PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911707

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911707

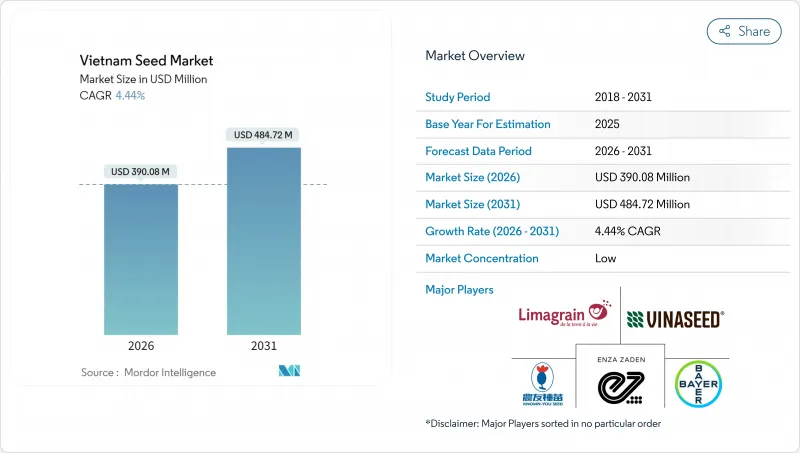

Vietnam Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Vietnam seed market is expected to grow from USD 373.5 million in 2025 to USD 390.08 million in 2026 and is forecast to reach USD 484.72 million by 2031 at 4.44% CAGR over 2026-2031.

Continued momentum in rice exports, vegetable demand, and climate-smart cultivation keeps the Vietnam seed market on a moderate expansion path. At the same time, technology alliances accelerate varietal innovation and data-centric farm management. Private capital inflows, digital certification platforms, and government incentives for certified seed adoption propel formal market channels, yet counterfeits, R&D cost burdens, and fragmented smallholder structures temper growth prospects. Companies respond by widening hybrid portfolios, tightening quality control, and forging research pacts with global institutes to tailor high-performing seeds for domestic ecologies and strict export specifications.

Vietnam Seed Market Trends and Insights

Government Subsidies for Certified Seeds

Targeted incentives under Decision 2151/QD-BNN-VP and the "One Million Hectares" low-emission rice program reimburse part of seed costs and fund traceability platforms that enhance farmer trust in certified lots. Subsidies cover up to 50% of premium seed prices for smallholders, lifting certified seed penetration in northern provinces above 70% while the Mekong Delta still trails near 40%. Digital tagging via quick response codes lets inspectors verify origin and germination data in real time, reducing loopholes that once enabled counterfeit trade. Vinaseed cites 45% higher farmer incomes from protected rice varieties compared with conventional lines, reinforcing willingness to purchase newer seeds.

Export-led Demand Growth for Vegetables and Rice

Agricultural exports generated USD 62.5 billion in 2024, including a historical 9 million metric tons rice shipment that motivates seed selection for milling yield, uniformity, and residue compliance. Vegetable seed orders soar for tomato, cucumber, and sweet pepper hybrids suited to climate-controlled tunnels that guarantee consistent color and size demanded by supermarkets in Japan and the European Union. Upcoming EU Deforestation Regulation further nudges exporters toward traceable seed sources that enable end-to-end carbon reporting.

Counterfeit Seeds and Informal Distribution Networks

Unofficial trading channels distribute mislabeled paddy and maize seeds, often with germination rates falling significantly below acceptable standards, which undermines farmer confidence and reduces the likelihood of repeat purchases. While blockchain tagging pilots have shown potential to address these issues by ensuring traceability and authenticity, their success largely depends on the widespread adoption of smartphones among farmers and the willingness of dealers to comply with the new system.

Other drivers and restraints analyzed in the detailed report include:

- Hybrid and GM Seed Adoption for Yield Gains

- Expansion of Protected Cultivation Acreage

- High R&D Cost and GMO Approval Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Open-pollinated varieties and hybrid derivatives held 55.30% of the Vietnam seed market share in 2025, while hybrid seeds are projected to expand at a 4.38% CAGR through 2031, signaling a gradual pivot away from traditional open-pollinated cultivars. The Vietnam seed market size for hybrids is poised to scale alongside rising export quality thresholds. Rice hybrids with cytoplasmic male sterility and two-line systems gain traction due to labor savings in seed multiplication, while triple-stacked corn hybrids integrate insect resistance and herbicide tolerance traits suited for mechanized Red River Delta farms.

Breeders leverage doubled haploid acceleration and genomic selection to trim development time from eight seasons to four, allowing quicker response to climate shocks. Vinaseed targets a 37% gross profit contribution from hybrid rice, corn, and vegetable seeds by 2027, aided by BAAS (Banking as a Service) germplasm exchange. Meanwhile, non-transgenic hybrids dominate adoption because they slot into existing regulatory pathways and consumer acceptance thresholds, yet precision-bred gene-edited variants are queued for release once biosafety guidelines clarify commercialization routes.

The Vietnam Seed Market Report is Segmented by Breeding Technology (Hybrids, Open-Pollinated Varieties and Hybrid Derivatives), Cultivation Mechanism (Open Field and Protected Cultivation), and Crop Type (Row Crops and Vegetables). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Vietnam National Seed Group (Vinaseed)

- East-West Seed

- Syngenta Group

- Bayer AG

- Groupe Limagrain

- Corteva Agriscience

- Advanta Seeds (UPL Ltd)

- DCM Shriram Ltd - Bioseed (DCM Shriram Group)

- Rijk Zwaan

- Enza Zaden

- Sakata Seed Corporation

- Takii and Co. Ltd

- Bejo Zaden BV

- Known You Seed Co. LTD

- Loc Troi Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.1.2 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Cucumber and Asparagus

- 4.2.2 Rice and Corn

- 4.2.3 Tomato and Cabbage

- 4.3 Breeding Techniques

- 4.3.1 Row Crops and Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain and Distribution Channel Analysis

- 4.6 Market Drivers

- 4.6.1 Government subsidies for certified seeds

- 4.6.2 Export-led demand growth for vegetables and rice

- 4.6.3 Hybrid and GM seed adoption for yield gains

- 4.6.4 Expansion of protected cultivation acreage

- 4.6.5 Foreign equity inflows after seed-sector liberalization

- 4.6.6 Climate-resilient rice varieties for Mekong Delta salinity

- 4.7 Market Restraints

- 4.7.1 Counterfeit seeds and informal distribution networks

- 4.7.2 High R&D cost and GMO approval delays

- 4.7.3 Farmer reliance on farm-saved seeds in upland areas

- 4.7.4 Poor cold-chain logistics for vegetable seeds

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Insect Resistant Hybrids

- 5.1.2 Open Pollinated Varieties and Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Type

- 5.3.1 Row Crops

- 5.3.1.1 Fiber Crops

- 5.3.1.1.1 Cotton

- 5.3.1.1.2 Other Fiber Crops

- 5.3.1.2 Forage Crops

- 5.3.1.2.1 Alfalfa

- 5.3.1.2.2 Forage Corn

- 5.3.1.2.3 Other Forage Crops

- 5.3.1.3 Grains and Cereals

- 5.3.1.3.1 Corn

- 5.3.1.3.2 Rice

- 5.3.1.3.3 Other Grains and Cereals

- 5.3.1.4 Oilseeds

- 5.3.1.4.1 Canola, Rapeseed and Mustard

- 5.3.1.4.2 Soybean

- 5.3.1.4.3 Other Oilseeds

- 5.3.1.5 Pulses

- 5.3.1.1 Fiber Crops

- 5.3.2 Vegetables

- 5.3.2.1 Brassicas

- 5.3.2.1.1 Cabbage

- 5.3.2.1.2 Carrot

- 5.3.2.1.3 Cauliflower and Broccoli

- 5.3.2.1.4 Other Brassicas

- 5.3.2.2 Cucurbits

- 5.3.2.2.1 Cucumber and Gherkin

- 5.3.2.2.2 Pumpkin and Squash

- 5.3.2.2.3 Other Cucurbits

- 5.3.2.3 Roots and Bulbs

- 5.3.2.3.1 Garlic

- 5.3.2.3.2 Onion

- 5.3.2.3.3 Potato

- 5.3.2.3.4 Other Roots and Bulbs

- 5.3.2.4 Solanaceae

- 5.3.2.4.1 Chilli

- 5.3.2.4.2 Eggplant

- 5.3.2.4.3 Tomato

- 5.3.2.4.4 Other Solanaceae

- 5.3.2.5 Unclassified Vegetables

- 5.3.2.5.1 Asparagus

- 5.3.2.5.2 Spinach

- 5.3.2.5.3 Other Unclassified Vegetables

- 5.3.2.1 Brassicas

- 5.3.1 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Vietnam National Seed Group (Vinaseed)

- 6.4.2 East-West Seed

- 6.4.3 Syngenta Group

- 6.4.4 Bayer AG

- 6.4.5 Groupe Limagrain

- 6.4.6 Corteva Agriscience

- 6.4.7 Advanta Seeds (UPL Ltd)

- 6.4.8 DCM Shriram Ltd - Bioseed (DCM Shriram Group)

- 6.4.9 Rijk Zwaan

- 6.4.10 Enza Zaden

- 6.4.11 Sakata Seed Corporation

- 6.4.12 Takii and Co. Ltd

- 6.4.13 Bejo Zaden BV

- 6.4.14 Known You Seed Co. LTD

- 6.4.15 Loc Troi Group

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS