PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911440

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911440

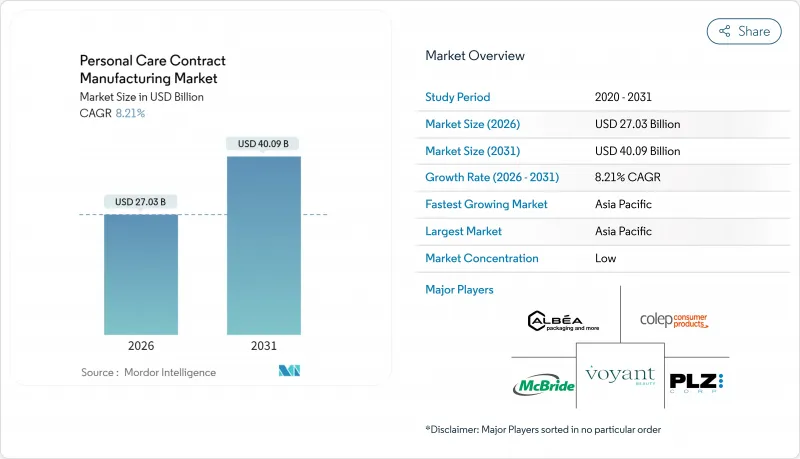

Personal Care Contract Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The personal care contract manufacturing market size in 2026 is estimated at USD 27.03 billion, growing from 2025 value of USD 24.98 billion with 2031 projections showing USD 40.09 billion, growing at 8.21% CAGR over 2026-2031.

A combination of tightening regulatory frameworks, brand-side focus on speed-to-market, and mounting sustainability pressures is steering both global majors and emerging indie labels toward external manufacturing alliances. Outsourcing also mitigates capital risk at a time when inflation and raw-material volatility have elevated the cost of plant upgrades and compliance programs. In parallel, digital formulation tools and modular production systems reduce minimum order quantities, opening the door for niche entrants and private-label retailers. Asia-Pacific's scalable factory base gives the region a cost lead, but reshoring activity in North America and Western Europe is accelerating as brands seek greater supply resilience.

Global Personal Care Contract Manufacturing Market Trends and Insights

Evolution of Service Offerings Enables Outsourcing Focus

Contract manufacturers are evolving into end-to-end solution partners that blend GMP production, regulatory filing, digital batch tracking, and sustainability consulting within a single contract. Enhanced capabilities create a one-stop ecosystem that allows beauty houses to concentrate resources on brand building and channel strategy. The forthcoming December 2025 GMP deadline under the U.S. MoCRA law has intensified demand for partners already operating FDA-ready lines. Full-service providers report rising inquiries from medium-sized North American brands eager to outsource compliance paperwork, stability testing, and safety substantiation. Larger manufacturers have responded by expanding peptide, biotech, and fermentation expertise through technology licensing from ingredient innovators. The convergence of compliance depth and formulation breadth is shifting the value proposition away from unit-cost calculation toward holistic risk sharing within the personal care contract manufacturing market.

Localization of Manufacturing for Lead-Time and Cost Advantage

Geopolitical friction, container shortages, and elevated freight costs have shortened acceptable lead times, driving procurement teams to re-map supply chains toward regional hubs. New investments in the United States, Poland, and Mexico emphasize modular clean-room design, allowing quick format changeovers for color-cosmetics or peel-off masks. Brands cite inventory holding reductions of up to 25 days when production sits inside the target customs zone. Localization also circumvents divergent rules on organic certification, allergen disclosure, and extended producer responsibility for packaging. Firms that operate dual-continent footprints now capture multi-year commitments from prestige clients seeking geographic diversification inside the personal care contract manufacturing market.

Stringent Regulatory and Counterfeit Concerns

Full enforcement of MoCRA begins December 2025, obliging every cosmetics facility that ships into the United States to register, list products, and maintain adverse-event files. Non-compliance triggers refusal of entry, civil penalties, or product seizure.Parallel rules in the EU boost traceability through digital product passports. Contract manufacturers shoulder significant audit, documentation, and serialization costs, especially when serving cross-border brand portfolios. Adding to the compliance load, counterfeit proliferation drives brands to demand tamper-evident seals and blockchain-based batch verification. Smaller factories lacking capital for such systems face exit risks, tightening capacity but curbing supplier diversity in the personal care contract manufacturing market.

Other drivers and restraints analyzed in the detailed report include:

- Surge of Indie/DTC Brands Outsourcing Production

- Demand for Organic and Natural Formulations

- Raw-Material Price and Supply-Chain Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing services captured 81.78% of the personal care contract manufacturing market in 2025, reflecting brands' core need for scalable, GMP-compliant production lines. The segment benefits from multi-shift utilization, automated filling, and economies of raw-material scale that individual labels cannot afford. Forecast expansion at 12.10% annually shows that even as digital formulating gains traction, physical output remains the capacity bottleneck. Turnkey providers bundle formulation, microbiological testing, and secondary packaging, enabling a single purchase order from ideation to warehouse gate. This integration locks in longer contracts and elevates switching costs for brand owners.

R&D and formulation services, although a smaller revenue slice, serve as a pipeline magnet. Early-stage engagements secure later manufacturing awards once pilots move to commercial scale, capturing lifetime value. Contract development arms now run solvent-less emulsification, green chemistry screening, and accelerated stability protocols, improving hit rates. Fee-for-service models convert to margin-rich unit production, reinforcing the service-led moat inside the personal care contract manufacturing market.

Skin care dominated with 35.05% personal care contract manufacturing market share in 2025, anchored by multi-step routines that spur cleanser, serum, and sunscreen rotations. The category's appetite for actives such as retinoids, ceramides, and probiotics commands fermentation tanks and clean-room environments, aligning with contract manufacturers that already hold relevant certifications. Bags-on-valve and airless pumps extend shelf stability, adding engineering complexity that favors specialized fillers.

Hair care races ahead at a 14.12% CAGR, propelled by scalp-health awareness, textured-hair inclusivity, and biotech-based bond-repair claims. Brands require emulsifiers that keep viscosity stable across climates, pushing contract partners to validate rheology at multiple humidity points. Professional salon crossover SKUs add high-margin volumes, intensifying demand for precise batch reproducibility within the personal care contract manufacturing market size at segment level. Down the stack, color cosmetics, fragrance, and deodorants preserve steady demand, absorbing filler capacity during off-peak skin-care cycles.

The Personal Care Contract Manufacturing Market Report is Segmented by Service Type (R&D and Formulation, Manufacturing, and More), Product Type (Skin Care, Hair Care, Color Cosmetics, and More), Packaging Format (Aerosols, Bottles and Jars, Tubes and Sachets, Pumps and Dispensers, and More), Contract Manufacturing Model (OEM, ODM, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 37.92% of the personal care contract manufacturing market in 2025 and is projected to grow 13.78% annually through 2031. China, South Korea, and Thailand host dense supplier ecosystems ranging from surfactant plants to pump-molder clusters. Shanghai's new 2,500-square-meter consumer-brand R&D center enables rapid prototype-to-production handoff, strengthening local supply resilience. Regional governments grant tax credits for advanced automation and export promotion, further lowering per-unit costs. Vietnam's domestic cosmetics turnover topping VND 45,000 billion in 2024 underscores rising intra-Asia demand that backfills any Western order softness.

North America is a mature yet strategically vital pocket for the personal care contract manufacturing market. MoCRA compliance deadlines create a compliance moat for FDA-registered factories, driving volume toward established operators. Brands appreciate domestic lead-time savings and ESG transparency when using U.S. or Canadian fillers. Incentives at state level-such as workforce grants and property-tax abatements-offset higher wage costs. New production wings in North Carolina illustrate the re-shoring play, targeting indie labels that value proximity for shorter concept reviews.

Europe balances tight regulation with premium positioning. The bloc's recyclable-packaging mandate spurs investment in refill pod assembly and mono-material componentry. A EUR 11 million Spanish facility featuring photovoltaic power showcases how energy-positive plants can still deliver unit-cost competitiveness. German and French labs focus on blue-biotech actives and microbiome-safe preservatives, cementing the region's technical reputation. Elsewhere, Latin America and the Middle East post mid-single-digit gains off small bases, leveraging growing middle-class demand and government import-substitution policies to attract capacity, though supply-chain maturity still lags leading regions.

- Fareva Group

- KDC/ONE (Knowlton Development Corp.)

- Intercos S.p.A

- Kolmar Korea Co., Ltd.

- McBride plc

- Albea Services S.A.S

- PLZ Corp

- Voyant Beauty LLC

- Maesa

- Cosmetic Solutions LLC

- Colep Consumer Products

- Powerpack Cosmetics

- H.S.A. S.p.A

- Clarion Cosmetics

- CoValence Laboratories

- Ancorotti Cosmetics

- Tropical Products Inc.

- Virospack

- HCT Group

- Vistta Cosmetics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Evolution of service offerings enables outsourcing focus

- 4.2.2 Localization of manufacturing for lead-time and cost advantage

- 4.2.3 Surge of indie/DTC brands outsourcing production

- 4.2.4 Demand for organic and natural formulations

- 4.2.5 AI-driven rapid formulation platforms

- 4.2.6 Refillable-packaging mandates requiring specialized CM

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory and counterfeit concerns

- 4.3.2 Raw-material price and supply-chain volatility

- 4.3.3 In-house capacity expansion by mega beauty brands

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 R&D and Formulation

- 5.1.2 Manufacturing

- 5.1.3 Packaging and Allied Services

- 5.1.4 Turnkey / Full-Service Manufacturing

- 5.2 By Product Type

- 5.2.1 Skin Care

- 5.2.2 Hair Care

- 5.2.3 Color Cosmetics

- 5.2.4 Fragrance and Deodorants

- 5.2.5 Oral Care

- 5.2.6 Other Product Type

- 5.3 By Packaging Format

- 5.3.1 Aerosols

- 5.3.2 Bottles and Jars

- 5.3.3 Tubes and Sachets

- 5.3.4 Pumps and Dispensers

- 5.3.5 Sticks and Roll-ons

- 5.3.6 Other Packaging Format

- 5.4 By Contract Manufacturing Model

- 5.4.1 OEM

- 5.4.2 ODM

- 5.4.3 OBM / Private Label

- 5.4.4 Toll Manufacturing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Fareva Group

- 6.4.2 KDC/ONE (Knowlton Development Corp.)

- 6.4.3 Intercos S.p.A

- 6.4.4 Kolmar Korea Co., Ltd.

- 6.4.5 McBride plc

- 6.4.6 Albea Services S.A.S

- 6.4.7 PLZ Corp

- 6.4.8 Voyant Beauty LLC

- 6.4.9 Maesa

- 6.4.10 Cosmetic Solutions LLC

- 6.4.11 Colep Consumer Products

- 6.4.12 Powerpack Cosmetics

- 6.4.13 H.S.A. S.p.A

- 6.4.14 Clarion Cosmetics

- 6.4.15 CoValence Laboratories

- 6.4.16 Ancorotti Cosmetics

- 6.4.17 Tropical Products Inc.

- 6.4.18 Virospack

- 6.4.19 HCT Group

- 6.4.20 Vistta Cosmetics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment