PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850255

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850255

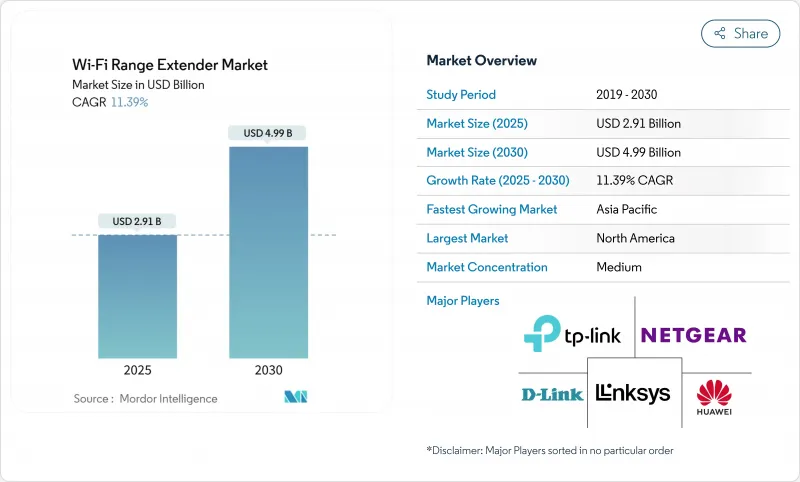

Wi-Fi Range Extender - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Wi-Fi range extender market size reached USD 2.91 billion in 2025 and is forecast to reach USD 4.99 billion by 2030, advancing at an 11.39% CAGR.

Surging smart-home adoption, hybrid-work policies and expanding regulatory mandates are extending wireless coverage requirements well beyond the reach of standard routers. Product redesigns to satisfy the European Union's 2025 cybersecurity and energy-efficiency rules are lifting development costs yet creating protective moats for compliant brands. Enterprises now regard uninterrupted Wi-Fi coverage as business-critical infrastructure, and the transition to Wi-Fi 7 is widening performance gaps that legacy devices cannot bridge. Simultaneously, mesh-networking solutions and antitrust investigations are reshaping competitive tactics in the Wi-Fi range extender market.

Global Wi-Fi Range Extender Market Trends and Insights

Smart-home Device Explosion

Annual shipments of 4.1 billion Wi-Fi devices in 2024 pushed the installed base to 21.1 billion and overloaded single-router footprints. Multi-story homes, thick walls and growing IoT ecosystems force households to add extenders for consistent automation and security performance. Corporate facilities mirror this density, requiring blanket coverage for sensor-driven building-management systems. As user experience degrades when latency spikes, both homeowners and enterprises allocate incremental budgets to coverage extension solutions.

BYOD and Hybrid Work Models

Hospitality chain Mitchells & Butlers installed 8,000 access points across 1,700 UK venues, underscoring how hybrid labor and guest expectations broaden Wi-Fi footprints. Finance and healthcare firms face regulatory imperatives for secure mobile access, driving demand for professionally managed extenders and access points in re-purposed or temporary spaces that lack structured cabling.

Mesh-Wi-Fi Cannibalisation

TP-Link's new Wi-Fi 7 mesh kits "democratize" seamless roaming and real-time management, eroding the value proposition of single-node extenders.Enterprises favor mesh for unified control while mass-market advertising stresses plug-and-play benefits, accelerating category blurring and price compression.

Other drivers and restraints analyzed in the detailed report include:

- Video-streaming Quality Race

- Wi-Fi 7 Upgrade Cycle Pull-through

- Cyber-security and Privacy Fears

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Outdoor deployments are growing at a 13.30% CAGR through 2030, reflecting municipal Wi-Fi and campus-wide coverage projects, yet indoor installs still account for 71% of the Wi-Fi range extender market size in 2024. Stadiums and transport hubs increasingly demand ruggedized extenders with directional antennas to manage dense crowds. The indoor segment's scale continues to anchor revenue, but volume growth is plateauing as many homes already own at least one extender. Smart-home adoption in emerging markets provides residual tailwinds, and retrofit demand spikes when families add connected security or entertainment gadgets.

Municipal projects under the WiFi4EU banner and city safety networks across France and Denmark favor weather-sealed Wi-Fi 6 and Wi-Fi 7 units, broadening supplier opportunities. Vendors with environmental-hardening expertise therefore gain traction. In contrast, indoor refresh cycles hinge on cost-effective Wi-Fi 5 or Wi-Fi 6 upgrades, sustaining legacy chip demand.

Extenders and repeaters retained 54% revenue leadership in 2024, yet enterprise migrations toward controller-based architectures are pushing access points at a 16.90% CAGR. Businesses appreciate remote firmware orchestration and role-based access security embedded in AP-centric designs. Consumer channels, however, favor plug-and-play repeaters for quick fixes.

Retailer Conforama Switzerland adopted Aruba WLAN solutions to streamline omnichannel inventory checks, illustrating how centralized AP management reduces operational friction. Conversely, mid-priced repeaters remain preferred in apartments where tenants cannot install Ethernet backhaul. Hybrid portfolios that couple APs with mesh satellites help vendors address both camps, keeping the Wi-Fi range extender market diversified.

The Wi-Fi Range Extender Market Report is Segmented by Type (Indoor Wi-Fi and Outdoor Wi-Fi), Product (Extenders and Repeaters, Access Points, and More), Technology Standard (Wi-Fi 5 [802. 11ac], Wi-Fi 6 / 6E [802. 11ax], and More), End User (Residential, Small and Medium Enterprises, and More), Sales Channel (Online [e-Commerce, D2C], Offline Retail, and More), and Geography.

Geography Analysis

North America retained 40% revenue share in 2024, building on mature broadband penetration and early smart-home uptake. Growth is moderating as saturation sets in, yet hybrid-work adoption and extensive single-family housing sustain replacement cycles. Canada's rural broadband subsidies and Mexico's digital-inclusion grants continue to lift volume. U.S. regulatory scrutiny, exemplified by the TP-Link antitrust probe, may re-shape competitive dynamics but is unlikely to dent overall demand given ingrained dependence on wireless connectivity.

Asia Pacific is the fastest-growing region with a 13.80% CAGR through 2030. China's near-universal fiber-to-the-home creates high expectations for in-unit Wi-Fi, yet structural barriers such as thick concrete walls constrain signal propagation, boosting extender sales. India's Smart Cities Mission and rapid smartphone adoption propel municipal Wi-Fi projects, while Japan and South Korea spearhead Wi-Fi 7 enterprise pilots focused on factory automation and immersive media. The diversity of economic stages requires suppliers to offer both entry-level Wi-Fi 5 and flagship Wi-Fi 7 skus.

Europe blends advanced regulation with moderate volume growth. Energy-efficiency and cybersecurity rules raise compliance costs but erect entry barriers that benefit incumbents. France posts the world's highest Wi-Fi 7 deployment density, translating fiber speed leadership into user-experience differentiation. Germany and the UK emphasize secure enterprise WLANs for Industry 4.0 and financial services, generating steady refresh cycles. EU subsidies such as WiFi4EU remain a cornerstone of rural and municipal roll-outs, ensuring durable public-sector demand.

- TP-Link Technologies Co. Ltd

- NETGEAR Inc.

- D-Link Corporation

- Linksys Group Inc. (Belkin)

- Huawei Technologies Co. Ltd

- Shenzhen Tenda Technology Co. Ltd

- AsusTek Computer Inc.

- Aruba Networks (HPE)

- Juniper Networks Inc.

- Ruckus Networks (CommScope)

- Motorola Solutions Inc.

- Ubiquiti Inc.

- Zyxel Communications Corp.

- Devolo GmbH

- Amped Wireless (Newo Corp.)

- Xiaomi Inc.

- Edimax Technology Co. Ltd

- Comfast (Shenzhen CF-Tech)

- Netis Systems Co. Ltd

- Belkin International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smart-home device explosion

- 4.2.2 BYOD and hybrid work models

- 4.2.3 Video-streaming quality race

- 4.2.4 Wi-Fi 7 upgrade cycle pull-through

- 4.2.5 "Work-from-anywhere" outdoor coverage needs

- 4.2.6 Mandatory in-building Wi-Fi coverage codes (EU)

- 4.3 Market Restraints

- 4.3.1 Mesh-Wi-Fi cannibalisation

- 4.3.2 Cyber-security and privacy fears

- 4.3.3 Energy-efficiency compliance costs

- 4.3.4 Antitrust scrutiny on leading vendors

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Wi-Fi 6/6E/7, EasyMesh, MLO)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Indoor Wi-Fi

- 5.1.2 Outdoor Wi-Fi

- 5.2 By Product

- 5.2.1 Extenders and Repeaters

- 5.2.2 Access Points

- 5.2.3 Powerline/Wi-Fi Combo Units

- 5.2.4 High-gain Antennas

- 5.3 By Technology Standard

- 5.3.1 Wi-Fi 5 (802.11ac)

- 5.3.2 Wi-Fi 6 / 6E (802.11ax)

- 5.3.3 Wi-Fi 7 (802.11be)

- 5.4 By End User

- 5.4.1 Residential

- 5.4.2 Small and Medium Enterprises

- 5.4.3 Large Enterprises and Campuses

- 5.4.4 Public and Municipal

- 5.5 By Sales Channel

- 5.5.1 Online (e-commerce, D2C)

- 5.5.2 Offline Retail

- 5.5.3 B2B/Enterprise Integrators

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TP-Link Technologies Co. Ltd

- 6.4.2 NETGEAR Inc.

- 6.4.3 D-Link Corporation

- 6.4.4 Linksys Group Inc. (Belkin)

- 6.4.5 Huawei Technologies Co. Ltd

- 6.4.6 Shenzhen Tenda Technology Co. Ltd

- 6.4.7 AsusTek Computer Inc.

- 6.4.8 Aruba Networks (HPE)

- 6.4.9 Juniper Networks Inc.

- 6.4.10 Ruckus Networks (CommScope)

- 6.4.11 Motorola Solutions Inc.

- 6.4.12 Ubiquiti Inc.

- 6.4.13 Zyxel Communications Corp.

- 6.4.14 Devolo GmbH

- 6.4.15 Amped Wireless (Newo Corp.)

- 6.4.16 Xiaomi Inc.

- 6.4.17 Edimax Technology Co. Ltd

- 6.4.18 Comfast (Shenzhen CF-Tech)

- 6.4.19 Netis Systems Co. Ltd

- 6.4.20 Belkin International

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment