PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850991

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850991

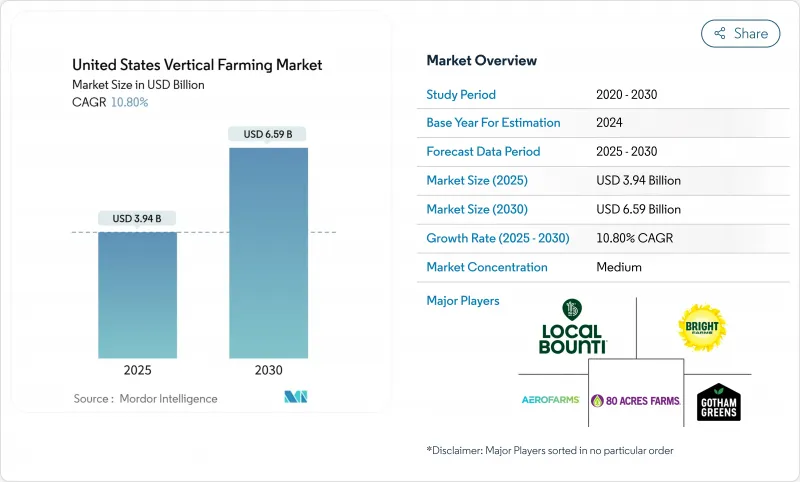

United States Vertical Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The vertical farming market reached USD 3.94 billion in 2025 and is forecast to grow at a 10.8% CAGR, hitting USD 6.59 billion by 2030.

The expansion rate signals that industry growth now depends on technology-driven efficiency rather than aggressive capacity build-outs. Market consolidation during 2024 underscored this shift, with large, venture-backed operators unable to cover high operating costs despite substantial fundraising. Artificial-intelligence-enabled climate control advanced LED lighting, and modular warehouse conversions are lowering energy use and shortening project timelines, giving disciplined players a cost advantage. Federal grants for urban agriculture, state-level drought regulations that favor water-frugal systems, and premium retail demand for pesticide-free produce together sustain a solid demand outlook. The competitive intensity remains moderate because the largest five firms hold less than half of the total revenue, allowing regional specialists to flourish.

United States Vertical Farming Market Trends and Insights

Rising Demand for Locally-Grown Pesticide-Free Produce

Year-round, pesticide-free food now earns premium shelf prices, and sensory studies from the University of Copenhagen show taste parity with organic field crops, lifting consumer acceptance. Gotham Greens sells premium leafy greens through more than 850 Northeast supermarkets and maintains profitability by pairing local freshness with brand trust. Large grocers deepen supply contracts at 80 Acres Farms, for example, supplies 316 Midwestern stores, shipping 10 million servings annually. Corporate cafeterias echo retail momentum; AeroFarms renewed its Costco fresh-produce program in 2025.

Urban Focus on Food-Mile Reduction and Freshness

Cities now treat vertical farms as critical food security assets. Gotham Greens' 210,000-square-foot Monroe, Georgia greenhouse places 90% of U.S. consumers within a one-day truck reach, strengthening cold-chain resilience. AutoStore and OnePointOne's Arizona site delivers crops in 15 days from seed to shelf using high-density robotics. New York State approved a 385,000-square-foot "GigaFarm" that will output 8 million lb of produce yearly while operating at carbon-negative status.

High CAPEX and Energy-Intensive OPEX

A typical multilevel farm costs about USD 1,000 per ft2 to build, and electricity accounts for up to 40% of monthly expenses. Bowery Farming and Plenty both filed for bankruptcy after raising more than USD 1.6 billion combined, underlining the risk when cost reductions lag scale-up. Dynamic lighting tied to wholesale power prices can trim bills by up to 18%. Operators such as Gotham Greens remain profitable by choosing low-cost power locations and standardizing designs across 13 facilities.

Other drivers and restraints analyzed in the detailed report include:

- Water-Efficient Agriculture Amid Drought Policies

- Corporate and Campus Sustainability Food Mandates

- Economically Viable Crop Range Remains Narrow

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydroponics held 68.0% of the vertical farming market revenue in 2024, supported by mature supply chains and proven designs. Aeroponics, though representing a smaller base, will log an 18.4% CAGR to 2030 as 95% water-efficiency targets catch regulators' attention in drought zones. The IoT nutrient sensors sharpen dosing accuracy across both systems, helping close the cost gap.

Precision imaging now notifies growers of nutrient stress within hours, further reducing waste. Operators, therefore, compete less on growth medium and more on integrated software that orchestrates lighting, fertigation, and harvesting.

The United States Vertical Farming Market Report is Segmented by Growth Mechanism (Aeroponics, Hydroponics, and Aquaponics), by Structure (Building-Based Vertical Farms, Shipping-Container Farms, and More), and by Crop Type (Leafy Greens, Herbs and Microgreens, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AeroFarms

- BrightFarms (Cox Enterprises)

- Gotham Greens

- 80 Acres Farms

- Freight Farms, Inc.

- Altius Farms (Jewish Family Service of Colorado)

- Local Bounti

- Pure Green Farms

- Square Roots

- Oishii

- Eden Green Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for locally-grown pesticide-free produce

- 4.2.2 Urban focus on food-mile reduction and freshness

- 4.2.3 Water-efficient agriculture amid drought policies

- 4.2.4 Corporate and campus sustainability food mandates

- 4.2.5 Tax incentives and Opportunity-Zone financing

- 4.2.6 AI-driven crop modeling lowers OPEX

- 4.3 Market Restraints

- 4.3.1 High CAPEX and energy-intensive OPEX

- 4.3.2 Economically viable crop range remains narrow

- 4.3.3 Electricity-price volatility hurts margins

- 4.3.4 Shortage of CEA-skilled workforce

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Growth Mechanism

- 5.1.1 Aeroponics

- 5.1.2 Hydroponics

- 5.1.3 Aquaponics

- 5.2 By Structure

- 5.2.1 Building-based Vertical Farms

- 5.2.2 Shipping-Container Farms

- 5.2.3 Warehouse-based Vertical Farms

- 5.3 By Crop Type

- 5.3.1 Leafy Greens

- 5.3.2 Herbs and Microgreens

- 5.3.3 Fruits and Berries

- 5.3.4 Flowers and Ornamentals

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AeroFarms

- 6.4.2 BrightFarms (Cox Enterprises)

- 6.4.3 Gotham Greens

- 6.4.4 80 Acres Farms

- 6.4.5 Freight Farms, Inc.

- 6.4.6 Altius Farms (Jewish Family Service of Colorado)

- 6.4.7 Local Bounti

- 6.4.8 Pure Green Farms

- 6.4.9 Square Roots

- 6.4.10 Oishii

- 6.4.11 Eden Green Technology

7 Market Opportunities and Future Outlook