PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934612

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934612

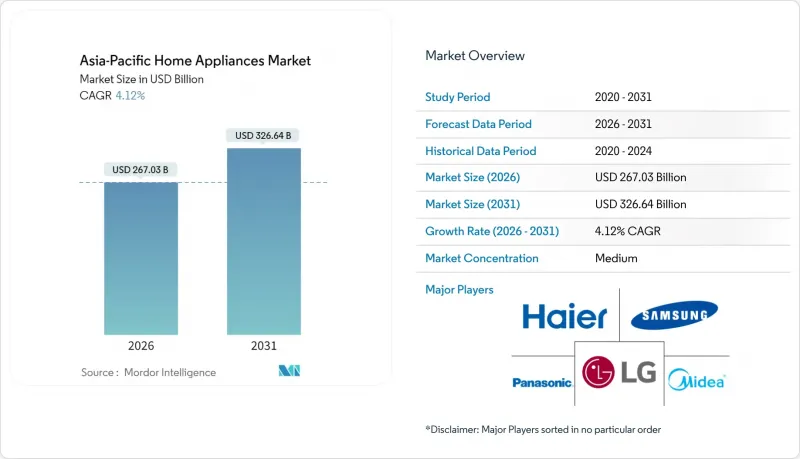

Asia-Pacific Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia-Pacific home appliances market is expected to grow from USD 256.45 billion in 2025 to USD 267.03 billion in 2026 and is forecast to reach USD 326.64 billion by 2031 at 4.12% CAGR over 2026-2031.

Demand growth rests on steady urban migration, larger disposable incomes, and an expanding smart-home ecosystem that lifts penetration of connected refrigerators, air conditioners, and washers. China anchors regional supply through cost-efficient clusters, while India supplies new consumption momentum that balances maturing volumes in Japan and South Korea. Government incentives for high-efficiency models, stronger e-commerce infrastructure, and the appeal of multifunctional designs add further lift. Competitive intensity has sharpened; Chinese brands hold commanding shares in small robotic categories, driving Korean and Japanese leaders to differentiate through artificial-intelligence features. At the same time, raw-material swings and cross-border price wars keep pressure on margins and force ongoing cost management.

Asia-Pacific Home Appliances Market Trends and Insights

Rising Disposable Incomes in Emerging Asia-Pacific Economies

Income growth in emerging Asia-Pacific markets creates a consumption upgrade cycle that extends beyond basic appliance penetration to premium feature adoption. India's appliances industry expects 10-15% growth in 2025 driven by premiumisation, with room air conditioners growing 30% in 2024 as rising incomes enable energy-efficient inverter models. This trend reflects a structural shift where middle-class expansion in tier-2 and tier-3 cities generates demand for branded appliances with advanced features, moving beyond the price-sensitive segments that dominated earlier growth phases. The income elasticity effect is particularly pronounced in categories like refrigerators and washing machines, where consumers upgrade to larger capacities and smart connectivity features as household purchasing power increases.

Rapid Urbanization & New-Housing Growth

Urban population growth across developing Asia creates concentrated appliance demand that outpaces rural market development, with city clusters accounting for most absolute increases in household formation. The Asian Development Bank projects urban population rising from 1.84 billion in 2017 to reach 64% urbanization by 2050, with large cities and urban corridors generating agglomeration economies that support higher appliance adoption rates. New housing construction in urban areas drives initial appliance purchases, while apartment-style living increases demand for space-efficient, built-in models that integrate with modern kitchen designs. This urbanization pattern creates geographic concentration of demand that enables efficient distribution networks and after-sales service coverage, supporting market expansion in previously underserved regions.

Raw-material Price Volatility

Commodity cost fluctuations create margin pressure that forces manufacturers to implement price increases or absorb reduced profitability, both of which constrain market growth. Indian appliance manufacturers faced 70% increases in metals and plastics costs during 2024, prompting industry-wide price hikes of 5-10% across air conditioners, refrigerators, and washing machines. This cost inflation particularly affects steel-intensive products like refrigerators and washing machines, where material costs represent 60-70% of manufacturing expenses. Supply chain disruptions and geopolitical tensions exacerbate volatility, forcing manufacturers to maintain higher inventory buffers and implement more frequent pricing adjustments that can dampen consumer demand in price-sensitive segments.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Expansion & Last-mile Reach

- AIoT-enabled Smart-home Ecosystems

- Cross-border E-commerce Price Wars

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Asia-Pacific home appliances market size for refrigerators stood as the largest slice at 24.92% in 2025. Strong household stock combined with longer replacement intervals secures a stable demand floor, while innovations in compressor efficiency and AI food management keep the category relevant. Conversely, air fryers record a 5.86% CAGR through 2031, demonstrating how small appliances can shift cooking behavior toward healthier, low-oil meal preparation. Robotic vacuum cleaners, multi-cookers, and countertop ovens follow similar momentum, aided by gift purchases and impulse e-commerce deals.

Air conditioners, washing machines, and dishwashers remain value pillars because each unit carries a higher average selling price and requires installation services. Brands inject AI diagnostics and inverter drives to refresh these categories without fundamentally altering core functions. In contrast, vacuum cleaners face cannibalization by robo-variants that tie into smart-home hubs. The clear divide between mature large appliances and fast-growing small appliances calls for portfolio strategies that balance high-value steady segments with nimble growth niches.

The Asia-Pacific Home Appliances Market Report is Segmented by Product Type (Major Home Appliances, Small Home Appliances), Distribution Channel (Multi-Brand Stores, Exclusive Brand Outlets, Online, Other Distribution Channels), and Geography (India, China, Japan, Australia, South Korea, South East Asia, Rest of Asia-Pacific). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Haier Smart Home Co., Ltd.

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Panasonic Corporation

- Midea Group Co., Ltd.

- Hisense Home Appliances Group Co., Ltd.

- Whirlpool Corporation

- Electrolux AB

- Toshiba Lifestyle Products & Services Corporation

- Hitachi Global Life Solutions, Inc.

- Sharp Corporation

- BSH Hausgerate GmbH

- Godrej Appliances

- IFB Industries Ltd.

- TTK Prestige Ltd.

- Bajaj Electricals Ltd.

- Dyson Ltd.

- Xiaomi Corporation

- Koninklijke Philips N.V.

- Robert Bosch GmbH

- Arcelik A.S. (Beko)

- Havells India Ltd.

- Groupe SEB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Disposable Incomes In Emerging Asia-Pacific Economies

- 4.2.2 Rapid Urbanisation & New?Housing Growth

- 4.2.3 E-Commerce Expansion & Last-Mile Reach

- 4.2.4 Energy-Efficiency Subsidy Programmes

- 4.2.5 AIOT-Enabled Smart-Home Ecosystems

- 4.2.6 Compact-Living Demand For Multifunctional Units

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility

- 4.3.2 Saturation In Mature Asia-Pacific Countries

- 4.3.3 Cross-Border E-Commerce Price Wars

- 4.3.4 Stringent E-Waste Compliance Costs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Major Home Appliances

- 5.1.1.1 Refrigerators

- 5.1.1.2 Freezers

- 5.1.1.3 Washing Machines

- 5.1.1.4 Dishwashers

- 5.1.1.5 Ovens (Incl. Combi & Microwave)

- 5.1.1.6 Air Conditioners

- 5.1.1.7 Other Major Home Appliances

- 5.1.2 Small Home Appliances

- 5.1.2.1 Coffee Makers

- 5.1.2.2 Food Processors

- 5.1.2.3 Grills & Roasters

- 5.1.2.4 Electric Kettles

- 5.1.2.5 Juicers & Blenders

- 5.1.2.6 Air Fryers

- 5.1.2.7 Vacuum Cleaners

- 5.1.2.8 Electric Rice Cookers

- 5.1.2.9 Toasters

- 5.1.2.10 Countertop Ovens

- 5.1.2.11 Other Small Home Appliances

- 5.1.1 Major Home Appliances

- 5.2 By Distribution Channel

- 5.2.1 Multi-Brand Stores

- 5.2.2 Exclusive Brand Outlets

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 India

- 5.3.2 China

- 5.3.3 Japan

- 5.3.4 Australia

- 5.3.5 South Korea

- 5.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.3.7 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Haier Smart Home Co., Ltd.

- 6.4.2 Samsung Electronics Co., Ltd.

- 6.4.3 LG Electronics Inc.

- 6.4.4 Panasonic Corporation

- 6.4.5 Midea Group Co., Ltd.

- 6.4.6 Hisense Home Appliances Group Co., Ltd.

- 6.4.7 Whirlpool Corporation

- 6.4.8 Electrolux AB

- 6.4.9 Toshiba Lifestyle Products & Services Corporation

- 6.4.10 Hitachi Global Life Solutions, Inc.

- 6.4.11 Sharp Corporation

- 6.4.12 BSH Hausgerate GmbH

- 6.4.13 Godrej Appliances

- 6.4.14 IFB Industries Ltd.

- 6.4.15 TTK Prestige Ltd.

- 6.4.16 Bajaj Electricals Ltd.

- 6.4.17 Dyson Ltd.

- 6.4.18 Xiaomi Corporation

- 6.4.19 Koninklijke Philips N.V.

- 6.4.20 Robert Bosch GmbH

- 6.4.21 Arcelik A.S. (Beko)

- 6.4.22 Havells India Ltd.

- 6.4.23 Groupe SEB

7 Market Opportunities & Future Outlook

- 7.1 Rising Smart and Connected Appliance Adoption

- 7.2 Energy-Efficient Solutions Driving Market Growth