PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910870

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910870

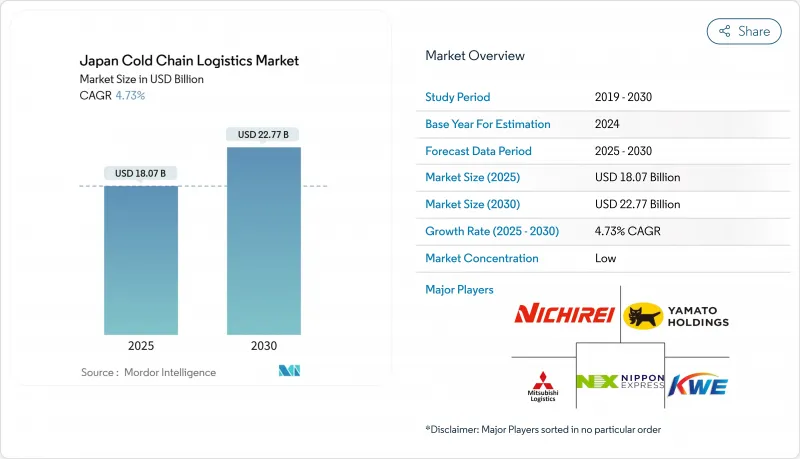

Japan Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Japan Cold Chain Logistics Market size in 2026 is estimated at USD 18.92 billion, growing from 2025 value of USD 18.07 billion with 2031 projections showing USD 23.78 billion, growing at 4.68% CAGR over 2026-2031.

In the near term, temperature-sensitive e-commerce grocery delivery, ultra-precision pharmaceutical distribution, and record seafood exports form a synchronized demand wave that accelerates facility upgrades, fleet electrification, and digital visibility platforms. Retailers convert micro-fulfillment centers into multi-zone hubs to handle surging same-day orders, while biologics producers secure redundant 2-8 °C capacity to protect high-value inventory. Long-term growth also benefits from government-funded vaccine stockpiles that ensure continuous utilization of ultra-low-temperature assets and from expanded Regional Comprehensive Economic Partnership (RCEP) trade flows that stimulate maritime reefer lanes. In response, major logistics providers pursue mergers, automation rollouts, and alternative-fuel vehicle pilots to improve margins and reduce carbon exposure.

Japan Cold Chain Logistics Market Trends and Insights

Temperature-sensitive e-commerce grocery delivery

Rapid online grocery adoption is redefining facility scale and location. Rakuten Mart now processes 70,000 chilled and frozen orders daily across Tokyo and Kansai, supported by micro-fulfillment centers equipped with goods-to-person robots and three-zone storage modules. Convenience chains replicate this model: 7-Eleven's 7NOW service plans nationwide coverage through 20,000 stores, creating dense last-mile networks that rely on sub-zero lockers and insulated totes. Retailers also deploy mobile shops to reach suburban seniors, turning delivery vans into rolling cold rooms. These shifts favor agile third-party operators able to add capacity in smaller increments, while legacy warehouse owners invest in high-bay automation to protect margins as order sizes decline. The result is an ecosystem where proximity to the consumer is valued as highly as pallet throughput accuracy.

Biologics & cell-gene therapy pipeline (2-8 °C)

Japan's biopharma sector is scaling precision logistics to curb USD 48 billion in global temperature excursion losses revealed by GLP-1 supply chain audits. New mRNA formulations that remain stable at 4 °C slash dependence on -80 °C storage, prompting a dual-temperature strategy in new builds. Tsukuba Medical Logistics Center Phase 2 offers segregated 15-25 °C, 2-8 °C, and -20 °C zones with triple-redundant power, underscoring the capital intensity required to meet PMDA validation rules. Smaller carriers struggle to finance such complexity, accelerating contract outsourcing to firms with validated data-loggers, 24/7 monitoring, and GDP-compliant SOPs. Geographic concentration around Ibaraki and Saitama generates supply-demand imbalances that spur regional DC projects in Kyushu and Hokkaido.

Shortage of licensed reefer-truck drivers

Driver numbers continue to decline as the median age tops 50 and overtime caps limit annual hours. Cold chain fleets feel the pinch more than ambient carriers because advanced endorsements are required to handle refrigerant systems. Nippon Express addressed the gap by investing in Gatik AI to test autonomous middle-mile routes between DCs. Government-backed pilots linking Tokyo and Osaka aim to certify platooning by 2027. Until autonomy scales, operators shift long-haul volumes onto rail and RORO vessels, preserving scarce drivers for intricate last-mile drops. Rural routes risk service gaps that could weaken national coverage if wage premiums fail to attract new licensees.

Other drivers and restraints analyzed in the detailed report include:

- Government-subsidized vaccine stockpiling

- Surge in seafood exports via RCEP corridors

- High urban real-estate prices for cold warehouses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated storage controlled 41.30% of 2025 revenue within the Japan cold chain logistics market, reflecting entrenched inventory-buffer strategies across food and pharma sectors. Multi-temperature facilities deploy shuttle cranes and mobile racks to handle SKU proliferation without expanding footprints. The LOGI FLAG TECH Koshigaya I build demonstrates how private operators embed solar panels and natural refrigerants to curb utility bills while achieving -25 °C setpoints. Public warehouses remain attractive to SMEs seeking flexible terms, yet the growing share of high-value pharmaceuticals steers larger shippers toward dedicated in-house sites that guarantee GDP compliance.

Value-added services are set to grow 4.72% annually through 2031 as customers demand kitting, re-labeling, and post-processing near point-of-sale. Providers integrate QA labs and light assembly zones, converting pallet storage into fee-earning activities that offset slower throughput. Refrigerated transportation keeps stable demand as Konoike Transport deploys electric trucks with 120-kilometer range for Aeon Group urban deliveries. Modal shifts expand: Kuribayashi Shipping's switch from 100% trucking to RORO ships on Sendai-Osaka frozen noodle lanes cut CO2 74% while trimming transit to 3 hours dock-to-dock. Airfreight retains a niche for clinical trials and urgent recalls but yields share to temperature-controlled rail as JR Freight adds reefer containers.

The Japan Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, Bakery & Confectionery, and More), and Geography (Kanto, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nippon Express

- Yamato Holdings

- Nichirei Logistics Group

- Mitsubishi Logistics

- Kintetsu World Express

- Itochu Logistics

- Sagawa Express

- Konoike Transport Co., Ltd

- K-Line Logistics

- DHL Supply Chain

- Kuehne + Nagel

- CEVA Logistics

- Mitsui-Soko Group

- SENKO Co., Ltd.

- Suzuyo & Co.

- SF Express

- Yusen Logistics (Part of NYK Line)

- MOL Logistics

- Matsuoka Co., Ltd.

- YOKOREI Co., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of temperature-sensitive e-commerce grocery delivery

- 4.2.2 Growing biologics and cell-gene therapy pipeline requiring 2-8 °C logistics

- 4.2.3 Government-subsidised vaccine stockpiling initiatives

- 4.2.4 Surge in seafood exports driven by RCEP tariff reductions

- 4.2.5 Automation and IoT lowering per-pallet handling costs

- 4.2.6 Hydrogen-powered reefer truck pilots lowering diesel dependency

- 4.3 Market Restraints

- 4.3.1 Shortage of licensed reefer-truck drivers amid ageing workforce

- 4.3.2 High urban real-estate prices limiting new cold-warehouse builds

- 4.3.3 Grid-instability risk for ultra-low-temp freezers during summer peaks

- 4.3.4 Stringent fluorocarbon phase-out rules increasing retrofit CAPEX

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Emission Standards and ESG Targets

- 4.9 Impact of Geopolitics and Pandemic

5 Market Size and Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5 °C)

- 5.2.2 Frozen (-18-0 °C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20 °C)

- 5.3 By Application

- 5.3.1 Fruits and Vegetables

- 5.3.2 Meat and Poultry

- 5.3.3 Fish and Seafood

- 5.3.4 Dairy and Frozen Desserts

- 5.3.5 Bakery and Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals and Biologics

- 5.3.8 Vaccines and Clinical Trial Materials

- 5.3.9 Chemicals and Specialty Materials

- 5.3.10 Other Applications

- 5.4 By Region (Domestic)

- 5.4.1 Kanto

- 5.4.2 Kansai

- 5.4.3 Chubu

- 5.4.4 Kyushu and Okinawa

- 5.4.5 Hokkaido and Tohoku

- 5.4.6 Rest of Japan

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Nippon Express

- 6.4.2 Yamato Holdings

- 6.4.3 Nichirei Logistics Group

- 6.4.4 Mitsubishi Logistics

- 6.4.5 Kintetsu World Express

- 6.4.6 Itochu Logistics

- 6.4.7 Sagawa Express

- 6.4.8 Konoike Transport Co., Ltd

- 6.4.9 K-Line Logistics

- 6.4.10 DHL Supply Chain

- 6.4.11 Kuehne + Nagel

- 6.4.12 CEVA Logistics

- 6.4.13 Mitsui-Soko Group

- 6.4.14 SENKO Co., Ltd.

- 6.4.15 Suzuyo & Co.

- 6.4.16 SF Express

- 6.4.17 Yusen Logistics (Part of NYK Line)

- 6.4.18 MOL Logistics

- 6.4.19 Matsuoka Co., Ltd.

- 6.4.20 YOKOREI Co., Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment