PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906258

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906258

Middle East & Africa Infrastructure Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

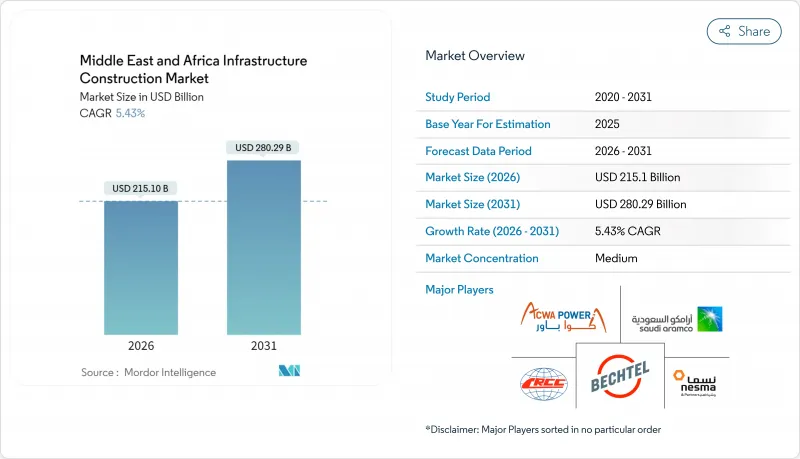

The Middle East Africa infrastructure construction market was valued at USD 204.02 billion in 2025 and estimated to grow from USD 215.10 billion in 2026 to reach USD 280.29 billion by 2031, at a CAGR of 5.43% during the forecast period (2026-2031).

Growth stems from sovereign wealth funds channeling oil earnings into giga-projects, escalating public-sector budgets, and maturing public-private partnership (PPP) frameworks that draw foreign capital. Transportation projects dominate current spending, but utilities infrastructure is expanding fastest as countries race to meet energy-transition deadlines and digital-economy goals. Saudi Arabia, Egypt, and the UAE act as investment anchors, each using ambitious national visions to attract capital and technology. Across the region, contractors confront twin cost pressures-56% report skilled-labor shortages and 51% face volatile materials prices, which accelerate the adoption of automation, modular building, and AI-driven project-management tools.

Middle East & Africa Infrastructure Construction Market Trends and Insights

Strong government spending on transport, utilities, and energy projects

Public budgets across the Gulf and North Africa are at record highs. Saudi Arabia alone has set aside SAR 42 billion (USD 11.2 billion) for basic infrastructure and transport in 2025, lifting Vision 2030 outlays by 33.8% every year since launch. South Africa plans to put R940 billion (USD 52.4 billion) into roads, bridges, dams, and ports within three years. The UAE's planned high-speed rail between Abu Dhabi and Dubai is forecast to add USD 39.5 billion to national output over five decades. Governments also back large renewable programs, with regional solar and wind expected to supply more than half of the power by 2050. Budgets increasingly bundle roads, grids, and digital links, which lowers lifecycle costs and amplifies economic impact.

Expansion of ports and logistics hubs across key coastal regions

Port programs are reshaping trade routes. NEOM's Oxagon plans fully automated cranes on a busy Red Sea lane. Dubai is spending USD 35 billion to turn Al Maktoum International into a 260-million-passenger, 13-million-tonne freight center. Egypt is promoting a USD 4 billion bridge over the Strait of Tiran to tighten Africa-Asia links. Such hubs need adjoining rails, highways, and inland depots, which widens the order book for contractors expert in automated cargo systems and cold-chain storage.

Shortage of skilled labor and contractor capacity limits progress

About 56% of firms report not having enough qualified staff, especially for work that combines civil engineering with digital systems. Gulf projects often rely on expatriates who make up as much as 95% of site workers; visa reviews can disrupt schedules. Reports of wage issues and poor conditions add reputational risk for international partners. Builders respond by using robotics, such as NEOM's automated rebar units that cut manual effort by 80%. Yet switching to high-tech methods requires capital and retraining, which not every contractor can fund quickly.

Other drivers and restraints analyzed in the detailed report include:

- Cross-border infrastructure corridors boosting regional integration

- Smart-city initiatives driving tech-enabled infrastructure growth

- Volatile material prices and logistics issues straining budgets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation accounted for 40.62% of the Middle East Africa infrastructure construction market size in 2025, reflecting rail, airport, and port megaprojects such as Etihad Rail's 900 km network and Dubai's USD 35 billion Al Maktoum airport expansion. Pipeline additions in high-speed rail and aviation logistics preserve this leadership through 2031. Utilities infrastructure, though smaller today, is expanding at a 6.12% CAGR on the back of renewable mandates. Saudi Arabia's green-hydrogen hub, Egypt's 10 GW wind farm, and Morocco's solar clusters illustrate scale plays that shift capital toward power grids, storage, and desalination. Contractors with hybrid power-and-civil skill sets capture premium contracts as grid interconnectors dovetail with hydrogen and battery projects. Increasing electrification of transport further ties the two segments, spurring integrated tender packages that reward multidisciplinary consortia.

In social infrastructure, healthcare and education investments rise with population growth, exemplified by the USD 250 million African Medical Centre of Excellence in Abuja. Extraction-sector projects remain significant, led by Saudi Aramco's USD 7.7 billion Fadhili Gas expansion and Qatar's USD 6 billion Ras Laffan complex, yet their share gradually tapers as non-oil priorities advance. Digital overlays, smart meters, IoT sensors, and AI analytics, blur segment boundaries, producing "infra-tech" contracts where traditional civil works combine with low-carbon and data-intensive systems. This fusion boosts opportunities for firms able to integrate sensors, control rooms, and cybersecurity from the design phase.

The Middle East & Africa Infrastructure Construction Market Report is Segmented by Infrastructure Segment (Transportation Infrastructure, Social Infrastructure, and More), by Construction Type (New Construction and Renovation), by Investment Source (Public and Private), and by Country (Saudi Arabia, Egypt, UAE, and More). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- ACWA Power

- Saudi Aramco

- Bechtel Corporation

- Nesma & Partners

- CRCC

- Larsen & Toubro

- SNC-Lavalin

- Samsung C&T

- Al-Ayuni Investment & Contracting

- Elm Co.

- Zain KSA

- STC (Saudi Telecom Company)

- Huawei Tech Investment Saudi

- Ma'aden

- Satorp

- SABIC

- Red Sea Global

- Diriyah Gate Development Authority

- Royal Commission for Jubail & Yanbu

- Tatweer Buildings Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strong government spending on transport, utilities, and energy projects.

- 4.2.2 Expansion of ports and logistics hubs across key coastal regions.

- 4.2.3 Cross-border infrastructure corridors are boosting regional integration.

- 4.2.4 Smart city initiatives are driving tech-enabled infrastructure growth.

- 4.2.5 Industrial and energy sector demand is expanding project pipelines.

- 4.2.6 Trade and freight activity growth is supporting airport and terminal upgrades.

- 4.3 Market Restraints

- 4.3.1 Shortage of skilled labor and contractor capacity limits progress.

- 4.3.2 Volatile material prices and logistics issues are straining budgets.

- 4.3.3 Regulatory delays and land access hurdles are slowing execution.

- 4.3.4 Oil price-linked fiscal uncertainty is affecting project financing.

- 4.4 Value / Supply-Chain Analysis

- 4.4.1 Overview

- 4.4.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.4.3 Architectural and Engineering Companies - Key Quantitative and Qualitative Insights

- 4.4.4 Building Material and Equipment Companies - Key Quantitative and Qualitative Insights

- 4.5 Government Initiatives & Vision

- 4.6 Regulatory or Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pricing (Construction Materials) and Construction Cost (Materials, Labour, Equipment) Analysis

- 4.9 Comparison of Key Industry Metrics of Middle East & Africa Countries with Other Countries

- 4.10 Key Upcoming/Ongoing Projects (with a focus on Mega Projects)

5 Market Size & Growth Forecasts (Value, USD Bn)

- 5.1 By Infrastructure Segment

- 5.1.1 Transportation Infrastructure

- 5.1.2 Utilities Infrastructure

- 5.1.3 Social Infrastructure

- 5.1.4 Extraction Infrastructure

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By Investment Source

- 5.3.1 Public

- 5.3.2 Private

- 5.4 By Country

- 5.4.1 Saudi Arabia

- 5.4.2 UAE

- 5.4.3 Nigeria

- 5.4.4 Egypt

- 5.4.5 South Africa

- 5.4.6 Rest of Middle East and Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 ACWA Power

- 6.4.2 Saudi Aramco

- 6.4.3 Bechtel Corporation

- 6.4.4 Nesma & Partners

- 6.4.5 CRCC

- 6.4.6 Larsen & Toubro

- 6.4.7 SNC-Lavalin

- 6.4.8 Samsung C&T

- 6.4.9 Al-Ayuni Investment & Contracting

- 6.4.10 Elm Co.

- 6.4.11 Zain KSA

- 6.4.12 STC (Saudi Telecom Company)

- 6.4.13 Huawei Tech Investment Saudi

- 6.4.14 Ma'aden

- 6.4.15 Satorp

- 6.4.16 SABIC

- 6.4.17 Red Sea Global

- 6.4.18 Diriyah Gate Development Authority

- 6.4.19 Royal Commission for Jubail & Yanbu

- 6.4.20 Tatweer Buildings Co.

7 Market Opportunities & Future Outlook