PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911705

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911705

North America Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

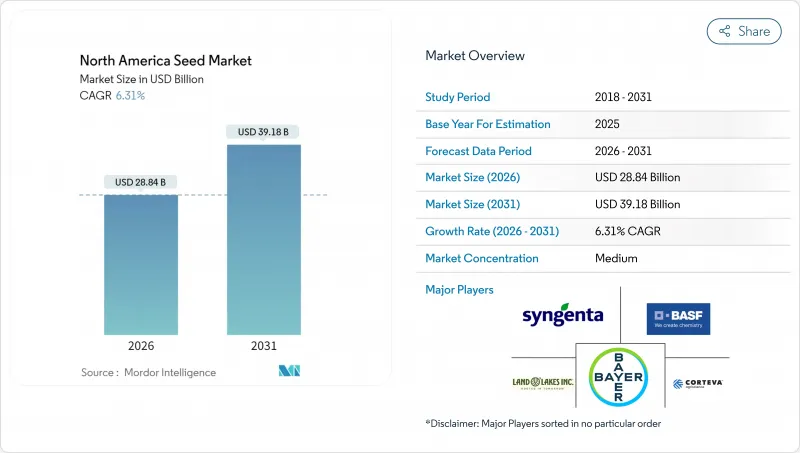

The North America seed market was valued at USD 27.13 billion in 2025 and estimated to grow from USD 28.84 billion in 2026 to reach USD 39.18 billion by 2031, at a CAGR of 6.31% during the forecast period (2026-2031).

This growth trajectory reflects the region's position as a global agricultural powerhouse, where technological innovation intersects with regulatory frameworks to drive seed adoption across diverse cropping systems. The market's expansion is anchored by precision agriculture integration, which enables variable-rate seeding technologies that optimize hybrid selection based on field-specific conditions, fundamentally altering how growers approach seed purchasing decisions. The regulatory environment presents both opportunities and constraints, with the United States Department of Agriculture - Animal and Plant Health Inspection Service (USDA-APHIS) approval processes creating bottlenecks for trait commercialization while simultaneously validating safety profiles that support farmer adoption. Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) enable gene editing, offering pathways to accelerate variety development timelines, though the Food and Drug Administration (FDA) labeling guidance uncertainties continue to influence investment allocation decisions across breeding programs. Carbon credit integration represents an emerging revenue model where seed companies bundle low-tillage varieties with carbon sequestration contracts, creating additional value streams that differentiate products beyond traditional yield metrics.

North America Seed Market Trends and Insights

Yield Gains from Next-Generation Transgenic Hybrids

Trait stacking underpins a new productivity curve. RNAi-enabled corn lines deliver 2-3 bushels per acre above today's leading options, and the United States Department of Agriculture (USDA) analyses attribute 22% cumulative yield improvement in United States corn since biotech adoption began in 1996 . Premium pricing is tolerated because the yield delta shields grower margins even under variable commodity prices. Multi-mode insect protection also curbs refuge needs, keeping field operations simpler. Regulatory oversight remains stringent, yet once approvals are secured, stacked hybrids enjoy de facto exclusivity until the next trait wave arrives.

Regulatory Push for Biofuel Feedstock Acreage

The United States Environmental Protection Agency Renewable Volume Obligations fix a 15 billion-gallon conventional biofuel floor, anchoring corn demand, while Canada's Clean Fuel Regulations impose a 3.5% carbon-intensity cut by 2030 . Seed companies translate these mandates into higher-starch corn and high-oil soybean pipelines. Policy certainty lengthens investment horizons, allowing breeders to pursue multi-year projects without fearing sudden demand swings. State-level low-carbon fuel standards in California and Washington add regional premiums that reward verified trait packages supporting no-till practices and carbon accounting.

Trait-Stack Approval Bottlenecks

The United States Department of Agriculture - Animal and Plant Health Inspection Service (USDA-APHIS) is vetting more than 200 biotech petitions, and complex stacks can wait a decade for clearance. Patent clocks keep ticking, squeezing commercial exclusivity. Smaller firms struggle with the regulatory cost burden, reinforcing incumbent dominance. Parallel CFIA reviews add paperwork but rarely diverge in outcome, so companies must synchronize filings to avoid out-of-phase launches that leave Canadian dealers short of new genetics.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Herbicide-Tolerant Traits

- CRISPR-Enabled Drought-Tolerant Germplasm

- Consolidation-Driven Channel Conflict

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid lines generated 81.05% of the North America seed market share in 2025. Superior yield stability and uniformity drive this share, while transgenic hybrids climb at 6.86% CAGR on the back of stacked herbicide and insect traits. Open-pollinated varieties persist in organic farming and niche vegetable production, where the benefits of genetic purity and seed saving outweigh the advantages of heterosis. Non-GMO hybrids satisfy premium export channels seeking trait-free corn and soy, giving breeders monetization routes on both sides of the biotech divide.

Seed firms channel roughly 60% of research and development spend into hybrid development, attracted by defensible intellectual property and reliable replacement cycles. Trait integration platforms shorten turnaround by layering CRISPR edits onto elite lines, enabling a continuous refresh without wholesale genetic replacement. The concentration of hybrid production in the Midwest optimizes logistics and quality assurance, reinforcing regional cost advantages.

The North America Seed Market Report is Segmented by Breeding Technology (Hybrids, and More), Cultivation Mechanism (Open Field and Protected Cultivation), Crop Type (Row Crops, Vegetables, and More), and Geography (Canada, Mexico, United States, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Corteva Agriscience

- Bayer AG

- Land O'Lakes, Inc.

- Syngenta Group

- BASF SE

- KWS SAAT SE & Co. KGaA

- Sakata Seed Corporation

- Groupe Limagrain Holding S.A.

- FMC Corporation

- DLF A/S

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- Enza Zaden Holding B.V.

- Beck's Superior Hybrids, Inc.

- Stine Seed Company

- GROWMARK, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 EXECUTIVE SUMMARY & KEY FINDINGS

3 REPORT OFFERS

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.1.2 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Alfalfa & Cotton

- 4.2.2 Cucumber & Cabbage

- 4.2.3 Rice & Corn

- 4.2.4 Tomato & Onion

- 4.2.5 Wheat & Soybean

- 4.3 Breeding Techniques

- 4.3.1 Row Crops & Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain and Distribution Channel Analysis

- 4.6 Market Drivers

- 4.6.1 Yield Gains from Next-Generation Transgenic Hybrids

- 4.6.2 Regulatory Push for Biofuel Feedstock Acreage

- 4.6.3 Rapid Adoption of Herbicide-Tolerant Traits

- 4.6.4 Expansion of Precision Agriculture Seed Prescriptions

- 4.6.5 Carbon-Credit Revenue Models for Seed Growers

- 4.6.6 CRISPR-Enabled Drought-Tolerant Germplasm

- 4.7 Market Restraints

- 4.7.1 Trait-Stack Approval Bottlenecks

- 4.7.2 Consolidation-Driven Channel Conflict

- 4.7.3 Gene-Editing Labeling Uncertainties

- 4.7.4 On-Farm Seed Saving in Pulses and Forage

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Insect Resistant Hybrids

- 5.1.1.2.3 Other Traits

- 5.1.2 Open Pollinated Varieties and Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Type

- 5.3.1 Row Crops

- 5.3.1.1 Fiber Crops

- 5.3.1.1.1 Cotton

- 5.3.1.1.2 Other Fiber Crops

- 5.3.1.2 Forage Crops

- 5.3.1.2.1 Alfalfa

- 5.3.1.2.2 Forage Corn

- 5.3.1.2.3 Forage Sorghum

- 5.3.1.2.4 Other Forage Crops

- 5.3.1.3 Grains & Cereals

- 5.3.1.3.1 Corn

- 5.3.1.3.2 Rice

- 5.3.1.3.3 Sorghum

- 5.3.1.3.4 Wheat

- 5.3.1.3.5 Other Grains & Cereals

- 5.3.1.4 Oilseeds

- 5.3.1.4.1 Canola, Rapeseed & Mustard

- 5.3.1.4.2 Soybean

- 5.3.1.4.3 Sunflower

- 5.3.1.4.4 Other Oilseeds

- 5.3.1.5 Pulses

- 5.3.1.5.1 Pulses

- 5.3.1.1 Fiber Crops

- 5.3.2 Vegetables

- 5.3.2.1 Brassicas

- 5.3.2.1.1 Cabbage

- 5.3.2.1.2 Cauliflower & Broccoli

- 5.3.2.1.3 Other Brassicas

- 5.3.2.2 Cucurbits

- 5.3.2.2.1 Cucumber & Gherkin

- 5.3.2.2.2 Pumpkin & Squash

- 5.3.2.2.3 Other Cucurbits

- 5.3.2.3 Roots & Bulbs

- 5.3.2.3.1 Garlic

- 5.3.2.3.2 Onion

- 5.3.2.3.3 Potato

- 5.3.2.3.4 Other Roots & Bulbs

- 5.3.2.4 Solanaceae

- 5.3.2.4.1 Chilli

- 5.3.2.4.2 Eggplant

- 5.3.2.4.3 Tomato

- 5.3.2.4.4 Other Solanaceae

- 5.3.2.5 Unclassified Vegetables

- 5.3.2.5.1 Asparagus

- 5.3.2.5.2 Lettuce

- 5.3.2.5.3 Okra

- 5.3.2.5.4 Peas

- 5.3.2.5.5 Spinach

- 5.3.2.5.6 Carrot

- 5.3.2.5.7 Other Unclassified Vegetables

- 5.3.2.1 Brassicas

- 5.3.1 Row Crops

- 5.4 Geography

- 5.4.1 Canada

- 5.4.2 Mexico

- 5.4.3 United States

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 6.4.1 Corteva Agriscience

- 6.4.2 Bayer AG

- 6.4.3 Land O'Lakes, Inc.

- 6.4.4 Syngenta Group

- 6.4.5 BASF SE

- 6.4.6 KWS SAAT SE & Co. KGaA

- 6.4.7 Sakata Seed Corporation

- 6.4.8 Groupe Limagrain Holding S.A.

- 6.4.9 FMC Corporation

- 6.4.10 DLF A/S

- 6.4.11 Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- 6.4.12 Enza Zaden Holding B.V.

- 6.4.13 Beck's Superior Hybrids, Inc.

- 6.4.14 Stine Seed Company

- 6.4.15 GROWMARK, Inc.

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS