PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910864

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910864

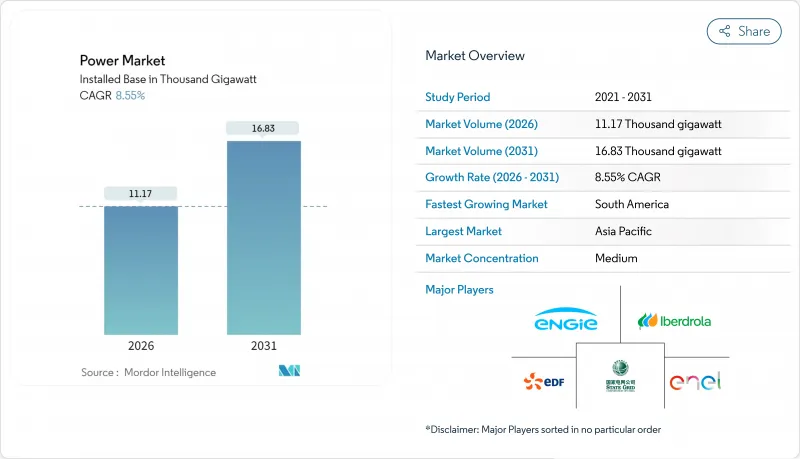

Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Power Market was valued at 10.29 Thousand gigawatt in 2025 and estimated to grow from 11.17 Thousand gigawatt in 2026 to reach 16.83 Thousand gigawatt by 2031, at a CAGR of 8.55% during the forecast period (2026-2031).

Capacity growth stems from spiraling electricity demand created by data-center build-outs, industrial electrification, and early green-hydrogen uptake. Renewables account for nearly half of all new capacity and benefit from steep battery-storage cost declines that unlock multi-hour grid flexibility. Sovereign wealth and pension funds continue to channel USD 180 billion each year into high-voltage grid upgrades, tightening competition in the transmission segment. At the same time, grid bottlenecks and slow permitting threaten to stall 23% of approved clean-energy projects, exposing a mismatch between generation ambitions and infrastructure readiness.

Global Power Market Trends and Insights

Explosive Data-Center Electricity Demand Surge

Data centers consumed 460 TWh in 2024, equaling Argentina's entire annual load and representing 2% of world electricity. Average hyperscale campuses now draw 100-200 MW of continuous power, forcing utilities to renegotiate interconnection rules and fast-track substation upgrades. Corporate buyers contracted 23.7 GW of clean energy in 2024 as tech giants sidestepped traditional utility supply models to secure 24/7 renewables. Virginia's "data-center alley" already absorbs 25% of statewide generation, prompting regulators to revise capacity-market participation rules [PJM.com]. These concentrated loads heighten voltage-stability risk and drive premium capacity-contract pricing that flows through to retail tariffs. The global power market is therefore recalibrating around localized baseload spikes that were uncommon a decade ago.

Electrification of Industrial Heat & Transport

Electric arc furnaces captured 73% of new steel capacity in 2024, and heat pumps displaced natural gas in 40% of European industrial heating retrofits. On the mobility side, 14.1 million EVs added 85 TWh of net demand yet supplied 280 GWh of vehicle-to-grid storage that helped shave evening peaks. Nordic grids illustrate the convergence: synchronized EV charging and industrial heat-pump cycles create time-bundled consumption spikes that are balanced through granular tariff signals and AI-based dispatch. Aluminum smelters and chemical complexes are already relocating to wind-rich zones to capture cheap, firmed renewable power, locking in 15-20-year offtakes that underpin local transmission expansion. As similar patterns echo worldwide, the global power market anticipates sustained 15-20% rises in industrial consumption that call for USD 45 billion of annual distribution hardening.

Grid Bottlenecks & Permitting Delays

Transmission constraints sidelined 127 GW of shovel-ready renewables in 2024, translating into a USD 340 billion investment backlog. U.S. interconnection queues ballooned to 2,600 GW, five times the present grid capacity, with average study cycles extending 5.2 years. European cross-border lines ran at 95% utilization during windy hours, forcing 47 TWh of curtailment, particularly in Spain and Germany. Policymakers reacted by capping review periods to 12 months for pre-zoned projects under the EU Net-Zero Industry Act, yet community opposition still delays one in four HVDC builds. If unaddressed, these chokepoints could undercut the global power market's decarbonization pathway by deferring capital and eroding investor confidence.

Other drivers and restraints analyzed in the detailed report include:

- Government Clean-Energy Subsidy Waves

- Rapid Cost Decline in Utility-Scale Battery Storage

- Critical-Mineral Supply-Chain Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Renewables commanded 47.95% of 2025 installed capacity and are scaling at 13.70% CAGR through 2031, underpinned by a record 346 GW of new solar and 116 GW of wind commissioned during the year. Solar photovoltaics, cheaper than marginal gas in most regions, dominate daytime supply and compress peak-price spreads. Wind plays the complementary role during evening hours, though integration challenges rise as variable output surpasses 30% of national mixes in 15 countries. Offshore wind, growing at a 23.10% CAGR, captures deep-water sites through floating foundations, accelerating uptake in Japan, South Korea, and California. Simultaneously, nuclear restarts and small modular reactor pilots add a nascent but strategic avenue for firm, low-carbon generation that can anchor industrial heat contracts. Coal and oil plants continue to retire or retrofit; 47 GW of coal capacity announced hydrogen co-firing conversions in 2024, though commercial viability remains tied to carbon prices above USD 80 per ton.

High renewable penetration tilts planning toward flexibility assets. Grid operators worldwide will require USD 2.8 trillion in cumulative investment for batteries, pumped-hydro, demand response, and expanded interconnectors over 2026-2031. Battery storage integration softens solar midday oversupply, while cross-border HVDC links move surplus wind to load centers. As these levers scale, the global power market embeds resilience through diversified resource stacks rather than single-fuel dominance. The renewables boom, therefore, redefines capital allocation, regulatory frameworks, and merchant-price formation across global electricity systems.

The Power Market Report is Segmented by Power Source (Thermal, Nuclear, and Renewables) and End-User (Utilities, Commercial and Industrial, and Residential), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

Geography Analysis

Asia-Pacific led the global power market with 44.20% capacity share in 2025, anchored by China's 1,411 GW fleet and India's 425 GW. China commissioned 216 GW of new renewables during the year, more than Germany's installed base, yet also added 47 GW of coal to safeguard grid inertia. India, by contrast, balances solar ambition with regional battery tenders that target 50 GWh of storage by 2026. Japan and South Korea lean on offshore wind and advanced nuclear to curb imported-fuel dependence; Japan intends to reach 45 GW of offshore turbines by 2040, while South Korea experiments with 12 GW of floating solar. The region's integration strain remains high, with renewable curtailment surpassing 8.2% in northwest China due to limited transmission, underscoring the urgency of interprovincial HVDC lines.

South America emerged as the fastest-expanding slice of the global power market at 15.10% CAGR, propelled by green-hydrogen hubs in Chile and lithium-driven grid storage demand in Argentina and Brazil. Brazil boasts 195 GW of installed capacity, leveraging low-cost wind and hydro to decarbonize mining and agriculture. Chile's Atacama solar boom supplies both mining loads and hydrogen export terminals, achieving sub-USD 30/MWh levelized costs. Beyond renewables, Argentina's Vaca Muerta shale gas underpins firm capacity additions that stabilize an increasingly variable generation fleet. Cross-border interconnectors, including the Andes-Pacific HVDC, unlock regional trade that optimizes hydropower between wet and dry seasons.

Europe sustained 22.80% of global capacity in 2025, concentrating on flexibility and energy-security upgrades after the 2022 gas crisis. Germany installed 17 GW of renewables while leaning on Nordic hydro and French nuclear imports to balance frequency. The United Kingdom added 3.2 GW of offshore wind, cementing its leadership in floating foundations. Yet mature grids confront rising saturation; negative-price hours proliferate, storage economics improve, and wholesale markets scramble to reconfigure settlement periods to five minutes. North America and the Middle East & Africa lag in share but represent promising growth. The United States installed 32 GW of renewables in 2024, buoyed by IRA tax credits, and the UAE put 5.6 GW of solar into its 2071 net-zero roadmap. Regional diversification, therefore, buffers the global power market against policy or resource shocks in any single geography.

- State Grid Corporation of China

- Engie SA

- Enel SpA

- Tokyo Electric Power Co. Holdings

- NTPC Ltd

- Dominion Energy

- China Huaneng Group

- Duke Energy

- E.ON SE

- Siemens Energy

- Hitachi Energy

- Electricite de France (EDF)

- Iberdrola SA

- Korea Electric Power Corp. (KEPCO)

- NextEra Energy

- Southern Company

- Exelon Corporation

- China Three Gorges Corp.

- Orsted A/S

- RWE AG

- General Electric Vernova

- Mitsubishi Electric

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive data-center electricity demand surge

- 4.2.2 Electrification of industrial heat & transport

- 4.2.3 Government clean-energy subsidy waves (IRA, REPowerEU, etc.)

- 4.2.4 Rapid cost decline in utility-scale battery storage

- 4.2.5 Cross-border HVDC super-grid build-outs

- 4.2.6 Green-hydrogen electrolyzer build-outs raising baseload demand

- 4.3 Market Restraints

- 4.3.1 Grid bottlenecks & permitting delays

- 4.3.2 Critical-mineral supply-chain volatility

- 4.3.3 Rising renewable curtailment in saturated grids

- 4.3.4 Climate-induced hydropower variability

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Smart Grids, BESS, AI-enabled Dispatch)

- 4.7 Renewable Energy Mix Snapshot (2024)

- 4.8 Installed Power-Generation Capacity Outlook (GW)

- 4.9 Electricity Generation Outlook (TWh)

- 4.10 Primary Energy Consumption Trend (Mtoe)

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Consumers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Power-Generation Source

- 5.1.1 Thermal (Coal, Natural Gas, Oil and Diesel)

- 5.1.2 Nuclear

- 5.1.3 Renewables (Solar, Wind, Hydro, Geothermal, Biomass & Waste, Tidal)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

- 5.3 By T&D Voltage Level (Qualitative Analysis only)

- 5.3.1 High-Voltage Transmission (Above 230 kV)

- 5.3.2 Sub-Transmission (69 to 161 kV)

- 5.3.3 Medium-Voltage Distribution (13.2 to 34.5 kV)

- 5.3.4 Low-Voltage Distribution (Up to 1 kV)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Nordic Countries

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Malaysia

- 5.4.3.6 Thailand

- 5.4.3.7 Indonesia

- 5.4.3.8 Vietnam

- 5.4.3.9 Australia

- 5.4.3.10 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 State Grid Corporation of China

- 6.4.2 Engie SA

- 6.4.3 Enel SpA

- 6.4.4 Tokyo Electric Power Co. Holdings

- 6.4.5 NTPC Ltd

- 6.4.6 Dominion Energy

- 6.4.7 China Huaneng Group

- 6.4.8 Duke Energy

- 6.4.9 E.ON SE

- 6.4.10 Siemens Energy

- 6.4.11 Hitachi Energy

- 6.4.12 Electricite de France (EDF)

- 6.4.13 Iberdrola SA

- 6.4.14 Korea Electric Power Corp. (KEPCO)

- 6.4.15 NextEra Energy

- 6.4.16 Southern Company

- 6.4.17 Exelon Corporation

- 6.4.18 China Three Gorges Corp.

- 6.4.19 Orsted A/S

- 6.4.20 RWE AG

- 6.4.21 General Electric Vernova

- 6.4.22 Mitsubishi Electric

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment