PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934595

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934595

China Cosmetic Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

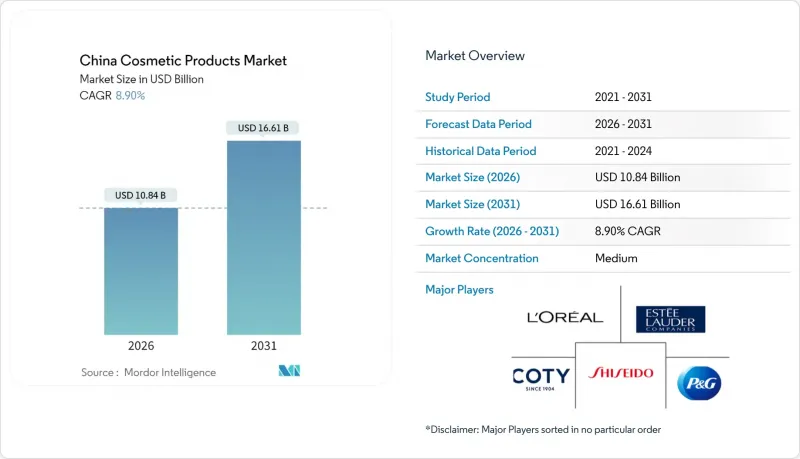

The China cosmetic products market was valued at USD 9.95 billion in 2025 and estimated to grow from USD 10.84 billion in 2026 to reach USD 16.61 billion by 2031, at a CAGR of 8.9% during the forecast period (2026-2031).

This growth is driven by enhanced digital engagement, rising incomes in smaller cities, and regulatory initiatives aimed at improving product standards. Increasing disposable incomes, particularly among the middle class, are enabling more consumers to purchase premium beauty and personal care products. Consumers are demonstrating a growing willingness to invest in skincare, makeup, and personal grooming. The premiumization trend is gaining momentum as consumers prioritize efficacy, safety, and brand authenticity. Online channels are leading growth, with live-stream commerce and short-video platforms converting social media impressions into rapid purchases and facilitating record-speed new product launches.

China Cosmetic Products Market Trends and Insights

Influence of social media platforms

The widespread adoption of smartphones has significantly enhanced the functionality and accessibility of social media. In December 2024, mobile phone shipments in China rose by 22.1% year-on-year, reaching approximately 34.53 million units, as reported by the China Academy of Information and Communications Technology (CAICT) . Live-streaming and short-video platforms have transformed into comprehensive storefronts with integrated checkout systems. Consumers now spend an average of 8 hours per week on social networks, with nearly 10% of domestic e-commerce orders originating from live-stream sessions. Influencers with millions of followers frequently drive product sell-outs within hours of launch. In response, beauty brands are increasingly investing in collaborations with Key Opinion Leaders (KOLs) and leveraging real-time analytics. This approach ensures that creative assets remain aligned with rapidly changing internet trends. As a result, a feedback loop is established, enabling data-driven product adjustments to effectively capture market sentiment and guide subsequent launches. This strategy not only accelerates innovation cycles but also strengthens brand loyalty.

Surge in premium facial products

China's premium cosmetics market is set for substantial growth, with a projected CAGR of 10.64% from 2025 to 2030. This growth is primarily driven by a significant consumer shift toward natural ingredients, avoiding synthetic additives. Both mainstream and private-label brands are adapting to this trend, aligning their product offerings with the increasing demand for ethical and eco-friendly cosmetics. As disposable incomes rise, Chinese consumers are demonstrating a greater willingness to invest in premium products. In 2024, China's per capita disposable income reached CNY 41,314, reflecting a 5.3% increase compared to the previous year, according to the National Bureau of Statistics of China . Renowned brands such as Estee Lauder, Lancome, and Chanel, along with domestic high-end lines like Perfect Diary's premium offerings, are becoming more accessible. The segment's growth is further supported by leading players employing effective digital strategies to strengthen their online presence. Collaborations with influencers are increasingly prevalent, enhancing brand visibility and expanding consumer reach for both domestic and international beauty brands.

Consumer concerns over product safety and ingredients

Regulatory compliance has become a critical differentiator in China's cosmetic products market. The implementation of the Cosmetic Supervision and Administration Regulation (CSAR) has established higher standards for product safety and ingredient transparency. CSAR provides a comprehensive framework for managing cosmetic products, encompassing stringent pre-market and post-market oversight, efficacy evaluations, and safety assessments. Chinese consumers are increasingly prioritizing product formulations, with a strong focus on ingredient safety and associated risks. Brands that effectively communicate their safety standards and ingredient benefits are gaining a competitive advantage, while those failing to meet these expectations face swift consumer backlash and increased regulatory scrutiny.

Other drivers and restraints analyzed in the detailed report include:

- Consumer focus on anti-aging products drives the growth

- Adoption of K-beauty and J-beauty cosmetic products

- Complex supply chain management

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, facial cosmetics led the Chinese cosmetic products market, capturing 50.92% of the market share. This reflects the increasing focus on daily skincare routines and the growing popularity of multi-step regimens. Chinese consumers are increasingly adopting serums, toners, and masks that offer benefits such as hydration, brightening, and repair. Additionally, social media campaigns and hashtags play a significant role in educating consumers about these skincare practices. Domestic brands are leveraging traditional medicine by incorporating ingredients like ginseng, angelica, and snow mushroom to create differentiated products. Moreover, the lip and nail makeup segment is growing at the fastest rate in the market, with a projected CAGR of 9.95% through 2031. This growth is driven by the rising culture of self-expression, advancements in long-lasting pigments, and the popularity of hybrid products such as tinted lip balms with SPF.

The rapid growth of the lip and nail segment is further supported by live-stream haul formats, where influencers quickly showcase multiple shades, encouraging real-time purchasing decisions. Meanwhile, facial cosmetics are advancing with innovations such as booster ampoules, microbiome-friendly moisturizers, and artificial intelligence-powered skin mapping that enables personalized product bundles. In response to these trends, multinational companies are establishing local innovation centers to accelerate product development and adapt textures to regional climates and diverse skin types. These factors ensure that the China cosmetic products market remains dynamic, continuously evolving with emerging micro-trends.

In 2025, mass lines contributed 69.12% of sales, driven by extensive distribution networks, competitive pricing strategies, and increased awareness of entry-level grooming products. Their penetration into lower-tier cities and rural areas strengthens the daily essentials market, offering products such as cleansing gels, basic moisturizers, and cost-effective lip colors. However, premium SKUs are projected to grow at a 10.1% CAGR through 2031, surpassing the overall market growth rate. This trend highlights the willingness of urban millennials and Gen Z consumers to invest in high-quality textures, patented active ingredients, and sophisticated brand narratives. Live-commerce platforms emphasize ingredient sourcing and clinical claims, enhancing perceived value and boosting average basket sizes.

Retailers are adopting tiered shelf strategies, combining mini-sized prestige creams with mass-market cleansers during promotional campaigns to gradually encourage up-trading among loyal customers. Cashback programs on super apps foster repeat purchases, while loyalty data enables hyper-personalized notifications. International luxury brands are focusing on niche categories such as couture makeup, while emerging Chinese prestige brands leverage culturally resonant storytelling. This dual approach supports volume growth in mainstream products and margin expansion in premium lines, diversifying revenue streams within China's cosmetic products market.

The China Cosmetic Products Market Report is Segmented by Product Type (Facial Cosmetics, Eye Cosmetics, and Lip and Nail Make-Up Products), Category (Mass and Premium), Ingredient Type (Natural/Organic and Conventional/Synthetic), and Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Online Retail Stores, and Other Channels). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- L'Oreal

- Procter & Gamble Co.

- Estee Lauder Companies Inc.

- Shiseido Company Ltd.

- Amorepacific Corp.

- Unilever PLC

- Coty Inc.

- Kao Corp.

- Yatsen Holding Perfect Diary

- Johnson & Johnson Consumer Health

- LVMH Moet Hennessy Louis Vuitton (Parfums & Cosmetics)

- Shanghai Jahwa United Co. Ltd.

- Shanghai Pechoin Daily Chemical

- Proya Cosmetics

- CHICMAX Group

- Guangdong Marubi Biotechnology

- Mary Kay (China) Co. Ltd.

- Henkel AG & Co. KGaA (Schwarzkopf)

- Beiersdorf AG

- Florasis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Influence of social media platforms

- 4.2.2 Surge in premium facial products

- 4.2.3 Consumer focus on anti-aging products

- 4.2.4 Adoption of K-beauty and J-beauty cosmetic products

- 4.2.5 Rising disposable income boosts cosmetic purchases

- 4.2.6 Increased urbanization drives demand for cosmetics

- 4.3 Market Restraints

- 4.3.1 Consumer concerns over product safety and ingredients

- 4.3.2 Complex supply chain management

- 4.3.3 Stringent regulatory environment limits growth

- 4.3.4 High competition among domestic and international brands

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Facial Cosmetics

- 5.1.2 Eye Cosmetics

- 5.1.3 Lip and Nail Make-up Products

- 5.2 By Category

- 5.2.1 Premium

- 5.2.2 Mass

- 5.3 By Ingredient Type

- 5.3.1 Natural/Organic

- 5.3.2 Conventional/Synthetic

- 5.4 By Distribution Channel

- 5.4.1 Specialty Stores

- 5.4.2 Supermarkets/Hypermarkets

- 5.4.3 Online Retail Stores

- 5.4.4 Other Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share for key companies, Products, and Recent Developments)

- 6.4.1 L'Oreal

- 6.4.2 Procter & Gamble Co.

- 6.4.3 Estee Lauder Companies Inc.

- 6.4.4 Shiseido Company Ltd.

- 6.4.5 Amorepacific Corp.

- 6.4.6 Unilever PLC

- 6.4.7 Coty Inc.

- 6.4.8 Kao Corp.

- 6.4.9 Yatsen Holding Perfect Diary

- 6.4.10 Johnson & Johnson Consumer Health

- 6.4.11 LVMH Moet Hennessy Louis Vuitton (Parfums & Cosmetics)

- 6.4.12 Shanghai Jahwa United Co. Ltd.

- 6.4.13 Shanghai Pechoin Daily Chemical

- 6.4.14 Proya Cosmetics

- 6.4.15 CHICMAX Group

- 6.4.16 Guangdong Marubi Biotechnology

- 6.4.17 Mary Kay (China) Co. Ltd.

- 6.4.18 Henkel AG & Co. KGaA (Schwarzkopf)

- 6.4.19 Beiersdorf AG

- 6.4.20 Florasis

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK