PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910448

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910448

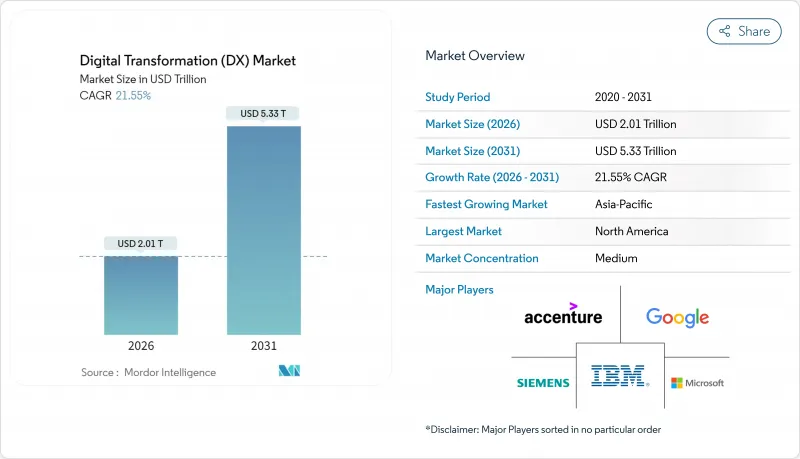

Digital Transformation (DX) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The digital transformation market is expected to grow from USD 1.65 trillion in 2025 to USD 2.01 trillion in 2026 and is forecast to reach USD 5.33 trillion by 2031 at 21.55% CAGR over 2026-2031.

Strong growth stems from enterprise AI adoption, cloud-first spending priorities, and regulatory mandates that compel organizations to digitize operations. Sovereign-AI policies push companies to localize computing, while 5G networks open real-time use cases in manufacturing and healthcare. Low-code platforms extend application development beyond IT departments, and ESG reporting rules accelerate data-driven compliance investments. Incremental modernization strategies gain favor as enterprises balance innovation goals with legacy-system cost pressures. Competitive intensity remains moderate because businesses pursue multi-vendor cloud and AI strategies to avoid lock-in, yet hyperscale-provider capital expenditure is redefining scale economics in the digital transformation market.

Global Digital Transformation (DX) Market Trends and Insights

Cloud-first enterprise IT spending boom

Organizations are reallocating budgets from on-premise hardware toward cloud-native platforms that support AI workloads and hybrid work models. For example, Amazon Web Services resolved more than 1 million internal developer questions with its AI assistant Amazon Q, saving 450,000 hours of manual effort. Cloud economics shorten procurement cycles and shift spending from capital to operating budgets, allowing faster experimentation. Strategic deals, such as Microsoft's partnership with Coca-Cola, show how generative-AI services ride atop scalable cloud foundations. As enterprises view cloud infrastructure as essential, vendors expand regional data centers to comply with sovereign-data rules.

Rising AI/ML integration across business functions

AI moves from pilots to production at scale. Goldman Sachs rolled out AI assistants across multiple departments, and UnitedHealth Group manages more than 1,000 AI use cases that automate claims and clinical decisions. Defense, industrial, and retail leaders replicate the pattern, embedding generative models in design, maintenance, and customer-experience workflows. Workforce upskilling and data-governance frameworks mature in tandem, making AI a core competency rather than an experimental add-on.

Legacy technical-debt lock-ins

Enterprises still devote up to 80% of IT budgets to maintain decades-old systems, reducing funds for innovation. ServiceNow found that aging applications cost USD 40,000 annually per system and drain 17 employee hours weekly.Government agencies illustrate the problem, spending the majority of their USD 100 billion IT outlay on legacy assets. The resulting technical debt inflates cybersecurity risk because outdated software lacks modern controls.

Other drivers and restraints analyzed in the detailed report include:

- 5G-enabled real-time data use-cases

- Mandatory ESG reporting digitisation

- Cyber-talent scarcity and wage inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

AI and ML claimed 28.05% of digital transformation market share in 2025, and the segment is expected to grow at 23.9% CAGR, reinforcing that data-driven automation is a strategic differentiator. This portion of the digital transformation market size is fueled by enterprises scaling chatbots, recommendation engines, and predictive-maintenance models. Production deployments at Goldman Sachs and Lockheed Martin exemplify the shift from pilots to mission-critical systems. Extended-Reality tools deliver 275% training-retention gains for industrial employees, while blockchain solutions such as Walmart's food-traceability network cut provenance checks from 7 days to 2.2 seconds.

A parallel wave of edge-computing clusters processes data near sensors to avoid cloud-latency penalties. Industrial robotics synchronized with digital twins allow continuous process optimization in automotive and electronics plants. Additive-manufacturing lines use real-time prints of tooling components to shrink downtime. Together these technologies deepen the digital transformation market penetration across heavy industries.

Cloud solutions owned 62.65% of digital transformation market share in 2025 and will expand at 22.1% CAGR through 2031. This share of the digital transformation market size correlates with hyperscalers' multi-billion-dollar data-center builds. AWS's Project Rainier clusters Trainium 2 chips into the world's most powerful AI training computer. Microsoft's USD 80 billion infrastructure spend underscores escalating investment cycles. Enterprises retain on-premises nodes for regulated workloads, yet hybrid architectures flourish; Oracle's pact with Google Cloud allows bidirectional low-latency links with no egress fees.

Cloud economics also attract small businesses that lack capital budgets for servers. Pay-as-you-go models align costs with usage, and regional availability zones satisfy data-residency regulations. Over time, platform lock-in concerns lead many firms to distribute microservices across multiple clouds, creating demand for cross-plane orchestration tools.

Digital Transformation Market is Segmented by Technology (AI and ML, Extended Reality (VR/AR), and More), Deployment Model (Cloud, On-Premises, Hybrid), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Industry Vertical (BFSI, Healthcare and Life-Sciences, Manufacturing and Industrial, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secured 31.95% of digital transformation market share in 2025, anchored by deep venture capital pools and proximity to hyperscale-cloud headquarters. Texas alone hosts a USD 500 billion data-center expansion featuring NVIDIA supercomputers, plus Texas Instruments' USD 30 billion chip plant that adds thousands of tech jobs. Federal and state agencies adopt AI assistants like "Humphrey" to automate administrative tasks, further boosting demand. Cross-border initiatives under USMCA support manufacturing digitisation throughout Canada and Mexico.

Asia-Pacific delivers the fastest growth at 22.0% CAGR due to extensive government infrastructure programs and mobile-first consumer behavior. Digital wallets account for nearly 70% of e-commerce checkouts, highlighting the region's leapfrog adoption curves. India, Japan, and South Korea each articulate national AI strategies, while Australia's Queensland earmarked AUD 1.2 billion (USD 800 million) for sovereign-cloud services. Combined, these moves expand the addressable digital transformation market.

Europe emphasizes digital sovereignty under eIDAS 2.0, mandating universal acceptance of European Digital Identity Wallets by 2027. Germany's EuroStack program predicts EUR 300 billion investment to localize compute stacks by 2035. Schleswig-Holstein's migration away from proprietary software shows practical implementation of sovereignty ideals. South America and the Middle East and Africa trail the leading regions but experience rising foreign investment in fiber backbones, cloud regions, and 5G rollouts, unlocking new service opportunities.

- Accenture

- Microsoft

- IBM

- Google (Alphabet)

- AWS (Amazon)

- SAP

- Oracle

- Adobe

- Salesforce

- Cisco Systems

- Dell Technologies

- Siemens

- Hewlett Packard Enterprise

- Cognex

- Apple

- ServiceNow

- Infosys

- Capgemini

- Wipro

- Schneider Electric

- Honeywell

- Hitachi

- Fujitsu

- Huawei

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first enterprise IT spending boom

- 4.2.2 Rising AI/ML integration across business functions

- 4.2.3 5G-enabled real-time data use-cases

- 4.2.4 Mandatory ESG reporting digitisation

- 4.2.5 "Digital-sovereignty" public-sector funding waves

- 4.2.6 Low-code / no-code platforms democratising DX

- 4.3 Market Restraints

- 4.3.1 Legacy technical-debt lock-ins

- 4.3.2 Cyber-talent scarcity and wage inflation

- 4.3.3 Digital-identity regulatory fragmentation

- 4.3.4 Scope-3 data-quality gaps for ESG audits

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 AI and ML

- 5.1.2 Extended Reality (VR/AR)

- 5.1.3 Internet of Things (IoT)

- 5.1.4 Industrial Robotics

- 5.1.5 Blockchain

- 5.1.6 Digital Twin

- 5.1.7 Additive Manufacturing / Industrial 3-D Printing

- 5.1.8 Edge Computing

- 5.1.9 Others

- 5.2 By Deployment Model

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.2.3 Hybrid

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Industry Vertical

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life-Sciences

- 5.4.3 Manufacturing and Industrial

- 5.4.4 Retail and E-commerce

- 5.4.5 Energy and Utilities

- 5.4.6 Automotive and Transportation

- 5.4.7 Government and Public Sector

- 5.4.8 Others (Media, Education, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Accenture

- 6.4.2 Microsoft

- 6.4.3 IBM

- 6.4.4 Google (Alphabet)

- 6.4.5 AWS (Amazon)

- 6.4.6 SAP

- 6.4.7 Oracle

- 6.4.8 Adobe

- 6.4.9 Salesforce

- 6.4.10 Cisco Systems

- 6.4.11 Dell Technologies

- 6.4.12 Siemens

- 6.4.13 Hewlett Packard Enterprise

- 6.4.14 Cognex

- 6.4.15 Apple

- 6.4.16 ServiceNow

- 6.4.17 Infosys

- 6.4.18 Capgemini

- 6.4.19 Wipro

- 6.4.20 Schneider Electric

- 6.4.21 Honeywell

- 6.4.22 Hitachi

- 6.4.23 Fujitsu

- 6.4.24 Huawei

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment