PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906205

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906205

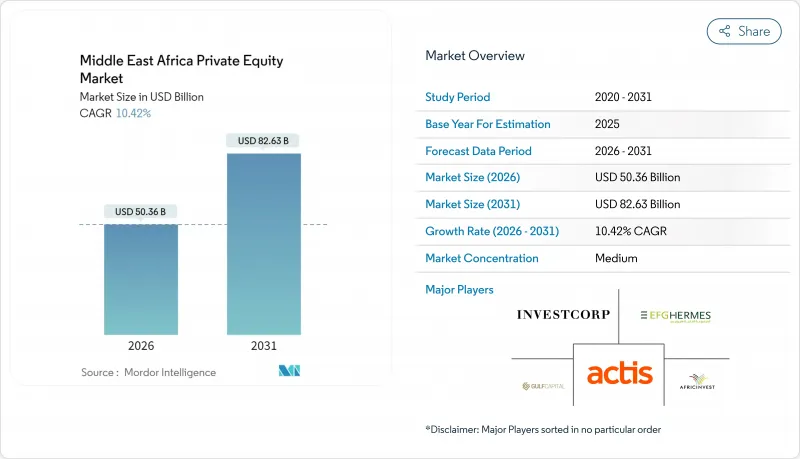

Middle East Africa Private Equity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle East Africa private equity market is expected to grow from USD 45.61 billion in 2025 to USD 50.36 billion in 2026 and is forecast to reach USD 82.63 billion by 2031 at 10.42% CAGR over 2026-2031.

This performance mirrors the region's diversification push, the catalytic role of sovereign-wealth funds, and progressive regulatory liberalization that widens foreign participation. Accelerating digital transformation programs, a maturing startup ecosystem, and the expansion of public-private partnership (PPP) pipelines underpin expanding deal flow, while family-office club-deals add competitive intensity and broaden capital sources. Simultaneously, currency hedging strategies, GP capability building, and Shariah-compliant co-investment structures are becoming mainstream as investors seek to mitigate macro and cultural risks. Exit constraints, particularly in Africa, temper near-term liquidity expectations, yet secondary recapitalizations and minority-stake sales have emerged as viable interim solutions, keeping dry-powder deployment on course.

Middle East Africa Private Equity Market Trends and Insights

Abundant Sovereign-Wealth Dry-Powder

Record dry-powder held by Gulf sovereign-wealth funds, led by the Saudi Public Investment Fund's USD 700 billion AUM in 2024, allows financing of mega-deals and co-investment structures that typical GPs cannot underwrite alone. Capital deployment is shifting toward domestic and regional assets, reinforcing economic-diversification mandates that favor infrastructure, technology, and healthcare transactions. Sovereigns frequently adopt patient-capital horizons beyond standard fund life cycles, anchoring transactions that require extended gestation. The scale advantage crowds-in other investors by lowering perceived execution risk and easing syndication logistics. Nonetheless, sovereign objectives often incorporate strategic priorities such as job creation or technology transfer that influence return profiles and exit timing.

Gradual Liberalization of Foreign-Ownership Laws

Saudi Arabia's Investment Law, effective 2025, discards sector caps and creates single-window licensing, compressing deal-approval timelines from months to weeks. The United Arab Emirates permits 100% foreign ownership in most onshore sectors and has introduced Qualifying Limited Partnership structures that enjoy favorable tax treatment. Select African jurisdictions mirror this trajectory, though progress remains uneven. The convergence toward global best practices reduces political-risk premia and unlocks larger institutional allocations to the Middle East Africa private equity market. Investors, however, must navigate evolving compliance requirements, including beneficial-ownership disclosures and ESG reporting, which raise transaction costs but enhance governance transparency.

Persistent Exit-Route Bottlenecks

Shallow public markets and limited pools of strategic acquirers constrain African exits. DFIs dominate the LP base, and secondary buyers often prefer minority stakes, resulting in protracted exits and pricing discounts. IPO windows remain sporadic, concentrating liquidity events in South Africa and select North African exchanges. In contrast, Tadawul and Abu Dhabi Securities Exchange list mature portfolio companies at premium valuations, highlighting a bifurcated liquidity landscape. Dividend recapitalizations and partial sales are gaining traction as interim solutions, but they dilute headline returns and complicate GP reporting obligations. Until local capital-market depth improves, exit risk will restrain the full potential of the Middle East Africa private equity market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Start-Up Ecosystems in GCC & Africa

- Acceleration of Infrastructure PPP Pipelines

- Currency-Convertibility & Repatriation Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Buyout and growth funds controlled 40.92% of the Middle East Africa private equity market in 2025, reflecting the abundance of mature, family-owned businesses ripe for ownership transitions. Venture capital, while smaller in absolute terms, is outpacing other strategies with a 10.69% CAGR as startup ecosystems scale and governments back seed accelerators. The Middle East Africa private equity market size for buyout transactions is forecast to reach USD 33.82 billion by 2031, while venture capital could top USD 19.12 billion under current growth trajectories. Competitive tension is most visible in mid-market buyouts where sovereign-wealth co-investment inflates valuations.

Mezzanine and distressed-debt funds capture niche opportunities created by tighter lending standards and debt-restructuring cycles in commodity-dependent economies. Private credit vehicles signal rising importance, particularly in infrastructure and late-stage venture financing, where bank appetite has receded. Secondary firms remain early-stage because many first-generation managers are only now approaching fund-life maturity. Regulatory clarity since Saudi Arabia's 2025 Investment Fund amendments encourages new structures, including evergreen vehicles and Shariah-compliant parallel funds, broadening GP toolkits and reducing capital-formation frictions.

The Middle East & Africa Private Equity Market Report is Segmented by Fund Type (Buyout & Growth, Venture Capital, Mezzanine & Distressed, and More), Sector (Technology, Healthcare, Real Estate & Services, Financial Services, and More), Investments (Large-Cap, Upper-Middle Market, Lower-Middle Market, and More), and Geography (United Arab Emirates, Saudi Arabia, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Investcorp

- Actis

- AfricInvest

- Gulf Capital

- EFG Hermes PE

- Helios Investment Partners

- Development Partners International (DPI)

- Qalaa Holdings

- Amethis Finance

- Partech Africa

- BlueOrchard

- LeapFrog Investments

- Abraaj Investment Management (legacy)

- Adenia Partners

- Kingsway Capital

- Endeavor Energy

- Carlyle Group (MEA)

- STV (Saudi Technology Ventures)

- TPG Growth (EMEA)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Abundant sovereign?wealth dry-powder

- 4.2.2 Gradual liberalisation of foreign-ownership laws

- 4.2.3 Growing start-up ecosystems in GCC & Africa

- 4.2.4 Acceleration of infrastructure PPP pipelines

- 4.2.5 Shar??ah-compliant co-investment structures

- 4.2.6 Rising family-office club-deals

- 4.3 Market Restraints

- 4.3.1 Persistent exit-route bottlenecks

- 4.3.2 Currency-convertibility & repatriation risks

- 4.3.3 Limited GP track-records outside buyouts

- 4.3.4 Fragmented regulatory disclosures

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD billions)

- 5.1 By Fund Type

- 5.1.1 Buyout & Growth

- 5.1.2 Venture Capital

- 5.1.3 Mezzanine & Distressed

- 5.1.4 Secondaries & Fund-of-Funds

- 5.2 By Sector

- 5.2.1 Technology (Software)

- 5.2.2 Healthcare

- 5.2.3 Real Estate & Services

- 5.2.4 Financial Services

- 5.2.5 Industrials

- 5.2.6 Consumer & Retail

- 5.2.7 Energy & Power

- 5.2.8 Media & Entertainment

- 5.2.9 Telecom

- 5.2.10 Others (Transportation, etc.)

- 5.3 By Investments

- 5.3.1 Large-Cap

- 5.3.2 Upper-Middle Market

- 5.3.3 Lower-Middle Market

- 5.3.4 Small & SMID

- 5.4 By Geography

- 5.4.1 United Arab Emirates

- 5.4.2 Saudi Arabia

- 5.4.3 South Africa

- 5.4.4 Nigeria

- 5.4.5 Rest of Middle East & Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Investcorp

- 6.4.2 Actis

- 6.4.3 AfricInvest

- 6.4.4 Gulf Capital

- 6.4.5 EFG Hermes PE

- 6.4.6 Helios Investment Partners

- 6.4.7 Development Partners International (DPI)

- 6.4.8 Qalaa Holdings

- 6.4.9 Amethis Finance

- 6.4.10 Partech Africa

- 6.4.11 BlueOrchard

- 6.4.12 LeapFrog Investments

- 6.4.13 Abraaj Investment Management (legacy)

- 6.4.14 Adenia Partners

- 6.4.15 Kingsway Capital

- 6.4.16 Endeavor Energy

- 6.4.17 Carlyle Group (MEA)

- 6.4.18 STV (Saudi Technology Ventures)

- 6.4.19 TPG Growth (EMEA)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment