PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906060

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906060

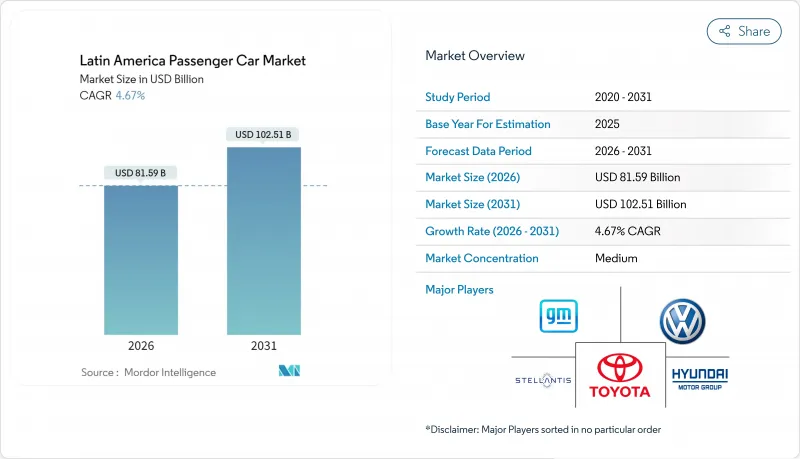

Latin America Passenger Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Latin America passenger car market size in 2026 is estimated at USD 81.59 billion, growing from 2025 value of USD 77.95 billion with 2031 projections showing USD 102.51 billion, growing at 4.67% CAGR over 2026-2031.

Robust household demand, accelerating electrification, and on-shoring of vehicle production continue to underpin this growth despite currency volatility and shifting trade policies. Manufacturers are scaling regional plants to comply with USMCA and Mercosur content rules, while government incentives-led by Brazil's Mover program-stimulate domestic EV output. Chinese brands capitalize on these dynamics with cost-effective models that pressure incumbent OEMs to update product portfolios and pricing strategies. Meanwhile, stabilizing semiconductor supplies restores production rhythm, enabling automakers to address deferred orders accumulated during 2021-2023 shortages.

Latin America Passenger Car Market Trends and Insights

Resilient Post-Pandemic Rebound in Household Car Ownership

As pandemic restrictions eased, personal vehicle ownership saw a notable uptick. This surge was fueled by changing work habits, a diminished reliance on shared mobility, and a notable migration trend towards suburban areas. In Mexico, this shift has led to a pronounced increase in light-vehicle sales, a momentum that's projected to persist into 2025, buoyed by an improving economy. Meanwhile, in Brazil, a recent economic upswing has rekindled consumer confidence, prompting many to make vehicle purchases they had previously postponed. Notably, demand is particularly robust in secondary cities. Here, a limited public transportation infrastructure has resulted in consistent showroom traffic and a sustained appetite for personal mobility solutions.

Rapid Inflow of Chinese OEM Capital and Low-Cost EV Imports

Chinese automakers, bolstered by robust domestic battery supply chains and state-backed financing, are making significant inroads into Latin America. BYD, for instance, has swiftly captured market share in Brazil by localizing its production. This strategy not only sidesteps import tariffs but also allows for more competitive pricing. Following suit, brands like GWM and Chery are amplifying price competition in the region. While this surge in competition offers consumers a wider array of affordable electric vehicle choices, it simultaneously strains established manufacturers, squeezing their profit margins and altering the competitive dynamics.

Peso and Real Depreciation Inflating Import Costs

Key Latin American markets are feeling the pinch of macroeconomic pressures, impacting automotive affordability. Brazil grapples with external trade imbalances, and Argentina's industrial capacity remains underutilized, both highlighting broader economic strains. Concurrently, local currency weaknesses are inflating the costs of imported components. In response, automakers are hiking vehicle prices, potentially elongating replacement cycles and curbing demand for non-essential upgrades. Such dynamics could temper growth forecasts and complicate efforts to maintain long-term market expansion.

Other drivers and restraints analyzed in the detailed report include:

- OEM On-Shoring to Skirt USMCA/Mercosur Tariff Escalation

- Resumption of Automaker Flex-Fuel Investment Programs

- Acceleration of BRT Expansion in Major Metros

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs/Crossovers accounted for 40.85% of the Latin America passenger car market in 2025 and are forecast to outpace all other body styles at a 4.88% CAGR during the forecast period (2026-2031). Buoyed by the increasing availability of sub-compact and B-segment variants, entry prices have seen a decline. Demand is driven by the vehicles' higher ground clearance, making them suitable for unpaved or flood-prone roads, and a prevailing perception of enhanced safety. Toyota's hybrid-flex SUV initiative not only leverages the current ethanol infrastructure but also tackles emissions caps. Meanwhile, Chinese newcomers are introducing feature-rich crossovers, priced similarly to traditional compacts, swaying consumer preference towards these taller vehicles.

Sedans and hatchbacks maintain relevance where urban congestion and fuel economy dominate decision factors, particularly across Brazil's coastal cities. However, their combined share continues to decline as households upgrade during replacement cycles. Multi-purpose vehicles remain niche, catering mainly to fleet operators and large families in rural areas where passenger capacity trumps efficiency.

Entry-level A/B models captured 47.83% of the Latin America passenger car market share in 2025, and with a 5.08% CAGR during the forecast period (2026-2031). Driven by competitive financing and governmental tax credits for compact cars. Credit access improvements in Brazil and Mexico expand the eligible buyer pool, while OEMs utilize platform commonality to cut per-unit costs.

Mid-size C-segment offerings cater to an expanding middle class, yet they face substitution risk as consumers transition directly to compact SUVs. Premium D/E classes stay limited to affluent urban professionals and government fleets, although EV variants add a new aspirational layer. BYD's Dolphin Mini illustrates how low-priced electric compacts can accelerate technology diffusion when paired with tax exemptions.

The Latin America Passenger Car Market Report is Segmented by Vehicle Type (Hatchback, Sedan, and More), Vehicle Class (Entry-Level (A/B), Mid-Size (C), and More), Propulsion/Fuel Type (Gasoline, Diesel, and More), Sales Channel (OEM-Owned Stores and Independent Dealers), and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- General Motors Company

- Volkswagen AG

- Stellantis N.V.

- Toyota Motor Corporation

- Hyundai Motor Company

- Ford Motor Company

- Nissan Motor Corporation

- Renault S.A.

- Honda Motor Co., Ltd.

- Kia Corporation

- BMW AG

- Daimler AG (Mercedes-Benz)

- Chery Automobile

- BYD Auto

- SAIC-GM-Wuling

- Subaru Corporation

- Mazda Motor Corporation

- Geely Auto

- Audi AG

- Suzuki Motor Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Resilient Post-Pandemic Rebound in Household Car Ownership

- 4.2.2 Rapid Inflow of Chinese OEM Capital and Low-Cost EV Imports

- 4.2.3 OEM On-Shoring to Skirt USMCA/Mercosur Tariff Escalation

- 4.2.4 Resumption of Automaker Flex-Fuel Investment Programs

- 4.2.5 EV-Friendly Fiscal Credits in Brazil and Colombia

- 4.2.6 Stabilizing Semiconductor Supply Chain Enabling Production Catch-Up

- 4.3 Market Restraints

- 4.3.1 Peso and Real Depreciation Inflating Import Costs

- 4.3.2 Acceleration of BRT Expansion in Major Metros

- 4.3.3 Limited Public Charging Density Outside Tier-1 Cities

- 4.3.4 Tightening Regional CO2 Fleet-Average Targets by 2027

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value and Volume)

- 5.1 By Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 SUV / Crossover

- 5.1.4 Multi-Purpose Vehicle (MPV)

- 5.2 By Vehicle Class

- 5.2.1 Entry-Level (A/B)

- 5.2.2 Mid-Size (C)

- 5.2.3 Full-Size (D/E)

- 5.3 By Propulsion / Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Flex-Fuel

- 5.3.4 Hybrid Electric Vehicle

- 5.3.5 Battery-Electric Vehicle

- 5.4 By Sales Channel

- 5.4.1 OEM-Owned Stores

- 5.4.2 Independent Dealers

- 5.5 By Country

- 5.5.1 Brazil

- 5.5.2 Mexico

- 5.5.3 Argentina

- 5.5.4 Colombia

- 5.5.5 Chile

- 5.5.6 Peru

- 5.5.7 Rest of Latin America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 General Motors Company

- 6.4.2 Volkswagen AG

- 6.4.3 Stellantis N.V.

- 6.4.4 Toyota Motor Corporation

- 6.4.5 Hyundai Motor Company

- 6.4.6 Ford Motor Company

- 6.4.7 Nissan Motor Corporation

- 6.4.8 Renault S.A.

- 6.4.9 Honda Motor Co., Ltd.

- 6.4.10 Kia Corporation

- 6.4.11 BMW AG

- 6.4.12 Daimler AG (Mercedes-Benz)

- 6.4.13 Chery Automobile

- 6.4.14 BYD Auto

- 6.4.15 SAIC-GM-Wuling

- 6.4.16 Subaru Corporation

- 6.4.17 Mazda Motor Corporation

- 6.4.18 Geely Auto

- 6.4.19 Audi AG

- 6.4.20 Suzuki Motor Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment