digit CAGRs, keeping its share stable rather than expansionary.

Asia Pacific is the fastest mover, advancing at a 16.47% CAGR. China's decision to lift foreign ownership limits for cell and gene therapy within free-trade zones and Japan's expedited Sakigake pathway shorten approval windows and attract multinational sponsors. Regional CDMOs like WuXi Biologics and Takara Bio are investing in vector suites and high-capacity virus filtration trains. The viral clearance services market size in Asia Pacific is projected to leap from USD 210 million in 2025 to USD 450 million by 2030, closing the gap with established Western hubs. Talent shortages persist, yet government grants and university partnerships aim to broaden the virology talent pool.

- BioOutsource Ltd (Sartorius)

- BIOSCIENCE LABORATORIES

- BSL BioService

- Catalent

- Charles River

- Clean Cells

- Creative Biolabs

- Cygnus Technologies

- Eurofins

- FUJIFILM

- Lonza Group

- Merck

- Microbac Laboratories

- Pall Corporation (Cytiva)

- Sartorius

- SGS

- Texcell

- Vironova

- ViruSure GmbH

- WuXi App Tec

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for viral safety validation in large-molecule manufacturing

- 4.2.2 Expanding biologics & biosimilar pipeline worldwide

- 4.2.3 Cell & gene therapy boom requiring bespoke protocols

- 4.2.4 Outsourcing surge to specialist CRO/CDMOs

- 4.2.5 Continuous bioprocessing drives in-line clearance technologies

- 4.2.6 AI-enabled predictive validation platforms shorten study timelines

- 4.3 Market Restraints

- 4.3.1 High cost & complexity of multi-virus validation studies

- 4.3.2 Shortage of skilled virology and biosafety workforce

- 4.3.3 Fragmented global guidance for novel modalities (e.g., AAV)

- 4.3.4 Supply-chain gaps in qualified model viruses & reference standards

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Method

- 5.1.1 Viral Removal

- 5.1.1.1 Chromatography

- 5.1.1.1.1 Protein A Capture

- 5.1.1.1.2 Ion-Exchange

- 5.1.1.1.3 Affinity & Mixed-Mode

- 5.1.1.2 Filtration

- 5.1.1.2.1 Nanofiltration

- 5.1.1.2.2 Depth Filtration

- 5.1.1.2.3 Membrane Adsorbers

- 5.1.1.3 Precipitation (PEG/Ethanol)

- 5.1.2 Viral Inactivation

- 5.1.2.1 Solvent/Detergent Treatment

- 5.1.2.2 Low-pH Incubation

- 5.1.2.3 UV-C Irradiation

- 5.1.2.4 Heat / Pasteurization

- 5.1.2.5 High-Pressure Processing

- 5.1.3 Hybrid Strategies

- 5.1.1 Viral Removal

- 5.2 By Application

- 5.2.1 Recombinant Proteins

- 5.2.2 Monoclonal Antibodies

- 5.2.3 Tissue & Blood-derived Products

- 5.2.4 Vaccines

- 5.2.5 Gene & Cell Therapies

- 5.2.6 Viral Vectors

- 5.2.7 Other Applications

- 5.3 By End-User

- 5.3.1 Large Pharma

- 5.3.2 Small & Mid-size Biotech

- 5.3.3 Contract Development & Manufacturing Organizations (CDMOs)

- 5.3.4 Contract Research & Testing Organizations (CROs)

- 5.3.5 Academic & Government Research Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 BioOutsource Ltd (Sartorius)

- 6.4.2 Bioscience Laboratories

- 6.4.3 BSL BioService

- 6.4.4 Catalent Inc.

- 6.4.5 Charles River Laboratories

- 6.4.6 Clean Cells

- 6.4.7 Creative Biolabs

- 6.4.8 Cygnus Technologies

- 6.4.9 Eurofins Scientific

- 6.4.10 Fujifilm Diosynth Biotechnologies

- 6.4.11 Lonza Group

- 6.4.12 Merck KGaA

- 6.4.13 Microbac Laboratories

- 6.4.14 Pall Corporation (Cytiva)

- 6.4.15 Sartorius AG

- 6.4.16 SGS SA

- 6.4.17 Texcell SA

- 6.4.18 Vironova AB

- 6.4.19 ViruSure GmbH

- 6.4.20 WuXi AppTec

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment