PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934669

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934669

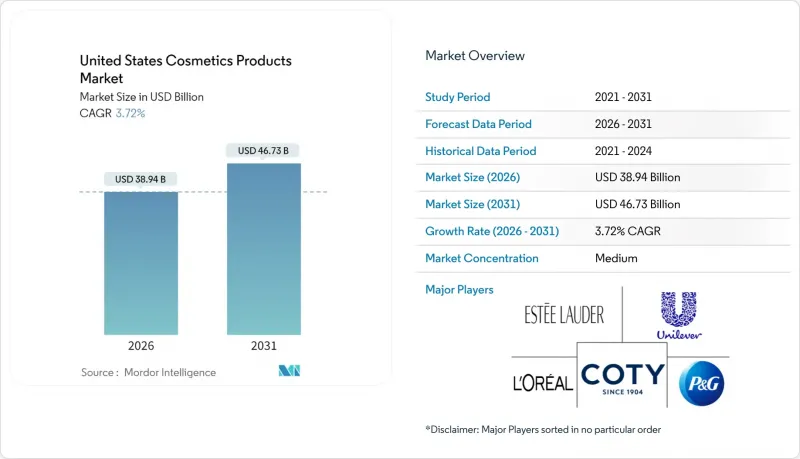

United States Cosmetics Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States cosmetics products market is expected to grow from USD 37.54 billion in 2025 to USD 38.94 billion in 2026 and is forecast to reach USD 46.73 billion by 2031 at 3.72% CAGR over 2026-2031.

Despite tightening discretionary budgets, consumers increasingly consider beauty products essential. This trend, along with a shift from mass-market products to premium, "clean," and digitally-focused offerings, is transforming the competitive landscape. Millennials and Gen Z, in particular, are driving demand for clean, natural, and organic beauty products. They prefer cosmetics free from harmful chemicals, often labeled as clean, vegan, or cruelty-free. This preference is prompting brands to innovate with eco-friendly formulations and sustainable packaging. While mass-market channels continue to dominate revenue streams, they are experiencing margin pressures. Supermarkets and hypermarkets are losing online market share to platforms like Amazon, TikTok Shop, and brand-specific websites. In response, established players are utilizing AI and vertical integration to strengthen their market position. However, agile newcomers focusing on traceability and community-driven marketing are gaining significant cultural influence.

United States Cosmetics Products Market Trends and Insights

Clean/Organic Beauty Demand Among Millennials and Gen Z

Millennials and Gen Z are significantly boosting beauty spending, with their emphasis on ingredient transparency driving changes in industry formulation strategies. Beginning January 2025, California's "Right to Know Act" will require brands to disclose fragrance components, removing the "trade secret" protection that legacy brands have relied on for decades. This regulatory change increases consumer skepticism; for example, Gen Z frequently cross-references ingredient lists with third-party databases, relying on crowdsourced platforms for quality assurance. According to 2024 data from the U.S. Census Bureau, Millennials account for 74.19 million people, while Gen Z numbers 70.79 million in the United States. Brands that voluntarily disclose ingredient origins, such as supply-chain details for mica or palm derivatives, are gaining a larger share of this consumer base. However, the lack of a federal definition for "clean" creates a fragmented market, with California's standards effectively becoming the national benchmark for premium branding.

AI-Powered Personalization Boosting Demand

AI-powered personalization is revolutionizing the U.S. cosmetics market by advancing product customization, enhancing shopping experiences, and driving product innovation. Estee Lauder's 2024 partnership with Microsoft and OpenAI to create an AI Innovation Lab signifies a transition from mass customization to large-scale hyper-personalization. The lab's implementation of over 240 customized GPT models covers diverse applications: from AI-enabled fragrance development, which interprets olfactory preferences through digital interactions, to accelerated clinical trial designs that identify efficacy markers in weeks rather than months. This advancement reduces the time-to-market for luxury product launches and supports dynamic pricing based on real-time demand. Simultaneously, smaller brands are utilizing third-party AI platforms to introduce virtual try-on and shade-matching tools. These solutions are minimizing return rates in online sales, addressing a challenge that previously benefited brick-and-mortar specialty stores. The strategic takeaway is clear: personalization is shifting from a premium feature to a standard expectation. Brands lacking advanced algorithmic infrastructure may struggle to justify premium pricing as consumers increasingly compare their experiences with AI-driven competitors.

Consumer Concerns About Chemical Ingredients

In 2024, the FDA introduced MoCRA, which requires mandatory adverse-event reporting for cosmetics, a regulation previously applicable only to drugs. This shift in transparency is bringing ingredient risks to light, risks that brands had historically managed discreetly. However, the more significant challenge lies in consumer perception. Social media has the power to amplify ingredient controversies, leading to drastic declines in sales almost overnight. For instance, parabens and sulfates faced widespread criticism and rejection, even though scientific evidence regarding their safety remains inconclusive. To mitigate such risks, brands are increasingly adopting "free-from" claims as a protective measure. Interestingly, many of these replacement ingredients often carry similar or even greater risk profiles. This trend highlights the disconnect between regulatory compliance and the psychological factors driving consumer behavior.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization of cosmetics product supports growth

- Social media influence to boost the market

- Ingredient and Packaging Supply-Chain Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lip and nail make-up products are expanding at 4.38% CAGR through 2031, the fastest pace among product categories, even as facial cosmetics retain 41.32% of 2025 revenue. This shift highlights Gen Z's preference for bold color cosmetics, contrasting with millennials' focus on full-coverage foundations and contouring palettes. TikTok's "lip combo" trend, where users layer products to create custom shades, has driven this growth. Similarly, nail polish sales have risen, supported by the sustained popularity of at-home manicures post-pandemic. Although eye cosmetics are not the fastest-growing segment, they are gaining traction due to innovative mascaras that combine cosmetic and treatment benefits, such as lash-care serums.

Facial cosmetics, despite their leading position, are under pressure from the "skin first, makeup second" trend, which prioritizes skincare over makeup, reducing the frequency of foundation and concealer use. To adapt, brands are launching hybrid products, such as tinted moisturizers with SPF 30+ and cushion compacts infused with hyaluronic acid, which blend skincare and cosmetic benefits. Regulatory oversight in this segment remains limited, as color additives face less scrutiny compared to skincare actives, though California's fragrance-disclosure rules apply across all categories. The key opportunity lies in developing multi-functional products within a single SKU, lowering barriers to trial and capturing a greater share of both cosmetics and skincare budgets.

Premium products are growing at 3.89% CAGR through 2031, closing the gap with mass products that held 55.84% of 2025 revenue. This ongoing trend of premiumization is not merely a result of increasing disposable incomes. Instead, it reflects a significant shift in consumer preferences, where shoppers are prioritizing quality over quantity. Consumers are opting for fewer, high-quality items rather than accumulating extensive collections of mass-market alternatives. Prestige brands are capitalizing on this behavioral shift by introducing innovative solutions such as refillable compacts and subscription-based models. These approaches effectively lower the cost per use for consumers while maintaining premium pricing for initial purchases. A notable example is E.l.f. Beauty's success in the "masstige" category, where it bridges the gap between prestige aesthetics and mass-market pricing. This success highlights the increasingly blurred boundaries between product categories.

Mass products, however, continue to dominate in high-turnover categories such as mascara and lip balm. In these segments, the functional similarities between products reduce consumers' willingness to pay a premium. Additionally, in value-conscious regions where household budgets are constrained, consumers tend to prioritize purchasing larger volumes over seeking brand prestige. Retailers are responding to these market dynamics by expanding their private-label prestige product lines. Brands that adopt portfolio strategies encompassing both premium and mass segments are well-positioned to capture a diverse consumer base across varying income levels and purchasing occasions. However, this dual-segment approach carries inherent risks, particularly the potential for brand dilution if consumers perceive the premium and mass offerings as functionally indistinguishable.

The United States Cosmetics Products Market Report is Segmented by Product Type (Facial Cosmetics, Eye Cosmetics, Lip and Nail Make-Up Products), Category (Premium Products, Mass Products), Ingredient Type (Natural and Organic, Conventional/Synthetic), and Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Online Retail Stores, Other Channels). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- L'Oreal SA

- Estee Lauder Companies

- Procter and Gamble Company

- Unilever

- Coty Inc.

- Johnson and Johnson Consumer Health

- Shiseido Americas

- Beiersdorf USA

- Kao USA

- Colgate-Palmolive Co.

- e.l.f. Beauty

- Revlon

- The Clorox Company

- Henkel North America

- Natura and Co USA (Aesop)

- LVMH Perfumes and Cosmetics

- Amway (Artistry)

- Church and Dwight

- Edgewell Personal Care

- Fenty Beauty

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Social media influence to boost the market

- 4.2.2 Clean/organic beauty demand among Millennials and Gen Z

- 4.2.3 Technological advancements in product formulations

- 4.2.4 Premiumization of cosmetics product supports growth

- 4.2.5 AI-powered personalization boosting demand

- 4.2.6 Increasing disposable income drives market expansion

- 4.3 Market Restraints

- 4.3.1 Ingredient and packaging supply-chain volatility

- 4.3.2 Consumer concerns about chemical ingredients

- 4.3.3 Rising concerns over counterfeit products in the market

- 4.3.4 Stringent regulatory frameworks impacting product launches

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Facial Cosmetics

- 5.1.2 Eye Cosmetics

- 5.1.3 Lip and Nail Make-up Products

- 5.2 By Category

- 5.2.1 Premium Products

- 5.2.2 Mass Products

- 5.3 By Ingredient Type

- 5.3.1 Natural and Organic

- 5.3.2 Conventional/Synthetic

- 5.4 By Distribution Channel

- 5.4.1 Specialty Stores

- 5.4.2 Supermarkets/Hypermarkets

- 5.4.3 Online Retail Stores

- 5.4.4 Other Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 L'Oreal SA

- 6.4.2 Estee Lauder Companies

- 6.4.3 Procter and Gamble Company

- 6.4.4 Unilever

- 6.4.5 Coty Inc.

- 6.4.6 Johnson and Johnson Consumer Health

- 6.4.7 Shiseido Americas

- 6.4.8 Beiersdorf USA

- 6.4.9 Kao USA

- 6.4.10 Colgate-Palmolive Co.

- 6.4.11 e.l.f. Beauty

- 6.4.12 Revlon

- 6.4.13 The Clorox Company

- 6.4.14 Henkel North America

- 6.4.15 Natura and Co USA (Aesop)

- 6.4.16 LVMH Perfumes and Cosmetics

- 6.4.17 Amway (Artistry)

- 6.4.18 Church and Dwight

- 6.4.19 Edgewell Personal Care

- 6.4.20 Fenty Beauty

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK