PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906035

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906035

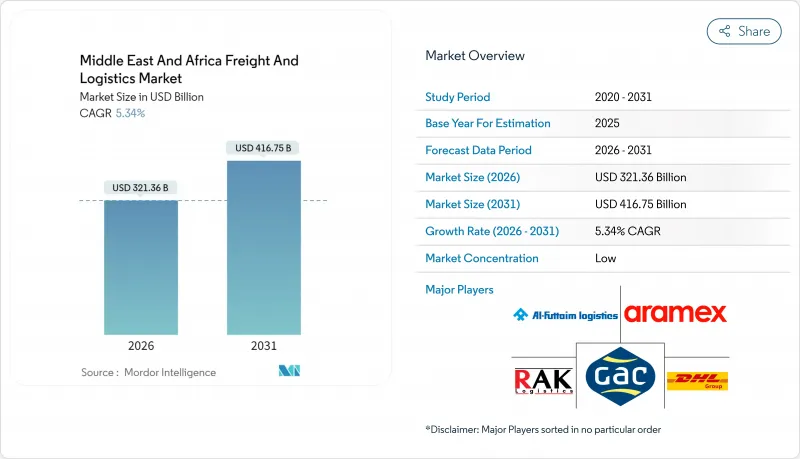

Middle East And Africa Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Middle East And Africa Freight And Logistics Market size in 2026 is estimated at USD 321.36 billion, growing from 2025 value of USD 305.07 billion with 2031 projections showing USD 416.75 billion, growing at 5.34% CAGR over 2026-2031.

The growth outlook flows from the region's pivotal position linking Asia, Europe, and Africa, combined with heavy infrastructure spending and permanent capacity upgrades triggered by Red Sea shipping disruptions. E-commerce expansion, the rollout of new multimodal corridors, and a surge in cold-chain demand strengthen baseline tonnage and yield per shipment. Sovereign wealth funds, free trade agreements, and digital freight platforms reinforce competitive intensity while mitigating geopolitical volatility. Operators that maximize network density, technology adoption, and sustainable practices are positioned to capture outsized returns.

Middle East And Africa Freight And Logistics Market Trends and Insights

E-commerce boom and cross-border retail

Cross-border e-commerce lifts last-mile shipment frequency, with domestic CEP covering 67.88% of traffic while international CEP advances at a 5.77% CAGR through 2030. Logistics providers are scaling automated sortation hubs and multi-carrier APIs that link Jebel Ali Port to Al Maktoum International Airport. Gulf operators deploy AI routing and collaborate with local universities to fill digital talent gaps. Omnichannel retailers demand integrated fulfillment that merges warehousing, click-and-collect, and door delivery, shifting volume toward express networks.

Mega-investments in multimodal logistics infrastructure

Saudi Arabia earmarked USD 133.3 billion for ports, airports, and railways through 2030, including Port of NEOM's first fully automated cranes slated for 2026 launch. DP World's USD 2.5 billion program and record USD 20 billion 2024 revenue signal deep private capital engagement. Automation and renewable energy integration compress dwell times and improve cost curves, reshaping transshipment competitiveness.

Uneven road, rail, and port infrastructure

Infrastructure gaps raise logistics costs for landlocked African economies relying on coastal gateways. The African Development Bank cites road density disparities and underfunded common-user marine assets as persistent bottlenecks. PPP corridors and toll finance frameworks attract limited private capital outside mining routes. Concentrated capacity in a handful of hubs heightens vulnerability to weather or labor stoppages, stalling hinterland market penetration.

Other drivers and restraints analyzed in the detailed report include:

- Cold-chain demand for pharma and perishables

- Rapid adoption of digital freight platforms and real-time visibility tools

- Red Sea/Suez chokepoint disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wholesale and retail trade contributed 33.92% of 2025 revenue, while manufacturing posts the fastest 5.58% CAGR through 2031 as localization and industrial parks proliferate. Oil, gas, and mining logistics remain sizable, supported by commodity flows and energy security spending. Construction logistics taps infrastructure mega-projects, and agri-food shipments expand under food-security strategies.

Nigeria's USD 20 billion Ogidigben industrial park underscores demand for specialized heavy-lift and project cargo services. Just-in-time production requires synchronized inbound material flows, elevating demand for real-time tracking and predictive inventory analytics

Freight transport retained 59.21% of the Middle East and Africa freight and logistics market in 2025, while courier, express, and parcel leads growth at 5.57% CAGR to 2031. Road-based bulk remains foundational, yet time-definite parcels capture e-commerce tailwinds. Freight forwarding and warehousing post steady gains, and temperature-controlled storage earns premium margins. Technology-driven value-added services under "other" activities scale quickly, feeding demand for end-to-end digital orchestration.

International integrators pledge nine-figure capex for hubs, whereas Aramex leverages ADQ backing to consolidate regional share. Robotics and AI inventory tools widen productivity differentials in Gulf warehouses, creating platforms that fuse parcel delivery, cross-dock, and forwarding under a single interface.

The Middle East and Africa Freight and Logistics Market Report is Segmented by Logistics Function (Freight Forwarding, Freight Transport, and More), End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), Geography (United Arab Emirates, Saudi Arabia, Nigeria, and More). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DHL

- Aramex

- Gulf Agency Company (GAC)

- RAK Logistics

- Al-Futtaim Logistics

- Almajdouie Group

- Gulf Warehousing Company

- RSA Global

- Saudi Transport & Investment Co. (Mubarrad)

- City Logistics

- BLG Logistics

- Kuehne + Nagel

- CEVA Logistics

- DSV

- Rhenus Logistics

- ATC Allied Transport

- Barloworld Logistics

- Unitrans Supply Chain Solutions (Pty) Ltd

- Cargo Carriers (Pty) Limited

- Compass Logistics International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-Commerce Boom and Cross-Border Retail

- 4.2.2 Mega-Investments in Multimodal Logistics Infrastructure

- 4.2.3 Growth of FTAs and Emerging Trade Corridors

- 4.2.4 Cold-Chain Demand for Pharma and Perishables

- 4.2.5 Warehouse Automation to Offset Labour Shortages

- 4.2.6 Rapid Adoption of Digital Freight Platforms and Real-Time Visibility Tools

- 4.3 Market Restraints

- 4.3.1 Uneven Road, Rail and Port Infrastructure

- 4.3.2 Complex Customs Rules and Border Delays

- 4.3.3 Red-Sea/Suez Chokepoint Disruptions

- 4.3.4 Driver Shortages and Localisation Policies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Geopolitics & Pandemics

5 Market Size & Growth Forecasts

- 5.1 By Logistics Function

- 5.1.1 Courier, Express, and Parcel (CEP)

- 5.1.1.1 By Destination Type

- 5.1.1.1.1 Domestic

- 5.1.1.1.2 International

- 5.1.1.1 By Destination Type

- 5.1.2 Freight Forwarding

- 5.1.2.1 By Mode of Transport

- 5.1.2.1.1 Air

- 5.1.2.1.2 Sea and Inland Waterways

- 5.1.2.1.3 Others

- 5.1.2.1 By Mode of Transport

- 5.1.3 Freight Transport

- 5.1.3.1 By Mode of Transport

- 5.1.3.1.1 Air

- 5.1.3.1.2 Rail

- 5.1.3.1.3 Road

- 5.1.3.1.4 Sea and Inland Waterways

- 5.1.3.1.5 Pipelines

- 5.1.3.1 By Mode of Transport

- 5.1.4 Warehousing and Storage

- 5.1.4.1 By Temperature Control

- 5.1.4.1.1 Non-Temperatured Control

- 5.1.4.1.2 Temperatured Control

- 5.1.4.1 By Temperature Control

- 5.1.5 Other Services

- 5.1.1 Courier, Express, and Parcel (CEP)

- 5.2 By End User Industry

- 5.2.1 Agriculture, Fishing, and Forestry

- 5.2.2 Construction

- 5.2.3 Manufacturing

- 5.2.4 Oil and Gas, Mining and Quarrying

- 5.2.5 Wholesale and Retail Trade

- 5.2.6 Others

- 5.3 By Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Qatar

- 5.3.4 Oman

- 5.3.5 Kuwait

- 5.3.6 Nigeria

- 5.3.7 South Africa

- 5.3.8 Rest of Middle East and Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 DHL

- 6.4.2 Aramex

- 6.4.3 Gulf Agency Company (GAC)

- 6.4.4 RAK Logistics

- 6.4.5 Al-Futtaim Logistics

- 6.4.6 Almajdouie Group

- 6.4.7 Gulf Warehousing Company

- 6.4.8 RSA Global

- 6.4.9 Saudi Transport & Investment Co. (Mubarrad)

- 6.4.10 City Logistics

- 6.4.11 BLG Logistics

- 6.4.12 Kuehne + Nagel

- 6.4.13 CEVA Logistics

- 6.4.14 DSV

- 6.4.15 Rhenus Logistics

- 6.4.16 ATC Allied Transport

- 6.4.17 Barloworld Logistics

- 6.4.18 Unitrans Supply Chain Solutions (Pty) Ltd

- 6.4.19 Cargo Carriers (Pty) Limited

- 6.4.20 Compass Logistics International

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment