PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934603

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934603

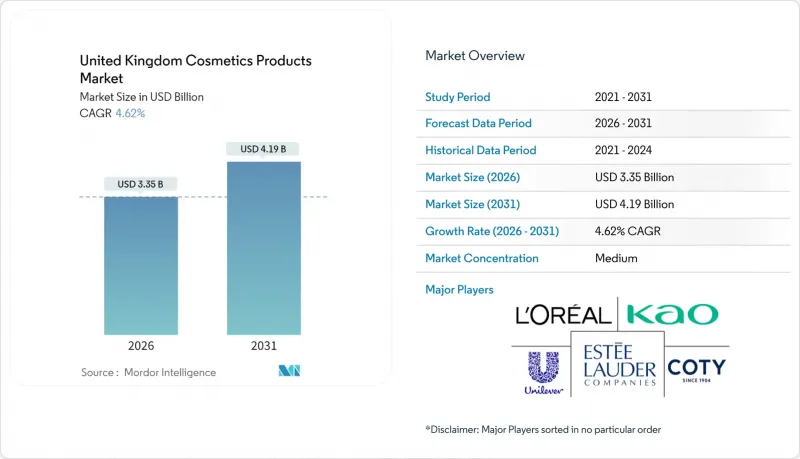

United Kingdom Cosmetics Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom Cosmetics Products Market market size in 2026 is estimated at USD 3.35 billion, growing from 2025 value of USD 3.20 billion with 2031 projections showing USD 4.19 billion, growing at 4.62% CAGR over 2026-2031.

This growth is largely driven by rising demand for high-quality, premium cosmetics, advancements in technology that allow for personalized beauty solutions, and the introduction of more inclusive shade ranges to meet the needs of diverse consumers. The market is also evolving in response to changing consumer lifestyles. In terms of product types, facial cosmetics are expected to see the highest growth, while eye makeup products are also gaining popularity. In terms of categories, premium cosmetics are expanding rapidly, while mass-market cosmetics continue to maintain steady demand. Organic and natural products are growing quickly as more consumers prioritize sustainability and health-conscious choices, though conventional products still dominate the market due to their affordability and widespread availability. In terms of distribution channels, online retail is growing at a fast pace; however, specialty beauty stores remain an important channel, as they offer expert advice and curated product selections that many consumers value. The market is moderately concentrated, with the top five suppliers accounting for a significant share of the revenue.

United Kingdom Cosmetics Products Market Trends and Insights

Growing consumer inclination toward natural and organic products

In the United Kingdom, consumer preferences are increasingly leaning toward natural and organic products as people become more conscious of product ingredients and sustainability. Studies show that while many consumers consider sustainability when purchasing beauty products, only a small percentage fully trust the claims made by brands. About 30% of United Kingdom consumers are willing to pay up to 10% more for products that are sustainable, highlighting the rising importance of ethical and environmentally friendly options. This trend is supported by the country's relatively high purchasing power, with per capita income standing at 4,450 USD according to the International Monetary Fund (IMF), which allows consumers to afford slightly higher prices for products that align with their values. The success of brands like Wild Cosmetics, which has grown quickly, positioning itself as a trustworthy alternative to traditional products, demonstrates this shift.

Social media influence to boost the market

Social media has become a significant sales channel in the United Kingdom, with social commerce generating GBP 7.3 billion in sales in April 2025. Platforms like TikTok and Instagram are playing a major role in influencing consumer behavior. On TikTok, trends such as "get-ready-with-me" videos encourage spontaneous purchases, while Instagram serves as a virtual storefront where consumers discover and buy products. Studies show that higher TikTok usage is linked to more impulsive buying in the beauty category, highlighting the platform's impact on driving unplanned purchases. This trend is further supported by the United Kingdom's high internet penetration, with 96% of the population using the internet in 2023, according to the World Bank. With such widespread connectivity, beauty content, influencer campaigns, and peer reviews reach a large audience, prompting brands to invest more in social media marketing.

Growth of counterfeit products availability

In the United Kingdom cosmetics products market, the rise of counterfeit goods has become a major issue, affecting both consumer trust and the reputation of brands. Counterfeit products are often sold through online platforms, making it easier for fake cosmetics to reach unsuspecting buyers. These fake items pose serious health risks, as some consumers have reported adverse reactions after using counterfeit products. To address this growing problem, the United Kingdom government introduced the "Choose Safe not Fake" campaign in March 2024, as per the Cosmetic, Toiletry and Perfumery Association. This initiative focuses on raising awareness about the dangers of counterfeit beauty and hygiene products while encouraging respect for intellectual property rights. Enforcement actions, such as Interpol's Operation Pangea, have played a key role in tackling the issue. Authorities have shut down 43 United Kingdom-specific illegal websites and seized counterfeit shipments during raids in cities like Bolton, Wigan, and Glasgow.

Other drivers and restraints analyzed in the detailed report include:

- Convenience and multi-functional products preference

- Rising male grooming and unisex trends

- Regulatory complexity and compliance costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In the United Kingdom cosmetics products market, facial cosmetics continue to lead the market, contributing 40.12% of revenue in 2025. These products are highly favored due to their dual functionality, combining skincare benefits with makeup features. Items like tinted moisturizers, BB/CC creams, and hybrid foundations are particularly popular as they offer hydration, sun protection, and coverage in one product. Consumers increasingly prefer such multifunctional solutions, making facial cosmetics a daily essential across various age groups. Both premium and mass-market brands are expanding their product lines in this category, focusing on quality formulations and convenience to meet evolving consumer demands and maintain loyalty.

Lip and nail cosmetics, on the other hand, are emerging as the fastest-growing segment, with a projected CAGR of 5.55% through 2031. Growth is being fueled by social media trends, influencer tutorials, and a desire among consumers, especially younger demographics, to experiment with bold, creative looks. Products such as vibrant lipsticks, glosses, nail polishes, and nail art kits are gaining traction, while brands launch limited-edition shades, seasonal collections, and multifunctional products. Retailers are curating engaging displays and experiences to showcase these items, positioning lip and nail cosmetics as key drivers of revenue growth and increased per-consumer spending.

In the United Kingdom cosmetics products market, mass-market brands continue to dominate, holding a significant 64.20% share. These brands excel due to their affordability, wide availability, and frequent product launches that cater to budget-conscious consumers. Their ability to offer discounts, bundle deals, and seasonal promotions keeps shoppers engaged and encourages repeat purchases. Mass-market brands benefit from strong distribution networks, ensuring their products are accessible both online and in physical stores. This broad reach and affordability make them a key driver of market volume in the United Kingdom.

On the other hand, premium cosmetics, while occupying a smaller share of the market, are expected to grow at a robust 6.66% CAGR through 2031. Consumers are increasingly drawn to premium products for their high-quality ingredients, innovative formulations, and the sense of luxury they provide. Many premium brands use loyalty programs and exclusive offers to attract and retain customers, making these products more appealing and accessible. Furthermore, premium cosmetics often emphasize brand storytelling and exclusivity, which resonate with consumers seeking aspirational products. This growing interest in premium offerings highlights their potential to capture a larger share of the market in the coming years.

The United Kingdom Cosmetics Products Market Report is Segmented by Product Type (Facial Cosmetics, Eye Cosmetics, and More), Category (Mass and Premium), Nature (Organic and Conventional), and Distribution Channel (Supermarkets/Hypermarkets, Online Retail Channels, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- L'Oreal SA

- Estee Lauder Companies Inc.

- Coty Inc.

- Unilever PLC

- Chanel Ltd.

- Walgreens Boots Alliance

- Revolution Beauty Group PLC

- Charlotte Tilbury Beauty Ltd

- Aurea Group

- Louis Vuitton Moet Hennessy

- Procter & Gamble Company

- Barry M Cosmetics

- Shiseido Company Limited

- The Hut Group (Eyeko)

- E.l.f. Cosmetics

- Oriflame Cosmetics Ltd

- Kao Corporation

- Freedom Cosmetics

- Pacific World Corporation (Nails Inc.)

- Lush Cosmetics Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing consumer inclination toward natural and organic products

- 4.2.2 Rising male grooming and unisex trends

- 4.2.3 Advancements in technology driving product innovation

- 4.2.4 Social media influence to boost the market

- 4.2.5 Convenience and multi-functional products preference

- 4.2.6 Inclusive shade ranges driven by multicultural demographics

- 4.3 Market Restraints

- 4.3.1 Regulatory complexity and compliance costs

- 4.3.2 Growth of counterfiet products availability

- 4.3.3 Supply chain disruptions

- 4.3.4 High costs associated with premium products

- 4.4 Regulatory Outlook

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Facial Cosmetics

- 5.1.2 Eye Cosmetics

- 5.1.3 Lip and Nail Cosmetics

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 By Nature

- 5.3.1 Organic

- 5.3.2 Conventional

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Specialty Beauty Stores

- 5.4.3 Online Retail Channels

- 5.4.4 Other Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 L'Oreal SA

- 6.4.2 Estee Lauder Companies Inc.

- 6.4.3 Coty Inc.

- 6.4.4 Unilever PLC

- 6.4.5 Chanel Ltd.

- 6.4.6 Walgreens Boots Alliance

- 6.4.7 Revolution Beauty Group PLC

- 6.4.8 Charlotte Tilbury Beauty Ltd

- 6.4.9 Aurea Group

- 6.4.10 Louis Vuitton Moet Hennessy

- 6.4.11 Procter & Gamble Company

- 6.4.12 Barry M Cosmetics

- 6.4.13 Shiseido Company Limited

- 6.4.14 The Hut Group (Eyeko)

- 6.4.15 E.l.f. Cosmetics

- 6.4.16 Oriflame Cosmetics Ltd

- 6.4.17 Kao Corporation

- 6.4.18 Freedom Cosmetics

- 6.4.19 Pacific World Corporation (Nails Inc.)

- 6.4.20 Lush Cosmetics Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK