PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906241

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906241

Philippines Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

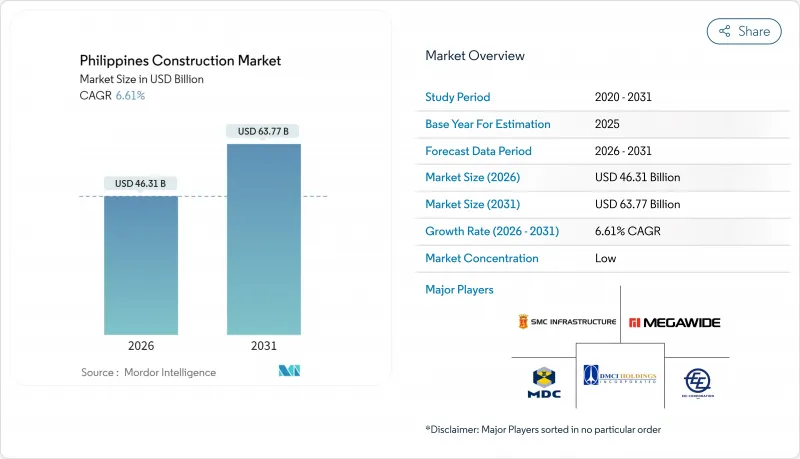

The Philippines construction market was valued at USD 43.44 billion in 2025 and estimated to grow from USD 46.31 billion in 2026 to reach USD 63.77 billion by 2031, at a CAGR of 6.61% during the forecast period (2026-2031).

Public outlays under the Build Better More (BBM) program equal 5.8% of GDP and continue to drive headline growth as more than USD 27.4 billion of capital was released for infrastructure in 2024. Medium-term expansion also benefits from a USD 162 billion pipeline of public-private partnership (PPP) opportunities unlocked by the new PPP Code, and a USD 147 billion BBM flagship list that prioritizes transport corridors over isolated projects. Foreign investors are reinforcing the momentum through USD 100 billion of Luzon Economic Corridor commitments alongside high-profile manufacturing, steel, and cement plants. Demand for 1 million housing units each year under the 4PH housing program sustains the dominant residential segment, while persistent labor shortages, elevated input costs, and project-approval bottlenecks temper upside potential.

Philippines Construction Market Trends and Insights

Massive Public Infrastructure Spending

The Philippines is undergoing a transformative phase in public infrastructure development, driven by strategic investments and innovative funding mechanisms. The BBM program directs development towards integrated, climate-resilient transport networks, including the Luzon Spine Expressway and inter-island bridges. Flagship projects worth over USD 147 billion boost contractor visibility, leading to early investments and a focus on marine viaducts, rail tunnels, and resilient roadbeds. A legally mandated infrastructure floor of 5-6% of GDP stabilizes annual budget flows. Meanwhile, the sovereign Maharlika Investment Fund provides an equity-based alternative to debt financing, expanding funding sources for priority projects. These initiatives collectively aim to enhance the nation's infrastructure landscape and support long-term economic growth.

Enhanced Public-Private Partnerships and Policy Reforms

Public-private partnerships (PPPs) are playing a pivotal role in bridging the infrastructure funding gap in the Philippines. The 2023 PPP Code, now in effect, streamlines approvals for 185 projects worth USD 162 billion, addressing a 40% infrastructure funding gap. Executive Order 59 eliminates redundant local permits, cutting a year from the usual approval timeline for rail and airport projects. Thanks to green-lane treatment under Executive Order 18, investments over USD 10 million, like the USD 600 million Terra Solar facility, can navigate bureaucracy in just 20 days. These reforms not only expedite revenue recognition for contractors but also entice private interest in utilities traditionally dominated by the state. By fostering collaboration between the public and private sectors, these measures are set to accelerate infrastructure development and economic progress.

Skilled Labor Shortages and Workforce Gaps

The construction industry is grappling with a significant shortage of skilled labor, which poses a challenge to meeting project deadlines. To fulfill BBM deadlines, the industry requires an additional 200,000 qualified tradespeople. Historically, technical education has leaned towards tourism and IT, leaving fields like masonry, welding, and heavy equipment training underrepresented. While TESDA's enterprise-based schemes and tax credits target an annual graduation of 10,000 entrants in Metro Manila, overseas migration continues to siphon off talent. Northern Mindanao, for instance, is short by 7,000 workers, compelling contractors to either import labor or postpone projects. However, with accelerated apprenticeship models and enhanced on-site amenities, retention rates are gradually improving. Addressing these workforce gaps is critical to ensuring the timely completion of infrastructure projects and sustaining industry growth.

Other drivers and restraints analyzed in the detailed report include:

- Surging Foreign Investment and Economic Growth

- Housing Demand and National Housing Program

- High Material Costs and Supply Chain Disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Infrastructure captured a significant portion of the Philippines' construction market size in 2025, while residential retained the largest 42.86% share. Government allocations worth USD 27.4 billion under BBM accelerate road, rail, and bridge packages such as the USD 5.8 billion South Commuter Railway and the USD 2.1 billion Bataan-Cavite Marine Link. The infrastructure sub-market is forecast to post a 7.45% CAGR, outpacing the wider Philippines construction market because transport corridors unlock land values and catalyze logistics hubs.

Pipeline visibility favors large EPC contractors that can manage marine viaducts, tunnelling, and rolling-stock integration. Energy and utilities construction adds further upside due to a legislated 35% renewables share by 2030, steering capital toward solar farms, battery storage, and grid upgrades. Private developers continue to fuel condominium towers, yet some office buildings face design re-scoping as hybrid work cuts space demand. As a result, contractors with infrastructure credentials hedge residential cycles and secure higher-margin specialized works.

New builds controlled 75.62% of the Philippines' construction market share in 2025, but renovation is projected to accelerate at a 7.05% CAGR to 2031. Aging bridges, public buildings, and commercial towers require seismic retrofits and energy-efficiency upgrades, demonstrated by JFE Engineering's USD 320 million strengthening of Guadalupe and Lambingan bridges. Owners are incentivized by power-cost savings and green-lease premiums, shifting budgets toward retrofit packages.

Renovation projects often occur in dense urban zones where land scarcity inflates replacement costs, favoring incremental over ground-up solutions. Contractors, therefore, invest in 3D scanning and digital twin tools to minimize downtime. The Philippines construction market benefits from skilled structural engineers and imported base-isolation technology, though smaller firms may struggle with capital requirements for specialized equipment.

The Philippines Construction Market Report is Segmented by Sector (Residential, Commercial, Infrastructure), by Construction Type (New Construction, Renovation), by Construction Method (Conventional On-Site, Modern Methods of Construction), by Investment Source (Public, Private), and by Geography (NCR Metro Manila, Calabarzon, Central Luzon, Rest of Philippines). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DMCI Holdings Inc.

- Megawide Construction Corp.

- EEI Corporation

- Makati Development Corp. (Ayala)

- San Miguel Infrastructure

- Aboitiz Construction Inc.

- DDT Konstract Inc.

- Prime BMD

- Metro Pacific Investments Corp.

- Filinvest Land Inc.

- Robinsons Land Corp.

- Megaworld Corp.

- Century Properties Group

- Sta. Lucia Land Inc.

- DATEM Inc.

- First Balfour Inc.

- JGC Philippines

- China State Construction Eng. Philippines

- Tokwing Construction

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Massive Public Infrastructure Spending (Build Better More Program)

- 4.2.2 Enhanced Public-Private Partnerships and Policy Reforms

- 4.2.3 Surging Foreign Investment and Economic Growth

- 4.2.4 Housing Demand and National Housing Program (4PH)

- 4.2.5 Rapid Urbanization and Demographic Trends

- 4.2.6 Infrastructure Initiatives in Energy and Transport

- 4.3 Market Restraints

- 4.3.1 Skilled Labor Shortages and Workforce Gaps

- 4.3.2 High Material Costs and Supply Chain Disruptions

- 4.3.3 Financing Constraints and High Interest Rates

- 4.3.4 Bureaucratic Delays and Regulatory Hurdles

- 4.4 Value / Supply-Chain Analysis

- 4.4.1 Overview

- 4.4.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.4.3 Architectural and Engineering Companies - Key Quantitative and Qualitative Insights

- 4.4.4 Building Material and Equipment Companies - Key Quantitative and Qualitative Insights

- 4.5 Government Initiatives & Vision

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Pricing (Construction Materials) and Construction Cost (Materials, Labour, Equipment) Analysis

- 4.10 Comparison of Key Industry Metrics of Philippines with Other Countries

- 4.11 Key Upcoming/Ongoing Projects (with a focus on Mega Projects)

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Sector

- 5.1.1 Residential

- 5.1.1.1 Apartments/Condominiums

- 5.1.1.2 Villas/Landed Houses

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Industrial and Logistics

- 5.1.2.4 Others

- 5.1.3 Infrastructure

- 5.1.3.1 Transportation Infrastructure (Roadways, Railways, Airways, others)

- 5.1.3.2 Energy & Utilities

- 5.1.3.3 Others

- 5.1.1 Residential

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By Construction Method

- 5.3.1 Conventional On-Site

- 5.3.2 Modern Methods of Construction (Prefabricated, Modular, etc)

- 5.4 By Investment Source

- 5.4.1 Public

- 5.4.2 Private

- 5.5 By Region

- 5.5.1 NCR (Metro Manila)

- 5.5.2 Calabarzon

- 5.5.3 Central Luzon

- 5.5.4 Rest of Philippines

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 DMCI Holdings Inc.

- 6.4.2 Megawide Construction Corp.

- 6.4.3 EEI Corporation

- 6.4.4 Makati Development Corp. (Ayala)

- 6.4.5 San Miguel Infrastructure

- 6.4.6 Aboitiz Construction Inc.

- 6.4.7 DDT Konstract Inc.

- 6.4.8 Prime BMD

- 6.4.9 Metro Pacific Investments Corp.

- 6.4.10 Filinvest Land Inc.

- 6.4.11 Robinsons Land Corp.

- 6.4.12 Megaworld Corp.

- 6.4.13 Century Properties Group

- 6.4.14 Sta. Lucia Land Inc.

- 6.4.15 DATEM Inc.

- 6.4.16 First Balfour Inc.

- 6.4.17 JGC Philippines

- 6.4.18 China State Construction Eng. Philippines

- 6.4.19 Tokwing Construction

7 Market Opportunities & Future Outlook