PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937342

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937342

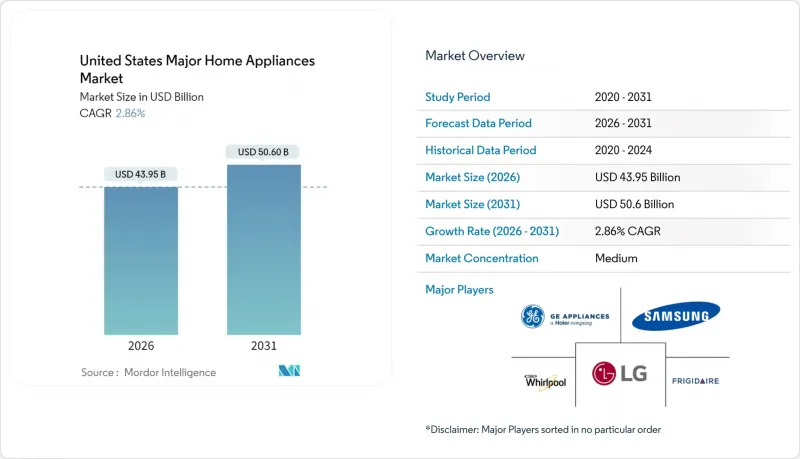

United States Major Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States Major Home Appliances Market was valued at USD 42.73 billion in 2025 and estimated to grow from USD 43.95 billion in 2026 to reach USD 50.6 billion by 2031, at a CAGR of 2.86% during the forecast period (2026-2031).

Sustained demand stems from essential replacement cycles, stronger energy-efficiency mandates, and escalating consumer interest in smart-home integration. At the same time, recently reinstated 50% Section 232 steel tariffs add production-cost pressures yet spur new domestic capacity investments, partially offsetting supply-chain risks. Digital sales continue to expand as retailers refine omnichannel experiences, while AI-enabled appliances deepen brand differentiation and spur premium-segment growth. Overall, the market's maturity, combined with regulatory support and technology upgrades, underpins a measured but resilient uptrend through 2030.

United States Major Home Appliances Market Trends and Insights

Shift To Smart & Connected Appliances

Adoption of AI-enabled refrigerators, washers, and cooking ranges accelerates as brands race to deliver value-added, personalized functionality. Samsung's 2025 Bespoke AI series layers voice recognition onto connected devices, enabling recipe guidance, energy controls, and preventative diagnostics. LG joins Microsoft to embed generative AI agents that predict usage patterns and schedule optimal cycles, with the majority of households prioritizing appliance personalization and data security. Subscription-based service bundles emerge, monetizing software updates and predictive maintenance. Yet market penetration hinges on common standards that mitigate cybersecurity risks and ensure interoperability across multi-brand ecosystems.

Energy-Efficiency Regulations & IRA Rebates

Federal rules mandate heat-pump technology for most residential water heaters by 2029, a shift poised to deliver USD 7.6 billion in annual consumer savings while lifting heat-pump water-heater share from 3% in 2025 to 61% post-2029 . State programs amplify incentives, with California and New York offering up to USD 8,000 per installation, stacking on top of a 30% federal tax credit . Manufacturers respond with hybrid heat-pump systems that reach up to 4.7 times the efficiency of conventional electric units, as showcased in GE's GeoSpring Smart Hybrid heat pump. Early rebate disbursements compress payback periods to under five years in high-utility-cost regions, accelerating replacement demand.

Re-Imposed Section 301 Tariffs On Chinese Components

Effective June 23, 2025, a 50% tariff on steel-intensive appliances lifts landed costs for refrigerators, washers, and dishwashers. While the Office of the U.S. Trade Representative reports that earlier tariff rounds pushed China to address some concerns, many practices remain unresolved, so higher duties continue to apply to numerous appliance parts. Section 301 duties have rippled straight through the supply chain to the sales floor. U.S. International Trade Commission research shows importers have passed virtually the full tariff cost along the line, so shoppers see almost a dollar-for-dollar increase in appliance price tags. OEMs counter with accelerated near-shoring to Mexican plants and component localization to protect margins.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Multi-Family Housing and Smaller Kitchens

- Rising E-Commerce Penetration in Appliance Category

- Skilled Technician Shortage Raising Service Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerators maintained 24.70% of the US major home appliances market share in 2025, anchored by essential food-preservation needs and recurring energy-upgrade cycles. Smart French-door models with AI vision cameras and dynamic temperature zones now command premium price points. In contrast, washing machines chart a 3.62% CAGR through 2031 as compact washer-dryer combos suit space-constrained multi-family housing. AI-assisted laundry platforms apply soil-detection sensors, reducing water consumption by 20-25% per load. Freezers remain steady, chiefly replacement-driven, while heat-pump water heaters emerge from a regulatory push, raising category value.

A gradual pivot toward induction cook-tops lifts cooking-appliance value growth amid electrification policies that restrict gas hookups in several Western and Northeastern municipalities. Dishwashers leverage water-efficiency standards to increase penetration in single-family homes. Ovens, range hoods, and cook-tops in the "other major appliances" group find premium opportunities in professional-grade aesthetics targeting food-enthusiast households.

The United States Major Home Appliances Market is Segmented by Product (Refrigerators, Freezers, Air-Conditioners, Dishwashers, Washing Machines, Ovens, and Other Major Home Appliances), by Distribution Channel (Multi-Branded Stores, Exclusive Brand Outlets, Online, and Other Distribution Channels), and by Geography (Northeast, Southeast, Midwest, Southwest, and West). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Samsung Electronics

- LG Electronics

- GE Appliances (Haier)

- Whirlpool Corporation

- Frigidaire (Electrolux AB)

- Bosch (BSH Home Appliances)

- Midea Group

- Haier Group (incl. Haier brand)

- Sub-Zero Group

- Viking Range Corporation

- Thermador (BSH)

- Kenmore

- Maytag

- KitchenAid

- Speed Queen (Alliance Laundry Systems)

- Hisense

- Arcelik AS (Beko)

- AGA Rangemaster Group (Middleby Corporation)

- Daewoo Electronics

- Winia Electronics (formerly Daewoo Electronics, part of Dayou Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift To Smart & Connected Appliances

- 4.2.2 Energy-Efficiency Regulations & IRA Rebates

- 4.2.3 Growth of Multi-Family Housing & Smaller Kitchens

- 4.2.4 Rising E-Commerce Penetration In Appliance Category

- 4.2.5 Inflation-Driven Replacement Demand Recovery (2026+)

- 4.2.6 OEM Near-Shoring Reducing Lead-Times

- 4.3 Market Restraints

- 4.3.1 Re-Imposed Section 301 Tariffs on Chinese Components

- 4.3.2 Skilled Technician Shortage Raising Service Costs

- 4.3.3 High Upfront Price of Premium Energy-Efficient Models

- 4.3.4 Volatile Compressor & Steel Input Prices

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Suppliers

- 4.5.3 Bargaining Power Of Buyers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights Into The Latest Trends And Innovations In The Market

- 4.7 Insights On Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, Etc.) In The Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Refrigerators

- 5.1.2 Freezers

- 5.1.3 Washing Machines

- 5.1.4 Dishwashers

- 5.1.5 Ovens (Incl. Combi & Microwave)

- 5.1.6 Air Conditioners

- 5.1.7 Other Major Home Appliances (range hoods, cooktops, etc.)

- 5.2 By Distribution Channel

- 5.2.1 Multi-Brand Stores

- 5.2.2 Exclusive Brand Outlets

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 Northeast

- 5.3.2 Southeast

- 5.3.3 Midwest

- 5.3.4 Southwest

- 5.3.5 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Samsung Electronics

- 6.4.2 LG Electronics

- 6.4.3 GE Appliances (Haier)

- 6.4.4 Whirlpool Corporation

- 6.4.5 Frigidaire (Electrolux AB)

- 6.4.6 Bosch (BSH Home Appliances)

- 6.4.7 Midea Group

- 6.4.8 Haier Group (incl. Haier brand)

- 6.4.9 Sub-Zero Group

- 6.4.10 Viking Range Corporation

- 6.4.11 Thermador (BSH)

- 6.4.12 Kenmore

- 6.4.13 Maytag

- 6.4.14 KitchenAid

- 6.4.15 Speed Queen (Alliance Laundry Systems)

- 6.4.16 Hisense

- 6.4.17 Arcelik AS (Beko)

- 6.4.18 AGA Rangemaster Group (Middleby Corporation)

- 6.4.19 Daewoo Electronics

- 6.4.20 Winia Electronics (formerly Daewoo Electronics, part of Dayou Group)

7 Market Opportunities & Future Outlook

- 7.1 Smart Home Integration