PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851883

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851883

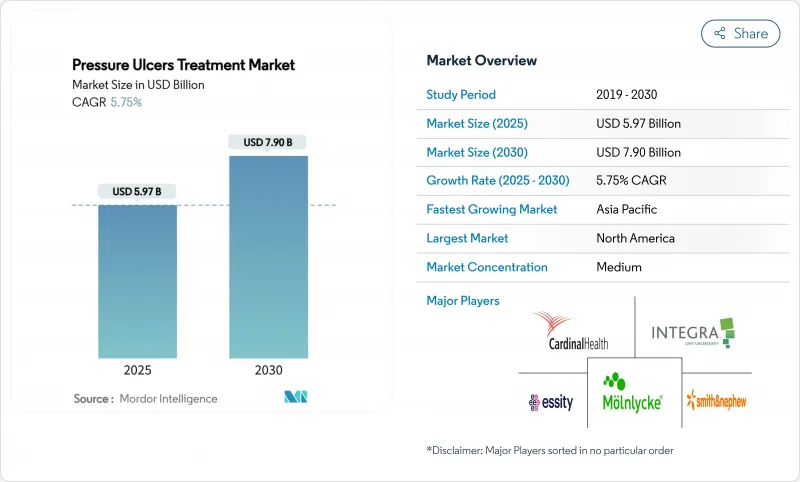

Pressure Ulcers Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The pressure ulcer treatment market size stands at USD 5.97 billion in 2025 and is projected to reach USD 7.90 billion by 2030, advancing at a 5.75% CAGR.

Growth is underpinned by accelerating demographic aging, surging chronic-disease prevalence, and value-based reimbursement policies that reward prevention while penalizing hospital-acquired injuries. Real-time AI pressure-mapping beds now achieve 94.2% accuracy in patient-position detection, enabling proactive repositioning and driving a structural pivot from reactive care to predictive prevention. Negative pressure wound therapy (NPWT) systems have become more portable and cost-efficient, supporting outpatient and home-care use while broadening the addressable patient base. Collectively, these factors are reshaping provider economics, pushing decision-makers toward technologies that shorten healing time, minimize readmissions, and reduce total cost of care.

Global Pressure Ulcers Treatment Market Trends and Insights

Aging Population & Prevalence of Chronic Diseases

Global life expectancy gains are producing a larger cohort of immobile, comorbid patients who remain susceptible to pressure injuries. World-wide, diabetes prevalence among surgical candidates reached 15.3% in 2024, intensifying tissue-repair complexity. Hospitals are therefore scaling investment in biologically active dressings that deliver epidermal growth factor, a modality shown to accelerate re-epithelialization in chronic wounds. In mature health systems, reimbursement codes already cover a spectrum of growth-factor therapies, encouraging clinicians to adopt premium products that shorten healing time. Emerging markets, meanwhile, are adopting simplified, lower-cost bioactive solutions to manage the same demographic pressures. The differential adoption framing is creating a tiered global opportunity for suppliers able to flex pricing and product complexity according to local capacity.

Rising Demand for Faster Wound Closure & Early Discharge

Provider payment reforms now link compensation to length-of-stay metrics, prompting an operational focus on closing wounds quickly without compromising outcomes. Electric bandage prototypes have demonstrated 30% faster healing versus conventional approaches, signalling commercial potential for energy-based therapies that can be monitored remotely. Biologic dressings impregnated with viable cells further boost granulation tissue formation, enabling same-week discharge for selected pressure-ulcer patients. Smart bandages equipped with micro-sensors transmit moisture and pH data to clinicians, cutting unnecessary dressing changes and nurse workload. These advances dovetail with payer objectives to reallocate inpatient resources toward high-acuity care. Consequently, device makers that integrate real-time analytics into cost-effective consumables stand to gain rapid formulary access across integrated delivery networks.

High Upfront Cost of Advanced Wound Products

Cellular tissue products can exceed USD 1,500 per application, a hurdle for hospitals operating under fixed-payment bundles. The Centers for Medicare & Medicaid Services (CMS) pruned its covered-skin-substitute list to 17 products in 2025, narrowing the reimbursable field and forcing clinicians to ration premium therapies. Capital-intensive NPWT consoles likewise demand justification through multi-year value analyses, delaying adoption in cash-constrained facilities. Suppliers are countering by introducing subscription-based pricing and repackaged single-use kits that lower per-episode spending. Nonetheless, the economic hurdle remains a significant dampener on rapid penetration in low-resource settings.

Other drivers and restraints analyzed in the detailed report include:

- Higher Surgical Volumes and Trauma Incidence Worldwide

- Increasing Adoption of Negative Pressure Wound Therapy (NPWT)

- Uneven Reimbursement Coverage in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Active wound-care therapies accounted for 21.51% of the pressure ulcer treatment market size in 2024, reflecting strong clinical preference for biologically active solutions that modulate inflammation and stimulate tissue regrowth. Growth factors, platelet-rich plasma, and cell-seeded matrices headline this category and command premium pricing across integrated delivery networks. Manufacturers are scaling production of allogeneic cell therapies, leveraging regulatory fast tracks that shorten commercialization timelines. Negative pressure wound therapy continues to outpace all other modalities at an 8.25% CAGR, buoyed by single-use platforms that allow rapid deployment in outpatient and home-care environments. Meanwhile, conventional foam and hydrogel dressings undergo iterative improvements-such as moisture-responding polymers and antimicrobial nanoparticles-to sustain relevance as cost-effective adjuncts. Over the forecast horizon, suppliers that pair active biologics with sensor-enabled delivery systems stand best positioned to capture incremental hospital spend.

Negative pressure wound therapy leads innovation pipelines, with next-generation systems combining instillation cycles and ionic-silver meshes to suppress biofilm formation while maintaining sub-atmospheric pressure. The FDA's 2025 clearance of a peel-and-place drape reduced setup time to under five minutes, widening nursing adoption. Film dressings and collagen pads retain niche roles in early-stage or superficial ulcers, providing cost-conscious providers with clinically validated options. As pricing pressure intensifies, vendors will differentiate through outcomes-based contracts that tie reimbursement to documented reductions in healing time, mirroring trends in the broader pressure ulcer treatment market.

The Pressure Ulcers Treatment Market Report is Segmented by Product Type (Wound Care Dressings, Active Wound Care Therapies, Negative Pressure Wound Therapy, Growth Factors & Biologics, and More), Ulcer Stage (Stage I Stage II, and More), End User (Hospitals & Clinics, Long-Term Care Facilities, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the pressure ulcer treatment market with 45.52% revenue share in 2024, supported by robust reimbursement schemes, high adoption of AI-enabled preventive technologies, and favorable regulatory pathways. Hospitals in the United States accelerated capital outlays for smart support surfaces following a USD 26.8 billion penalty burden tied to hospital-acquired pressure injuries. Canada followed with province-level funding earmarked for NPWT kits in home-care programs, further broadening patient access.

In Europe, budgeting frameworks require cost-effectiveness dossiers, motivating suppliers to sponsor pragmatic trials that demonstrate resource-adjusted benefits. Countries such as Germany and the Netherlands now reimburse NPWT under DRG add-on payments, while the United Kingdom's NICE validated single-use NPWT for surgical sites in 2024. The region's embrace of evidence-based procurement sustains moderate growth despite mature penetration levels.

Asia-Pacific is the fastest-growing territory, projected at an 8.61% CAGR, fueled by health-insurance expansion in China and India and rising orthopedic and cardiovascular surgery volumes. Regional ministries are launching wound-management guidelines that prioritize infection control and rapid mobilization, stimulating imports of silver-impregnated foam and portable NPWT systems. Local contract manufacturers are entering licensing deals with multinational suppliers, lowering final-product costs and facilitating wider adoption. The Middle East & Africa and South America collectively account for a smaller share but present high unmet need; multilateral development programs are funding pilot deployments of AI-enabled pressure-mapping beds in tertiary hospitals, potentially seeding demand for broader rollouts by 2027.

List of Companies Covered in this Report:

- Smiths Group

- Integra LifeSciences Holdings Corp.

- Solventum Corporation

- Molnlycke Health Care

- Cardinal Health

- Essity

- B. Braun

- Convatec

- Coloplast

- Baxter

- Medline Industries

- Hartmann Group

- Urgo Medical

- Medela

- Tissue Regenix Group

- Advanced Medical Solutions Group PLC

- DermaRite Industries

- Hollister

- Kinetic Concepts Inc.

- Aroa Biosurgery Ltd

- Joerns Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Population & Prevalence Of Chronic Diseases

- 4.2.2 Rising Demand For Faster Wound Closure & Early Discharge

- 4.2.3 Higher Surgical Volumes And Trauma Incidence Worldwide

- 4.2.4 Increasing Adoption Of Negative Pressure Wound Therapy (NPWT)

- 4.2.5 Real-Time AI Pressure-Mapping Beds Driving Preventive Spend

- 4.2.6 Value-Based Reimbursement Penalties For Hospital-Acquired Pressure Injuries

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost Of Advanced Wound Products

- 4.3.2 Uneven Reimbursement Coverage In Emerging Economies

- 4.3.3 Silver-Based Dressing Raw-Material Supply Volatility

- 4.3.4 Home-Care Skill Gap Limiting Correct Device Usage

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Wound-Care Dressings

- 5.1.2 Film Dressings

- 5.1.3 Foam Dressings

- 5.1.4 Hydrogel Dressings

- 5.1.5 Collagen Dressings

- 5.1.6 Active Wound-Care Therapies

- 5.1.7 Skin Substitutes

- 5.1.8 Growth Factors & Biologics

- 5.1.9 Wound-Care Devices

- 5.1.10 Negative Pressure Wound Therapy

- 5.1.11 Hyperbaric Oxygen Equipment

- 5.1.12 Pressure-Relieving Devices

- 5.1.13 Other Devices

- 5.2 By Ulcer Stage

- 5.2.1 Stage I

- 5.2.2 Stage II

- 5.2.3 Stage III

- 5.2.4 Stage IV

- 5.2.5 Unstageable / Deep-Tissue Injury

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Long-Term Care Facilities

- 5.3.3 Home-Care Settings

- 5.3.4 Ambulatory Surgical Centers

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Smith & Nephew PLC

- 6.3.2 Integra LifeSciences Holdings Corp.

- 6.3.3 Solventum Corporation

- 6.3.4 Molnlycke Health Care AB

- 6.3.5 Cardinal Health Inc.

- 6.3.6 Essity AB

- 6.3.7 B. Braun Melsungen AG

- 6.3.8 ConvaTec Group PLC

- 6.3.9 Coloplast A/S

- 6.3.10 Baxter International Inc.

- 6.3.11 Medline Industries LP

- 6.3.12 Paul Hartmann AG

- 6.3.13 Urgo Medical

- 6.3.14 Medela AG

- 6.3.15 Tissue Regenix Group

- 6.3.16 Advanced Medical Solutions Group PLC

- 6.3.17 DermaRite Industries

- 6.3.18 Hollister Incorporated

- 6.3.19 Kinetic Concepts Inc.

- 6.3.20 Aroa Biosurgery Ltd

- 6.3.21 Joerns Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment