PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851549

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851549

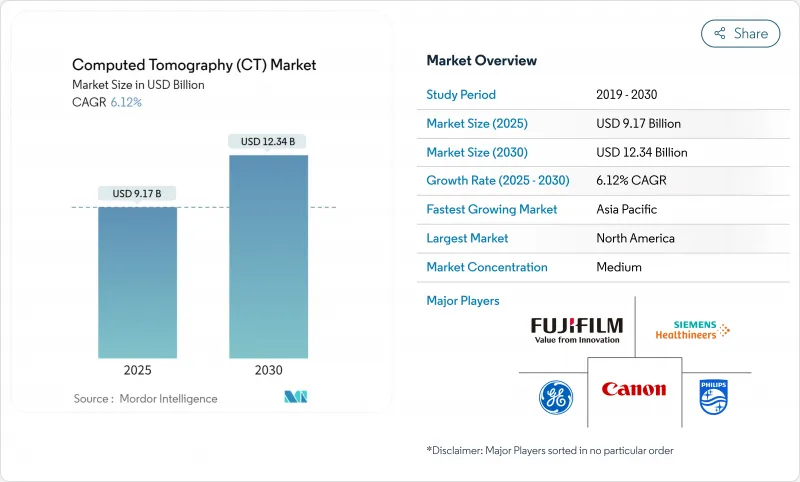

Computed Tomography (CT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The CT scanner market size reached USD 9.17 billion in 2025 and is on track to rise to USD 12.34 billion by 2030, expanding at a 6.12% CAGR.

Continued gains come from accelerating adoption of photon-counting detectors, artificial-intelligence-enabled workflow orchestration, and higher scan volumes for oncology, cardiology, and full-body preventive imaging. The CT scanner market also benefits from a growing geriatric population that demands minimally invasive diagnostics, while mobile stroke units and rural outreach programs broaden geographic reach. Competitive rivalry intensifies as GE HealthCare, Siemens Healthineers, and Philips shorten product cycles, embed cloud connectivity, and form strategic alliances that fuse hardware with software. Supply-chain fragility around semiconductor components and persistent radiologic-technologist shortages temper momentum but simultaneously spark investment in automation and remote-operation capabilities that extend CT scanner market access.

Global Computed Tomography (CT) Market Trends and Insights

Surging Chronic-Disease Burden

Rising prevalence of cardiovascular disease, projected to cause more than 23 million deaths by 2030, is sharply elevating demand for cardiothoracic imaging. CT scans already account for 25.87% of imaging volume in pharmaceutical trials, underscoring their central role in oncology and cardiovascular drug evaluation. Low-dose lung-cancer screening programs are scaling across multiple regions and demonstrate mortality reductions near 25% in high-risk cohorts. Health systems integrate AI triage that cuts inter-reader variability by 42.5% and shortens report turnaround by 63%, enabling higher throughput without sacrificing quality. Emerging economies, supported by infrastructure upgrades, are rapidly widening CT scanner market penetration to address previously unmet diagnostic needs.

Rapid Detector & Spectral-CT Innovations

Photon-counting detectors such as Siemens Healthineers' Naeotom Alpha class reach spatial-resolution ratings of 134.7 HU/mm while lowering radiation dose, redefining image clarity for vascular studies. Spectral imaging adds material decomposition and quantitative iodine mapping that assist oncologic staging and cardiology plaque analysis. Mobile stroke units equipped with high-performance scanners accelerate thrombolysis by shrinking door-to-needle times. Capital allocation follows technology leadership, as Siemens commits USD 350 million exclusively for CT advancement within its broader med-tech program.

High Acquisition & Maintenance Cost

Capital outlays for premium scanners can exceed USD 2 million per unit and the supply-chain burden equals up to 20% of manufacturing revenue, compressing margins for vendors. Semiconductor vulnerabilities, highlighted by disruptions to high-purity quartz mining, threaten downstream component availability that keeps CT scanner market production on schedule. Providers mitigate cost barriers by lengthening asset life cycles, leveraging cloud-hosted reconstruction engines, and adopting vendor financing that aligns payments with scan volumes. Smaller centers, facing elevated contract-labor expenses, must balance technology upgrades against financial sustainability.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Minimally-Invasive Diagnostics

- Expanding Geriatric Population Base

- Radiation-Dose Concerns and Tightening Regulation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The CT scanner market size for mid-slice platforms stood at USD 3.54 billion in 2024, reflecting 38.56% of global installations. This cohort balances throughput and affordability for routine diagnostics, yet demand is shifting toward high-slice scanners that deliver sub-second cardiac imaging and sub-millimeter isotropic resolution. High-slice models now grow at 6.89% CAGR as cardiology, oncology, and trauma specialists prioritize spectral decomposition and whole-organ perfusion. Photon-counting detectors further elevate the premium tier by enhancing contrast-to-noise ratios while trimming radiation dose, a proposition valued by pediatric and serial-follow-up protocols. Manufacturers leverage modular gantry designs that allow in-field upgrades from 128-slice to 256-slice, protecting capital budgets. Clinical evidence underscores diagnostic superiority: vessel sharpness scores of 134.7 HU/mm versus 100.9 HU/mm for energy-integrating predecessors. Health systems consolidate procurement around fewer, more capable units, reinforcing high-slice momentum within the CT scanner market.

At the opposite end, low-slice scanners preserve relevance in emergency and point-of-care deployments where quick setup, minimal shielding, and favorable pricing outweigh resolution demands. Rural hospitals adopt 16-slice units mounted on mobile trailers for trauma triage, expanding CT scanner market access without expensive room construction. Convergence between cone-beam and multidetector domains blurs boundaries as algorithms correct cone-beam artifacts, widening their clinical scope.

Stationary scanners accounted for 79.79% of CT scanner market share in 2024, anchored within hospitals and diagnostic centers that need high uptime and integration with RIS/PACS networks. Vendors differentiate through AI-reconstruction engines that shorten scan-to-view times and through iterative dose-reduction software that aligns with upcoming radiation-reporting mandates. However, mobile and portable devices represent the fastest-growing category as emergency-medicine teams deploy them in ambulances and field clinics. ARPA-H's USD 12 million grant to develop rugged mobile platforms validates institutional confidence in transportable solutions.

Revenue opportunity escalates when mobile stroke units demonstrate 30-minute reductions in time to thrombolysis, translating to improved patient outcomes and lower long-term neuro-rehabilitation expenses. ICU adoption is high, with 97% of physicians reporting portable head CT utility to avoid transporting unstable patients. Manufacturing collaborations such as GE HealthCare and Kalbe's facility expansion in Southeast Asia shorten lead times and localize service, supporting mobile-segment expansion.

The Computed Tomography Market Report is Segmented by Technology (Low-Slice, Mid-Slice, High-Slice), Product Type (Stationary, Portable/Mobile), Application (Oncology, Cardiology, Neurology, and More), End-User (Hospitals, Diagnostic Centers, and More), Device Architecture (Spiral, Ring-Gantry, and More), and Geography (North America, Europe, and More). Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 42.23% of CT scanner market share in 2024, anchored by extensive modality fleets, robust reimbursement, and rapid adoption of photon-counting systems. Medicare's doubled payment for coronary CT angiography incentivizes outpatient service expansion. Strategic alliances such as GE HealthCare's seven-year deal with Sutter Health pair capital investment with workforce-development programs that aim to ease technologist shortages. The region prepares for compulsory radiation-dose reporting by 2027, prompting hospitals to upgrade to low-dose software and analytics dashboards. Teleradiology and remote scanner operation trials gain momentum as a mitigation strategy for rural staffing deficits.

Asia-Pacific registers the fastest 7.82% CAGR through 2030, propelled by large-scale government investment in healthcare infrastructure and expansion of point-of-care imaging. Local manufacturing partnerships, including GE HealthCare-Kalbe's Indonesian plant and Wipro GE's USD 959 million capacity build-out, shorten supply chains and reduce cost barriers for regional buyers. Population aging and escalating lifestyle-related diseases underpin higher imaging demand, while cloud-enabled AI platforms lower entry hurdles for smaller centers. National cancer-screening mandates across China, Japan, and South Korea stimulate sustained procurement of low-dose CT technology.

Europe retains a robust installed base, propelled by stringent quality standards that favor premium detector technology and eco-friendly workflow solutions. Environmental policies encourage procurement of scanners with intelligent power-saving modes and recyclable component designs. Middle East and Africa undergo rapid modernization with public-private partnerships that fund tertiary hospitals equipped with advanced CT suites; GE HealthCare's collaboration with Dr. Sulaiman Al-Habib Medical Group exemplifies value-chain localization. South America experiences steady growth led by Brazil's nationwide telehealth roll-outs, although constrained fiscal space and complex import regulations temper the pace of high-end scanner adoption.

- GE HealthCare Technologies Inc.

- Siemens Healthineers

- Koninklijke Philips

- Canon

- Shimadzu

- Fujifilm Holdings Corp.

- Hitachi

- Samsung Group

- United Imaging Healthcare Co., Ltd.

- Neusoft

- Shenzhen Anke Hi-Tech Co., Ltd.

- Medtronic

- Carestream Health

- J. Morita Corp.

- Planmed

- CurveBeam LLC

- IMRIS Inc.

- NeuroLogica

- RefleXion Medical, Inc.

- SinoVision Technologies (Beijing) Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging chronic-disease burden

- 4.2.2 Rapid detector & spectral-CT innovations

- 4.2.3 Growing demand for minimally-invasive diagnostics

- 4.2.4 Expanding geriatric population base

- 4.2.5 Eco-sustainability mandates driving low-dose CT investment

- 4.2.6 Cardiac CT angiography guideline adoption

- 4.3 Market Restraints

- 4.3.1 High acquisition & maintenance cost

- 4.3.2 Radiation-dose concerns and tightening regulation

- 4.3.3 Reimbursement pressure in price-sensitive nations

- 4.3.4 Shortage of CT-trained radiologic technologists

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Technology (Slice Count)

- 5.1.1 Low-slice (<64)

- 5.1.2 Mid-slice (64)

- 5.1.3 High-slice (128-256)

- 5.2 By Product Type

- 5.2.1 Stationary CT Scanners

- 5.2.2 Portable / Mobile CT Scanners

- 5.3 By Application

- 5.3.1 Oncology

- 5.3.1.1 Lung Cancer Screening

- 5.3.1.2 Head & Neck Oncology

- 5.3.1.3 Colorectal Oncology

- 5.3.1.4 Other Oncology

- 5.3.2 Cardiology

- 5.3.2.1 Coronary CT Angiography

- 5.3.2.2 Calcium Scoring

- 5.3.2.3 Structural Heart Disease

- 5.3.3 Neurology

- 5.3.3.1 Stroke Assessment

- 5.3.3.2 Brain Trauma

- 5.3.4 Vascular

- 5.3.4.1 Peripheral Vascular Disease

- 5.3.4.2 Pulmonary Angiography

- 5.3.5 Musculoskeletal

- 5.3.5.1 Orthopedic Trauma

- 5.3.5.2 Sports Injuries

- 5.3.6 Dental & Maxillofacial

- 5.3.7 Trauma & Emergency

- 5.3.8 Other Applications

- 5.3.1 Oncology

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.1.1 Public Hospitals

- 5.4.1.2 Private Hospitals

- 5.4.2 Diagnostic Imaging Centers

- 5.4.3 Ambulatory Surgical Centers

- 5.4.4 Dental Clinics

- 5.4.5 Veterinary Clinics & Hospitals

- 5.4.6 Academic & Research Institutes

- 5.4.1 Hospitals

- 5.5 By Device Architecture

- 5.5.1 Spiral / Helical CT

- 5.5.2 Ring-Gantry CT

- 5.5.3 C-arm CT

- 5.5.4 O-arm CT

- 5.5.5 Flat-Panel Detector CT

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 GE HealthCare Technologies Inc.

- 6.3.2 Siemens Healthineers AG

- 6.3.3 Koninklijke Philips N.V.

- 6.3.4 Canon Medical Systems Corp.

- 6.3.5 Shimadzu Corp.

- 6.3.6 Fujifilm Holdings Corp.

- 6.3.7 Hitachi Ltd.

- 6.3.8 Samsung Electronics Co., Ltd.

- 6.3.9 United Imaging Healthcare Co., Ltd.

- 6.3.10 Neusoft Medical Systems Co., Ltd.

- 6.3.11 Shenzhen Anke Hi-Tech Co., Ltd.

- 6.3.12 Medtronic plc

- 6.3.13 Carestream Health, Inc.

- 6.3.14 J. Morita Corp.

- 6.3.15 Planmed Oy

- 6.3.16 CurveBeam LLC

- 6.3.17 IMRIS Inc.

- 6.3.18 NeuroLogica Corp.

- 6.3.19 RefleXion Medical, Inc.

- 6.3.20 SinoVision Technologies (Beijing) Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment