PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906221

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906221

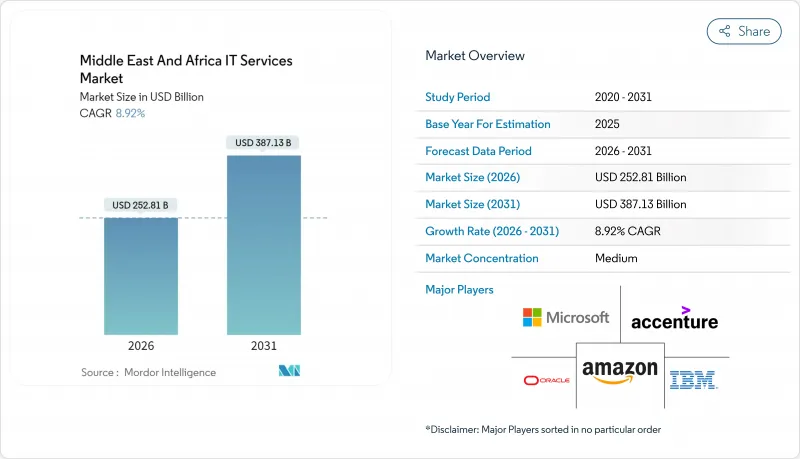

Middle East And Africa IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle East and Africa IT services market was valued at USD 232.1 billion in 2025 and estimated to grow from USD 252.81 billion in 2026 to reach USD 387.13 billion by 2031, at a CAGR of 8.92% during the forecast period (2026-2031).

Accelerated government-backed digitization programs, sovereign-wealth-fund technology mandates, and widespread 5G coverage are reshaping enterprise IT spending patterns across the Gulf Cooperation Council (GCC) and key African economies. Rising cloud adoption, surging hyperscale data-center investments, and a region-wide fintech boom are intensifying demand for consultative, implementation, and managed-service offerings. Meanwhile, chronic shortages of bilingual cloud-native professionals and fragmented cross-border data laws temper growth prospects, prompting providers to refine delivery models and compliance strategies. Competitive dynamics remain balanced as global integrators leverage scale and technology depth while regional specialists capitalize on localization requirements and Arabic language capabilities.

Middle East And Africa IT Services Market Trends and Insights

Cloud-First Mandates Under National Visions

Saudi Arabia's digital-government policy targets 90% cloud migration of public services by 2030, backed by USD 24.8 billion in infrastructure funding and nationwide 5G coverage. Comparable agendas in the UAE and Qatar require extensive integration, cybersecurity, and managed-service support, shifting demand from legacy outsourcing toward cloud-native delivery. Private enterprises mirror these public-sector benchmarks to sustain competitive parity, driving sustained uptake of hybrid-cloud consulting and platform services.

Surge in Hyperscale Data-Center Build-Outs

Saudi Arabia's USD 21 billion data-center pipeline and a USD 30 billion regional AI-infrastructure alliance anchored by Microsoft, BlackRock, and Temasek are transforming local hosting economics. Newly available in-region capacity satisfies data-residency statutes, supports latency-sensitive workloads, and enables edge-computing use cases that command higher service margins than traditional colocation offerings.

Bilingual Cloud-Native Talent Shortage

South Africa ranks third worldwide for outbound IT-talent recruitment, and 2% of all posted roles are international, draining local capacity. GCC projects intensify shortages by requiring Arabic-English fluent professionals, forcing providers to rely on expatriate hires or distributed offshore teams that increase delivery costs and timelines.

Other drivers and restraints analyzed in the detailed report include:

- Digital Public-Services Spending

- Fintech-Led Managed-Services Uptake

- Fragmented Cross-Border Data Laws

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment accounted for 34.83% of the Middle East and Africa IT services market share in 2025, yet cloud and platform services are set to grow at 10.72% CAGR, reflecting enterprises' pivot toward AI-ready architectures. Traditional outsourcing retains relevance for legacy workloads but faces pricing pressure as cloud-native offerings mature. The Middle East and Africa IT services market size attributed to managed security services is expanding as cyber-risk escalates across critical infrastructure. Regional hyperscale expansions by AWS, Microsoft, and Oracle allow providers to layer value-added services such as real-time analytics and IoT orchestration, displacing low-margin infrastructure support.

Demand for consulting and implementation remains robust as enterprises re-platform core applications and re-architect networks for edge-computing use cases. Business-process outsourcing maintains steady public-sector demand for document-management and citizen-service functions. Providers that bundle consulting, migration, and long-term managed services create sticky client relationships, mitigating commoditization risk.

Large enterprises represented 67.55% of 2025 spend, but SMEs are forecast to post a 10.18% CAGR, buoyed by subsidized cloud vouchers and technical-support schemes across GCC economies. Government funds worth USD 40 billion are earmarked for SME digital-enablement, lower entry barriers to ERP, CRM, and e-commerce platforms. The Middle East and Africa IT services market size for standardized SaaS onboarding is therefore rising sharply.

Large enterprises continue to award multi-year, multi-million-dollar contracts for AI, predictive maintenance, and multi-cloud governance projects. However, price sensitivity has increased, prompting outcome-based contracts. Providers that segment delivery teams for high-touch enterprise projects and automated SME engagements optimize utilization and margin.

The Middle East and Africa IT Services Market is Segmented by Service Type (IT Consulting and Implementation, IT Outsourcing, and More), End-User Enterprise Size (Small and Medium Enterprises and Large Enterprises), End-User Vertical (BFSI, Manufacturing, and More), Deployment Model (Onshore Delivery, Nearshore Delivery, and Offshore Delivery), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Accenture plc

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Microsoft Corporation

- Amazon Web Services, Inc.

- SAP SE

- Tata Consultancy Services Limited

- Infosys Limited

- Wipro Limited

- HCL Technologies Limited

- Google LLC (Google Cloud)

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Tech Mahindra Limited

- NTT Data Corporation (Dimension Data)

- Gulf Business Machines (GBM)

- STC Solutions (Saudi Telecom Company)

- eand (Etisalat Group)

- Ooredoo Q.P.S.C.

- Alareeb ICT Company

- Raqmiyat LLC

- Atos SE

- Deloitte Touche Tohmatsu Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first initiatives under Vision 2030 programs

- 4.2.2 Surge in hyperscale data-center investments across GCC

- 4.2.3 Digital public-services and e-government spending

- 4.2.4 Regional fintech boom driving managed-services demand

- 4.2.5 AI and generative-AI mandates by sovereign wealth funds

- 4.2.6 5G and edge-computing rollout fuelling integration projects

- 4.3 Market Restraints

- 4.3.1 Chronic shortage of bilingual cloud-native talent

- 4.3.2 Fragmented cross-border data-flow regulations

- 4.3.3 High energy cost and unreliable grids in parts of Africa

- 4.3.4 Geopolitical volatility affecting outsourcing contracts

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 IT Consulting and Implementation

- 5.1.2 IT Outsourcing (ITO)

- 5.1.3 Business Process Outsourcing (BPO)

- 5.1.4 Managed Security Services

- 5.1.5 Cloud and Platform Services

- 5.2 By End-User Enterprise Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Manufacturing

- 5.3.3 Government and Public Sector

- 5.3.4 Healthcare and Life-Sciences

- 5.3.5 Retail and Consumer Goods

- 5.3.6 Telecom and Media

- 5.3.7 Logistics and Transport

- 5.3.8 Energy and Utilities

- 5.3.9 Other End-User Verticals

- 5.4 By Deployment Model

- 5.4.1 Onshore Delivery

- 5.4.2 Nearshore Delivery

- 5.4.3 Offshore Delivery

- 5.5 By Country

- 5.5.1 Middle East

- 5.5.1.1 Saudi Arabia

- 5.5.1.2 United Arab Emirates

- 5.5.1.3 Qatar

- 5.5.1.4 Kuwait

- 5.5.1.5 Oman

- 5.5.1.6 Bahrain

- 5.5.1.7 Rest of Middle East

- 5.5.2 Africa

- 5.5.2.1 South Africa

- 5.5.2.2 Egypt

- 5.5.2.3 Nigeria

- 5.5.2.4 Kenya

- 5.5.2.5 Morocco

- 5.5.2.6 Rest of Africa

- 5.5.1 Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 International Business Machines Corporation (IBM)

- 6.4.3 Oracle Corporation

- 6.4.4 Microsoft Corporation

- 6.4.5 Amazon Web Services, Inc.

- 6.4.6 SAP SE

- 6.4.7 Tata Consultancy Services Limited

- 6.4.8 Infosys Limited

- 6.4.9 Wipro Limited

- 6.4.10 HCL Technologies Limited

- 6.4.11 Google LLC (Google Cloud)

- 6.4.12 Capgemini SE

- 6.4.13 Cognizant Technology Solutions Corporation

- 6.4.14 Tech Mahindra Limited

- 6.4.15 NTT Data Corporation (Dimension Data)

- 6.4.16 Gulf Business Machines (GBM)

- 6.4.17 STC Solutions (Saudi Telecom Company)

- 6.4.18 eand (Etisalat Group)

- 6.4.19 Ooredoo Q.P.S.C.

- 6.4.20 Alareeb ICT Company

- 6.4.21 Raqmiyat LLC

- 6.4.22 Atos SE

- 6.4.23 Deloitte Touche Tohmatsu Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment