PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934654

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934654

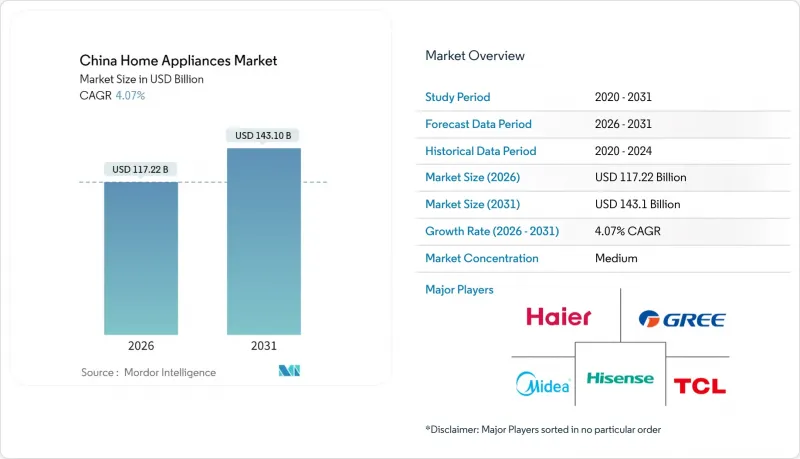

China Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

China home appliances market size in 2026 is estimated at USD 117.22 billion, growing from 2025 value of USD 112.64 billion with 2031 projections showing USD 143.1 billion, growing at 4.07% CAGR over 2026-2031.

A decisive shift from volume-led expansion to premium, value-oriented growth is underway as manufacturers integrate AI, IoT, and energy-efficiency features into both major and small appliances. Government trade-in subsidies covering 15-20% of the price for Grade 1 products and rising disposable incomes in urban centers underpin steady replacement demand. E-commerce platforms streamline subsidy applications and old-unit collection, accelerating channel migration while multi-brand stores respond with experiential showrooms and bundled installation services. Regional dynamics also shape market opportunities: East China retains leadership through its manufacturing clusters and high incomes, whereas Southwestern China delivers the fastest CAGR thanks to infrastructure spending and rapid urbanization. Competitive intensity remains moderate yet technology-focused, with leading brands embedding large language models for predictive maintenance and voice control in refrigerators, washing machines, and HVAC systems.

China Home Appliances Market Trends and Insights

Rising Disposable Incomes

Accelerating wage growth in major urban centers fuels an appetite for premium, smart, and energy-efficient products. Middle-class households now prioritize lifestyle enhancement over first-time purchases, boosting uptake of AI-enabled refrigerators, voice-controlled washers, and multi-function rice cookers. Brands capitalize on this willingness to pay by bundling extended warranties and predictive-maintenance subscriptions that generate recurring revenue. Higher incomes also spur demand for design-oriented small appliances such as retro-style coffee makers and countertop ovens, creating new value pools in an otherwise mature sector. In Tier-1 cities, dual-income professionals increasingly favor built-in dishwashers and centralized HVAC solutions, accelerating the upgrade cycle. Rising affluence therefore sustains growth despite market saturation in early-adopter regions. Government incentives further amplify this effect by rewarding high-efficiency purchases with instant rebates, closing the affordability gap for premium models.

Urbanization and Residential Construction

China targets a 70% urbanization rate by 2030, necessitating large-scale residential projects that act as natural demand motors for major appliances. Newly constructed apartments often include pre-installed smart home gateways, prompting developers to procure IoT-ready air conditioners, water heaters, and refrigerators in bulk. Compact urban living spaces inspire manufacturers to design slim, multi-functional units that fit standardized kitchen cabinetry, thus opening innovation opportunities. Migrants moving into Tier-2 and Tier-3 cities create incremental first-time demand for entry-level washing machines and affordable cooling units. Infrastructure expansion in Southwest and Northwest China also improves last-mile logistics, reducing distribution costs and expanding retailer footprints in previously under-served locales. As urbanization deepens, replacement cycles shorten because consumers expect appliances to match the rapidly rising smart-home baseline. The construction boom, therefore, underpins both initial sales and future upgrade momentum.

Intense Price Competition Squeezing Margins

The commoditization of core white-goods technologies keeps ASP growth muted despite rising feature counts. Domestic mid-tier brands often sacrifice gross margin to hold shelf space in hypermarkets and rural franchise stores. Flash sales and "618/Double-11" megasales create consumer expectations for deep discounts, pulling forward demand but eroding profitability. Export pressures compound the situation as global buyers push for FOB reductions amid exchange-rate fluctuations. To mitigate, leading firms invest in vertically integrated component production, lowering unit costs while protecting IP. Smaller manufacturers without scale advantages risk exit or consolidation, nudging overall market concentration upward. Service-led differentiation, such as IoT-driven diagnostics and subscription consumables, emerges as a buffer against pure price wars.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Energy-Efficient Smart Appliances

- E-commerce Expansion and Omnichannel Retail

- Supply-Chain Volatility and Raw-Material Cost Swings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerators commanded 24.05% of the China home appliances market share in 2025, reflecting their essential role in daily living and higher average selling prices. Manufacturers refreshed portfolios with four-door, zero-degree preservation zones and inverter-driven cooling, contributing to sustained replacement demand. The China home appliances market size for refrigerators also benefits from growing preference for larger 500-liter models that meet family lifestyle changes. In parallel, small-appliance innovation cycles accelerate: air fryers post a 5.23% CAGR, buoyed by health-conscious cooking trends and social-media recipe virality. Brands differentiate through dual-zone heating and AI-guided temperature profiles, which justify incremental premiums despite stiff competition. Coffee makers, juicers, and countertop ovens piggyback on this momentum, leveraging influencer-led marketing to drive impulse purchases. Collectively, cross-category bundling helps retailers raise basket sizes, while extended warranties and recipe-subscription services diversify revenue streams.

Second-generation smart products integrate large language models that learn user habits, automatically reorder water filters, and provide app-based energy-optimization tips. Refrigerators now offer touchscreen family hubs that sync shopping lists with e-commerce grocery portals, further embedding the appliance into daily digital routines. Multi-door formats enhance spatial segmentation, enabling precise humidity zones for produce and meat. In washing machines, heat-pump dryers gain favor for their 60% energy savings versus vented units, and AI-based fabric recognition optimizes detergent dosing. This constant innovation sustains high-value replacements even in saturated urban markets. Meanwhile rural revitalization projects distribute entry-level cooling and laundry units, enlarging the total addressable base.

The China Home Appliances Market Report is Segmented by Product (Major Home Appliances: Refrigerators, Freezers, and Other; Small Home Appliances: Coffee Makers, Food Processors, and Other), Distribution Channel (Multi-Brand Stores, Exclusive Brand Outlets, Online, Other Distribution Channels), and Geography (East China, and Other). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Haier Smart Home Co., Ltd.

- Midea Group Co., Ltd.

- Gree Electric Appliances Inc. of Zhuhai

- Hisense Home Appliances Group Co., Ltd.

- TCL Technology Group Corporation

- Xiaomi Corp. (Smart Home Ecosystem)

- BSH Home Appliances (Bosch-Siemens)

- Whirlpool Corp.

- Panasonic Corp.

- LG Electronics Inc.

- Samsung Electronics Co., Ltd.

- Joyoung Co., Ltd.

- Zhejiang Supor Co., Ltd. (SEB Group)

- Galanz Enterprise Group Co., Ltd.

- AUX Group Co., Ltd.

- Changhong Electric Co., Ltd.

- Skyworth Group Co., Ltd.

- Konka Group Co., Ltd.

- Royalstar Group Co., Ltd.

- Philips Domestic Appliances

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising disposable incomes among urban households

- 4.2.2 Rapid urbanization & residential construction boom

- 4.2.3 Demand surge for energy-efficient & smart appliances

- 4.2.4 E-commerce expansion & omnichannel retailing

- 4.2.5 Emergence of rental economy & appliance leasing

- 4.2.6 Rural revitalization subsidies for appliance upgrades

- 4.3 Market Restraints

- 4.3.1 Intense price competition squeezing margins

- 4.3.2 Supply-chain disruptions & raw-material cost swings

- 4.3.3 Stricter e-waste regulations raising compliance costs

- 4.3.4 Market saturation in Tier-1 cities

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts

- 5.1 By Product

- 5.1.1 Major Home Appliances

- 5.1.1.1 Refrigerators

- 5.1.1.2 Freezers

- 5.1.1.3 Washing Machines

- 5.1.1.4 Dishwashers

- 5.1.1.5 Ovens (Incl. Combi & Microwave)

- 5.1.1.6 Air Conditioners

- 5.1.1.7 Other Major Home Appliances

- 5.1.2 Small Home Appliances

- 5.1.2.1 Coffee Makers

- 5.1.2.2 Food Processors

- 5.1.2.3 Grills & Roasters

- 5.1.2.4 Electric Kettles

- 5.1.2.5 Juicers & Blenders

- 5.1.2.6 Air Fryers

- 5.1.2.7 Vacuum Cleaners

- 5.1.2.8 Electric Rice Cookers

- 5.1.2.9 Toasters

- 5.1.2.10 Countertop Ovens

- 5.1.2.11 Other Small Home Appliances

- 5.1.1 Major Home Appliances

- 5.2 By Distribution Channel

- 5.2.1 Multi-Brand Stores

- 5.2.2 Exclusive Brand Outlets

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 East China

- 5.3.2 Southwestern China

- 5.3.3 North China

- 5.3.4 South Central China

- 5.3.5 Northeast China

- 5.3.6 Northwestern China

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Haier Smart Home Co., Ltd.

- 6.4.2 Midea Group Co., Ltd.

- 6.4.3 Gree Electric Appliances Inc. of Zhuhai

- 6.4.4 Hisense Home Appliances Group Co., Ltd.

- 6.4.5 TCL Technology Group Corporation

- 6.4.6 Xiaomi Corp. (Smart Home Ecosystem)

- 6.4.7 BSH Home Appliances (Bosch-Siemens)

- 6.4.8 Whirlpool Corp.

- 6.4.9 Panasonic Corp.

- 6.4.10 LG Electronics Inc.

- 6.4.11 Samsung Electronics Co., Ltd.

- 6.4.12 Joyoung Co., Ltd.

- 6.4.13 Zhejiang Supor Co., Ltd. (SEB Group)

- 6.4.14 Galanz Enterprise Group Co., Ltd.

- 6.4.15 AUX Group Co., Ltd.

- 6.4.16 Changhong Electric Co., Ltd.

- 6.4.17 Skyworth Group Co., Ltd.

- 6.4.18 Konka Group Co., Ltd.

- 6.4.19 Royalstar Group Co., Ltd.

- 6.4.20 Philips Domestic Appliances

7 Market Opportunities & Future Outlook

- 7.1 AI-Powered Kitchen Appliances Optimizing Personalized Cooking

- 7.2 Domestic Manufacturing Shifts to High-Tech Export-Led Production