PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848082

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848082

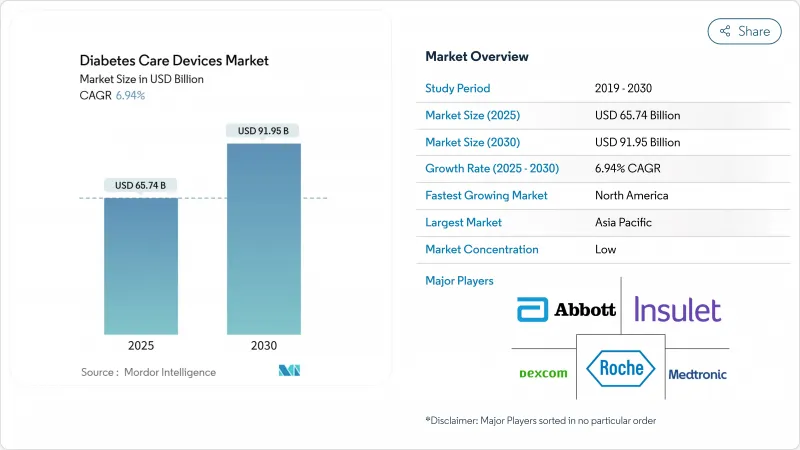

Diabetes Care Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Diabetes Care Devices Market size is estimated at USD 65.74 billion in 2025, and is expected to reach USD 91.95 billion by 2030, at a CAGR of 6.94% during the forecast period (2025-2030).

A closer link between those population dynamics and unit demand emerges as payers, providers and manufacturers increasingly recognize that technology-enabled care lowers lifetime treatment costs. Executives weighing expansion strategies can infer that every incremental percentage point increase in the diagnosed population translates into a disproportionately larger uptick in technology adoption because most newly diagnosed individuals today start their journey with at least one connected device rather than legacy finger-stick meters.

Global Diabetes Care Devices Market Trends and Insights

Rapid Reimbursement Expansion for CGM Worldwide

The expansion of insurance coverage for continuous glucose monitoring (CGM) systems is fundamentally reshaping market dynamics, with a 1.7% contribution to the overall CAGR forecast. In a significant development, New Zealand announced funding for CGMs and expanded access to insulin pumps effective October 2024, with expectations of over 12,000 people accessing funded CGMs in the first year [1]. Similarly, Canada's introduction of Bill C-64 in February 2024 aims to provide universal coverage for diabetes medications and create a dedicated fund for diabetes devices and supplies, addressing the financial burden for approximately 3.7 million Canadians with diabetes Health Canada . The reimbursement landscape is shifting from covering only high-risk patients to broader populations, with private insurers following government initiatives to expand coverage criteria, creating a virtuous cycle of increased adoption, improved outcomes, and further reimbursement expansion

Increasing Global Prevalence of Diabetes and Associated Risk Factors

The alarming rise in diabetes prevalence is driving market growth with a 1.4% contribution to the overall CAGR forecast. According to a BMJ study, the global age-standardized prevalence of type 1 diabetes increased from 400 to 514 per 100,000 population between 1990 and 2019, while mortality decreased from 4.74 to 3.54 per 100,000, indicating longer lifespans for diabetic patients requiring continuous management. This epidemiological shift is creating sustained demand for diabetes devices across all segments. The Western Sydney Diabetes initiative reported diabetes rates exceeding 13% among adults in the region, with an economic burden of USD 1.8 billion annually, highlighting the financial imperative for effective management solutions. The convergence of aging populations, increasing obesity rates, and sedentary lifestyles is accelerating diabetes incidence worldwide, with particularly rapid growth in emerging economies where changing dietary patterns and urbanization are contributing factors.

High Cost of Devices

Premium CGM annualized costs hover near USD 3,800 for flagship brands before insurance, while lower-priced flash glucose monitors cost closer to USD 2,300. These figures, drawn from publicly available company catalog pricing, create a bifurcated market in which reimbursement status largely dictates adoption. Executives should recognize that in low-income regions even a USD 500 annual out-of-pocket burden can depress uptake, so localized manufacturing or subscription-based financing may prove effective. The takeaway for strategy teams is that pricing elasticity varies not only by per-capita income but also by cultural perceptions of preventive care; for instance, some emerging markets accept higher spending on chronic-disease devices if bundled telehealth support is included.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in Technology

- Increased Government and Private Investments

- Less Awareness About Device Usage in Remote and Underdeveloped Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The monitoring devices segment commands a dominant 65.01% market share in 2024, reflecting its critical role in diabetes management across all patient populations. Continuous glucose monitoring (CGM) systems are revolutionizing diabetes care through real-time data provision and integration with automated insulin delivery systems, fundamentally changing treatment paradigms. A study published in the Journal of Diabetes Science and Technology demonstrated that CGM use is associated with lower HbA1c levels and improved outcomes, though disparities in access persist based on race and socioeconomic status Liebertpub. The management devices segment, encompassing insulin pumps, pens, and syringes, is projected to grow at a faster rate of 8.07% CAGR from 2025-2030, driven by innovations in automated insulin delivery systems and smart insulin pens.

Technological convergence is reshaping the competitive landscape, with integration between monitoring and management devices creating comprehensive diabetes management ecosystems. The emergence of hybrid closed-loop systems that combine CGM data with automated insulin delivery represents a significant advancement, with studies showing improvements in time-in-range metrics and quality of life for users. A clinical trial of the Omnipod 5 automated insulin delivery system in adults with type 2 diabetes demonstrated a significant reduction in hemoglobin A1c levels from 8.2% to 7.4% after 13 weeks, indicating improved glycemic control JAMA Network Open. The development of non-invasive glucose monitoring technologies, including optical and electromagnetic sensors, promises to further transform the market by addressing patient discomfort associated with traditional monitoring methods.

The Diabetes Care Devices Market is Segmented by Management Devices (Insulin Pumps, Insulin Syringes, and More), Monitoring Devices (Self-Monitoring Blood Glucose and Continuous Glucose Monitoring), by Patient Type (Type-1 Diabetes, Type-2 Diabetes and More), by End User (Hospitals & Clinics, Home-Care Settings and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains a 40.71 % share in 2024, partially owing to Medicare reimbursement and a high density of device-trained endocrinologists. In that same year the CDC recorded 29.7 million diagnosed and 8.7 million undiagnosed cases of diabetes in the United States (same CDC citation). This sizable undiagnosed cohort provides a latent expansion pool that device makers can target via screening initiatives tied to retail pharmacies. Yet mounting pressure from employers and government payers to reduce healthcare spending suggests future price compression for premium platforms, nudging manufacturers toward value-based-care contracts.

Asia-Pacific posts the fastest growth at 8.19 % CAGR through 2030, driven by urbanization and the world's highest absolute number of diabetes cases. International Diabetes Federation estimates place the region's share above 60 % of global prevalence. Manufacturing executives often overlook that Asia-Pacific also boasts some of the world's most digitally engaged populations, so smartphone-tethered CGM models may leapfrog earlier Bluetooth-only variants. Consequently, suppliers that embed local language AI coaching into their apps stand to win disproportionately high market share.

Europe sustains a stable presence thanks to universal health systems and aging demographics. The region's regulatory environment, guided by the European Medicines Agency, traditionally demands longer trial follow-ups than the FDA, which can delay commercialization. The recent Abbott-Dexcom patent truce removes a legal overhang that previously cast uncertainty on procurement timelines, giving hospital buyers clearer visibility into multi-year supply contracts. An astute reading of the situation suggests that European buyers will now leverage the presence of two legally unencumbered suppliers to negotiate bulk-purchase discounts, compressing average selling prices but potentially boosting unit volumes.

- Abbott Laboratories

- Roche

- Dexcom

- Medtronic

- Insulet

- Novo Nordisk

- Lifescan

- Ascensia

- Tandem Diabetes Care

- Senseonics Holdings

- Ypsomed

- Terumo

- Beckton Dickinson

- Bionime

- Rossmax

- Trividia Health

- Nipro

- Arkray

- Menarini Diagnostics

- Sanofi

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid reimbursement expansion for CGM Worldwide

- 4.2.2 Increasing Global prevalence of diabetes and associated risk factors

- 4.2.3 advancements in technology

- 4.2.4 Increased Government and Private Investments

- 4.2.5 European paediatric guidelines accelerating hybrid closed-loop pump uptake

- 4.2.6 Off-label GLP-1 surge fuelling home glucose testing demand in North America

- 4.3 Market Restraints

- 4.3.1 High Cost of Devices

- 4.3.2 Less Awareness about Device usage in remote and underdeveloped region

- 4.3.3 EU-MDR re-certification backlog for legacy lancets

- 4.3.4 Patch-pump recalls dampening uptake in Oceania

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 Monitoring Devices

- 5.1.1.1 Self-Monitoring

- 5.1.1.1.1 Blood Glucose

- 5.1.1.1.2 Glucometer Devices

- 5.1.1.1.3 Test Strips

- 5.1.1.1.4 Lancets

- 5.1.1.2 Continuous Glucose Monitoring

- 5.1.1.2.1 Sensors

- 5.1.1.2.2 Durables

- 5.1.2 Management Devices

- 5.1.2.1 Insulin Pumps

- 5.1.2.1.1 Insulin Pump Device

- 5.1.2.1.2 Insulin Pump Reservoir

- 5.1.2.1.3 Infusion Set

- 5.1.2.2 Insulin Syringes

- 5.1.2.3 Insulin Pens

- 5.1.2.4 Jet Injectors

- 5.1.1 Monitoring Devices

- 5.2 By Patient Type

- 5.2.1 Type-1 Diabetes

- 5.2.2 Type-2 Diabetes

- 5.2.3 Gestational & Others

- 5.3 By End-user

- 5.3.1 Hospitals & Clinics

- 5.3.2 Home-care Settings

- 5.3.3 Ambulatory Surgical Centres

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 Italy

- 5.4.2.4 Spain

- 5.4.2.5 United Kingdom

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 Japan

- 5.4.3.2 South Korea

- 5.4.3.3 China

- 5.4.3.4 India

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments

- 6.3.1 Abbott Diabetes Care

- 6.3.2 Roche Diabetes Care

- 6.3.3 Dexcom

- 6.3.4 Medtronic

- 6.3.5 Insulet Corporation

- 6.3.6 Novo Nordisk

- 6.3.7 LifeScan (Johnson & Johnson)

- 6.3.8 Ascensia Diabetes Care

- 6.3.9 Tandem Diabetes Care

- 6.3.10 Senseonics Holdings

- 6.3.11 Ypsomed

- 6.3.12 Terumo

- 6.3.13 Becton, Dickinson & Co.

- 6.3.14 Bionime Corporation

- 6.3.15 Rossmax International

- 6.3.16 Trividia Health

- 6.3.17 Nipro Corporation

- 6.3.18 ARKRAY

- 6.3.19 Menarini Diagnostics

- 6.3.20 Sanofi

7 Market Opportunities & Future Outlook