PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911398

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911398

Italy Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

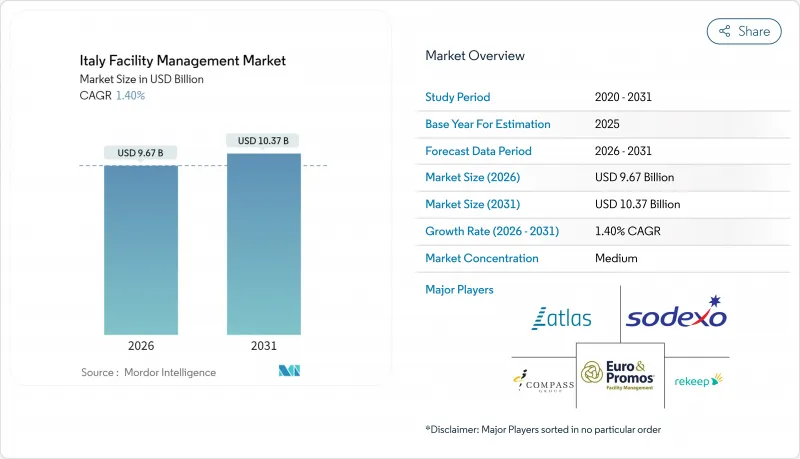

The Italy facility management market is expected to grow from USD 9.54 billion in 2025 to USD 9.67 billion in 2026 and is forecast to reach USD 10.37 billion by 2031 at 1.4% CAGR over 2026-2031.

The measured expansion traced back to the National Recovery and Resilience Plan, the gradual rebound of commercial real estate, and stepped-up demand for integrated contracts despite rising electricity and gas prices. Growing adoption of predictive maintenance, heightened ESG scrutiny from asset owners, and new public-procurement rules all shaped the competitive logic of the Italy facility management market, while technology spending continued to shift toward IoT-enabled HVAC optimisation and remote asset monitoring. The hard-services core of the Italy facility management market retained a strong base in 2024, yet soft-services demand accelerated as tourism led capital inflows back into hotels and luxury resorts. Provider margins came under pressure from labour shortages in northern regions, prompting a shift towards automation and outcome-based contracting models that tie remuneration to measurable building-performance metrics.

Italy Facility Management Market Trends and Insights

Outsourcing Trend Among Public Sector Entities Expanding FM Market

Reduced municipal budgets intensified the outsourcing of non-core activities after the Public Procurement Code (D.Lgs. 36/2023) simplified tendering, enabling municipalities to bundle multiple services under performance-based contracts. The Tuscany region, for instance, awarded a single provider responsibility for 38 museums, demonstrating scalable cultural heritage outsourcing models that trim coordination costs while improving service consistency. Larger frameworks encouraged unified digital platforms and IoT adoption, creating sustained momentum for the Italy facility management market.

Growth of Italy's Tourism and Hospitality Sector Boosts Demand for Soft FM Services

Hotel investments exceeded EUR 2.1 billion(USD 2.4 billion) in 2024-30% above the decade average-prompting resorts in Rome, Venice, and Milan to sharpen focus on high-presence services such as housekeeping, concierge and catering. Average daily rates rose 4% alongside 64.5 million visitor arrivals, spurring providers that could flex capacity with seasonal volatility. Sustainability labels and energy-efficient back-of-house operations emerged as core selection criteria, further propelling technology-driven soft-service offerings and underpinning near-term expansion of the Italy facility management market.

Fragmented Regulatory Framework Across Italian Regions Complicates Compliance Costs

Italy's 20 regions retained discretion over workplace-safety enforcement under D.Lgs. 81/2008, leading to divergent inspection schedules and documentation formats. Efforts to harmonise training through the May 2025 State-Regions agreement progressed unevenly, forcing multi-region FM providers to maintain bespoke compliance teams and dampening cross-border economies of scale. These costs ultimately offset a portion of operating-margin gains in the Italy facility management market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of Integrated Facility Management Contracts for Cost Optimization

- Aging Building Stock Requiring Predictive Maintenance and Retrofit Services

- Rising Costs of Skilled Technical Labor Squeeze FM Provider Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard services held 58.85% of the Italy facility management market share in 2025. Mandatory fire-safety inspections, MEP upgrades, and HVAC retrofits underpinned this dominance, especially within hospital estates that averaged EUR 161.58 per m2 in annual FM outlay. The Italy facility management market size for hard services advanced modestly as compliance-led investment cushioned volume even when discretionary spending softened.

Soft services nonetheless registered a 2.38% CAGR outlook through 2031, buoyed by the revival of luxury tourism and evolving workplace protocols that elevated hygiene, catering, and security standards. Cleaning services captured outsized gains as healthcare and hospitality clients enforced stricter infection-control routines. Digital Twin pilots at the Lazio Region headquarters illustrated how space-optimisation analytics tightened the linkage between environmental quality and occupant experience, giving soft-service providers higher-margin advisory roles.

Italy Facility Management Market is Segmented by Service Type (Hard Service, Soft Service), Offering Type (In-House, Outsourced), End-User Industry (Commercial (IT and Telecom, Retail and Warehouses), Hospitality (Hotels, Eateries and Large-Scale Restaurants), Institutional and Public Infrastructure (Government, Education, Transportation)) and More. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ATLAS I.F.M. SRL

- Sodexo Facilities Management Services (SODEXO GROUP)

- Compass Group PLC

- Euro & Promos Facility Management SPA (EURO & PROMOS)

- Rekeep SpA

- Olly Services SRL

- NAZCA

- Elmet SRL

- Apleona GmbH

- SGI Srl

- CNS Consorzio Nazionale Servizi

- Siram SpA

- BumaQ S.r.l.

- Ares Facility Management

- P&P Spa

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labor Participation

- 4.1.4 Facility Management Market Share (%), by Service Type

- 4.1.5 Facility Management Market Share (%), by Hard Services

- 4.1.6 Facility Management Market Share (%), by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in Italy's Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Drivers

- 4.2.1 Outsourcing Trend Among Public Sector Entities Expanding FM Market

- 4.2.2 Growth of Italy's Tourism and Hospitality Sector Boosts Demand for Soft FM Services

- 4.2.3 Increasing Adoption of Integrated Facility Management Contracts for Cost Optimization

- 4.2.4 Aging Building Stock Requiring Predictive Maintenance and Retrofit Services

- 4.2.5 EU Recovery and Resilience Facility Funds Earmarked for School Renovation Projects Catalyze Regional FM Opportunities

- 4.2.6 Expansion of Data Center Industry in Northern Italy Spurs Specialized Technical FM Demand

- 4.3 Market Restraints

- 4.3.1 Fragmented Regulatory Framework Across Italian Regions Complicates Compliance Costs

- 4.3.2 Rising Costs of Skilled Technical Labor Squeeze FM Provider Margins

- 4.3.3 Slow Roll-out of 5G Infrastructure Delays Smart Building FM Deployments

- 4.3.4 Municipal Budget Constraints Post-COVID Reduce Outsourcing of Public Facility Upkeep in Smaller Cities

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses, etc.)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Government, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ATLAS I.F.M. SRL

- 6.4.2 Sodexo Facilities Management Services (SODEXO GROUP)

- 6.4.3 Compass Group PLC

- 6.4.4 Euro & Promos Facility Management SPA (EURO & PROMOS)

- 6.4.5 Rekeep SpA

- 6.4.6 Olly Services SRL

- 6.4.7 NAZCA

- 6.4.8 Elmet SRL

- 6.4.9 Apleona GmbH

- 6.4.10 SGI Srl

- 6.4.11 CNS Consorzio Nazionale Servizi

- 6.4.12 Siram SpA

- 6.4.13 BumaQ S.r.l.

- 6.4.14 Ares Facility Management

- 6.4.15 P&P Spa

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)