PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910699

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910699

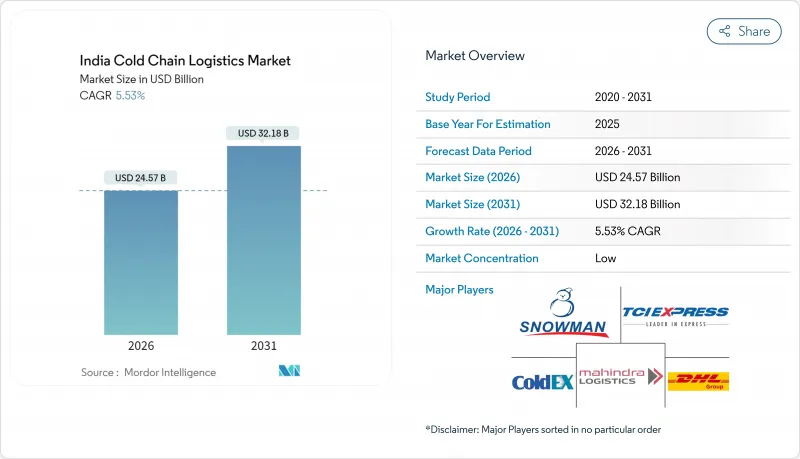

India Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India Cold Chain Logistics Market size in 2026 is estimated at USD 24.57 billion, growing from 2025 value of USD 23.28 billion with 2031 projections showing USD 32.18 billion, growing at 5.53% CAGR over 2026-2031.

Rapid urban food-service growth, public subsidies for warehousing, and biologics-heavy pharma pipelines collectively steer a decisive move from isolated bulk storage toward integrated end-to-end temperature-controlled solutions. The India Cooling Action Plan promotes energy-efficient assets, while the National Logistics Policy targets a logistics-to-GDP ratio that signifies enhanced efficiency, encouraging operators to upgrade fleets and adopt AI-based routing. LNG-ready highways, e-grocery fulfillment hubs, and eVIN-enabled vaccine monitoring strengthen demand for reliable sub-zero distribution. Meanwhile, import duty barriers on high-efficiency compressors and a chronic reefer-driver shortfall temper near-term momentum but also raise entry thresholds that favor integrated operators with scale advantages. Private investments in solar-hybrid depots and green-energy reefer fleets further differentiate players seeking carbon-aligned growth trajectories.

India Cold Chain Logistics Market Trends and Insights

Expansion of National Gas Grid Enabling LNG-Fuelled Reefer Trucking

Nationwide pipeline roll-outs are slated to lift natural-gas coverage to 70% by 2030, underpinning 1,000 LNG fueling points that offer refrigerated fleets fuel cost savings near 20% against diesel and carbon cuts near 25% for long hauls. Gujarat and Rajasthan already deploy LNG corridors on export-heavy routes, while Maharashtra's grape and onion exporters gain from steadier line-haul temperatures. Indian Oil's target of 50 LNG retail sites by 2025 shortens refueling gaps and accelerates reefer conversion programs. Lower maintenance expenses from cleaner combustion add 30-40% life-cycle savings for fleet owners, supplying further tailwinds to the India cold chain logistics market adoption curves.

Government-Subsidized Bulk-Cold-Storage Schemes

Under the PM Kisan Sampada Yojana, 394 sanctioned projects aim to curb the 25-30% post-harvest losses in fruit and vegetables by building standardized hubs. The National Centre for Cold-chain Development provides engineering templates that unify pack-house and transport specs, improving interoperability across the India cold chain logistics market. Subsidies close funding gaps in smaller agri-states, but execution rests on local grid reliability and operator training, prompting public-private tie-ups for solar-backup retrofits.

Power-Grid Instability in Tier-2/3 Cities

Cold stores outside metro hubs confront frequent outages that trigger diesel genset reliance, lifting energy spends by 18-22% and risking temperature excursions that jeopardize perishable value. Solar-powered prototypes in Assam sustain 4-10 °C for 30 hours, but upfront costs deter adoption among smallholders. Long-term grid modernization remains pivotal to rural cold chain viability.

Other drivers and restraints analyzed in the detailed report include:

- Pharma Biologics & Vaccine Pipeline Expansion

- E-Grocery Last-mile Refrigerated Demand

- Fragmented Ownership of Small Warehouses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated storage retains 40.62% India cold chain logistics market share in 2025, owing to historically siloed investments in bulk agri commodities, and it still attracts PM Kisan Sampada grants for capacity additions. Road haulage underpins 80% of refrigerated transportation lanes, but Dedicated Freight Corridors promise modal shifts that can curb dwell times. Value-added services, from barcoded labeling to kitting, are forecast to outperform at a 5.22% CAGR through 2031 as omnichannel retailers seek single-window solutions. Operators such as Snowman Logistics now position multi-client chambers adjacent to integration desks that handle QA audits and pallet reconsolidation, bolstering cross-dock velocity.

Demand for comprehensive offerings also sparks hybrid public-private depot models that split shell investment from 3PL management contracts, letting smaller farmers tap upgraded facilities without upfront capital. Rail-enabled reefer containers by CONCOR reach eastern fishery hubs, shrinking spoilage and expanding the reach of the India cold chain logistics market size for marine exports. Air-cargo corridors stay niche, accounting for less than 2% of volumes, yet remain indispensable for high-value biologics dispatches to Europe and North America. As retailers link WMS platforms directly to warehouse temperature logs, service providers monetize data analytics dashboards that optimize SKU rotation and cut energy peaks.

The India Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, and Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, and Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, and More), Region (North India, South India, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Snowman Logistics Ltd

- ColdEx Logistics Pvt Ltd

- TCI Express Ltd

- DHL Supply Chain India

- Mahindra Logistics Ltd

- Gubba Cold Storage Ltd

- Cold Star Logistics Pvt Ltd

- CONCOR Cold Chain Logistics

- Crystal Logistics Cool Chain Ltd

- R. K. Foodland Pvt Ltd

- Indraprastha Cold Storage

- Arihant Cold Storage

- Godamwale

- Siddhi Cold Chain

- Coldrush Logistics

- Coldman Warehousing & Distribution

- Indicold Private Limited

- GK Cold Chain Solutions

- Transworld

- CEVA Logistics (Stellar Value Chain Solutions Pvt Ltd)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urbanisation-linked Food-service Boom

- 4.2.2 Government-subsidised Bulk-Cold-Storage Schemes

- 4.2.3 Pharma Biologics & Vaccine Pipeline Expansion

- 4.2.4 E-grocery Last-mile Refrigerated Demand

- 4.2.5 AI-optimised Route & Load Planning Adoption

- 4.2.6 Green-Energy-Based Reefer Fleets

- 4.3 Market Restraints

- 4.3.1 Power-grid Instability in Tier-2/3 Cities

- 4.3.2 Fragmented Ownership of Small Warehouses

- 4.3.3 Reefer-truck Driver Shortage

- 4.3.4 High Import Duty on High-efficiency Compressors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5 °C)

- 5.2.2 Frozen (-18-0 °C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20 °C)

- 5.3 By Application

- 5.3.1 Fruits & Vegetables

- 5.3.2 Meat & Poultry

- 5.3.3 Fish & Seafood

- 5.3.4 Dairy & Frozen Desserts

- 5.3.5 Bakery & Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals & Biologics

- 5.3.8 Vaccines & Clinical Trial Materials

- 5.3.9 Chemicals & Specialty Materials

- 5.3.10 Other Perishables

- 5.4 By Region

- 5.4.1 North India

- 5.4.1.1 Delhi-NCR

- 5.4.1.2 Punjab

- 5.4.1.3 Haryana

- 5.4.1.4 Others

- 5.4.2 South India

- 5.4.2.1 Karnataka

- 5.4.2.2 Tamil Nadu

- 5.4.2.3 Telangana

- 5.4.2.4 Others

- 5.4.3 West India

- 5.4.3.1 Maharashtra

- 5.4.3.2 Gujarat

- 5.4.3.3 Others

- 5.4.4 East India

- 5.4.4.1 West Bengal

- 5.4.4.2 Odisha

- 5.4.4.3 Others

- 5.4.5 Central India

- 5.4.5.1 Madhya Pradesh

- 5.4.5.2 Chhattisgarh

- 5.4.1 North India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Snowman Logistics Ltd

- 6.4.2 ColdEx Logistics Pvt Ltd

- 6.4.3 TCI Express Ltd

- 6.4.4 DHL Supply Chain India

- 6.4.5 Mahindra Logistics Ltd

- 6.4.6 Gubba Cold Storage Ltd

- 6.4.7 Cold Star Logistics Pvt Ltd

- 6.4.8 CONCOR Cold Chain Logistics

- 6.4.9 Crystal Logistics Cool Chain Ltd

- 6.4.10 R. K. Foodland Pvt Ltd

- 6.4.11 Indraprastha Cold Storage

- 6.4.12 Arihant Cold Storage

- 6.4.13 Godamwale

- 6.4.14 Siddhi Cold Chain

- 6.4.15 Coldrush Logistics

- 6.4.16 Coldman Warehousing & Distribution

- 6.4.17 Indicold Private Limited

- 6.4.18 GK Cold Chain Solutions

- 6.4.19 Transworld

- 6.4.20 CEVA Logistics (Stellar Value Chain Solutions Pvt Ltd)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment