PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844601

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844601

Italy Ophthalmic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

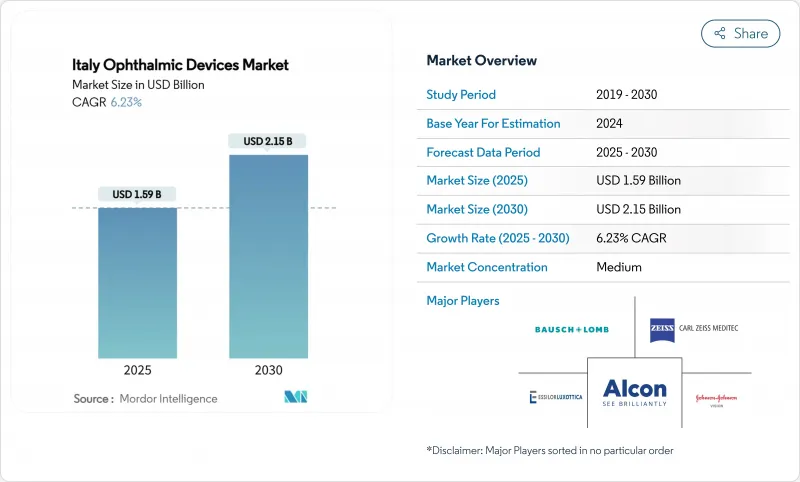

The Italy ophthalmic devices market size is USD 1.59 billion in 2025 and is forecast to reach USD 2.15 billion by 2030, expanding at a 6.23% CAGR.

This trajectory is powered by a rapidly aging population, a southern European diabetes cluster, and Milan's unique ability to merge medical need with fashion-forward eyewear demand. Hospitals dominate complex surgery volumes, yet ambulatory surgery centers (ASCs) are scaling quickly as Piano Nazionale di Ripresa e Resilienza (PNRR) grants modernize outpatient infrastructure. At the same time, corporate optical chains deepen market consolidation while EU-MDR rules slow the speed of new product launches, indirectly protecting incumbents with seasoned compliance functions. These dynamics collectively shape the competitive rhythm of the Italy ophthalmic devices market.

Italy Ophthalmic Devices Market Trends and Insights

Rising Prevalence of Diabetic Retinopathy & AMD In Northern Italy

Northern provinces now report diabetic retinopathy (DR) rates as high as 39% among adults with diabetes, a burden that elevates demand for spectral-domain OCT scanners, ultra-wide-field fundus cameras, and tele-ophthalmology kits. Screening uptake hovers below 50%, creating latitude for community-based programs that route retinal images to tertiary centers for rapid reads. Direct DR treatment costs lie between EUR 4,050 and 5,799 per patient, an outlay that convinces payers to reimburse technologies that catch pathology sooner rather than later. In response, vendors bundle artificial-intelligence triage algorithms with hardware to shorten interpretation times and unlock incremental revenue in the Italy ophthalmic devices market.

High Per-Capita Eyewear Spending Driven by Fashion Industry Clustering in Milan

Milan's global fashion pull reframes glasses as lifestyle accessories, allowing "Made in Italy" labels to command premium price points even during macroeconomic volatility. Exports still totaled EUR 5.236 billion in 2024 despite a fractional 0.6% dip from the prior year, underscoring the resilience of high-end frames. Younger professionals favor recycled acetate and bio-based polymers, driving a sustainability narrative that enhances margins. Omnichannel corporate chains amplify brand storytelling with digitally enabled fittings, strengthening their grip on the Italy ophthalmic devices market.

Lengthy EU-MDR Conformity Approval Cycles Delaying Product Launches

The 2021 EU-MDR regime increases data requirements, post-market surveillance steps, and unique device identification mandates. Smaller domestic innovators now face certification delays up to 18 months, pushing commercialization milestones and elevating costs. Limited notified-body capacity prioritizes certificate renewals over new submissions, giving multinational incumbents a timing advantage and slowing innovation flow into the Italy ophthalmic devices market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Public-Hospital Adoption of Femtosecond & Excimer Laser Platforms

- Government PNRR Funding for ASC Upgrades

- Price Caps Imposed By Servizio Sanitario Nazionale (SSN) Tenders

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vision care devices secured 64.21% of the Italy ophthalmic devices market in 2024, propelled by domestic design strength and high per-capita eyewear replacement cycles. Premium acetate frames now retail near EUR 250 and frequently integrate smart coatings for blue-light absorption, reflecting consumer readiness to invest in performance and aesthetics. Contact lenses ride a hygiene-focused tailwind, with daily disposables outpacing monthlies as urban professionals choose convenience over price. Meanwhile diagnostic & monitoring devices represent the fastest-growing slice, expanding at an 8.35% CAGR as hospitals upgrade to spectral-domain OCT units that interface with AI triage software. The Attention-Based DenseNet model recently validated for OCT segmentation with 0.9792 accuracy adds clinical momentum for imaging investments. These dynamics cement multi-year demand certainty for suppliers in the Italy ophthalmic devices market.

Second-generation point-of-care tonometers, handheld fundus cameras, and cloud-linked slit lamps further widen the technological scope of the Italy ophthalmic devices market. Vendors increasingly bundle analytics dashboards that integrate Electronic Health Record (EHR) data, allowing clinicians to track disease progression and streamline referrals. Portfolio depth thus becomes a differentiator as hospitals seek single-source partners to simplify procurement compliance.

The Italy Ophthalmic Devices Market Report is Segmented by Device Type (Diagnostic & Monitoring Devices, Surgical Devices, and Vision Care Devices), Disease Indication (Cataract, Glaucoma, Diabetic Retinopathy, Other Disease Indications), End-User (Hospitals, Specialty Ophthalmic Clinics, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alcon

- Johnson & Johnson

- EssilorLuxottica S.A.

- Carl Zeiss

- Bausch + Lomb Corp.

- Hoya Corp.

- CooperVision Inc.

- Topcon Corp.

- Nidek

- HAAG-Streit

- Heidelberg Engineering

- Quantel Medical SAS

- Danaher

- Glaukos Corp.

- Menicon Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Diabetic Retinopathy & AMD In Northern Italy

- 4.2.2 High Per-Capita Eyewear Spending Driven by Fashion Industry Clustering in Milan

- 4.2.3 Rapid Public-Hospital Adoption of Femtosecond & Excimer Laser Platforms

- 4.2.4 Government "Piano Nazionale Di Ripresa (PNRR) " Funding for ASC Upgrades

- 4.2.5 Expansion of Corporate Optical Retail Chains

- 4.2.6 Domestic IOL Contract-Manufacturing Base Lowering Procurement Costs

- 4.3 Market Restraints

- 4.3.1 Lengthy EU-MDR Conformity Approval Cycles Delaying Product Launches

- 4.3.2 Price Caps Imposed By Servizio Sanitario Nazionale (SSN) Tenders

- 4.3.3 Shortage of Ophthalmologists in Southern Regions

- 4.3.4 Rising Post-Operative Endophthalmitis Litigation Risk

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 OCT Scanners

- 5.1.1.2 Fundus & Retinal Cameras

- 5.1.1.3 Autorefractors & Keratometers

- 5.1.1.4 Corneal Topography Systems

- 5.1.1.5 Ultrasound Imaging Systems

- 5.1.1.6 Perimeters & Tonometers

- 5.1.1.7 Other Diagnostic & Monitoring Devices

- 5.1.2 Surgical Devices

- 5.1.2.1 Cataract Surgical Devices

- 5.1.2.2 Vitreoretinal Surgical Devices

- 5.1.2.3 Refreactive Surgical Devices

- 5.1.2.4 Glaucoma Surgical Devices

- 5.1.2.5 Other Surgical Devices

- 5.1.3 Vision Care Devices

- 5.1.3.1 Spectacles Frames & Lenses

- 5.1.3.2 Contact Lenses

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By Disease Indication

- 5.2.1 Cataract

- 5.2.2 Glaucoma

- 5.2.3 Diabetic Retinopathy

- 5.2.4 Other Disease Indications

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Specialty Ophthalmic Clinics

- 5.3.3 Ambulatory Surgery Centers (ASCs)

- 5.3.4 Other End-users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Alcon Inc.

- 6.3.2 Johnson & Johnson Vision

- 6.3.3 EssilorLuxottica S.A.

- 6.3.4 Carl Zeiss Meditec AG

- 6.3.5 Bausch + Lomb Corp.

- 6.3.6 Hoya Corp.

- 6.3.7 CooperVision Inc.

- 6.3.8 Topcon Corp.

- 6.3.9 Nidek Co. Ltd.

- 6.3.10 HAAG-Streit Group

- 6.3.11 Heidelberg Engineering GmbH

- 6.3.12 Quantel Medical SAS

- 6.3.13 Leica Microsystems GmbH

- 6.3.14 Glaukos Corp.

- 6.3.15 Menicon Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment