PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910947

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910947

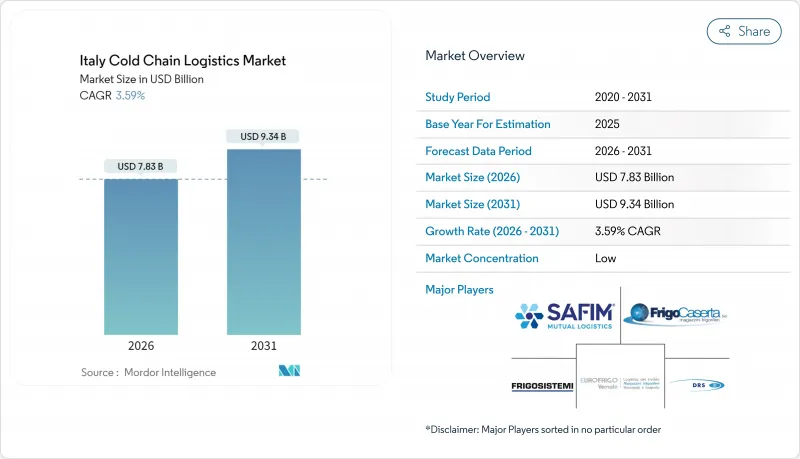

Italy Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Italy Cold Chain Logistics Market size in 2026 is estimated at USD 7.83 billion, growing from 2025 value of USD 7.56 billion with 2031 projections showing USD 9.34 billion, growing at 3.59% CAGR over 2026-2031.

Maturation creates steady rather than spectacular gains, yet structural shifts toward life-science distribution, e-commerce grocery fulfillment, and carbon-neutral operations sustain investment momentum. Profitability hinges on the ability to blunt energy inflation through renewable power and to deploy automation that counters labor shortages. Competitive intensity is rising as international providers deepen Italian footprints through acquisitions, while domestic specialists leverage local relationships to retain high-margin contracts. Technology-led transparency has become table stakes, with real-time IoT monitoring and AI-guided routing now common across the Italy cold chain logistics market.

Italy Cold Chain Logistics Market Trends and Insights

E-commerce Grocery Fulfillment

Rapid penetration of online grocery has pushed retailers to build last-mile refrigerated capacity, raising premium demand for reliable temperature integrity. Poste Italiane and DHL rolled out 10,000 parcel lockers in 2024, many equipped to keep fresh food below 5 °C until customer pickup. Lockers shorten dwell times and cut failed-delivery costs, encouraging further network densification. Retailers such as MD and Everli integrate same-day delivery promises tied to cold chain guarantees. Logistics providers monetize value-added services, notably pre-sorting and consolidated micro-hub staging. Urban congestion rules now favor electric refrigerated vans, nudging fleet renewal toward zero-emission models.

Convenience Food Demand

Changing lifestyles have lifted household spending on ready-to-eat meals and frozen snacks, which depend on end-to-end cold integrity. Promotional activity in grocery reached 24.3% of sales in 2024, with fresh and frozen ranges leading the uplift. DACHSER's Italian unit scaled throughput by acquiring Muller Fresh Food Logistics, ensuring peak-season capacity. Retailer Esselunga allocated USD 252 million for logistics upgrades in 2024 to keep service levels high during promotional cycles. As convenience formats broaden, order sizes fragment, intensifying drop density challenges. Automation at cross-docks now sorts mixed-temperature pallets in minutes, extending shelf life while trimming picking errors.

High Energy & Fuel Price Volatility

Average business electricity bills climbed 24% and gas 27% in 2025, making refrigeration a cost flashpoint. Operators with 24/7 blast freezers suffer amplified exposure, eroding margins on fixed-price contracts. Some mitigate by hedging futures and installing rooftop photovoltaics that cover 15-25% of load. Others pilot hydrogen-ready chillers, although capex remains high. Price uncertainty stalls smaller carriers' fleet-renewal plans, potentially tightening capacity during peak seasons.

Other drivers and restraints analyzed in the detailed report include:

- Biopharma Cold Chain Expansion

- Horticulture & Seafood Exports

- Driver & Warehouse Labor Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated storage represented 50.55% of the Italy cold chain logistics market size in 2025, underscoring the capital barrier that shelters incumbents. Operators enlarge capacity near Milan and Rome to exploit consolidation demand from grocery and pharma shippers. Growth favors multi-temperature campuses integrating cross-dock zones, pick-to-light modules, and pharma-grade clean rooms. Value-added services, including kitting, labeling, and GDP documentation, are advancing at a 3.78% CAGR, outpacing basic transport. Providers monetize regulatory expertise as audits tighten under EU GDP updates effective 2025. Refrigerated transportation keeps stable volume, yet decarbonization rules mandate fleet turnover toward electric vans inside low-emission zones. Rail disruptions caused by line upgrades through 2025 redirect some freight to road, temporarily boosting trucking yields while elevating CO2 intensity. Sea-air multimodal solutions capture niche pharma demand seeking time-temperature integrity with lower emissions than full airfreight.

A wave of mergers signals consolidation. Lineage Logistics absorbed local warehouse chains, while MARR builds new platforms in Lazio and Puglia to serve hospitality corridors. Investors chase steady rent yields, prompting REIT entry into cold storage. Automation spend rises, covering pallet shuttles, AS/RS cranes, and digital twins for energy modeling. Providers embedding AI in inventory planning lower spoilage and free up 5-7% more usable space, defending margins despite rising electricity tariffs.

The Italy Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, Bakery & Confectionery, and More), and Geography (Italy). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Safim Logistics

- Frigocaserta Srl

- Eurofrigo Vernate Srl

- Frigoscandia SpA

- DRS Depositi Regionali Surgelati Srl

- Frigogel Srl

- Soluzioni Logistiche Freddo Srl

- Sodele Magazzini Generali Frigoriferi Srl

- Horigel Srl

- Fridocks General Warehouses & Frigoriferi Srl

- Lineage Logistics

- Mazzocco Srl

- Stef Italia

- DHL Supply Chain

- Kuehne + Nagel CoolCare Ital

- DSV

- CEVA Logistics

- Gruppo Marconi Logistica Integrata

- Trans Isole S.r.l.

- Linofrigo Trasporti Srl

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce growth in temperature-sensitive grocery

- 4.2.2 Rising demand for fresh and frozen convenience foods

- 4.2.3 Expansion of biopharma cold chain (vaccines & biologics)

- 4.2.4 Export-oriented horticulture and seafood volumes

- 4.2.5 Online pharmacy and direct-to-patient delivery surge

- 4.2.6 Adoption of carbon-neutral refrigeration solutions

- 4.3 Market Restraints

- 4.3.1 High energy and fuel price volatility

- 4.3.2 Shortage of qualified drivers and warehouse labour

- 4.3.3 Complex EU/Italian food-safety and GDP compliance

- 4.3.4 Scarcity of urban micro-fulfilment cold hubs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Emission Standards & EU Green Deal Targets

- 4.9 Impact of COVID-19 and Geo-Political Events

5 Market Size & Growth Forecasts

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5°C)

- 5.2.2 Frozen (-18-0°C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20°C)

- 5.3 By Application

- 5.3.1 Fruits & Vegetables

- 5.3.2 Meat & Poultry

- 5.3.3 Fish & Seafood

- 5.3.4 Dairy & Frozen Desserts

- 5.3.5 Bakery & Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals & Biologics

- 5.3.8 Vaccines & Clinical Trial Materials

- 5.3.9 Chemicals & Specialty Materials

- 5.3.10 Other Perishables

- 5.4 By Italian Region (Value)

- 5.4.1 Northern Italy

- 5.4.2 Central Italy

- 5.4.3 Southern Italy

- 5.4.4 Islands (Sicily & Sardinia)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Safim Logistics

- 6.4.2 Frigocaserta Srl

- 6.4.3 Eurofrigo Vernate Srl

- 6.4.4 Frigoscandia SpA

- 6.4.5 DRS Depositi Regionali Surgelati Srl

- 6.4.6 Frigogel Srl

- 6.4.7 Soluzioni Logistiche Freddo Srl

- 6.4.8 Sodele Magazzini Generali Frigoriferi Srl

- 6.4.9 Horigel Srl

- 6.4.10 Fridocks General Warehouses & Frigoriferi Srl

- 6.4.11 Lineage Logistics

- 6.4.12 Mazzocco Srl

- 6.4.13 Stef Italia

- 6.4.14 DHL Supply Chain

- 6.4.15 Kuehne + Nagel CoolCare Ital

- 6.4.16 DSV

- 6.4.17 CEVA Logistics

- 6.4.18 Gruppo Marconi Logistica Integrata

- 6.4.19 Trans Isole S.r.l.

- 6.4.20 Linofrigo Trasporti Srl

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment