PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844594

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844594

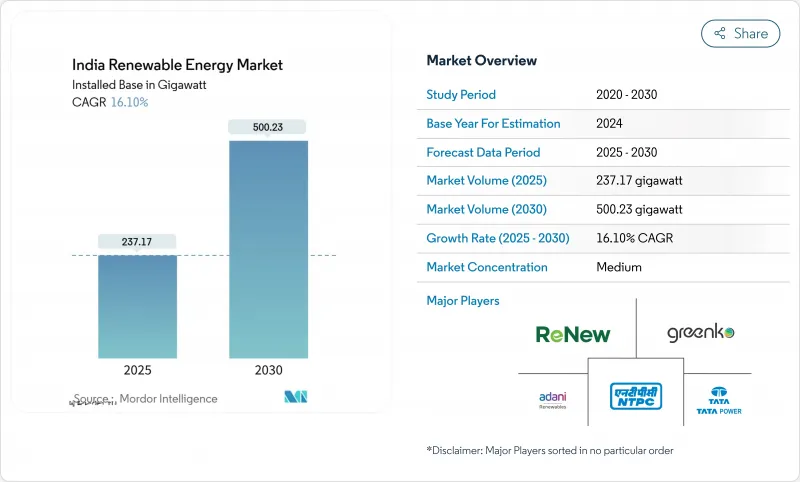

India Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Renewable Energy Market size in terms of installed base is expected to grow from 237.17 gigawatt in 2025 to 500.23 gigawatt by 2030, at a CAGR of 16.10% during the forecast period (2025-2030).

Declining technology costs, aggressive auctions, and policy tools such as PM-KUSUM and the Production-Linked Incentive (PLI) scheme have created a self-reinforcing cycle of scale and cost reduction. Solar's expanding dominance, commercial and industrial (C&I) procurement surge, and a widening pipeline of hybrid-plus-storage tenders are redefining competitive dynamics and spurring record capital inflows. At the same time, grid bottlenecks, DISCOM payment delays, and critical-mineral exposure threaten to temper momentum if left unresolved. Nevertheless, the India renewable energy market continues to demonstrate strong investor confidence, underscored by USD 86 billion in fresh commitments announced at recent summits .

India Renewable Energy Market Trends and Insights

Falling LCOE of Solar PV & Wind

Record solar tariffs of INR 2.51/kWh have been achieved on the back of PLI-supported module production and technology gains, reducing import dependence from 90% in 2020 to below 60% in 2025. Wind's cost trajectory is similar, though slower, yet 25.4 GW of repowering potential for sub-2 MW turbines offers further cost optimization. The merging of solar, wind, and coal cost curves has reached a tipping point where renewable additions are now the default choice for new capacity.

Aggressive Central & State-Level RE Auctions

Solar Energy Corporation of India (SECI) and state agencies issued 7.6 GW of tenders in H1 2024, 191% higher year-on-year, while evolving bid structures now require storage and domestic content to enhance grid integration . Visibility of 132.7 GW of projects through 2026 gives developers confidence to expand manufacturing and project pipelines.

DISCOM Financial Stress & Payment Delays

Distribution losses above 20% in several states continue to erode DISCOM liquidity, delaying payments and discouraging new projects despite payment-security mechanisms . Structural reforms in tariff setting and subsidy rationalization remain essential.

Other drivers and restraints analyzed in the detailed report include:

- Renewable Purchase Obligations & ESCerts Enforcement

- Surge in Green-Power PPAs from C&I Off-takers

- Land-Acquisition & Right-of-Way Bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar capacity stood at 114 GW in 2024, representing 48% of the India renewable energy market. Solar's 17% CAGR to 2030 is expected to raise the India renewable energy market size for solar alone to 254 GW. Domestic module output climbed from 10 GW in 2021 to 77.2 GW in 2024 after the PLI outlay, while wind remains steady at 47.36 GW, yet faces a repowering requirement for aging projects. Hydro contributes 51.99 GW and biomass 11.32 GW, supplying baseload support. A mandatory domestic-cell rule from April 2026 will necessitate a many-fold expansion of the current 7.6 GW cell capacity. Gujarat hosts 45% of modules and 52% of cell lines, fostering a supply-chain cluster that cuts logistics costs and export times.

Solar's export surge to 3 GW in FY 2023, mainly to the United States, underlines rising global competitiveness. Wind developers pursue larger turbines to replace 25 GW of sub-2 MW units, while hybrid solar-wind-storage plants win tenders that demand round-the-clock profiles. Geothermal and tidal technologies remain nascent but benefit from supportive R&D grants.

The India Renewable Energy Market Report is Segmented by Source (Solar, Wind, Hydro, Bioenergy, and Other Renewables), End-Use Sector (Utilities, Commercial and Industrial, Residential, R and Agricultural). The Market Size and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Adani Green Energy Ltd

- NTPC Ltd (RE Arm)

- ReNew Energy Global Plc

- Tata Power Renewables

- ACME Solar Holdings

- Azure Power Global Ltd

- Greenko Group

- JSW Energy (Neo)

- Suzlon Energy Ltd

- SJVN Green Energy Ltd

- Hero Future Energies

- Waaree Energies Ltd

- Vikram Solar Ltd

- Sterling & Wilson Renewable Energy

- Jakson Group (Solar)

- First Solar Inc

- Trina Solar Co Ltd

- JinkoSolar Holding Co Ltd

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems AS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Falling LCOE of Solar PV & Wind

- 4.2.2 Aggressive Central & State-Level RE Auctions (SECI, GUVNL, etc.)

- 4.2.3 Renewable Purchase Obligations & ESCerts Enforcement

- 4.2.4 Surge in Green-Power PPAs from C&I Off-takers

- 4.2.5 Production-Linked Incentive (PLI) Boosting Domestic Manufacturing

- 4.2.6 Hybrid + Storage Tender Structure Reducing Curtailment Risk

- 4.3 Market Restraints

- 4.3.1 DISCOM Financial Stress & Payment Delays

- 4.3.2 Land-Acquisition & Right-of-Way Bottlenecks

- 4.3.3 Critical-Mineral Supply-Chain Exposure (Si, NdFeB, Li)

- 4.3.4 Rising Day-time Curtailment & Grid Congestion Hot-spots

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Source

- 5.1.1 Solar

- 5.1.2 Wind

- 5.1.3 Hydro (Large and Small)

- 5.1.4 Bioenergy (Biomass, Bagasse, Waste-to-Energy)

- 5.1.5 Other Renewables (Hybrid, Geothermal, Tidal)

- 5.2 By End-Use Sector

- 5.2.1 Utility

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

- 5.2.4 Agricultural (PM-KUSUM, Solar Pumps)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Adani Green Energy Ltd

- 6.4.2 NTPC Ltd (RE Arm)

- 6.4.3 ReNew Energy Global Plc

- 6.4.4 Tata Power Renewables

- 6.4.5 ACME Solar Holdings

- 6.4.6 Azure Power Global Ltd

- 6.4.7 Greenko Group

- 6.4.8 JSW Energy (Neo)

- 6.4.9 Suzlon Energy Ltd

- 6.4.10 SJVN Green Energy Ltd

- 6.4.11 Hero Future Energies

- 6.4.12 Waaree Energies Ltd

- 6.4.13 Vikram Solar Ltd

- 6.4.14 Sterling & Wilson Renewable Energy

- 6.4.15 Jakson Group (Solar)

- 6.4.16 First Solar Inc

- 6.4.17 Trina Solar Co Ltd

- 6.4.18 JinkoSolar Holding Co Ltd

- 6.4.19 Siemens Gamesa Renewable Energy SA

- 6.4.20 Vestas Wind Systems AS

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment