PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906266

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906266

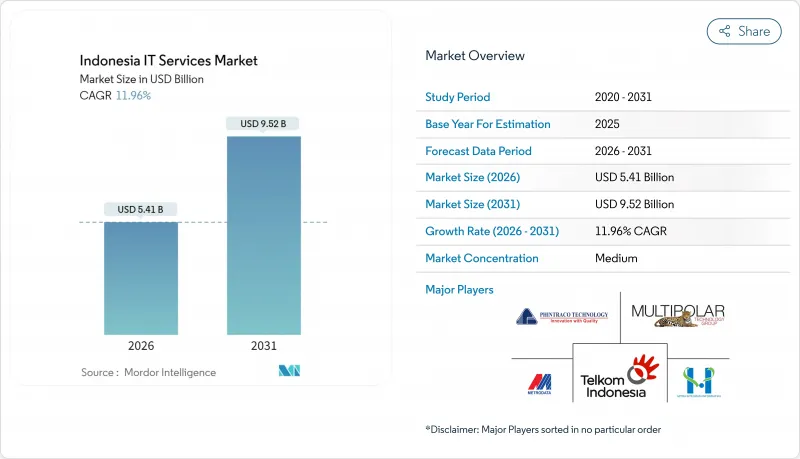

Indonesia IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indonesia IT Services Market was valued at USD 4.83 billion in 2025 and estimated to grow from USD 5.41 billion in 2026 to reach USD 9.52 billion by 2031, at a CAGR of 11.96% during the forecast period (2026-2031).

Growth is anchored in national programs such as Making Indonesia 4.0 and the Golden Indonesia 2045 Vision, rising foreign direct investment in digital infrastructure, and sustained enterprise demand for cloud-centric and managed services solutions. Large enterprises continue to dominate spending, yet small and medium enterprises (SMEs) are delivering the fastest revenue uplift as affordable cloud platforms lower adoption barriers. Financial services institutions remain the single largest vertical because of intensive regulatory, security, and customer experience requirements that favour advanced analytics and real-time processing capabilities. Cloud deployment, already the predominant model, is evolving into hybrid architectures as firms weigh latency, sovereignty, and cost considerations. Regional opportunity is still centred on Java, but expansion of fibre backbones and data-centre campuses is accelerating uptake in Sulawesi, Sumatra, and Kalimantan.

Indonesia IT Services Market Trends and Insights

Rapid enterprise digital-first strategies

Indonesian corporations are rebuilding business models around always-on digital platforms. Bank Mandiri processes 10 million records per day on a real-time system that has cut loan approval times from five days to one day. PT Pegadaian reached 99.99% system availability and slashed database provisioning from days to under 90 minutes after moving to a cloud-native stack. Industrial manufacturers are embracing integrated IoT and analytics to meet Industry 4.0 targets, and across sectors, boards are shifting budgets from capital hardware to outcome-based managed service agreements. The result is durable demand for consulting, migration, and run-phase support across the Indonesian IT services market.

Surge in cloud-native application migration

Enterprises that finished lift-and-shift projects are now modernising applications into microservices. Bank Central Asia cut new-service rollout cycles from three months to one by standardising on Red Hat OpenShift. Hybrid strategies are widespread as firms pair local sovereign clouds such as Lintasarta's Cloud Sovereign, which is purpose-built to comply with the Personal Data Protection Law. A parallel trend is the standing up of private AI infrastructure to meet latency and privacy needs, widening the service scope for architecture design, Kubernetes operations, and FinOps optimisation.

Persistent domestic skills gap in advanced cloud and DevSecOps

The International Labour Organization cites a shortage of 500,000 ICT professionals, notably in advanced cloud engineering and DevSecOps roles. IBM finds 48% of Indonesian firms hampered by digital-skills deficits. Although the Kartu Prakerja scheme has trained 14 million citizens, the pace lags enterprise demand, lengthening implementation cycles and increasing reliance on expatriate or offshore talent. Providers that integrate skills-transfer programs with project delivery gain a competitive edge.

Other drivers and restraints analyzed in the detailed report include:

- Government "Making Indonesia 4.0" incentives

- Accelerated fintech and e-commerce expansion

- Ageing legacy infrastructure outside tier-1 cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IT outsourcing and managed services secured 33.02% of the Indonesian IT services market share in 2025 as enterprises shifted from project-based engagements to outcome-driven service-level agreements. Financial services firms outsource real-time fraud analytics to specialist partners using FICO's decision platform, which protects 1.64 billion annual transactions. The Indonesian IT services market size attributed to cloud services and SaaS implementation is forecast to expand at a 14.01% CAGR, underpinned by regulations that require auditable data-sovereign environments.

Demand for consulting remains steady as enterprises navigate regulatory updates and evaluate multi-cloud patterns. Business-process outsourcing persists in telecom and banking back offices where domain expertise adds measurable value. Cybersecurity and data analytics engagements are climbing on the back of the Personal Data Protection Law, creating niches for zero-trust architectures and data-governance frameworks. Providers able to deliver integrated security, analytics, and automation within a managed offering are winning longer contracts and higher margins, reinforcing the structural shift in the Indonesian IT services market.

Large enterprises concentrated 63.72% of 2025 revenue, reflecting their extensive application estates and compliance workloads. Typical engagements include multi-year hybrid cloud programmes and managed security operations designed to meet board-level risk metrics. In contrast, SMEs are on a high-growth path with a 14.72% CAGR as cloud marketplace bundles bring enterprise-grade platforms within reach. TikTok-enabled live-stream selling lifted small-merchant sales by up to seven times, showcasing the leverage SMEs gain from ready-made digital tools.

Government grants and simplified digital-loan facilities spur adoption of accounting SaaS, point-of-sale analytics, and lightweight ERP. Providers that deliver preconfigured templates, rapid onboarding, and pay-as-you-go models are scaling quickly in the SME segment of the Indonesian IT services market. As these companies mature, demand progresses from basic infrastructure to advanced analytics and cybersecurity, enlarging lifetime customer value.

Indonesia IT Services Market is Segmented by Service Type (IT Consulting and Implementation, Business Process Outsourcing Services, and More), Enterprise Size (Small and Medium Enterprises and Large Enterprises), Industry (BFSI, IT and Telecom, Manufacturing, and More), Deployment (On-Premise, Cloud, and Hybrid), Technology (Cloud Computing, and More), and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PT Telekomunikasi Indonesia Tbk (Telkomsigma)

- PT Multipolar Technology Tbk

- PT Mitra Integrasi Informatika (MII)

- PT Metrodata Electronics Tbk

- PT Phintraco Technology

- PT Lintasarta

- PT Sigma Cipta Caraka

- Accenture Indonesia

- IBM Indonesia

- Microsoft Indonesia

- Hewlett Packard Enterprise Indonesia

- Fujitsu Indonesia

- Tata Consultancy Services Indonesia

- Wipro Indonesia

- PT Indosat Tbk (Indosat Ooredoo Hutchison Business Services)

- PT XL Axiata Tbk (XL Business Solutions)

- PT Biznet Gio Nusantara

- PT WOWrack Indonesia

- PT Kharisma (Kharisma Group)

- PT ABeam Consulting Indonesia

- PT Xapiens Teknologi Indonesia

- TDCX Indonesia

- PT Cloud4C Services Indonesia

- PT DCI Indonesia Tbk

- PT EdgeConneX Indonesia

- PT Equine Global

- PT Jatis Solutions

- PT Soltius Indonesia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid enterprise digital-first strategies

- 4.2.2 Surge in cloud-native application migration

- 4.2.3 Government "Making Indonesia 4.0" incentives

- 4.2.4 Accelerated fintech and e-commerce expansion

- 4.2.5 Data-center build-operate-transfer (BOT) deals with SOEs

- 4.2.6 Mandated domestic disaster-recovery hosting for critical data

- 4.3 Market Restraints

- 4.3.1 Persistent domestic skills gap in advanced cloud and DevSecOps

- 4.3.2 Ageing legacy infrastructure outside tier-1 cities

- 4.3.3 Fragmented provincial procurement standards

- 4.3.4 Rising electricity tariffs impacting hyperscale economics

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 IT Consulting and Implementation

- 5.1.2 Business Process Outsourcing (BPO) Services

- 5.1.3 IT Outsourcing and Managed Services

- 5.1.4 Cloud Services and SaaS Implementation

- 5.1.5 Other IT Services

- 5.2 By Enterprise Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By Industry

- 5.3.1 BFSI

- 5.3.2 IT and Telecom

- 5.3.3 Manufacturing

- 5.3.4 Healthcare

- 5.3.5 Government and Public Sector

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Education

- 5.3.9 Other Industries

- 5.4 By Deployment Model

- 5.4.1 On-premise

- 5.4.2 Cloud

- 5.4.3 Hybrid

- 5.5 By Technology

- 5.5.1 Cloud Computing

- 5.5.2 Artificial Intelligence and Machine Learning

- 5.5.3 Internet of Things (IoT)

- 5.5.4 Cybersecurity Services

- 5.5.5 Big Data and Analytics

- 5.5.6 Blockchain and Emerging Tech

- 5.5.7 Others

- 5.6 By Region

- 5.6.1 Java

- 5.6.2 Sumatra

- 5.6.3 Kalimantan

- 5.6.4 Sulawesi

- 5.6.5 Papua and Maluku

- 5.6.6 Other Regions

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PT Telekomunikasi Indonesia Tbk (Telkomsigma)

- 6.4.2 PT Multipolar Technology Tbk

- 6.4.3 PT Mitra Integrasi Informatika (MII)

- 6.4.4 PT Metrodata Electronics Tbk

- 6.4.5 PT Phintraco Technology

- 6.4.6 PT Lintasarta

- 6.4.7 PT Sigma Cipta Caraka

- 6.4.8 Accenture Indonesia

- 6.4.9 IBM Indonesia

- 6.4.10 Microsoft Indonesia

- 6.4.11 Hewlett Packard Enterprise Indonesia

- 6.4.12 Fujitsu Indonesia

- 6.4.13 Tata Consultancy Services Indonesia

- 6.4.14 Wipro Indonesia

- 6.4.15 PT Indosat Tbk (Indosat Ooredoo Hutchison Business Services)

- 6.4.16 PT XL Axiata Tbk (XL Business Solutions)

- 6.4.17 PT Biznet Gio Nusantara

- 6.4.18 PT WOWrack Indonesia

- 6.4.19 PT Kharisma (Kharisma Group)

- 6.4.20 PT ABeam Consulting Indonesia

- 6.4.21 PT Xapiens Teknologi Indonesia

- 6.4.22 TDCX Indonesia

- 6.4.23 PT Cloud4C Services Indonesia

- 6.4.24 PT DCI Indonesia Tbk

- 6.4.25 PT EdgeConneX Indonesia

- 6.4.26 PT Equine Global

- 6.4.27 PT Jatis Solutions

- 6.4.28 PT Soltius Indonesia

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment