PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907297

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907297

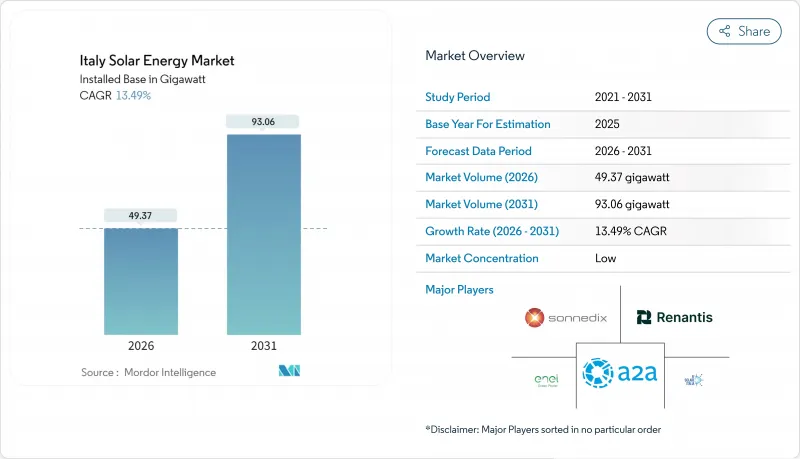

Italy Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Italy Solar Energy Market size in terms of installed base was valued at 43.5 gigawatt in 2025 and estimated to grow from 49.37 gigawatt in 2026 to reach 93.06 gigawatt by 2031, at a CAGR of 13.49% during the forecast period (2026-2031).

Lowered levelized cost of electricity, the European Union's REPowerEU mandate, and Italy's PNIEC 2030 target combine to provide developers with long-range visibility, while abundant capital inflows sustain momentum even as subsidies taper. Utility-scale projects now achieve an average LCOE of below EUR 0.040/kWh in sunny southern provinces, outperforming gas-fired generation at every hour of the day. Corporate power-purchase agreements (PPAs) worth EUR 2.8 billion were signed in 2024 alone, indicating that large manufacturers view fixed-price solar contracts as a hedge against commodity volatility. At the household level, the Superbonus incentive is spurring residential demand, although its upcoming phase-down creates urgency that may prompt front-loading of installations into 2025.

Italy Solar Energy Market Trends and Insights

Declining LCOE of PV Electricity

Italy's average solar LCOE fell to EUR 0.045/kWh in 2024, marking the first instance of subsidy-free parity with conventional generation. Module efficiencies reached 22.5% for mainstream crystalline panels, and standardized racking further trimmed balance-of-system expenses. Southern utility projects now deliver LCOE as low as EUR 0.040/kWh, pushing gas peakers into residual duty. Domestic inverter maker Fimer introduced 99.2% efficiency string models that reduce conversion losses, locking in cost reductions that are likely to deepen through 2027.

EU REPowerEU & PNIEC 2030 Targets

Brussels raised Italy's 2030 solar obligation to 85 GW, nearly doubling the earlier PNIEC figure and incorporating quarterly compliance reviews that maintain political focus. Rome earmarked EUR 6.9 billion in PNRR funds, with 60% dedicated to southern solar build-out. Regional "green corridors" have reduced permit cycles for sites exceeding 50 MW from 24 months to approximately 8 months, while new commercial buildings over 1,000 m2 are required to install rooftop systems, creating an assured demand pipeline.

Grid Saturation & Lengthy Permitting

Northern grids face 23 GW of queued projects, which delays connections by up to two years and increases interconnection fees to EUR 80,000/MW in hotspots. Terna's EUR 18 billion expansion plan is still ramping. Developers must navigate 14 approvals; environmental impact assessments alone can take up to 12 months. Fast-track rules for sub-10 MW plants ease pressure but do little for the large farms that dominate new capacity.

Other drivers and restraints analyzed in the detailed report include:

- Corporate-PPA Boom Among Italian Industrials

- Residential "Superbonus" & Tax-Credit Schemes

- Phase-down of Superbonus Incentives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PV installations accounted for 99.97% of total additions in 2025, driven by mature supply chains and the ease of rooftop siting. Concentrated solar power, though scarcely 0.02 GW today, is accelerating at a 104.7% CAGR and could supply evening peaks with six-hour molten-salt storage. Sicily's high direct normal irradiance, exceeding 2,000 kWh/m2/year, enables CSP to dispatch at fixed tariffs that rival those of gas units, and the EU taxonomy favors its grid-firming traits. Enel Green Power's hybrid CSP-PV blueprint pairs up-front PV yields with stored thermal output after dusk, a template that could reshape baseload renewables.

The Italy solar energy market size for CSP remains modest, yet favorable debt terms under green bonds lower capital cost. Independent power producers secure 25-year feed-in contracts that cover both electricity and "capacity-like" availability payments, improving risk-adjusted returns. A policy requiring >=50 MW projects to demonstrate grid-support services implicitly rewards thermal storage, nudging developers toward CSPs' dispatchable profile. Medium-term growth thus hinges less on technology risk than on how quickly component suppliers can scale specialized receivers and salts.

The Italy Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Grid Type (On-Grid and Off-Grid), and End-User (Utility-Scale, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Enel Green Power S.p.A.

- EF Solare Italia S.p.A.

- Sonnedix Power Holdings Ltd

- Renantis S.p.A. (ex-Falck Renewables)

- A2A S.p.A.

- Acea S.p.A.

- Gruppo STG S.r.l.

- Peimar S.r.l.

- SunPower Corporation

- SunEdison Inc.

- Canadian Solar Inc.

- JinkoSolar Holding Co., Ltd.

- Trina Solar Co., Ltd.

- SMA Solar Technology AG

- Fimer S.p.A.

- TerniEnergia S.p.A.

- Sorgenia S.p.A.

- Saras S.p.A. (Sardeolica)

- NextEnergy Capital Group

- Engie Italia S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining LCOE of PV Electricity

- 4.2.2 EU REPowerEU & PNIEC 2030 Targets

- 4.2.3 Corporate-PPA Boom Among Italian Industrials

- 4.2.4 Residential "Superbonus" & Tax-credit Schemes

- 4.2.5 Agrivoltaics Enhancing Dual-Use Land Value

- 4.2.6 Behind-the-Meter Storage Cost Parity with PV

- 4.3 Market Restraints

- 4.3.1 Grid Saturation & Lengthy Permitting

- 4.3.2 Phase-down of Superbonus Incentives

- 4.3.3 Restrictions on Ground-mount PV on Farmland

- 4.3.4 Local Opposition & Landscape-Protection Rules

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecast

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Grid Type

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By End-User

- 5.3.1 Utility-Scale

- 5.3.2 Commercial and Industrial (C&I)

- 5.3.3 Residential

- 5.4 By Component (Qualitative Analysis)

- 5.4.1 Solar Modules/Panels

- 5.4.2 Inverters (String, Central, Micro)

- 5.4.3 Mounting and Tracking Systems

- 5.4.4 Balance-of-System and Electricals

- 5.4.5 Energy Storage and Hybrid Integration

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Enel Green Power S.p.A.

- 6.4.2 EF Solare Italia S.p.A.

- 6.4.3 Sonnedix Power Holdings Ltd

- 6.4.4 Renantis S.p.A. (ex-Falck Renewables)

- 6.4.5 A2A S.p.A.

- 6.4.6 Acea S.p.A.

- 6.4.7 Gruppo STG S.r.l.

- 6.4.8 Peimar S.r.l.

- 6.4.9 SunPower Corporation

- 6.4.10 SunEdison Inc.

- 6.4.11 Canadian Solar Inc.

- 6.4.12 JinkoSolar Holding Co., Ltd.

- 6.4.13 Trina Solar Co., Ltd.

- 6.4.14 SMA Solar Technology AG

- 6.4.15 Fimer S.p.A.

- 6.4.16 TerniEnergia S.p.A.

- 6.4.17 Sorgenia S.p.A.

- 6.4.18 Saras S.p.A. (Sardeolica)

- 6.4.19 NextEnergy Capital Group

- 6.4.20 Engie Italia S.p.A.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment