PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906259

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906259

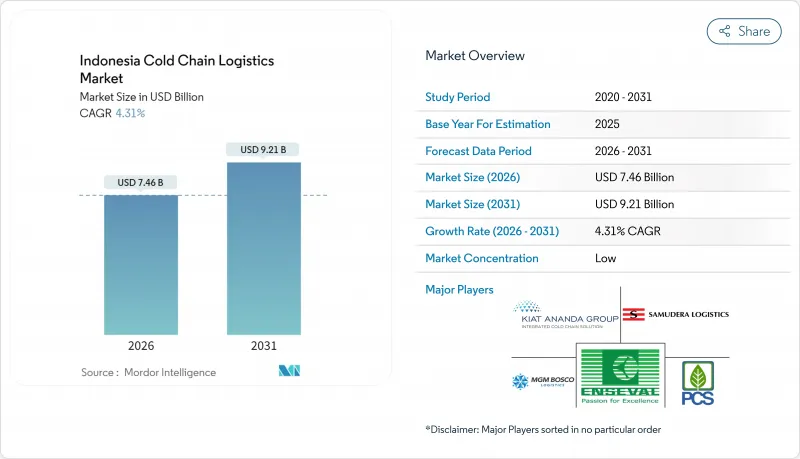

Indonesia Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indonesia Cold Chain Logistics Market was valued at USD 7.15 billion in 2025 and estimated to grow from USD 7.46 billion in 2026 to reach USD 9.21 billion by 2031, at a CAGR of 4.31% during the forecast period (2026-2031).

The market's upward trajectory reflects Indonesia's efforts to modernize logistics infrastructure, lower nationwide distribution costs, and unlock new export channels for high-value perishable goods. Growth momentum is reinforced by the government's SiNasLog program, which reduced logistics costs to 14.29% of GDP in 2024 and is targeting 8% by 2045. Rapid e-grocery adoption, surging seafood exports, and nationwide vaccine distribution have pushed up demand for temperature-controlled storage and value-added services. Companies are investing in IoT sensors, blockchain traceability, and solar-powered micro cold stores to improve reliability, meet halal certification rules, and extend reach to off-grid islands. Digitalization of ports and reefer-friendly vessel upgrades further strengthen Indonesia's role as a regional refrigeration hub.

Indonesia Cold Chain Logistics Market Trends and Insights

Surge in Frozen Seafood & Meat Exports

Indonesia remains the world's second-largest fisheries producer, and the Ministry of Marine Affairs and Fisheries is upgrading aquaculture standards to satisfy premium export markets. New cold storage nodes on Sumatra and Sulawesi shorten export lead times, helping processors meet U.S. and EU temperature protocols. A recent deal to ship 1.6 million eggs monthly to the United States underlines rising protein export volumes that need certified refrigerated handling. Integrated quality-assurance platforms combine IoT sensors and blockchain to secure chain-of-custody data, boosting buyer confidence and pricing power. As demand for verified halal seafood rises in Gulf markets, export-oriented processors are adding dedicated halal-only cold rooms compliant with Government Regulation 42/2024. These investments broaden the Indonesian cold chain logistics market by attracting international carriers to schedule additional reefer-equipped sailings.

E-grocery & Last-mile Refrigerated Delivery Boom

Indonesia's e-commerce value is forecast to jump from USD 58.7 billion in 2024 to USD 86.81 billion in 2028, with groceries as a standout growth category. Online shoppers expect fresh and frozen items to arrive within 24 hours, forcing platforms to deploy dark stores, cross-dock micro hubs, and refrigerated two-wheeler fleets in dense urban corridors. Ministerial Regulation 31/2023 simplified licensing, enabling start-ups to roll out chilled delivery services faster. Large parcel integrators such as NCS now operate 160 multipurpose warehouses equipped with proprietary WMS that maintain +-1 °C precision during order picking. Advanced temperature probes dispatch real-time alerts to riders' handhelds, preventing spoilage and reinforcing consumer trust. These dynamics inject fresh capital into the Indonesia cold chain logistics market and foster experimentation with battery-powered refrigerated bikes for zero-emission urban fulfillment.

High Electricity & Diesel Costs

Cold rooms draw heavy power, yet grid tariffs and generator diesel prices climbed in 2024, squeezing operators' margins. While the biodiesel program advanced to a B35 blend for trucks, stationary warehouses still rely on fossil-based electricity. President Prabowo's pledge to retire coal plants within 15 years requires 75 GW of new renewables, but procedural delays slow capacity additions. Solar chillers show promise: locally engineered units cost USD 2,682 each and deliver a 0.69 coefficient of performance suitable for vaccines. Yet financing hurdles and land-lease complexities limit widespread deployment. High energy costs, therefore, temper the Indonesia cold chain logistics market expansion until low-carbon electricity becomes more accessible.

Other drivers and restraints analyzed in the detailed report include:

- Government "SiNasLog" Logistics-Infrastructure Push

- Pharmaceutical Cold-Chain Expansion (Vaccines/Biologics)

- Capacity Gap Outside Java Corridor

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated storage contributed 53.40% to the Indonesia cold chain logistics market in 2025 and continues to anchor national food security reserves. Government rice, egg, and seafood buffers require bulk cold depots near Jakarta, Surabaya, and Medan, ensuring strategic stockpiles remain export-ready and inflation-proof. Operators retrofit facilities with ammonia or CO2 systems to comply with Kigali standards, while digital twins optimize airflow patterns and cut energy use 8% year-on-year. Blockchain integration verifies product authenticity for halal export consignments, shortening clearance at destination ports.

Value-added services are expanding at a 4.73% CAGR as manufacturers outsource labelling, portioning, and quality-assurance workflows that once occurred in-house. Regulation 42/2024 compels separate halal and non-halal lines, spurring demand for segregated rooms and certified inspectors, a boon for third-party logistics (3PLs). Transportation retains a large but fragmented share, led by road carriers deploying insulation-grade rigid boxes and GPS-linked sensors that upload 98.35% of temperature logs in real time. Maritime traffic gains from Samudera Indonesia's USD 280 million vessel expansion, bolstering feeder links from Makassar to China. Airfreight's premium niche is reinforced by DHL's direct Hong Kong-Jakarta rotation, shaving delivery times for high-value biologics. Collectively, service innovation is reshaping competitive boundaries within the Indonesia cold chain logistics market.

The Indonesia Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, and Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, and Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, and More), Region (Java, Sumatra, Kalimantan, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kiat Ananda Group

- Enseval Putera Megatrading Tbk

- MGM Bosco Logistics

- Samudera Logistics

- Pluit Cold Storage

- PT International Mega Sejahtera

- PT YCH Indonesia

- PT Wira Logitama Saksama

- DHL Supply Chain Indonesia

- PT BGR Logistik Indonesia

- PT Wahana Cold Storage

- Yusen Logistics

- Ninja Xpress

- Nippon Express

- PT Tira Cipta Logistik (TCL)

- CKL Indonesia Raya (CKL Cargo)

- PT Perishable Logistics Indonesia (PLI)

- PT Mitsubishi Logistics Indonesia

- JAS Worldwide

- Coolkas

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in frozen seafood & meat exports

- 4.2.2 E-grocery & last-mile refrigerated delivery boom

- 4.2.3 Government "SiNasLog" logistics-infrastructure push

- 4.2.4 Pharmaceutical cold-chain expansion (vaccines/biologics)

- 4.2.5 Halal-certified cold-chain demand for exports

- 4.2.6 Solar-powered micro cold-stores in off-grid islands

- 4.3 Market Restraints

- 4.3.1 High electricity & diesel costs

- 4.3.2 Capacity gap outside Java corridor

- 4.3.3 Shortage of certified reefer-truck drivers

- 4.3.4 Kigali refrigerant phase-down retrofit costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.5.1 Government regulations & initiatives

- 4.5.2 Halal standards & certification impacts

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Value-Chain / Supply-Chain Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5 °C)

- 5.2.2 Frozen (-18-0 °C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20 °C)

- 5.3 By Application

- 5.3.1 Fruits & Vegetables

- 5.3.2 Meat & Poultry

- 5.3.3 Fish & Seafood

- 5.3.4 Dairy & Frozen Desserts

- 5.3.5 Bakery & Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals & Biologics

- 5.3.8 Vaccines & Clinical Trial Materials

- 5.3.9 Chemicals & Specialty Materials

- 5.3.10 Other Perishables

- 5.4 By Region (Indonesia)

- 5.4.1 Java (Jakarta & BOD)

- 5.4.2 Sumatra

- 5.4.3 Kalimantan

- 5.4.4 Sulawesi

- 5.4.5 Bali & Nusa Tenggara

- 5.4.6 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Kiat Ananda Group

- 6.4.2 Enseval Putera Megatrading Tbk

- 6.4.3 MGM Bosco Logistics

- 6.4.4 Samudera Logistics

- 6.4.5 Pluit Cold Storage

- 6.4.6 PT International Mega Sejahtera

- 6.4.7 PT YCH Indonesia

- 6.4.8 PT Wira Logitama Saksama

- 6.4.9 DHL Supply Chain Indonesia

- 6.4.10 PT BGR Logistik Indonesia

- 6.4.11 PT Wahana Cold Storage

- 6.4.12 Yusen Logistics

- 6.4.13 Ninja Xpress

- 6.4.14 Nippon Express

- 6.4.15 PT Tira Cipta Logistik (TCL)

- 6.4.16 CKL Indonesia Raya (CKL Cargo)

- 6.4.17 PT Perishable Logistics Indonesia (PLI)

- 6.4.18 PT Mitsubishi Logistics Indonesia

- 6.4.19 JAS Worldwide

- 6.4.20 Coolkas

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment

8 Appendix

- 8.1 Annual Statistics on Refrigerated Storage Facilities

- 8.2 Import-Export Trade Data of Frozen Food Products

- 8.3 Regulatory Framework on Food Transport & Storage

- 8.4 Food & Beverage Sector Indicators