PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911387

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911387

Indonesia Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

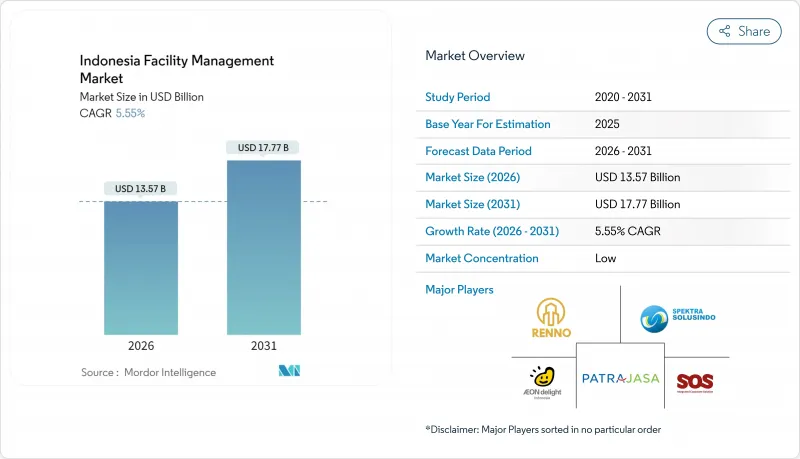

The Indonesia facility management market is expected to grow from USD 12.86 billion in 2025 to USD 13.57 billion in 2026 and is forecast to reach USD 17.77 billion by 2031 at 5.55% CAGR over 2026-2031.

Accelerating urbanisation, a USD 3.17 billion infrastructure financing pipeline, and the government's goal of 8% annual economic expansion are the primary growth catalysts. Commercial real-estate activity in Jakarta and other metros continues to spur demand for integrated services, while industrial investments worth USD 33.2 billion in 2022 amplify requirements for technically specialised support. Outsourcing momentum, the adoption of Internet-of-Things (IoT) platforms, and sustainability-linked mandates are reshaping operating models. Meanwhile, wage inflation, regulatory complexity and an intensifying talent drain put pressure on provider margins. Technology-enabled differentiation and outcome-based contracts therefore emerge as pivotal competitive strategies within the Indonesia facility management market.

Indonesia Facility Management Market Trends and Insights

Urbanisation in Major Metros

Soaring city populations reconfigure the Indonesia facility management market as surging housing, office and transit projects tighten asset-performance requirements. Jakarta's 11.3 million residents intensify pressure on existing stock, while transport-oriented developments raise property values by up to 10 %, triggering demand for advanced maintenance, IoT-based occupancy monitoring and predictive service models. Expatriate inflows heighten service-quality benchmarks, pushing providers toward globally aligned safety, hygiene and digital reporting protocols.

Rising Occupancy Optimisation

Hybrid work policies oblige landlords and tenants to unlock latent floor-space efficiencies. Facility managers deploy sensor networks and analytics platforms that knit occupancy data to HVAC, lighting and security systems, delivering measured energy savings such as the 8.5 % electricity reduction achieved at PT Aspex Kumbong's Bogor plant. Compensation structures are increasingly tied to utilisation outcomes, cementing a data-driven culture across the wider Indonesia facility management market.

Margin Pressure on Leading Firms

Price-sensitive clients and rising wages compress profitability. Sodexo's Q1 2025 facilities-services growth of 2.4 % underscores the trend. A January 2025 VAT rise to 12 % further heightens operating costs, squeezing negotiated rates. Key players counter by automating work-order management, consolidating labour pools and renegotiating contracts toward performance-linked fee structures.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Pipeline Investment

- Labour and Safety Regulation

- Skilled Labour Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard Services held 58.42 % of the Indonesia facility management market share in 2025, driven by infrastructure build-out and stringent safety codes across mega-projects. Mechanical, electrical and plumbing (MEP) work dominates, backed by tropical-climate HVAC demand and stricter emergency-system audits. Asset-management programmes attached to new toll roads, ports and rail corridors underpin stable fee income. Soft Services, forecast to expand 6.78 % annually to 2031, gain momentum as occupants prioritise user experience and hygiene. Security, cleaning and catering providers leverage smart cameras, robotic cleaners and nutritional analytics to improve efficiency and satisfy ESG reporting metrics. Elevated service expectations in healthcare and hospitality amplify premium outsourcing opportunities, gradually rebalancing revenue weightings within the wider Indonesia facility management market.

The Indonesia Facility Management Market Report is Segmented by Service Type (Hard Services, and Soft Services), Offering Type (In-House, and Outsourced), and End-User Industry (Commercial, Hospitality, Institutional and Public Infrastructure, Healthcare, Industrial and Process, and Other End-User Industries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PT. SGS Indonesia (Societe Generale de Surveillance SA (SGS SA))

- OCS Group Holdings Ltd

- PT Shield On Service Tbk (SOS)

- Sodexo Group

- ISS A/S

- PT Patra Jasa

- PT. Spektra Solusindo

- Titan Facility Services

- Astra Property Services

- Angkasa Pura Supports

- Colliers

- Renno Indonesia

- AEON Deligh Indonesia

- Indoservice

- Atalian Global Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labor Participation

- 4.1.4 Facility Management Market Share (%), by Service Type

- 4.1.5 Facility Management Market Share (%), by Hard Services

- 4.1.6 Facility Management Market Share (%), by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in Indonesia's Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Drivers

- 4.2.1 Urbanisation in Major Metros

- 4.2.2 Rising Occupancy Optimisation

- 4.2.3 Infrastructure Pipeline Investment

- 4.2.4 Labour and Safety Regulation

- 4.2.5 Surge in ESG-linked Financing Favoring Green-Certified Facilities

- 4.2.6 Proliferation of Mixed-Use Mega-Developments in Secondary Cities

- 4.3 Market Restraints

- 4.3.1 Margin Pressure on Leading Firms

- 4.3.2 Skilled Labour Shortages

- 4.3.3 Dependency on Imported Building Automation Hardware

- 4.3.4 Fragmented Provincial Regulatory Oversight

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses, etc.)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PT. SGS Indonesia (Societe Generale de Surveillance SA (SGS SA))

- 6.4.2 OCS Group Holdings Ltd

- 6.4.3 PT Shield On Service Tbk (SOS)

- 6.4.4 Sodexo Group

- 6.4.5 ISS A/S

- 6.4.6 PT Patra Jasa

- 6.4.7 PT. Spektra Solusindo

- 6.4.8 Titan Facility Services

- 6.4.9 Astra Property Services

- 6.4.10 Angkasa Pura Supports

- 6.4.11 Colliers

- 6.4.12 Renno Indonesia

- 6.4.13 AEON Deligh Indonesia

- 6.4.14 Indoservice

- 6.4.15 Atalian Global Services

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)