PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907260

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907260

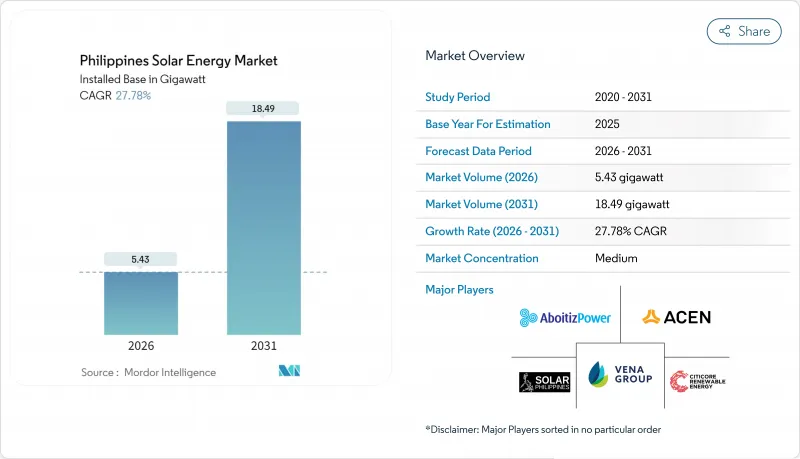

Philippines Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Philippines Solar Energy Market is expected to grow from 4.25 gigawatt in 2025 to 5.43 gigawatt in 2026 and is forecast to reach 18.49 gigawatt by 2031 at 27.78% CAGR over 2026-2031.

Declining module and balance-of-system costs have driven the levelized cost of utility-scale solar down to USD 0.044 per kWh, making new photovoltaic capacity the least-cost choice for meeting baseload demand. Strong demand from hyperscale data centers and business-process outsourcing firms is accelerating hybrid solar-plus-storage projects that guarantee 24/7 clean power. Meanwhile, the Department of Energy's Green Energy Auction Program (GEAP) has awarded 10.2 GW of capacity in its fourth round, pushing the national development pipeline above 36 GW. Floating solar on Laguna Lake and irrigation reservoirs is emerging as a land-neutral alternative, and reforms that lifted the net-metering ceiling from 100 kW to 1 MW are expected to unlock commercial and industrial rooftops.

Philippines Solar Energy Market Trends and Insights

Rapid Decline in PV Module & BOS Costs

Global utility-scale solar leveledized costs fell to USD 0.044 /kWh in 2023, a 90% drop since 2010, slashing capital outlays for every Philippine project.Local firms now receive price quotes under USD 0.19 /W for Tier-1 modules, widening project margins and spurring Sol-Go to locate assembly lines in the country. Balance-of-system spending, historically 75% of Asian solar budgets, is becoming a new domestic value-add avenue, with metal frame, inverter, and cable manufacturers repositioning for export. This cost trajectory raises the competitive standing of the Philippines' solar energy market against imported LNG and legacy coal, accelerating utility procurement and corporate PPAs. Over the medium term, it also underpins a nascent local manufacturing base that could supply 3-5 GW of modules annually by 2030, further anchoring the supply chain.

Green Energy Auctions (GEAP) Unlocking >=1 GW Solar Pipeline from 2025

The Department of Energy's competitive tender model replaces static feed-in tariffs with price discovery, awarding 1 GW of solar in its inaugural round and setting a 9,378 MW target for the fourth auction that includes solar-storage hybrids. Developer appetite remains robust, GEA-3 drew 7,500 MW of solar bids for a 4,650 MW cap, compressing tariffs and ensuring 20-year off-take certainty. Auction-linked PPAs lower financing risk, enabling lenders to trim spreads and developers to stretch capacity factors with storage add-ons. The integration of mandatory battery systems from GEA-4 onwards signals policy maturation toward grid-friendly renewables that can address midday curtailment. Collectively, auctions move the Philippines' solar energy market toward predictable build-out cycles and transparent cost benchmarks.

Weak Grid Capacity in Visayas-Mindanao Corridor

Only 6 of 16 priority transmission projects were completed by 2023, delaying the PHP 52 billion Mindanao-Visayas backbone by three years.Bottlenecks restrict solar additions south of Luzon, compelling developers to cluster where interconnection is available and leaving ample irradiance unexploited. The Transmission Development Plan 2022-2040 maps expansions, but execution lags grid demand. Until high-voltage lines catch up, project pipelines will stay skewed toward Luzon.

Other drivers and restraints analyzed in the detailed report include:

- Corporate PPAs by Hyperscalers & BPOs Demanding 24/7 Clean Power

- DOE Net-Metering Reform Lifting 100 kW Cap to 1 MW (2024)

- High Financing Costs vs Vietnam & Malaysia (>=9% WACC)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar photovoltaic accounted for the entire 2025 installation base, reinforcing a Philippines solar energy market share of 100.00%. High-efficiency n-type i-TOPCon and bifacial modules lift output and cut land needs, helping the Philippines' solar energy market size for PV rise at a 27.78% CAGR. CSP remains commercially non-viable due to land scarcity and typhoons, and the DOE master plan allocates no targets for the technology.

The market's equipment shift toward string inverters and hybrid PV-plus-storage architectures improves uptime and meets 24/7 procurement clauses in corporate PPAs. Terra Solar's 3.5 GW PV and 4.5 GWh storage confirm this hybrid trend, locking in long-duration supply contracts with hyperscalers.

The Philippines Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Grid Type (On-Grid and Off-Grid), and End-User (Utility-Scale, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Solar Philippines Power Project Holdings

- ACEN Corp.

- Vena Energy

- Citicore Power Inc.

- Aboitiz Power Corp.

- Solenergy Systems Inc.

- SunAsia Energy

- Helios Solar Energy Corp.

- Cleantech Global Renewables

- Trina Solar Ltd.

- Canadian Solar

- JinkoSolar

- First Gen Corp.

- Meralco PowerGen (MGen)

- Shell Pilipinas - Solar

- TotalEnergies - Solar

- NextGen Power

- Enfinity Global

- Rizal Wind-Solar Energy Corp.

- Greenergy Holdings

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid decline in PV module & BOS costs

- 4.2.2 Green energy auctions (GEAP) unlocking >=1 GW solar pipeline from 2025

- 4.2.3 Corporate PPAs by hyperscalers & BPOs demanding 24/7 clean power

- 4.2.4 DOE net-metering reform lifting 100 kW cap to 1 MW (2024)

- 4.2.5 Floating-solar deployment on irrigation reservoirs (National Irrigation Admin MoU)

- 4.2.6 ASEAN-wide carbon border adjustment pressure on export manufacturers

- 4.3 Market Restraints

- 4.3.1 Weak grid capacity in Visayas-Mindanao corridor

- 4.3.2 High financing costs vs. Vietnam & Malaysia (>=9 % WACC)

- 4.3.3 Land-acquisition disputes under CARP agrarian rules

- 4.3.4 Typhoon-related O&M disruptions raising LCOE by ~4 %

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Grid Type

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By End-User

- 5.3.1 Utility-Scale

- 5.3.2 Commercial and Industrial (C&I)

- 5.3.3 Residential

- 5.4 By Component (Qualitative Analysis)

- 5.4.1 Solar Modules/Panels

- 5.4.2 Inverters (String, Central, Micro)

- 5.4.3 Mounting and Tracking Systems

- 5.4.4 Balance-of-System and Electricals

- 5.4.5 Energy Storage and Hybrid Integration

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Solar Philippines Power Project Holdings

- 6.4.2 ACEN Corp.

- 6.4.3 Vena Energy

- 6.4.4 Citicore Power Inc.

- 6.4.5 Aboitiz Power Corp.

- 6.4.6 Solenergy Systems Inc.

- 6.4.7 SunAsia Energy

- 6.4.8 Helios Solar Energy Corp.

- 6.4.9 Cleantech Global Renewables

- 6.4.10 Trina Solar Ltd.

- 6.4.11 Canadian Solar

- 6.4.12 JinkoSolar

- 6.4.13 First Gen Corp.

- 6.4.14 Meralco PowerGen (MGen)

- 6.4.15 Shell Pilipinas - Solar

- 6.4.16 TotalEnergies - Solar

- 6.4.17 NextGen Power

- 6.4.18 Enfinity Global

- 6.4.19 Rizal Wind-Solar Energy Corp.

- 6.4.20 Greenergy Holdings

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment