PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906230

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906230

Europe IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

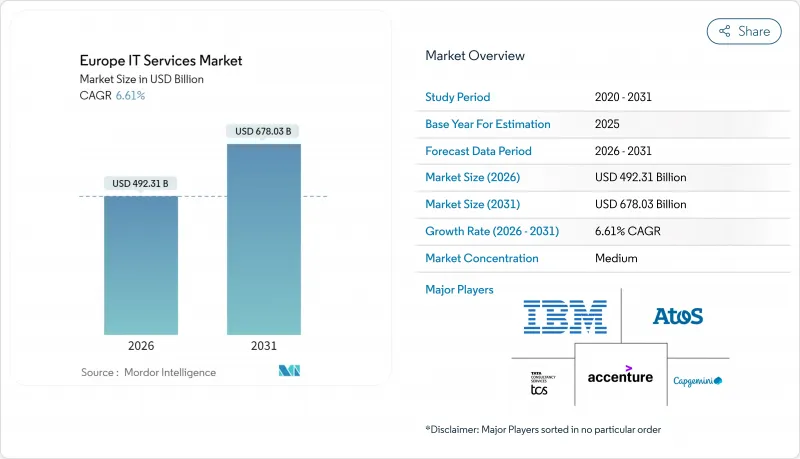

The European IT services market was valued at USD 461.80 billion in 2025 and estimated to grow from USD 492.31 billion in 2026 to reach USD 678.03 billion by 2031, at a CAGR of 6.61% during the forecast period (2026-2031).

Rapid SAP and legacy ERP modernization ahead of the 2027 support sunset is accelerating large-scale transformation programs, especially in Germany, the Netherlands, and France. The EU Corporate Sustainability Reporting Directive is expanding demand for ESG-linked consulting and data services across more than 51,000 companies. Parallel enforcement of the AI Act is redirecting budgets toward managed security and AI-driven vendor-selection frameworks that integrate transparency and data-sovereignty controls. Private-equity-backed consolidation, with disclosed deals exceeding USD 10 million each quarter, is reshaping competitive dynamics and stimulating cross-border M&A that deepens service portfolios.

Europe IT Services Market Trends and Insights

Surging Enterprise-Wide Cloud Migration

More than 99% of European enterprises prioritize cloud investment, signaling that cloud adoption has moved from cost efficiency to strategic necessity. AI readiness is the leading motivator, cited by 78% of organizations planning cloud spend that aligns with future machine-learning workloads. Despite this urgency, European firms have achieved only 32% of their stated cloud-transformation goals, leaving a sizable execution gap for providers in the European IT services market. GDPR and AI Act compliance require modern data-governance frameworks, pushing clients toward cloud-native architectures with sovereign-cloud options such as GAIA-X. As a result, hyperscaler partnerships now emphasize regional availability zones and joint compliance blueprints that accelerate migration while satisfying sovereignty rules.

Demand for Cost-Optimized ITO and BPO Contracts

Macroeconomic pressure has shifted boardroom priorities from innovation to measurable savings, driving a wave of renegotiated outsourcing deals that aim for payback within 18 months. Salary inflation reached 12% in Sweden and double-digit levels elsewhere, encouraging enterprises to rebalance delivery footprints toward lower-cost nearshore hubs in Central and Eastern Europe. Build-Operate-Transfer models are gaining favor because they combine immediate savings with eventual captive ownership, a hybrid that resonates with risk-averse European finance chiefs. Private-equity funds have noticed this pattern and now account for 60% of managed-services acquisitions, adding scale to the European IT services market while guaranteeing disciplined cost structures. Providers that demonstrate contractual flexibility-shorter tenures, outcome-based pricing, and joint governance-win a disproportionate share of new logos.

Talent Scarcity and Wage Inflation in Key Delivery Hubs

Nearly 58% of EU businesses report difficulty hiring ICT specialists, and shortages have risen 20% in the past decade. Germany alone needs 310,000 additional STEM professionals, while Sweden's entry-level software salaries touched EUR 4,000 (USD 4,520) per month after a 12% rise since 2022. Tight labor markets inflate delivery costs, squeezing margins for providers heavily weighted toward onshore capacity in the European IT services market. Vendors respond by investing in large-scale upskilling programs-Infosys, for example, has trained 275,000 employees in AI-but reskilling cycles lag client demand by several quarters. Persistent wage pressure could offset as much as 1.4 percentage points from forecast CAGR unless nearshore and offshore talent pools expand.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Managed Security Amid EU-Wide Cyber-Threat Directives

- AI-Driven Vendor-Selection Platforms Accelerating Outsourcing

- Geopolitical Data-Sovereignty Barriers (Schrems II, AI Act)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IT Consulting and Implementation opened 2025 with a 27.32% share of the European IT services market, underscoring its role in navigating SAP S/4HANA migrations and regulatory mandates. The advisory portfolio remains sticky because clients depend on consultants for target-operating-model design, vendor-selection criteria, and change-management roadmaps. Managed Security Services, however, records the fastest 8.27% CAGR, propelled by NIS2 and sector-specific directives that push continuous compliance monitoring. Over the forecast horizon, cloud-platform services amplify demand for multi-disciplinary skills, enabling providers to bundle migration, modernization, and security under one contract. This convergence reinforces wallet share for incumbents but also invites specialized boutique entrants that target high-growth niches such as AI-ethics audits.

IT outsourcing retains value when coupled with automation commitments that improve cost-to-serve ratios by double digits. The European IT services market size attached to business-process outsourcing is now influenced by AI-assisted document processing, which reduces error rates below 1% and elevates demand for process-re-engineering experts. Strategic acquisitions-Capgemini buying WNS for USD 3.3 billion, CGI absorbing Apside-signal intent to deepen vertical specialization and secure defensive moats against price-led challengers.

Large Enterprises controlled 64.23 of % European IT services market share in 2025, a dominance rooted in multi-year modernization roadmaps and exhaustive compliance obligations that necessitate tier-one partners. These clients continue to ink mega-deals-Wipro's USD 650 million Phoenix Group contract exemplifies scale and buying power. Yet the Small and Medium Enterprise segment is growing 8.74% annually, closing capability gaps through cloud-first subscriptions that compress time-to-value.

Government subsidies, such as Digital Europe Programme vouchers, subsidize up to 50% of qualified SME transformation costs, further accelerating adoption. Nordic programs extend tax credits for cybersecurity audits, funneling incremental spend toward managed services. Providers tailor modular offerings-bundled SaaS, pay-as-you-grow infrastructure, and fractional CISO services-to suit constrained budgets. As this cohort matures, SME penetration of the European IT services market is expected to add 3.95 percentage points to the aggregate revenue mix by 2031.

The Europe IT Services Report is Segmented by Service Type (IT Consulting and Implementation, and More), End-User Enterprise Size (Small and Medium Enterprises, and Large Enterprises), Deployment Model (Onshore, Nearshore, and More), End-User Vertical (BFSI, Manufacturing, Government and Public Sector, and More), and Country (United Kingdom, Germany, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Accenture plc

- Capgemini SE

- IBM Consulting

- Atos SE

- Tata Consultancy Services Limited

- Cognizant Technology Solutions Corporation

- Infosys Limited

- Wipro Limited

- CGI Inc.

- Sopra Steria Group SA

- DXC Technology Company

- NTT DATA Europe and LATAM

- Tietoevry Oyj

- EVRYTHNG Group AB

- Fujitsu Services Ltd

- Orange Business Services

- Swisscom Ltd (Enterprise Services)

- Telefonica Tech

- GFT Technologies SE

- Reply SpA

- Endava plc

- Luxoft (DXC Technology)

- Kyndryl Holdings, Inc.

- HCLTech Ltd

- NCC Group plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging enterprise-wide cloud migration

- 4.2.2 Demand for cost-optimized ITO and BPO contracts

- 4.2.3 Shift to managed security amid EU-wide cyber-threat directives

- 4.2.4 AI-driven vendor selection platforms accelerating outsourcing

- 4.2.5 Corporate urgency to modernise SAP and legacy ERP before 2027 support sunset

- 4.2.6 EU CSRD-linked ESG reporting services boosting consulting demand

- 4.3 Market Restraints

- 4.3.1 Talent scarcity and wage inflation in key delivery hubs

- 4.3.2 Geopolitical data-sovereignty barriers (Schrems II, AI Act)

- 4.3.3 Prolonged client decision cycles due to macro-uncertainty

- 4.3.4 Rising carbon-footprint penalties on energy-intensive data centres

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Evaluation of Critical Regulatory Framework

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Industry Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 IT Consulting and Implementation

- 5.1.2 IT Outsourcing (ITO)

- 5.1.3 Business Process Outsourcing (BPO)

- 5.1.4 Managed Security Services

- 5.1.5 Cloud and Platform Services

- 5.2 By End-User Enterprise Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By Deployment Model

- 5.3.1 Onshore Delivery

- 5.3.2 Nearshore Delivery

- 5.3.3 Offshore Delivery

- 5.4 By End-User Vertical

- 5.4.1 BFSI

- 5.4.2 Manufacturing

- 5.4.3 Government and Public Sector

- 5.4.4 Healthcare and Life-Sciences

- 5.4.5 Retail and Consumer Goods

- 5.4.6 Telecom and Media

- 5.4.7 Logistics and Transport

- 5.4.8 Energy and Utilities

- 5.4.9 Other End-User Verticals

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Nordics (Sweden, Denmark, Finland, Norway)

- 5.5.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 Capgemini SE

- 6.4.3 IBM Consulting

- 6.4.4 Atos SE

- 6.4.5 Tata Consultancy Services Limited

- 6.4.6 Cognizant Technology Solutions Corporation

- 6.4.7 Infosys Limited

- 6.4.8 Wipro Limited

- 6.4.9 CGI Inc.

- 6.4.10 Sopra Steria Group SA

- 6.4.11 DXC Technology Company

- 6.4.12 NTT DATA Europe and LATAM

- 6.4.13 Tietoevry Oyj

- 6.4.14 EVRYTHNG Group AB

- 6.4.15 Fujitsu Services Ltd

- 6.4.16 Orange Business Services

- 6.4.17 Swisscom Ltd (Enterprise Services)

- 6.4.18 Telefonica Tech

- 6.4.19 GFT Technologies SE

- 6.4.20 Reply SpA

- 6.4.21 Endava plc

- 6.4.22 Luxoft (DXC Technology)

- 6.4.23 Kyndryl Holdings, Inc.

- 6.4.24 HCLTech Ltd

- 6.4.25 NCC Group plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment