PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906938

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906938

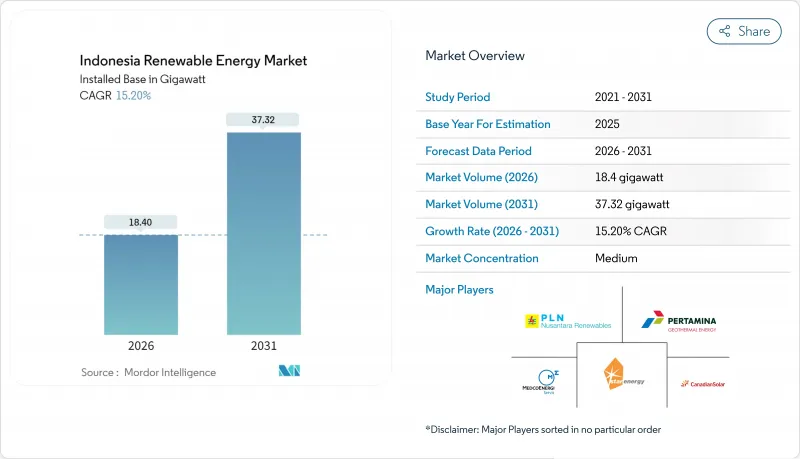

Indonesia Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Indonesia Renewable Energy market size in 2026 is estimated at 18.4 gigawatt, growing from 2025 value of 15.97 gigawatt with 2031 projections showing 37.32 gigawatt, growing at 15.20% CAGR over 2026-2031.

Strong policy tailwinds, falling technology costs, and rising corporate demand drive this momentum while the government balances climate goals with economic growth. President Prabowo Subianto's January 2025 inauguration of 37 electricity projects worth IDR 72 trillion (USD 4.4 billion) underscored state backing for grid upgrades and new capacity. Hydropower still leads the generation mix, yet solar PV registers the fastest growth as project economics improve, and independent power producers diversify beyond legacy assets. Climate-finance inflows, including the USD 20 billion Just Energy Transition Partnership, are easing capital constraints, though coal over-capacity and PLN's single-buyer model continue to slow private investment.

Indonesia Renewable Energy Market Trends and Insights

Falling solar & wind LCOE

Global average solar costs fell to USD 0.044/kWh in 2024 and onshore wind to USD 0.033/kWh, undercutting coal's USD 0.065/kWh benchmark. Indonesia's August 2024 relaxation of local-content rules lets developers import cheaper modules while keeping assembly onshore, accelerating project pipelines. These economics sharpen PLN's focus on curbing generation costs, especially as avoided fuel outlays and carbon-pricing risks tilt new-build economics toward renewables. The result is a steady pivot in the Indonesian renewable energy market toward solar and wind for green-field capacity additions. Ongoing financing reforms further magnify this cost parity by narrowing the premium that developers once faced.

RUPTL 2025-34 Pipeline of 53 GW New Renewable Capacity

Indonesia's power-supply plan calls for 69.5 GW of new capacity by 2034, 76% of which is renewable or storage, requiring IDR 2,967 trillion (USD 182.5 billion) in investment. Private partnerships are expected to fund 73% of this pipeline, shifting the Indonesian renewable energy market toward deeper technology diversification. The roadmap earmarks 17.1 GW solar, 7.2 GW wind, and 5.2 GW geothermal, moving beyond hydropower's historic dominance and enabling a more flexible grid. Two planned 250 MW nuclear units underscore a longer-term quest for baseload low-carbon supply, while the 41% renewable target for 2040 offers clearer visibility for investors.

Coal Over-Capacity & Must-Run PPAs

Legacy coal PPAs obligate PLN to pay capacity charges even when plants are idle, costing the utility more than USD 8 billion annually. These must-run clauses crowd out procurement of cheaper renewables, limiting short-term additions despite favorable economics. Coal's structural lock-in is set to ease only as early-retirement schemes under the Energy Transition Mechanism secure funding and renegotiate contracts, but the timetable remains uncertain and continues to temper growth in the Indonesian renewable energy market.

Other drivers and restraints analyzed in the detailed report include:

- JETP & Multilateral Climate-Finance Inflows

- Mandatory B40/B50 Biofuel Blending Push

- High Cost of Capital versus ASEAN Peers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydropower held 47.70% of Indonesia's Renewable Energy market share in 2025, owing to legacy dams commissioned before 2020. Conversely, wind capacity is forecast to post a 55.95% CAGR from 2026 to 2031, fueled by offshore zones in Sulawesi and robust onshore sites in South Sulawesi. The Indonesian Renewable Energy market size for hydropower will grow slowly as future additions skew to small run-of-river projects that skirt resettlement controversies. Solar installations are accelerating in Java, Bali, and on floating reservoirs, benefiting from 4-hour battery add-ons that qualify for capacity payments.

Wind's rapid rise rests on higher capacity factors and joint-venture finance from ACWA Power and Masdar, although subsea-cable links and marine-use zoning remain underdeveloped. Geothermal projects add a steady 200-300 MW annually, constrained by drilling risk and high upfront cost, yet provide dispatchable baseload that anchors PLN's system planning. Bioenergy growth follows B40 and B50 blending mandates that stabilize biomass feedstock demand in palm-oil provinces. Ocean energy stays at pilot scale pending tariff clarity. The evolving mix will pivot the Indonesian Renewable Energy market toward variable renewables plus storage by the late decade.

The Indonesia Renewable Energy Market Report is Segmented by Technology (Solar Energy, Wind Energy, Hydropower, Bioenergy, Geothermal, and Ocean Energy) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- PLN Renewables (PT Pembangkitan Jawa-Bali, PT Indonesia Power)

- Pertamina Geothermal Energy

- Star Energy Geothermal

- Medco Power Indonesia

- Canadian Solar Inc.

- Trina Solar Ltd

- PT Sumber Energi Sukses Makmur

- PT Barito Renewables Energy Tbk

- SEG Solar

- PT ATW Solar Indonesia

- Fourth Partner Energy Pvt Ltd

- Xurya Daya Indonesia

- TotalEnergies ENEOS

- ACWA Power

- Masdar

- Northstar PLTS

- Bright PLN Batam

- PT Supreme Energy

- PT Geo Dipa Energi

- PT Sarulla Operations

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Falling solar & wind LCOE

- 4.2.2 RUPTL 2025-34 pipeline of 53 GW new RE

- 4.2.3 JETP & multilateral climate-finance inflows

- 4.2.4 Mandatory B40/B50 biofuel blending push

- 4.2.5 Data-centre & corporate PPA boom

- 4.2.6 Off-grid microgrids for last-mile electrification

- 4.3 Market Restraints

- 4.3.1 Coal over-capacity & must-run PPAs

- 4.3.2 High cost of capital vs ASEAN peers

- 4.3.3 PLN single-buyer monopoly limits competition

- 4.3.4 Land-acquisition conflicts in wind/hydro sites

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Energy (PV and CSP)

- 5.1.2 Wind Energy (Onshore and Offshore)

- 5.1.3 Hydropower (Small, Large, PSH)

- 5.1.4 Bioenergy

- 5.1.5 Geothermal

- 5.1.6 Ocean Energy (Tidal and Wave)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 PLN Renewables (PT Pembangkitan Jawa-Bali, PT Indonesia Power)

- 6.4.2 Pertamina Geothermal Energy

- 6.4.3 Star Energy Geothermal

- 6.4.4 Medco Power Indonesia

- 6.4.5 Canadian Solar Inc.

- 6.4.6 Trina Solar Ltd

- 6.4.7 PT Sumber Energi Sukses Makmur

- 6.4.8 PT Barito Renewables Energy Tbk

- 6.4.9 SEG Solar

- 6.4.10 PT ATW Solar Indonesia

- 6.4.11 Fourth Partner Energy Pvt Ltd

- 6.4.12 Xurya Daya Indonesia

- 6.4.13 TotalEnergies ENEOS

- 6.4.14 ACWA Power

- 6.4.15 Masdar

- 6.4.16 Northstar PLTS

- 6.4.17 Bright PLN Batam

- 6.4.18 PT Supreme Energy

- 6.4.19 PT Geo Dipa Energi

- 6.4.20 PT Sarulla Operations

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment